* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download VIT Multi-Strategy Alternatives Portfolio

Short (finance) wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Interbank lending market wikipedia , lookup

Corporate venture capital wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

Negative gearing wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Stock trader wikipedia , lookup

International investment agreement wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Fund governance wikipedia , lookup

Annuity (American) wikipedia , lookup

Collateralized debt obligation wikipedia , lookup

Money market fund wikipedia , lookup

Private equity wikipedia , lookup

Securities fraud wikipedia , lookup

Security (finance) wikipedia , lookup

Early history of private equity wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Synthetic CDO wikipedia , lookup

Private equity secondary market wikipedia , lookup

Mutual fund wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Securitization wikipedia , lookup

Private money investing wikipedia , lookup

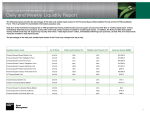

Goldman Sachs VIT Multi-Strategy Alternatives Portfolio Diversified Alternatives Exposure in a Single Portfolio Investors may be seeking access to a broader set of potential opportunities to help diversify traditional portfolios of domestic equity and core fixed income. This multi-strategy offering provides access to a variety of non-traditional asset classes in a single fund. Diversified Opportunities Invests across various alternative strategies, as well as non-traditional asset classes such as global infrastructure, real estate, and commodities, through differentiated investment styles and strategies. Goal: Provide a packaged exposure to the broader universe of alternative and non-traditional asset classes to potentially deliver long-term capital appreciation and manage drawdowns over time Specialized Portfolio Construction Innovative Experience Combines strategic asset allocation and active top-down market views across underlying strategies and exposures. The ability to tactically allocate among asset classes provides flexibility to manage risks and seek timely opportunities. With a legacy in alternative investing that goes back to 1969, GSAM is one of the largest participants in this market with over $150bn in alternatives assets.1 Goal: Offer Variable Annuity investors access to the experience and broad capabilities of Goldman Sachs Goal: Take advantage of a highly dynamic and risk-aware approach to portfolio management to provide Variable Annuity investors access to broader diversification Non-Traditional Asset Classes Have Offered Differentiated Returns From Those of Core Stocks and Core Bonds Annualized Returns (%) Alternatives Real Assets Core Equity Core Fixed Income 1990–1994 1995–1999 2000–2004 2005–2009 2010–2015 Whole Period Annualized Returns 13% 29% 22% 5% 15% 9% 9% 12% 8% 3% 13% 9% 8% 8% 5% 0% 4% 7% 0% 8% -2% 0% 3% 6% Non-traditional Asset Classes (Alternatives or Real Assets) have outperformed at least one element of an investor’s core portfolio in 69% (18 out of 26) of years since 1990. For Illustrative Purposes Only. January 1, 1990 to December 31, 2015. Source: GSAM, HFR Database © HFR, Inc. 2016, www.hedgefundresearch.com, PerTrac Indices Database, www. standardandpoors.com, www.barcap.com, Bloomberg. Time frame is representative of multiple, full market cycles. Underlying Indices: Alternatives- HFRI Fund of Funds Composite Index; Real Assets - Wilshire Real Estate Securities Index; Core Equity - S&P 500 Index; Core Fixed Income - Barclays U.S. Aggregate Bond Index. Returns shown do not reflect the past or current performance for the Goldman Sachs VIT Multi-Strategy Alternatives (Portfolio) and is not indicative of future results for the Portfolio. Past performance does not guarantee future results, which may vary. Diversification does not protect an investor from market risk and does not ensure a profit. Please see the next page for index definitions. VIT Multi-Strategy Alternatives Portfolio Investor Profile About Goldman Sachs Asset Management (GSAM) • Gain exposure to a broad set of alternative and non-traditional investments in a single portfolio • Leveraging the ideas and insights of Goldman Sachs, GSAM offers investment expertise across a diverse set of regions, sectors and asset classes This portfolio is for an investor that seeks to: • Access traditionally less tax efficient strategies and asset classes in a tax-deferred vehicle • Capture active decision making and leverage the broader resources across GSAM • A leading global asset manager, with over $1.12 trillion trillion in assets under supervision and over 2,200 professionals located in 33 locations around the world* • Extensive experience developing and implementing investment solutions across asset classes, regions and the risk spectrum • Experienced investment teams offer a broad range of competitive products across asset classes, regions and the risk spectrum • Provides customized, multi-asset class solutions and asset allocation expertise with a team of over 115 dedicated GSAM professionals 1. In June 1997, The Goldman Sachs Group, Inc. acquired the assets and business of Commodities Corporation Limited. This group is now known as Goldman Sachs Hedge Fund Strategies LLC. *All data as of June 30, 2016 unless noted otherwise. Assets Under Supervision (AUS) includes assets under management and other client assets for which Goldman Sachs does not have full discretion. A drawdown is the peak-to-trough decline during a specific recorded period of an investment. Goldman Sachs does not provide accounting, tax, or legal advice. Notwithstanding anything in this document to the contrary, and except as required to enable compliance with applicable securities law, you may disclose to any person the US federal and state income tax treatment and tax structure of the transaction and all materials of any kind (including tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind. Investors should be aware that a determination of the tax consequences to them should take into account their specific circumstances and that the tax law is subject to change in the future or retroactively and investors are strongly urged to consult with their own tax advisor regarding any potential strategy, investment or transaction. The HFRI Fund of Funds Composite Index is an equal-weighted index of over 650 domestic and offshore constituent fund of funds that report assets in USD, provide Net of All Fees returns on a monthly basis, and have at least $50 Million under management or have been actively trading for at least twelve (12) months. The Wilshire Real Estate Securities Index is an unmanaged index of publicly traded REITs and real estate operating companies.The S&P 500 Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. Standard & Poor’s and S&P are registered trademarks of Standard & Poor’s Financial Services LLC, a part of McGraw Hill Financial. The Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgagebacked andasset-backed securities. It is not possible to invest in an unmanaged index. Fund Risk Considerations Equity securities are more volatile than bonds and subject to greater risks. Bonds are subject to interest rate, price and credit risks. Prices tend to be inversely affected by changes in interest rates. Investors should also consider some of the potential risks of alternative investments: Alternative strategies may engage in investment practices that are speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the entire amount that is invested. Real Assets are more volatile than bonds and subject to greater risks than equities. The Multi-Strategy Alternatives Portfolio invests primarily in affiliated variable insurance funds and mutual funds (“underlying funds”) that provide exposure to liquid alternatives strategies and real assets. The Portfolio may also invest directly in other securities, including exchange-traded funds (“ETFs”). The Portfolio is intended for investors seeking long-term growth of capital. Through its investments in the underlying funds and ETFs, the Portfolio indirectly invest in equity securities, fixed income and/or floating rate securities, mortgage-backed and asset-backed securities, currencies, and restricted securities. In addition, the Portfolio and certain underlying funds may invest in derivatives including futures contracts, swaps, options, forward contracts and other instruments. The Portfolio is subject to the risk factors of the underlying funds in direct proportion to its investments in those underlying funds, and the ability of the Portfolio to meet its investment objective is directly related to the ability of the underlying funds to meet their investment objectives, as well as the allocation among those underlying funds by the Investment Adviser. An underlying fund is subject to the risks associated with its investments, including (as applicable) those associated with equity (including master limited partnerships, real estate investment trusts and mid- and small-cap securities), fixed income (including non-investment grade securities, loans, mortgage-backed and asset-backed securities), foreign and emerging countries, commodity and derivative investments generally. From time to time, the underlying funds in which the Portfolio invests, and the size of the investments in the underlying funds, is expected to change. Because the Portfolio is subject to the underlying fund expenses as well as its own expenses, the cost of investing in the Portfolio may be higher than investing in a mutual fund that only invests directly in stocks and bonds. The investment program of the Portfolio is speculative, entails substantial risks and includes alternative investment techniques not employed by traditional mutual funds. The Portfolio should not be relied upon as a complete investment program. The Portfolio’s investment techniques (if they do not perform as designed) may increase the volatility of performance and the risk of investment loss, including the loss of the entire amount that is invested, and there can be no assurance that the investment objective of the Portfolio will be achieved. Shares of the Goldman Sachs Variable Insurance Trust—Goldman Sachs Multi-Strategy Alternatives Portfolio are offered to separate accounts of participating life insurance companies for the purpose of funding variable annuity contracts and variable life insurance policies. Shares of the Portfolio are not offered directly to the general public. The variable annuity contracts and variable life insurance policies are described in the separate prospectuses issued by participating insurance companies. You should refer to those prospectuses for information about surrender charges, mortality and expense risk fees and other charges that may be assessed by participating insurance companies under the variable annuity contracts or variable life insurance policies. Such fees or charges, if any, may affect the return you realize with respect to your investments. Ask your representative for more complete information. Please consider the Portfolio’s objective, risks and charges and expenses, and read the Prospectus carefully before investing. The Prospectus contains this and other information about the Portfolio. A summary prospectus, if available, or a Prospectus for the Portfolio containing more information may be obtained from your authorized dealer or from Goldman, Sachs & Co. by calling 1-800-526-7384. Please read the summary prospectus, if available, and the Prospectus, which contains a portfolio’s objectives, risks, charges and expenses, and other information about the Portfolio, carefully before investing. Confidentiality No part of this material may, without GSAM’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. Goldman, Sachs & Co. is the distributor of the Goldman Sachs Variable Insurance Trust Funds. MSAPEFCT/8-16 © 2016 Goldman Sachs. All rights reserved. Compliance code: 51569-TMPL-10/2016-382351 NOT FDIC-INSURED May Lose Value No Bank Guarantee Date of First Use: August 15, 2016.