THU VI?N PHÁP LU?T

... issuance and payment conditions, assurance of legitimate rights and benefits of investors and other conditions. 3. Conditions for public offering of fund certificates to the public include: a/ The total value of fund certificates registered for offering is at least VND 50 billion; b/ There are an is ...

... issuance and payment conditions, assurance of legitimate rights and benefits of investors and other conditions. 3. Conditions for public offering of fund certificates to the public include: a/ The total value of fund certificates registered for offering is at least VND 50 billion; b/ There are an is ...

OPEN JOINT STOCK CO LONG DISTANCE

... should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, OJSC “Svyazinvest” and all the abovementioned companies disclaim any responsibility or liability for the violation of such restrictions by any person. The securities of OJSC “Rostelecom” th ...

... should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, OJSC “Svyazinvest” and all the abovementioned companies disclaim any responsibility or liability for the violation of such restrictions by any person. The securities of OJSC “Rostelecom” th ...

HSBC Jintrust Large Cap Equity Securities Investment Fund

... Past results of the Fund are not indicative of its future performance. Investment involves risks, and investors should read the Prospectus of the Fund carefully before making investment decisions. Hong Kong Securities and Futures Commission’s authorization is not a recommendation or endorsement of a ...

... Past results of the Fund are not indicative of its future performance. Investment involves risks, and investors should read the Prospectus of the Fund carefully before making investment decisions. Hong Kong Securities and Futures Commission’s authorization is not a recommendation or endorsement of a ...

IRR = 12.3%

... and yields a inflow of $20,000 one year later. Project D requires an initial investment of $20,000 and yields an inflow of $35,000 one year later. It would appear that we should choose project C due to its higher IRR. Project D, however, has the higher NPV. Project ...

... and yields a inflow of $20,000 one year later. Project D requires an initial investment of $20,000 and yields an inflow of $35,000 one year later. It would appear that we should choose project C due to its higher IRR. Project D, however, has the higher NPV. Project ...

Management Fee Evaluation

... any potential change in control of Janus Capital, the investment adviser to the Funds. These basic principles were communicated to Janus Capital on September 27, 2016, and were intended to be shared with Henderson. On October 3, 2016, Janus announced that it had entered into a definitive Agreement a ...

... any potential change in control of Janus Capital, the investment adviser to the Funds. These basic principles were communicated to Janus Capital on September 27, 2016, and were intended to be shared with Henderson. On October 3, 2016, Janus announced that it had entered into a definitive Agreement a ...

Do Shareholder Preferences Affect Corporate

... and operating characteristics in the firms they invest in. For example, some institutional investors tend to hold stocks of firms that are underleveraged relative to other firms in their industries with similar characteristics, while others tend to hold stocks that are overleveraged. Furthermore, I ...

... and operating characteristics in the firms they invest in. For example, some institutional investors tend to hold stocks of firms that are underleveraged relative to other firms in their industries with similar characteristics, while others tend to hold stocks that are overleveraged. Furthermore, I ...

Did Stop Signs Stop Investor Trading?

... firms relative to unclassified firms (i.e., firms dually quoted on the Pink Sheets and OTCBB markets). These results are robust to controlling for industry, firm size, ADR status, and time trends in liquidity. We also investigate the stock market response to three key events related to the implement ...

... firms relative to unclassified firms (i.e., firms dually quoted on the Pink Sheets and OTCBB markets). These results are robust to controlling for industry, firm size, ADR status, and time trends in liquidity. We also investigate the stock market response to three key events related to the implement ...

NBER WORKING PAPER SERIES INDIVIDUAL INVESTOR MUTUAL-FUND FLOWS Zoran Ivkovich Scott Weisbenner

... redemption side. That notion, however, is not grounded in a direct inquiry into the patterns of inflows and outflows, and it might well be that redemptions are related to past performance. Also, inflows and outflows might be related to other fund characteristics very differently. This paper studies ...

... redemption side. That notion, however, is not grounded in a direct inquiry into the patterns of inflows and outflows, and it might well be that redemptions are related to past performance. Also, inflows and outflows might be related to other fund characteristics very differently. This paper studies ...

Coming into force of the Investment Code

... This Guidance Notice presents the main features of the notification procedure in accordance with section 320 of the KAGB of 4 July 2013 and explains the prerequisites for marketing units and shares of EU AIFs or foreign AIFs to retail investors in the Federal Republic of Germany. This Guidance Notic ...

... This Guidance Notice presents the main features of the notification procedure in accordance with section 320 of the KAGB of 4 July 2013 and explains the prerequisites for marketing units and shares of EU AIFs or foreign AIFs to retail investors in the Federal Republic of Germany. This Guidance Notic ...

6. Law on the Investment Funds

... the investment fund management company where they are employed, as well as members of the closer family of the employees; 10. Persons related to the investment fund are an investment fund management company, depository bank, lawyer, auditor and tax advisor that have established relations for providi ...

... the investment fund management company where they are employed, as well as members of the closer family of the employees; 10. Persons related to the investment fund are an investment fund management company, depository bank, lawyer, auditor and tax advisor that have established relations for providi ...

Book CHI IPE 141 13628.indb

... crowdfunding will arise due to the amplification of information asymmetries. Whereas the asymmetry problem currently concerns the feasibility of and the creator’s ability to deliver the product, in the equity setting the asymmetry problem includes the above as well as the creator’s ability to genera ...

... crowdfunding will arise due to the amplification of information asymmetries. Whereas the asymmetry problem currently concerns the feasibility of and the creator’s ability to deliver the product, in the equity setting the asymmetry problem includes the above as well as the creator’s ability to genera ...

The Impact of Leverage on Hedge Fund Performance

... portfolios on commodities. In addition to seven-factor model, researchers enhance the model for emerging market hedge funds with an 8th factor that captures the return on emerging equity markets. Bollen and Whaley (2009) also contribute in the literature on performance measurement in the hedge fund ...

... portfolios on commodities. In addition to seven-factor model, researchers enhance the model for emerging market hedge funds with an 8th factor that captures the return on emerging equity markets. Bollen and Whaley (2009) also contribute in the literature on performance measurement in the hedge fund ...

Required Documents and Guidance Notes for Investment

... 3. Juridical persons applying for its change of name are not required to attach new Power of Attorney (POA) Certificates in its new name. 4. Detailing preconditions for non-ROC enterprises to be an eligible participant of merger and acquisition: (1) Enterprises with substantial business operations. ...

... 3. Juridical persons applying for its change of name are not required to attach new Power of Attorney (POA) Certificates in its new name. 4. Detailing preconditions for non-ROC enterprises to be an eligible participant of merger and acquisition: (1) Enterprises with substantial business operations. ...

Evidence about Bubble Mechanisms: Precipitating Event

... the Han and Hirshliefer (2016) model of the social transmission of information. Finally, we show that the predicted trading volumes due to positive feedback trading and social contagion explain warrant price levels, especially during the extreme phase of the bubble. These results are the first direc ...

... the Han and Hirshliefer (2016) model of the social transmission of information. Finally, we show that the predicted trading volumes due to positive feedback trading and social contagion explain warrant price levels, especially during the extreme phase of the bubble. These results are the first direc ...

A Cross-sectional Analysis Of Malaysian Unit Trust Fund Expense

... authors find that while there is a positive relation between fees and performance for high quality managers, a negative relation exists for low quality managers. Consistent with earlier studies, fund size and the number of funds within the management group are found to be negatively related to fund ...

... authors find that while there is a positive relation between fees and performance for high quality managers, a negative relation exists for low quality managers. Consistent with earlier studies, fund size and the number of funds within the management group are found to be negatively related to fund ...

2015 Preqin Sovereign Wealth Fund Review: Exclusive Extract

... of sovereign wealth funds, potential investments in highly illiquid asset classes and strategies are more feasible, the longer the investment horizon. Sovereign wealth funds are able to capture a wider range of return drivers and access more investment opportunities perhaps not available to their li ...

... of sovereign wealth funds, potential investments in highly illiquid asset classes and strategies are more feasible, the longer the investment horizon. Sovereign wealth funds are able to capture a wider range of return drivers and access more investment opportunities perhaps not available to their li ...

united states securities and exchange commission - corporate

... and critical shareholders to better explain why the transaction is good for the company and for them. Another reason this was important is that Monsanto has a bad reputation on account of its past, even though it has long since become a very different company. Monsanto today is an extremely well-man ...

... and critical shareholders to better explain why the transaction is good for the company and for them. Another reason this was important is that Monsanto has a bad reputation on account of its past, even though it has long since become a very different company. Monsanto today is an extremely well-man ...

Market Signals Associated with Taiwan REIT IPOs

... approved, and the maximum number of news reports is released on the date of the public offering, but news declines afterwards. News is only reported on the listing day, without much attention paid before or after that day. Therefore, the decreasing number of news reports and dearth of information ma ...

... approved, and the maximum number of news reports is released on the date of the public offering, but news declines afterwards. News is only reported on the listing day, without much attention paid before or after that day. Therefore, the decreasing number of news reports and dearth of information ma ...

Portfolio Performance, Discount Dynamics, and the Turnover of Closed-End Fund Mangers

... business day. For example, stocks held by U.S. closed-end equity funds (with the exception of very small issues) are traded frequently during the open hours of the New York Stock Exchange or Nasdaq. Further, each business day at the market close (4:00 p.m., New York Time), securities held by such a ...

... business day. For example, stocks held by U.S. closed-end equity funds (with the exception of very small issues) are traded frequently during the open hours of the New York Stock Exchange or Nasdaq. Further, each business day at the market close (4:00 p.m., New York Time), securities held by such a ...

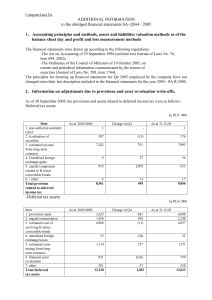

notes to - Sygnity

... Purchase series G bonds with a first purchase right to subscribe series U shares, Dom Inwestycyjny BRE Bank SA made an entry in the register of 137,200 series G bonds with a right of first purchase to subscribe series U shares, indicating that it became the owner of the bonds allocated to it. The pu ...

... Purchase series G bonds with a first purchase right to subscribe series U shares, Dom Inwestycyjny BRE Bank SA made an entry in the register of 137,200 series G bonds with a right of first purchase to subscribe series U shares, indicating that it became the owner of the bonds allocated to it. The pu ...

Proceedings of 7th Annual American Business Research Conference

... Thus, insider trading manifests itself through changes in the share ownership of large shareholders (La Porta et al., 1999). Large shareholders have an incentive to transfer the resources of the firm either directly or indirectly to themselves in pursuit of private benefits, undermining the interest ...

... Thus, insider trading manifests itself through changes in the share ownership of large shareholders (La Porta et al., 1999). Large shareholders have an incentive to transfer the resources of the firm either directly or indirectly to themselves in pursuit of private benefits, undermining the interest ...

Hedge Funds and the Technology Bubble

... 1978 all institutions with more than $100 million under discretionary management are required to disclose their holdings to the SEC each quarter on form 13F. This concerns all long positions in section 13(f) securities greater than 10,000 shares or $200,000, over which the manager exercises sole or ...

... 1978 all institutions with more than $100 million under discretionary management are required to disclose their holdings to the SEC each quarter on form 13F. This concerns all long positions in section 13(f) securities greater than 10,000 shares or $200,000, over which the manager exercises sole or ...

Investor Preferences and Demand for Active Management

... index options. In addition, since investments by U.S. open-end equity mutual funds account for a significant part of stock market capitalization, we expect that our index option-based risk preference estimates are representative of the risk attitude of the average mutual fund investor.7 Using flows ...

... index options. In addition, since investments by U.S. open-end equity mutual funds account for a significant part of stock market capitalization, we expect that our index option-based risk preference estimates are representative of the risk attitude of the average mutual fund investor.7 Using flows ...

Familiarity Breeds Investment

... absence of barriers to international investment.” An article in the Economist (1996), “Stay-at-Home Shareholders,” concludes: “It appears, therefore, that foreign investment has been hampered, at least until recently, by many of the factors that common sense would suggest: capital controls, opaque m ...

... absence of barriers to international investment.” An article in the Economist (1996), “Stay-at-Home Shareholders,” concludes: “It appears, therefore, that foreign investment has been hampered, at least until recently, by many of the factors that common sense would suggest: capital controls, opaque m ...