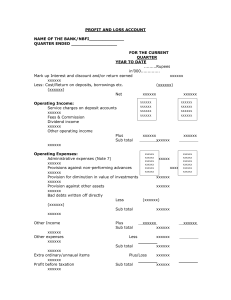

profit and loss account - State Bank of Pakistan

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

Bermuda Monetary Authority (Collective Investment Scheme

... or established in Bermuda prior to the coming into operation of these Regulations, shall continue under these Regulations as a Bermuda Recognised Scheme, a Bermuda Standard Scheme or a Bermuda Institutional Scheme, as the case may require, and everything lawfully done by such scheme shall be of full ...

... or established in Bermuda prior to the coming into operation of these Regulations, shall continue under these Regulations as a Bermuda Recognised Scheme, a Bermuda Standard Scheme or a Bermuda Institutional Scheme, as the case may require, and everything lawfully done by such scheme shall be of full ...

Time Consistent Multi-period Robust Risk Measures and

... Application of worst-case risk measures Lobo and Boyd [1999]: worst-case variance, variance uncertainty, transformed to seme-definite program El Ghaoui et al. [2003]: worst-case VaR, mean and variance uncertainty , transformed to SOCP Zhu and Fukushima [2009]: worst-case CVaR, mixture distribution u ...

... Application of worst-case risk measures Lobo and Boyd [1999]: worst-case variance, variance uncertainty, transformed to seme-definite program El Ghaoui et al. [2003]: worst-case VaR, mean and variance uncertainty , transformed to SOCP Zhu and Fukushima [2009]: worst-case CVaR, mixture distribution u ...

Firm boundaries and buyer-supplier match in market transaction: IT

... CUs are financial institutions that provide services to their members (customers). CUs offer not only checking and saving accounts but also a wider array of financial services including more sophisticated saving and investment options as well as personal loans and mortgages; the specific product off ...

... CUs are financial institutions that provide services to their members (customers). CUs offer not only checking and saving accounts but also a wider array of financial services including more sophisticated saving and investment options as well as personal loans and mortgages; the specific product off ...

Management Fee Evaluation

... amended (the “1940 Act”). Section 15(f) provides a non-exclusive safe harbor for an investment adviser to an investment company or any of its affiliated persons to receive any amount or benefit in connection with a change in control of the investment adviser so long as two conditions are met. First, ...

... amended (the “1940 Act”). Section 15(f) provides a non-exclusive safe harbor for an investment adviser to an investment company or any of its affiliated persons to receive any amount or benefit in connection with a change in control of the investment adviser so long as two conditions are met. First, ...

Study on the remuneration provisions applicable to credit institutions

... management. Deferral of variable pay, malus arrangements and a maximum ratio for the variable pay of risk-taking personnel are seen to be effective incentives even at this early stage. Competitive disadvantages with regard to attracting and retaining staff from unregulated sectors could not be verif ...

... management. Deferral of variable pay, malus arrangements and a maximum ratio for the variable pay of risk-taking personnel are seen to be effective incentives even at this early stage. Competitive disadvantages with regard to attracting and retaining staff from unregulated sectors could not be verif ...

In this Rule - ACT Legislation Register

... Meeting means the venue and date upon which the Corporation is accepting Bets is conducted. Notional Dividend means in relation to an All-Up Parlay Bets the amount of winnings accumulated following a successful Selection which is ultimately re-bet upon the person’s Selection in the next Event of the ...

... Meeting means the venue and date upon which the Corporation is accepting Bets is conducted. Notional Dividend means in relation to an All-Up Parlay Bets the amount of winnings accumulated following a successful Selection which is ultimately re-bet upon the person’s Selection in the next Event of the ...

BlackBerry Receives Investment of U.S. $1 Billion from Fairfax

... by this group of preeminent, long-term investors," said Barbara Stymiest, Chair of BlackBerry's Board. "The BlackBerry Board conducted a thorough review of strategic alternatives and pursued the course of action that it concluded is in the best interests of BlackBerry and its constituents, including ...

... by this group of preeminent, long-term investors," said Barbara Stymiest, Chair of BlackBerry's Board. "The BlackBerry Board conducted a thorough review of strategic alternatives and pursued the course of action that it concluded is in the best interests of BlackBerry and its constituents, including ...

dollar cost averaging - the role of cognitive error

... ESA1 is an attempt to invest the same total amount as DCA over these three periods, but to do so in equal share amounts. With the share price initially at $3, a reasonable approach would be to buy 20 shares, since if prices remain at this level in periods 2 and 3 we will end up investing exactly th ...

... ESA1 is an attempt to invest the same total amount as DCA over these three periods, but to do so in equal share amounts. With the share price initially at $3, a reasonable approach would be to buy 20 shares, since if prices remain at this level in periods 2 and 3 we will end up investing exactly th ...

News from CFA Sacramento

... region for nearly 20 years. He completed his undergraduate studies at the University of California, Davis, where he earned a Bachelor's of Science degree in Managerial Economics. After graduating and working for several years at State Street in portfolio accounting, his desire to transition to a c ...

... region for nearly 20 years. He completed his undergraduate studies at the University of California, Davis, where he earned a Bachelor's of Science degree in Managerial Economics. After graduating and working for several years at State Street in portfolio accounting, his desire to transition to a c ...

The European Commission`s Push to Consolidate and Expand ISDS

... tribunals that resolve disputes concerning the legality of sovereign conduct. ISDS does not incorporate these safeguards, allowing instead for: (a) case-by-case appointment of adjudicators; (b) case-by-case (i.e. for-profit) payment of adjudicators; (c) executive control over default case assignment ...

... tribunals that resolve disputes concerning the legality of sovereign conduct. ISDS does not incorporate these safeguards, allowing instead for: (a) case-by-case appointment of adjudicators; (b) case-by-case (i.e. for-profit) payment of adjudicators; (c) executive control over default case assignment ...

On the history of the Growth Optimal Portfolio

... introduced into economic theory, not as a special case of a general utility maximization problem, but because it seems as an intuitive objective, when the investment horizon stretches over several periods. The next section will demonstrate the importance of this observation. For simplicity it is alw ...

... introduced into economic theory, not as a special case of a general utility maximization problem, but because it seems as an intuitive objective, when the investment horizon stretches over several periods. The next section will demonstrate the importance of this observation. For simplicity it is alw ...

Retirement Date Fund

... All you have to do is choose the fund that most closely matches the year you expect to retire from the Florida Retirement System (FRS) Investment Plan. Diversification, asset allocation, and account rebalancing are all done for you. Each Retirement Date Fund is a diversified portfolio of other Inves ...

... All you have to do is choose the fund that most closely matches the year you expect to retire from the Florida Retirement System (FRS) Investment Plan. Diversification, asset allocation, and account rebalancing are all done for you. Each Retirement Date Fund is a diversified portfolio of other Inves ...

CANACCORD CAPITAL CORPORATION, DONALD GRANT

... gross commissions of at least $26,597. Only 93 of these trades were marked unsolicited. This trading occurred when MacDonald and Dipasquale knew or ought to have known that Pryde was out of the office and being treated for a mental health related issue. MacDonald and Dipasquale therefore knew, or ou ...

... gross commissions of at least $26,597. Only 93 of these trades were marked unsolicited. This trading occurred when MacDonald and Dipasquale knew or ought to have known that Pryde was out of the office and being treated for a mental health related issue. MacDonald and Dipasquale therefore knew, or ou ...

Read full article - Harvard International Law Journal

... the free movement of transnational capital.”18 The system is constitutional because it focuses on providing investors with vaguely worded substantive rights, like the right to “prompt, adequate, and effective compensation” in the event of expropriation.19 Such rights are normatively higher than dome ...

... the free movement of transnational capital.”18 The system is constitutional because it focuses on providing investors with vaguely worded substantive rights, like the right to “prompt, adequate, and effective compensation” in the event of expropriation.19 Such rights are normatively higher than dome ...

MSCI Equity Indexes February 2016 Index Review

... Without limiting any of the foregoing and to the maximum extent permitted by applicable law, in no event shall any Information Provider have any liability regarding any of the Information for any direct, indirect, special, punitive, consequential (including lost profits) or any other damages even if ...

... Without limiting any of the foregoing and to the maximum extent permitted by applicable law, in no event shall any Information Provider have any liability regarding any of the Information for any direct, indirect, special, punitive, consequential (including lost profits) or any other damages even if ...

View the presentation.

... activity does not occur in the U.S. Personnel in Non-U.S. manager’s U.S. office are responsible for stock selection on an autonomous basis subject to direction and high-level oversight by higher-level non-U.S. personnel Because the fund is not owned by majority of U.S. persons, fund does not tri ...

... activity does not occur in the U.S. Personnel in Non-U.S. manager’s U.S. office are responsible for stock selection on an autonomous basis subject to direction and high-level oversight by higher-level non-U.S. personnel Because the fund is not owned by majority of U.S. persons, fund does not tri ...

The Impacts of Capital Structure on Depth of Outreach in Sub

... to meet the “double-bottom line,” microfinance strives to not only do-good but to pay for itself. Since MFI borrowers are charged an interest rate on credit and sometimes fees associated with membership, in theory, MFIs should be able to cover costs. The idea that microfinance is a social service th ...

... to meet the “double-bottom line,” microfinance strives to not only do-good but to pay for itself. Since MFI borrowers are charged an interest rate on credit and sometimes fees associated with membership, in theory, MFIs should be able to cover costs. The idea that microfinance is a social service th ...

Form ADV Part 2

... account”) is a professionally managed investment plan in which all expenses, including brokerage commissions, management fees, and administrative costs, are “wrapped” into a single charge. The Wealthfront Program provides clients investment guidance, portfolio management, and necessary basic brokera ...

... account”) is a professionally managed investment plan in which all expenses, including brokerage commissions, management fees, and administrative costs, are “wrapped” into a single charge. The Wealthfront Program provides clients investment guidance, portfolio management, and necessary basic brokera ...

FAQs by Issuers

... economy, industry, capital markets and companies. We also conduct training programs to financial sector professionals on a wide array of technical issues. We are India's most credible provider of economy and industry research. Our industry research covers 86 sectors and is known for its rich insight ...

... economy, industry, capital markets and companies. We also conduct training programs to financial sector professionals on a wide array of technical issues. We are India's most credible provider of economy and industry research. Our industry research covers 86 sectors and is known for its rich insight ...

417KB

... established to manage the business. In addition, with the aim of further enhancing our capability to capture and support projects in environmental, natural resources, water and new energy industries, which are expected to show high growth, the internal project team for these industries and Environme ...

... established to manage the business. In addition, with the aim of further enhancing our capability to capture and support projects in environmental, natural resources, water and new energy industries, which are expected to show high growth, the internal project team for these industries and Environme ...

Book CHI IPE 141 13628.indb

... crowdfunding will arise due to the amplification of information asymmetries. Whereas the asymmetry problem currently concerns the feasibility of and the creator’s ability to deliver the product, in the equity setting the asymmetry problem includes the above as well as the creator’s ability to genera ...

... crowdfunding will arise due to the amplification of information asymmetries. Whereas the asymmetry problem currently concerns the feasibility of and the creator’s ability to deliver the product, in the equity setting the asymmetry problem includes the above as well as the creator’s ability to genera ...

2015 Preqin Sovereign Wealth Fund Review: Exclusive Extract

... important change in investment philosophy and asset allocation. More recently, the developments in commodity markets, particularly the decline in oil prices, are significant game changers for a number of sovereign wealth funds. Long periods of substantial cash in-flows, standstills in expansion, and ...

... important change in investment philosophy and asset allocation. More recently, the developments in commodity markets, particularly the decline in oil prices, are significant game changers for a number of sovereign wealth funds. Long periods of substantial cash in-flows, standstills in expansion, and ...

HSBC Jintrust Large Cap Equity Securities Investment Fund

... The Analysis of Top Five Precious Metal Investments by Percentage of the Fair Value in the Net Asset Value of the Fund at the End of the Reporting Period........................................................................................................... The Analysis of Top Five Warrant Invest ...

... The Analysis of Top Five Precious Metal Investments by Percentage of the Fair Value in the Net Asset Value of the Fund at the End of the Reporting Period........................................................................................................... The Analysis of Top Five Warrant Invest ...