OFFERING CIRCULAR 27 April 2016* J.P. Morgan Structured

... each Issuer's business activities as well as certain financial information and material risks faced by each Issuer. What are the Securities? An Issuer may issue Securities in the form of any of (i) Warrants (ii) Certificates and (iii) Notes (all of which are referred to as "Securities"), under the S ...

... each Issuer's business activities as well as certain financial information and material risks faced by each Issuer. What are the Securities? An Issuer may issue Securities in the form of any of (i) Warrants (ii) Certificates and (iii) Notes (all of which are referred to as "Securities"), under the S ...

OPEN JOINT STOCK CO LONG DISTANCE

... of the voting stock, as can be deduced from the data of the depositary - The Bank of New York Mellon. The largest interest - some 741,900 ADRs — according to the depositary data was acquired by Emerging Markets Growth Fund, part of Capital International Funds. Additionally, securities were purchased ...

... of the voting stock, as can be deduced from the data of the depositary - The Bank of New York Mellon. The largest interest - some 741,900 ADRs — according to the depositary data was acquired by Emerging Markets Growth Fund, part of Capital International Funds. Additionally, securities were purchased ...

securities and exchange commission

... guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statements. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use ...

... guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statements. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use ...

base prospectus £100000000 secured bond issuance

... Act 2000 does not apply (all such persons together referred to as “Relevant Persons”). This Base Prospectus must not be acted on or relied on in the United Kingdom by persons who are not Relevant Persons. Any investment or investment activity to which the Base Prospectus relates is available in the ...

... Act 2000 does not apply (all such persons together referred to as “Relevant Persons”). This Base Prospectus must not be acted on or relied on in the United Kingdom by persons who are not Relevant Persons. Any investment or investment activity to which the Base Prospectus relates is available in the ...

FORM F-9 and FORM F-3

... Barrick’s cumulative total shareholders return on publicly traded securities compared with the cumulative total return of the S&P/TSX Gold Index, the S&P/TSX Composite Index or any other broad equity market index or a published industry or line-of-business index) that Barrick files with the OSC will ...

... Barrick’s cumulative total shareholders return on publicly traded securities compared with the cumulative total return of the S&P/TSX Gold Index, the S&P/TSX Composite Index or any other broad equity market index or a published industry or line-of-business index) that Barrick files with the OSC will ...

star gas partners, lp star gas finance company

... Home heating oil is primarily used as a source of fuel to heat residences and businesses in the Northeast and Mid-Atlantic regions. According to the U.S. Department of Energy—Energy Information Administration, 2005 Residential Energy Consumption Survey (the latest survey published), these regions ac ...

... Home heating oil is primarily used as a source of fuel to heat residences and businesses in the Northeast and Mid-Atlantic regions. According to the U.S. Department of Energy—Energy Information Administration, 2005 Residential Energy Consumption Survey (the latest survey published), these regions ac ...

CMS Energy Corporation

... This prospectus, the applicable prospectus supplement and any free writing prospectus we authorize contains and incorporates by reference information that you should consider when making your investment decision. We have not authorized anyone to provide you with different information. You should not ...

... This prospectus, the applicable prospectus supplement and any free writing prospectus we authorize contains and incorporates by reference information that you should consider when making your investment decision. We have not authorized anyone to provide you with different information. You should not ...

pdf

... present greater hedging difficulties to the dealer. In theory, if one specifies the dynamics of instantaneous volatility as a one-dimensional diffusion, then one can replicate a volatility derivative by trading the underlying shares and one option. Such simple stochastic volatility models are, howev ...

... present greater hedging difficulties to the dealer. In theory, if one specifies the dynamics of instantaneous volatility as a one-dimensional diffusion, then one can replicate a volatility derivative by trading the underlying shares and one option. Such simple stochastic volatility models are, howev ...

Corestates Capital II

... sole assets of the Trust. The Company will guarantee the payment of Distributions and payments on liquidation of the Trust or redemption of the Capital Securities, but only in each case to the extent of funds held by the Trust, as described herein (the "Guarantee"). See "Description of Guarantee." I ...

... sole assets of the Trust. The Company will guarantee the payment of Distributions and payments on liquidation of the Trust or redemption of the Capital Securities, but only in each case to the extent of funds held by the Trust, as described herein (the "Guarantee"). See "Description of Guarantee." I ...

NBER WORKING PAPER SERIES SIMPLE VARIANCE SWAPS Ian Martin Working Paper 16884

... In particular, sharp moves in the underlying highlighted exposures to cubed and higherorder daily returns. The inability to take positions in deep OTM options when hedging a variance swap later affected the efficacy of the hedging strategy. As the underlying index or stock moved away from its initia ...

... In particular, sharp moves in the underlying highlighted exposures to cubed and higherorder daily returns. The inability to take positions in deep OTM options when hedging a variance swap later affected the efficacy of the hedging strategy. As the underlying index or stock moved away from its initia ...

Word - corporate

... any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should a ...

... any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should a ...

Investing in CLOs - CION Investments

... primary markets, or among non‐US credits. In our view, every CLO manager feels at least some pressure to stretch a little, to become more creative, or to dig a little deeper into the market to protect the arbitrage. Question 1: Where is the stretch? A common topic found within CLO researc ...

... primary markets, or among non‐US credits. In our view, every CLO manager feels at least some pressure to stretch a little, to become more creative, or to dig a little deeper into the market to protect the arbitrage. Question 1: Where is the stretch? A common topic found within CLO researc ...

THU VI?N PHÁP LU?T

... VND 10 billion or more accounted according to the book value; b/ Its business operation in the year preceding the year of offering registration is profitable and, at the same time, it has no accrued loss up to the year of offering registration; c/ Its issuance plan and plan on the use of capital gen ...

... VND 10 billion or more accounted according to the book value; b/ Its business operation in the year preceding the year of offering registration is profitable and, at the same time, it has no accrued loss up to the year of offering registration; c/ Its issuance plan and plan on the use of capital gen ...

State-Boston Retirement System Complaint

... manipulation of the market for U.S. Treasury bills, notes, and bonds (together, "Treasury securities"), and derivative financial products based on these Treasury securities, including Treasury futures and options traded on the Chicago Mercantile Exchange (collectively with Treasury securities, "Trea ...

... manipulation of the market for U.S. Treasury bills, notes, and bonds (together, "Treasury securities"), and derivative financial products based on these Treasury securities, including Treasury futures and options traded on the Chicago Mercantile Exchange (collectively with Treasury securities, "Trea ...

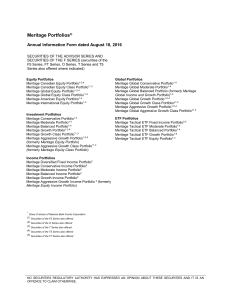

Annual Information Form

... practices are designed to ensure that the investments of the Portfolios are diversified and relatively liquid, and to ensure that the Portfolios are properly administered. The Portfolios are subject, namely, to section 4.1 of Regulation 81-102, which prohibits certain investments when certain relate ...

... practices are designed to ensure that the investments of the Portfolios are diversified and relatively liquid, and to ensure that the Portfolios are properly administered. The Portfolios are subject, namely, to section 4.1 of Regulation 81-102, which prohibits certain investments when certain relate ...

shares as security in modern times: problems and prospects

... Borrowing is an important method of financing the activities of companies in most commercial climes. A company may finance itself not only via issuance of shares but also by incurring debt. These two principal means of financing corporate activities come with their peculiar incidents. This paper how ...

... Borrowing is an important method of financing the activities of companies in most commercial climes. A company may finance itself not only via issuance of shares but also by incurring debt. These two principal means of financing corporate activities come with their peculiar incidents. This paper how ...

As filed with the Securities and Exchange Commission on August 13

... We may offer and sell ordinary shares, including ordinary shares represented by American depositary shares, or ADSs, preferred shares, debt securities or warrants in any combination from time to time in one or more offerings, at prices and on terms described in one or more supplements to this prospe ...

... We may offer and sell ordinary shares, including ordinary shares represented by American depositary shares, or ADSs, preferred shares, debt securities or warrants in any combination from time to time in one or more offerings, at prices and on terms described in one or more supplements to this prospe ...

The Impact of Collateralization on Swap Rates

... after the Long-Term Capital Management (LTCM) hedge fund crisis in 1998. In fact, Lowenstein (2000) notes that LTCM both collateralized and marked their positions to market: “the banks did hold collateral, after all, and Long-Term generally settled up (in cash) at the end of each trading day, collec ...

... after the Long-Term Capital Management (LTCM) hedge fund crisis in 1998. In fact, Lowenstein (2000) notes that LTCM both collateralized and marked their positions to market: “the banks did hold collateral, after all, and Long-Term generally settled up (in cash) at the end of each trading day, collec ...

More Mortgages, Lower Growth? - Economics of Credit And Debt

... compared to credit supporting transactions in goods and services, as suggested by Werner (1997, 2012). Werner (1997) applied this insight to data on Japan for the 1980s and 1990s. In this paper we extend this disaggregation to a large panel of countries. Our paper is closely related to Beck et al. ...

... compared to credit supporting transactions in goods and services, as suggested by Werner (1997, 2012). Werner (1997) applied this insight to data on Japan for the 1980s and 1990s. In this paper we extend this disaggregation to a large panel of countries. Our paper is closely related to Beck et al. ...

NSTAR ELECTRIC COMPANY doing business as - corporate

... "Commission") using a "shelf" registration process as a "well-known seasoned issuer." Under the shelf registration process, we may, from time to time, issue and sell to the public the securities described in the accompanying prospectus, including the Debt Securities, up to an indeterminate amount, o ...

... "Commission") using a "shelf" registration process as a "well-known seasoned issuer." Under the shelf registration process, we may, from time to time, issue and sell to the public the securities described in the accompanying prospectus, including the Debt Securities, up to an indeterminate amount, o ...

Frequently Asked Questions About

... unidentified company or companies, another entity or person. (Securities Act Rule 419(a)(2)). A shell corporation is a company that serves as a vehicle for business transactions without itself having any significant assets or operations. (Securities Act Rule 405). A penny stock issuer is a very smal ...

... unidentified company or companies, another entity or person. (Securities Act Rule 419(a)(2)). A shell corporation is a company that serves as a vehicle for business transactions without itself having any significant assets or operations. (Securities Act Rule 405). A penny stock issuer is a very smal ...

not for release, publication or distribution, directly or indirectly

... that invests in venture capital, buyout, mezzanine debt, and distressed debt through primary partnerships, secondary purchases, and direct investments. Since 1984, HarbourVest has been a leading buyer of private equity assets, acquiring $8 billion of assets in over 350 deals of all stages, types, vi ...

... that invests in venture capital, buyout, mezzanine debt, and distressed debt through primary partnerships, secondary purchases, and direct investments. Since 1984, HarbourVest has been a leading buyer of private equity assets, acquiring $8 billion of assets in over 350 deals of all stages, types, vi ...

The Behavior of US Interest Rate Swap Spreads in Global Financial

... Four determinants of swap spreads - default risk, the slope of yield curve, liquidity premium and volatility - are chosen. As for default risk, two kinds of default risk are used to investigate the sensitivity of swap spreads to Aaa and Baa corporate bond spreads. An interest rate swap is an agreeme ...

... Four determinants of swap spreads - default risk, the slope of yield curve, liquidity premium and volatility - are chosen. As for default risk, two kinds of default risk are used to investigate the sensitivity of swap spreads to Aaa and Baa corporate bond spreads. An interest rate swap is an agreeme ...

CSC FAQs - Module 21: Hedge Funds

... General Feedback: Convertible securities have a theoretical value that is based on a number of factors, including the value of the underlying stock. When the trading price of a convertible bond moves away from its theoretical value, an arbitrage opportunity exists. This strategy typically involves b ...

... General Feedback: Convertible securities have a theoretical value that is based on a number of factors, including the value of the underlying stock. When the trading price of a convertible bond moves away from its theoretical value, an arbitrage opportunity exists. This strategy typically involves b ...

Guide for Equity - Cayman Islands Stock Exchange

... • this can be varied for certain specialist issuers, see above • an accountants report is required where there has been any material change to the group structure, accounting policies, or a qualified audit in the past three years • newly formed companies must have sufficient working capital for a ...

... • this can be varied for certain specialist issuers, see above • an accountants report is required where there has been any material change to the group structure, accounting policies, or a qualified audit in the past three years • newly formed companies must have sufficient working capital for a ...