ING Group Inaugural AT1 Roadshow (PDF 0,4 Mb)

... • We will aim to maintain a comfortable buffer above the minimum 10% to absorb regulatory changes and potential volatility ...

... • We will aim to maintain a comfortable buffer above the minimum 10% to absorb regulatory changes and potential volatility ...

payments and securities clearance and settlement systems in

... The Kazakhstan Interbank Settlement Center (KISC) of the National Bank of Kazakhstan is currently acting as Technical Secretariat of the CISPI and is playing a major role in making the process sustainable. To this end, the initiative has helped strengthen KISC's in-house expertise. Additionally, pra ...

... The Kazakhstan Interbank Settlement Center (KISC) of the National Bank of Kazakhstan is currently acting as Technical Secretariat of the CISPI and is playing a major role in making the process sustainable. To this end, the initiative has helped strengthen KISC's in-house expertise. Additionally, pra ...

ROYAL BANK OF CANADA

... unsecured debt obligations of the issuer, Royal Bank of Canada, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Securities, including any repayment of principal at maturity, depends on the ability of Royal Bank of Canada to satisfy its obli ...

... unsecured debt obligations of the issuer, Royal Bank of Canada, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Securities, including any repayment of principal at maturity, depends on the ability of Royal Bank of Canada to satisfy its obli ...

SunAmerica Dynamic Allocation Portfolio Summary

... derivative instruments to manage the Portfolio’s net equity exposure. The derivative instruments used by the Overlay Component will primarily consist of stock index futures and stock index options, but may also include options on stock index futures and stock index swaps. The aforementioned derivati ...

... derivative instruments to manage the Portfolio’s net equity exposure. The derivative instruments used by the Overlay Component will primarily consist of stock index futures and stock index options, but may also include options on stock index futures and stock index swaps. The aforementioned derivati ...

BARCLAYS BANK PLC (Form: 424B2, Received: 12/30

... lower returns, of fixed income investments with comparable maturities and credit ratings that bear interest at a prevailing market rate. ...

... lower returns, of fixed income investments with comparable maturities and credit ratings that bear interest at a prevailing market rate. ...

Reporting Responsibilities on U.S. Holdings of Foreign Securities

... SLT is a monthly report required by the U.S. Department of the Treasury, which is being assisted by the FRBNY, to gather information (i) on U.S.-resident holdings of certain foreign securities and (ii) on foreign-resident holdings of certain U.S. securities. TIC SLT must be filed if, as of the last ...

... SLT is a monthly report required by the U.S. Department of the Treasury, which is being assisted by the FRBNY, to gather information (i) on U.S.-resident holdings of certain foreign securities and (ii) on foreign-resident holdings of certain U.S. securities. TIC SLT must be filed if, as of the last ...

Portfolio rebalancing is the process of bringing the different asset

... that are expected to outperform over the shorter term. ...

... that are expected to outperform over the shorter term. ...

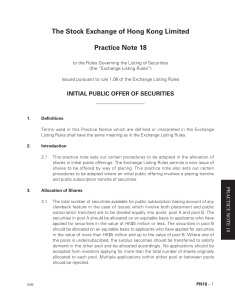

initial public offer of securities

... applied for securities in the value of HK$5 million or less. The securities in pool B should be allocated on an equitable basis to applicants who have applied for securities in the value of more than HK$5 million and up to the value of pool B. Where one of the pools is undersubscribed, the surplus s ...

... applied for securities in the value of HK$5 million or less. The securities in pool B should be allocated on an equitable basis to applicants who have applied for securities in the value of more than HK$5 million and up to the value of pool B. Where one of the pools is undersubscribed, the surplus s ...

Insights 1213_Berman.indd

... Issuers with affiliated broker-dealers (typically, financial holding companies) will note the registration of the resale by the broker-dealer of the issuer’s securities in market-making transactions by means of a footnote under the “Calculation of Registration Fee” table in the issuer’s Form S-3 or ...

... Issuers with affiliated broker-dealers (typically, financial holding companies) will note the registration of the resale by the broker-dealer of the issuer’s securities in market-making transactions by means of a footnote under the “Calculation of Registration Fee” table in the issuer’s Form S-3 or ...

Tax-exempt housing bonds: municipals and mortgages intersect

... Contractually, housing bonds cannot extend beyond their stated final maturities, but there are potentially many ways for the bonds to be redeemed before the stated final maturity. Thus, it is a challenge for investors to analyze the expected duration of housing bonds given the number of options invo ...

... Contractually, housing bonds cannot extend beyond their stated final maturities, but there are potentially many ways for the bonds to be redeemed before the stated final maturity. Thus, it is a challenge for investors to analyze the expected duration of housing bonds given the number of options invo ...

The Role of Bond Covenants in Municipal Finance Credit

... Additional bonds test - the additional bonds test restricts the issuance of additional bonds to an amount that would leave the revenue stream sufficient to pay both the existing and proposed debt. The test is intended to ensure that future bond issuance does not reduce bondholder security by placing ...

... Additional bonds test - the additional bonds test restricts the issuance of additional bonds to an amount that would leave the revenue stream sufficient to pay both the existing and proposed debt. The test is intended to ensure that future bond issuance does not reduce bondholder security by placing ...

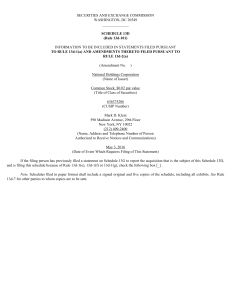

NATIONAL HOLDINGS CORP (Form: SC 13D

... (b) The address of the principal office of Mr. Klein is 590 Madison Avenue, 29th Floor, New York, NY 10022. (c) The principal occupation of Mr. Klein is serving as an employee of B. Riley Capital Management, LLC, a registered investment advisor, with a principal business address of 11100 Santa Monic ...

... (b) The address of the principal office of Mr. Klein is 590 Madison Avenue, 29th Floor, New York, NY 10022. (c) The principal occupation of Mr. Klein is serving as an employee of B. Riley Capital Management, LLC, a registered investment advisor, with a principal business address of 11100 Santa Monic ...

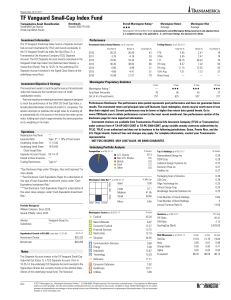

TF Vanguard Small-Cap Index Fund

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

Business 3 Template

... C. The authorized capital of the company. D. Action plan for the first three years from the date of establishment, including the actions and procedures for collecting, entering, retrieving the information and the security and protection of credit information and credit reports and its confidentialit ...

... C. The authorized capital of the company. D. Action plan for the first three years from the date of establishment, including the actions and procedures for collecting, entering, retrieving the information and the security and protection of credit information and credit reports and its confidentialit ...

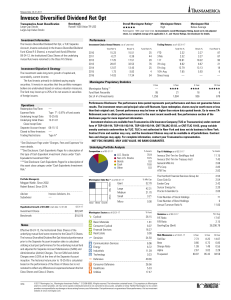

Invesco Diversified Dividend Ret Opt

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

Repurchase agreements and the law

... In 2000, however, a court ruling in the bankruptcy of Criimi Mae, a publicly held commercial mortage REIT, took market participants by surprise, creating a disturbance in the repo market (Schroeder 2002, ...

... In 2000, however, a court ruling in the bankruptcy of Criimi Mae, a publicly held commercial mortage REIT, took market participants by surprise, creating a disturbance in the repo market (Schroeder 2002, ...

CFTC Grants No-Action Relief from Clearing Requriment for Certain

... For each exempted swap, the reporting counterparty is required to provide notice of the election and confirmation that the electing party satisfies the conditions of the No-Action Relief. The reporting counterparty must have a reasonable basis to believe that the electing counterparty meets these co ...

... For each exempted swap, the reporting counterparty is required to provide notice of the election and confirmation that the electing party satisfies the conditions of the No-Action Relief. The reporting counterparty must have a reasonable basis to believe that the electing counterparty meets these co ...

INVESTMENT POLICY STATEMENT APPROVED JANUARY 30

... c. Invest no more than 25% of the portfolio in any one economic sector; d. Assure that no position of any one issuer shall exceed 5% of the manager’s total portfolio as measured at market value except for securities issued by the U. S. government or its agencies; e. Use of Non-rated convertible bond ...

... c. Invest no more than 25% of the portfolio in any one economic sector; d. Assure that no position of any one issuer shall exceed 5% of the manager’s total portfolio as measured at market value except for securities issued by the U. S. government or its agencies; e. Use of Non-rated convertible bond ...

The Myths and Fallacies about Diversified Portfolios

... frontier – but only if you make the assumption that all of the securities have the same Sharpe ratio, the same volatilities, the same expected returns and the same pairwise correlations. Maximizing the diversification ratio Choueifaty and Coignard (2008) defined a measure of diversification by formi ...

... frontier – but only if you make the assumption that all of the securities have the same Sharpe ratio, the same volatilities, the same expected returns and the same pairwise correlations. Maximizing the diversification ratio Choueifaty and Coignard (2008) defined a measure of diversification by formi ...

Tanguy Dehapiot

... initial P&L is zero and both counterparties agree the price. The entity has implicitly made a capital distribution (decrease) to the shareholder and share intrinsic value decrease but time value increases. DVA is like a dividend in kind. Basel III paragraph 75 seems correct: the new derivative g ...

... initial P&L is zero and both counterparties agree the price. The entity has implicitly made a capital distribution (decrease) to the shareholder and share intrinsic value decrease but time value increases. DVA is like a dividend in kind. Basel III paragraph 75 seems correct: the new derivative g ...

MODERN RISK MANAGEMENT

... • There are several types of risks which any bank or corporation has to face. Today and tomorrow we are focusing especially on two of them, namely market risk (risk caused by changes in market prices) and credit risk (risk caused by changes in creditworthiness of our debtors or counterparties). • O ...

... • There are several types of risks which any bank or corporation has to face. Today and tomorrow we are focusing especially on two of them, namely market risk (risk caused by changes in market prices) and credit risk (risk caused by changes in creditworthiness of our debtors or counterparties). • O ...

Credit Management

... Charge Accounts • Revolving Accounts • Most popular form of sales credit • Charge purchases at any time, but only part of the debt must be paid each month • A credit limit is set for the maximum amount to be spent • Payments are required once a month, but it doesn’t have to be the FULL payment • A ...

... Charge Accounts • Revolving Accounts • Most popular form of sales credit • Charge purchases at any time, but only part of the debt must be paid each month • A credit limit is set for the maximum amount to be spent • Payments are required once a month, but it doesn’t have to be the FULL payment • A ...

Risk Management Lessons from the Credit Crisis

... risk factors, could be incorrect. These fall in the broad category of model risk. As an example of the first problem, many portfolios unexpected lost money on basis trades during 2008. These involve hedged positions. For instance, a trader could buy a corporate bond and at the same time purchase a c ...

... risk factors, could be incorrect. These fall in the broad category of model risk. As an example of the first problem, many portfolios unexpected lost money on basis trades during 2008. These involve hedged positions. For instance, a trader could buy a corporate bond and at the same time purchase a c ...

AVEO Announces $17 Million Private Placement CAMBRIDGE

... announced that it entered into a securities purchase agreement for a private placement with a select group of qualified institutional buyers, institutional accredited investors and accredited investors. The private placement will consist of 17,642,482 units, at a price of $0.965 per unit, for gross ...

... announced that it entered into a securities purchase agreement for a private placement with a select group of qualified institutional buyers, institutional accredited investors and accredited investors. The private placement will consist of 17,642,482 units, at a price of $0.965 per unit, for gross ...