derivatives

... payments to A based on 6-month LIBOR (the London InterBank Offered Rate, currently 0.8%). They agree that on any given payment date, they will exchange the net difference of their obligations. Note that the principal amount never changes hands, which is why it is referred to as notional. The cash fl ...

... payments to A based on 6-month LIBOR (the London InterBank Offered Rate, currently 0.8%). They agree that on any given payment date, they will exchange the net difference of their obligations. Note that the principal amount never changes hands, which is why it is referred to as notional. The cash fl ...

Explaining Cross-Sectional Differences in Credit Default

... latter obtaining a right for future compensation conditioned on the happening of a credit event at a later date. ...

... latter obtaining a right for future compensation conditioned on the happening of a credit event at a later date. ...

Consumers - Cloudfront.net

... Create a budget: set financial goals, estimate income, estimate expenditures. Factors to consider: safety, rate of return, liquidity. Where people put their savings: savings accounts, certificates of deposit, money market, pension funds, corporate stocks, U.S. savings bonds, other government sec ...

... Create a budget: set financial goals, estimate income, estimate expenditures. Factors to consider: safety, rate of return, liquidity. Where people put their savings: savings accounts, certificates of deposit, money market, pension funds, corporate stocks, U.S. savings bonds, other government sec ...

Interest Rate Parity

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

Structured Products to Gain Interest in Korea

... products such as synthetic collateralized debt obligations in Korea, an international financial service company said Tuesday. During the Korea Finance and Capital Markets Conference organized by Euro Events and sponsored by The Korea Times, Sam Pang, vice president at Fortis Bank, said that there wi ...

... products such as synthetic collateralized debt obligations in Korea, an international financial service company said Tuesday. During the Korea Finance and Capital Markets Conference organized by Euro Events and sponsored by The Korea Times, Sam Pang, vice president at Fortis Bank, said that there wi ...

Chapter 5 File

... repeal Glass-Steagall and it was finally repealed by the Gramm-Leach-Bliley Act of November 1999 ...

... repeal Glass-Steagall and it was finally repealed by the Gramm-Leach-Bliley Act of November 1999 ...

PreConf-Session B – Heaney

... Change: To make the form, nature, content etc. of something different from what it is. Regulation and Enforcement are Here to Stay ...

... Change: To make the form, nature, content etc. of something different from what it is. Regulation and Enforcement are Here to Stay ...

The Global Risk of Subprime

... unregulated, $3 trillion over-the-counter market for complex structured assets, some of which happen to contain subprime residential mortgages. • The subprime structured asset crisis of 2007 represents a sharp reversal in how global investors view all securitized assets and custom derivative structu ...

... unregulated, $3 trillion over-the-counter market for complex structured assets, some of which happen to contain subprime residential mortgages. • The subprime structured asset crisis of 2007 represents a sharp reversal in how global investors view all securitized assets and custom derivative structu ...

Mortgage crisis in the US, economic slowdown in Europe

... insufficient in a global, liberal financial system. Furthermore, the question as to who – besides banks and securities firms – is to be supervised needs to be reviewed. This applies to originators, rating companies and hedge funds. ...

... insufficient in a global, liberal financial system. Furthermore, the question as to who – besides banks and securities firms – is to be supervised needs to be reviewed. This applies to originators, rating companies and hedge funds. ...

Introduction to Investments

... -Wealth of society is increased -Consumption & investment flexibility is increased Primary market benefits; secondary market benefits The Nature of Investment decisions: -Speculative strategies: to what extent? Timing and selection -Asset allocation -Security selection ...

... -Wealth of society is increased -Consumption & investment flexibility is increased Primary market benefits; secondary market benefits The Nature of Investment decisions: -Speculative strategies: to what extent? Timing and selection -Asset allocation -Security selection ...

The Financial Crisis

... Liquidity thru standardization Cash for originators Diversification of finance sources Regulatory arbitrage: meet capital requirements easier Profitable ...

... Liquidity thru standardization Cash for originators Diversification of finance sources Regulatory arbitrage: meet capital requirements easier Profitable ...

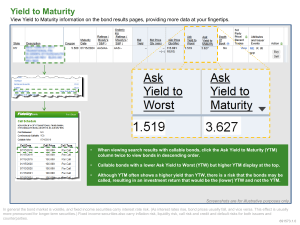

US High Yield Fund

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

National Deficit

... The Federal Reserve System (the Fed) (= the US central bank) Too low interest for too long? Too easy to borrow from the Fed? ...

... The Federal Reserve System (the Fed) (= the US central bank) Too low interest for too long? Too easy to borrow from the Fed? ...

Inside Job – Vocabulary Asset Backed Security (ABS) An asset

... An aggressively managed portfolio of investments that uses advanced investment strategies such as leveraged, long, short and derivative positions in both domestic and international markets with the goal of generating high returns (either in an absolute sense or over a specified market benchmark). Le ...

... An aggressively managed portfolio of investments that uses advanced investment strategies such as leveraged, long, short and derivative positions in both domestic and international markets with the goal of generating high returns (either in an absolute sense or over a specified market benchmark). Le ...

Financial assets

... mortgage payments, so the investors will get the interest payments, the values of slices of CDOs increase When housing bubble busts, mortgage borrowers, especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The v ...

... mortgage payments, so the investors will get the interest payments, the values of slices of CDOs increase When housing bubble busts, mortgage borrowers, especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The v ...

Financial assets

... mortgage payments, so the investors will get the interest payments, the values of slices of CDOs increase When housing bubble busts, mortgage borrowers, especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The v ...

... mortgage payments, so the investors will get the interest payments, the values of slices of CDOs increase When housing bubble busts, mortgage borrowers, especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The v ...