* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download US High Yield Fund

Private equity wikipedia , lookup

Stock trader wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Interbank lending market wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Short (finance) wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Private equity secondary market wikipedia , lookup

Early history of private equity wikipedia , lookup

Corporate venture capital wikipedia , lookup

Synthetic CDO wikipedia , lookup

International investment agreement wikipedia , lookup

Money market fund wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Auction rate security wikipedia , lookup

Securities fraud wikipedia , lookup

Fixed-income attribution wikipedia , lookup

Security (finance) wikipedia , lookup

Securitization wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Private money investing wikipedia , lookup

Socially responsible investing wikipedia , lookup

Investment banking wikipedia , lookup

Mutual fund wikipedia , lookup

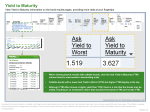

U.S. High Yield Fund The Objective The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public credit research. It invests primarily in high yield corporate bonds that have been rated below investment-grade, as well as non-rated securities of comparable quality. The Risk There are special risks associated with non-rated bonds and those rated below investmentgrade. These securities are subject to a greater risk for loss of principal and interest, including default risk. Disclosure: Shares of these funds may not be offered or sold to citizens or residents of the U.S. These funds are currently registered for sale in the following countries: Belgium, France, Germany, Hong Kong, Korea, Luxembourg, Netherlands, Spain, Trinidad & Tobago and the United Kingdom through authorized local sub-distributors appointed by the distributor of the Fund. CJ Investment Trust & Securities Co., Ltd. is not registered to do business in these countries and should not be seen as offering the funds via website to investors located in these countries. Copies of the prospectus are available in Korea from CJ Investment Trust & Securities Co., Ltd. For more information refer to the prospectus. There is no assurance the Fund's objectives will be attained. U.S. Investment Quality Bond The Philosophy The Fund attempts to add value to the U.S. Bond market through its research-driven investment process, and specialized investment management that focuses on sector rotation, and yield curve positioning.