THU VI?N PHÁP LU?T

... issuance and payment conditions, assurance of legitimate rights and benefits of investors and other conditions. 3. Conditions for public offering of fund certificates to the public include: a/ The total value of fund certificates registered for offering is at least VND 50 billion; b/ There are an is ...

... issuance and payment conditions, assurance of legitimate rights and benefits of investors and other conditions. 3. Conditions for public offering of fund certificates to the public include: a/ The total value of fund certificates registered for offering is at least VND 50 billion; b/ There are an is ...

Annual Information Form

... We manage the Portfolios according to securities laws. Except as described below, each Portfolio has adopted the standard investment restrictions and practices imposed by the applicable legislation, including Regulation 81-102 respecting Investment Funds (“Regulation 81-102”). These restrictions and ...

... We manage the Portfolios according to securities laws. Except as described below, each Portfolio has adopted the standard investment restrictions and practices imposed by the applicable legislation, including Regulation 81-102 respecting Investment Funds (“Regulation 81-102”). These restrictions and ...

Understanding our fees, charges and other

... Additional information regarding revenue sharing for mutual funds and for insurance and annuities can be found at ubs.com/mutualfundrevenuesharing and ubs.com/va-revenuesharing. A number of companies that issue investment products that we offer to and place with our clients enter into agreements to ...

... Additional information regarding revenue sharing for mutual funds and for insurance and annuities can be found at ubs.com/mutualfundrevenuesharing and ubs.com/va-revenuesharing. A number of companies that issue investment products that we offer to and place with our clients enter into agreements to ...

Financial planning model for the Armed Forces of

... and returns of investments. The model should also be able to show the yearly portfolio returns, the yearly inflows ...

... and returns of investments. The model should also be able to show the yearly portfolio returns, the yearly inflows ...

14. procedure for application and allotment

... ALLOTMENT OF UNITS Vetiva Fund Managers Limited reserves the right to accept or reject any application in whole or in part for not meeting the conditions of the Offer. The allotment proposal will be subject to the clearance of the Board of Vetiva Fund Managers Limited. Please note that the Directors ...

... ALLOTMENT OF UNITS Vetiva Fund Managers Limited reserves the right to accept or reject any application in whole or in part for not meeting the conditions of the Offer. The allotment proposal will be subject to the clearance of the Board of Vetiva Fund Managers Limited. Please note that the Directors ...

Does pension funds` fiduciary duty prohibit the integration of

... and Osthoff, 2007; Lo and Sheu, 2007; Scholtens, 2008; Scholtens and Zhou, 2008). Another stream provided detailed explorations of pension funds’ fiduciary duties with respect to ESG criteria but did not undertake any empirical analysis of the financial implications of ESG integration (e.g. Martin, ...

... and Osthoff, 2007; Lo and Sheu, 2007; Scholtens, 2008; Scholtens and Zhou, 2008). Another stream provided detailed explorations of pension funds’ fiduciary duties with respect to ESG criteria but did not undertake any empirical analysis of the financial implications of ESG integration (e.g. Martin, ...

Management Fee Evaluation

... The Funds’ current operations were expected to remain largely unchanged, except for certain fund reorganizations which will be separately considered by the Board, and such other changes as were or will be presented to the Board. Janus does not intend to make changes to the portfolio managers providi ...

... The Funds’ current operations were expected to remain largely unchanged, except for certain fund reorganizations which will be separately considered by the Board, and such other changes as were or will be presented to the Board. Janus does not intend to make changes to the portfolio managers providi ...

Retirement Plan Enrollment Booklet

... You should carefully consider the investment objectives, risks, charges and expenses of the investment options offered under the retirement plan before investing. Smallcompany (small cap) investing involves specific risks not necessarily encountered in large-company investing, such as increased vola ...

... You should carefully consider the investment objectives, risks, charges and expenses of the investment options offered under the retirement plan before investing. Smallcompany (small cap) investing involves specific risks not necessarily encountered in large-company investing, such as increased vola ...

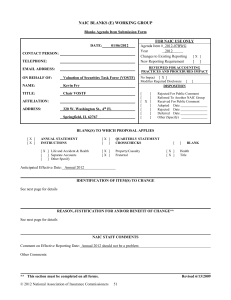

naic blanks (e) working group - National Association of Insurance

... Designation that is not obtained from the current edition of the Valuation of Securities or its Supplement and that is entered by the reporting entity under its own judgment shall have the letter “Z” appended to the designation. For the meaning and applicability of suffixes and designations, please ...

... Designation that is not obtained from the current edition of the Valuation of Securities or its Supplement and that is entered by the reporting entity under its own judgment shall have the letter “Z” appended to the designation. For the meaning and applicability of suffixes and designations, please ...

HSBC Jintrust Large Cap Equity Securities Investment Fund

... The Analysis of Top Five Precious Metal Investments by Percentage of the Fair Value in the Net Asset Value of the Fund at the End of the Reporting Period........................................................................................................... The Analysis of Top Five Warrant Invest ...

... The Analysis of Top Five Precious Metal Investments by Percentage of the Fair Value in the Net Asset Value of the Fund at the End of the Reporting Period........................................................................................................... The Analysis of Top Five Warrant Invest ...

collective investment schemes in emerging markets

... Collective Investment Schemes (CIS) exist in several markets, both emerging and developed such as the UK and most of continental Europe, the USA, Australia, China, Japan, Turkey, Greece and several other countries. The Capital Markets Authority (CMA) began licensing Collective Investment Schemes aft ...

... Collective Investment Schemes (CIS) exist in several markets, both emerging and developed such as the UK and most of continental Europe, the USA, Australia, China, Japan, Turkey, Greece and several other countries. The Capital Markets Authority (CMA) began licensing Collective Investment Schemes aft ...

6. Law on the Investment Funds

... the investment fund management company where they are employed, as well as members of the closer family of the employees; 10. Persons related to the investment fund are an investment fund management company, depository bank, lawyer, auditor and tax advisor that have established relations for providi ...

... the investment fund management company where they are employed, as well as members of the closer family of the employees; 10. Persons related to the investment fund are an investment fund management company, depository bank, lawyer, auditor and tax advisor that have established relations for providi ...

BlackRock funds rebranding to iShares

... The anticipated effective date for the Rebranding in respect of the Sub-Funds is also available at https://www.blackrock.com/international/intermediaries/en-zz/rebranding-of-certain-blackrock-funds. Rationale for the Rebranding BlackRock is committed to the continuous enhancement of its product suit ...

... The anticipated effective date for the Rebranding in respect of the Sub-Funds is also available at https://www.blackrock.com/international/intermediaries/en-zz/rebranding-of-certain-blackrock-funds. Rationale for the Rebranding BlackRock is committed to the continuous enhancement of its product suit ...

Statement of Investment Policy and Objectives

... that not voting will have a material adverse effect on investors (taking into consideration the size of the managed investment scheme’s exposure to the issuer and the proportion of the issuer held by managed investment schemes managed by Smartshares). When Smartshares votes, it will do so in what it ...

... that not voting will have a material adverse effect on investors (taking into consideration the size of the managed investment scheme’s exposure to the issuer and the proportion of the issuer held by managed investment schemes managed by Smartshares). When Smartshares votes, it will do so in what it ...

Voya Senior Income Fund Repurchase Offer Notice

... such market is restricted; or (B) for any period during which an emergency exists as a result of which disposal by the Fund of securities owned by it is not reasonably practicable, or during which it is not reasonably practicable for the Fund fairly to determine the value of its net assets; or (C) f ...

... such market is restricted; or (B) for any period during which an emergency exists as a result of which disposal by the Fund of securities owned by it is not reasonably practicable, or during which it is not reasonably practicable for the Fund fairly to determine the value of its net assets; or (C) f ...

THIS FILE GENERATED BY THE FUND LIBRARY. (c) The Fund

... the Global Guide to Investing. In his 27 years as a money manager, Cundill has had only two down years. What's his secret? If you boil it down, there are five ingredients to Cundill's investing success.Balance Sheet Security BlanketFirst and foremost, the balance sheet is Peter Cundill's best frien ...

... the Global Guide to Investing. In his 27 years as a money manager, Cundill has had only two down years. What's his secret? If you boil it down, there are five ingredients to Cundill's investing success.Balance Sheet Security BlanketFirst and foremost, the balance sheet is Peter Cundill's best frien ...

AAA Video Games EIS Fund

... The Manager currently manages £110 million of investments which qualify for the benefits of the Enterprise Investment Scheme (“EIS”) and £30 million qualifying for the benefits under the Seed Enterprise Investment Scheme (“SEIS”). The Fund will benefit from the extensive knowledge, experience and ne ...

... The Manager currently manages £110 million of investments which qualify for the benefits of the Enterprise Investment Scheme (“EIS”) and £30 million qualifying for the benefits under the Seed Enterprise Investment Scheme (“SEIS”). The Fund will benefit from the extensive knowledge, experience and ne ...

Sustainable Landscapes: Investor Mapping in Asia

... that achieve both financial and environmental returns as well as USAID ASIA’s partnership opportunities with other donors and corporate and financial investors experienced in conservation finance to facilitate new green investments while avoiding or reducing GHG emissions, particularly concerning ...

... that achieve both financial and environmental returns as well as USAID ASIA’s partnership opportunities with other donors and corporate and financial investors experienced in conservation finance to facilitate new green investments while avoiding or reducing GHG emissions, particularly concerning ...

Who Owns the Assets?

... constraints. Exhibit 6 shows the average allocations for different types of US insurers over time. P&C insurers rely on investment returns as a critical driver of shareholder returns. Over the past 30 years this was primarily accomplished by holding corporate and municipal bonds with high embedded b ...

... constraints. Exhibit 6 shows the average allocations for different types of US insurers over time. P&C insurers rely on investment returns as a critical driver of shareholder returns. Over the past 30 years this was primarily accomplished by holding corporate and municipal bonds with high embedded b ...

Cash, Cash Equivalents, and Investments

... As mentioned above, a campus’ annual payroll expenses exceed the GF appropriation. In order to resolve this issue and to comply with RMP (to use the available GF appropriation for payroll), the CO must distribute its unallocated GF appropriation to the campus via a supplemental allocation order (AO) ...

... As mentioned above, a campus’ annual payroll expenses exceed the GF appropriation. In order to resolve this issue and to comply with RMP (to use the available GF appropriation for payroll), the CO must distribute its unallocated GF appropriation to the campus via a supplemental allocation order (AO) ...

Brochure - The Brookdale Group

... Brookdale’s institutional co-investors consist of some of the nation’s best known university endowments, foundations and charitable trusts. Through its seven sponsored investment funds to date, Brookdale has enjoyed a working relationship with a total of 41 such institutional investors, 37 of whom a ...

... Brookdale’s institutional co-investors consist of some of the nation’s best known university endowments, foundations and charitable trusts. Through its seven sponsored investment funds to date, Brookdale has enjoyed a working relationship with a total of 41 such institutional investors, 37 of whom a ...

Retirement Date Fund

... When the market goes down, I see it as a buying opportunity I’m comfortable building and maintaining my portfolio I don’t get emotional about investing ...

... When the market goes down, I see it as a buying opportunity I’m comfortable building and maintaining my portfolio I don’t get emotional about investing ...

submission on the safety of superannuation

... Individual savings accumulated through the operation of Australia’s superannuation system should be accorded the highest possible level of protection commensurate with the objective of creating a pool of personal wealth sufficient to provide retirement incomes to individual contributors. As a result ...

... Individual savings accumulated through the operation of Australia’s superannuation system should be accorded the highest possible level of protection commensurate with the objective of creating a pool of personal wealth sufficient to provide retirement incomes to individual contributors. As a result ...

2015 Preqin Sovereign Wealth Fund Review: Exclusive Extract

... assets fall in size since 2013 (Fig. 2); of those that have lost assets over this time, half derived their capital from hydrocarbons. Falling oil prices over the second half of 2014 have led to significant withdrawals from some sovereign wealth funds by governments highly funded by such assets in or ...

... assets fall in size since 2013 (Fig. 2); of those that have lost assets over this time, half derived their capital from hydrocarbons. Falling oil prices over the second half of 2014 have led to significant withdrawals from some sovereign wealth funds by governments highly funded by such assets in or ...

THE CITY UNIVERSITY OF NEW YORK – INVESTMENT POLICY

... fixed income holdings of the portfolio and b) to support the Portfolio through periods of unexpected high inflation through investment in assets and asset classes which are expected to perform well during inflation. The diversifying assets portfolio may include real estate, inflation-adjusted fixed ...

... fixed income holdings of the portfolio and b) to support the Portfolio through periods of unexpected high inflation through investment in assets and asset classes which are expected to perform well during inflation. The diversifying assets portfolio may include real estate, inflation-adjusted fixed ...