The Landsbanki Freezing Order 2008

... Debt instruments and other securities issued by Landsbanki; Debts owed by Landsbanki to a third party; Funds owned held or controlled by a subsidiary of Landsbanki. 17. Accounts held at Landsbanki are a special case. They are not “frozen funds” insofar as the customer’s account is a debt owed to it ...

... Debt instruments and other securities issued by Landsbanki; Debts owed by Landsbanki to a third party; Funds owned held or controlled by a subsidiary of Landsbanki. 17. Accounts held at Landsbanki are a special case. They are not “frozen funds” insofar as the customer’s account is a debt owed to it ...

Evaluating Managers: Are We Sending the Right

... historical measures were a poor guide to the future. funds because the benchmark also contains stocks The ratios were not stable. classified as value and as a result, in theory, is styleneutral. We therefore measured the same largeThe information ratio was also a poor predictor of cap growth manager ...

... historical measures were a poor guide to the future. funds because the benchmark also contains stocks The ratios were not stable. classified as value and as a result, in theory, is styleneutral. We therefore measured the same largeThe information ratio was also a poor predictor of cap growth manager ...

Summary of Investment Objectives

... exchange. The generally accepted, nationally recognized index for this asset class is the Standard & Poor’s 500 Stock Index (S&P 500)*. US Mid Capitalization Stocks: A portfolio of stocks composed primarily of US-based companies having a market capitalization, on average, between $2.0 billion and $1 ...

... exchange. The generally accepted, nationally recognized index for this asset class is the Standard & Poor’s 500 Stock Index (S&P 500)*. US Mid Capitalization Stocks: A portfolio of stocks composed primarily of US-based companies having a market capitalization, on average, between $2.0 billion and $1 ...

Investor Preferences and Demand for Active Management

... For our empirical investigations linking the demand for actively managed funds to investors’ risk preferences, we define PK slopes on the left and right sides of the market returns distribution. Intuitively, these slopes correspond to the ratio of risk-neutral to physical cdf on the left side and th ...

... For our empirical investigations linking the demand for actively managed funds to investors’ risk preferences, we define PK slopes on the left and right sides of the market returns distribution. Intuitively, these slopes correspond to the ratio of risk-neutral to physical cdf on the left side and th ...

Infrastructure Investments - ForUM for Utvikling og Miljø

... Source: Preqin, “The 2015 Preqin Sovereign Wealth Fund Review”, 2015, page 1. ...

... Source: Preqin, “The 2015 Preqin Sovereign Wealth Fund Review”, 2015, page 1. ...

The Effect of the Recent Financial Crisis on Defined

... indexed to price- or wage growth, which adds an additional objective for the fund’s manager to counter. Thirdly, pension funds invest on behalf of their members, who often have large investments in, for example, housing and human capital, and thus have to take these factors into account. Bovenberg e ...

... indexed to price- or wage growth, which adds an additional objective for the fund’s manager to counter. Thirdly, pension funds invest on behalf of their members, who often have large investments in, for example, housing and human capital, and thus have to take these factors into account. Bovenberg e ...

BSE – Driving the Indian capital market: Asia`s first stock exchange

... on the next working day following their date of application as well as redemption proceeds in two days. ...

... on the next working day following their date of application as well as redemption proceeds in two days. ...

Balanced Income Portfolio Interim Management Report of Fund

... make an investment in the securities of an issuer for which CIBC WM, CIBC World Markets Corp., or any affiliate of CIBC (a Related Dealer) acts as an underwriter during the offering of such securities at any time during the 60-day period following the completion of the offering of the securities (in ...

... make an investment in the securities of an issuer for which CIBC WM, CIBC World Markets Corp., or any affiliate of CIBC (a Related Dealer) acts as an underwriter during the offering of such securities at any time during the 60-day period following the completion of the offering of the securities (in ...

Credit Suisse Mid-Year Survey of Hedge Fund Investor Sentiment

... Course” and provided interesting insights into investors’ mindset towards hedge funds at the beginning of the year. Given the eventful first half of 2016, we also wanted to take a fresh look at investors’ hedge fund investment activity at the mid-year point as well as at their levels of interest goi ...

... Course” and provided interesting insights into investors’ mindset towards hedge funds at the beginning of the year. Given the eventful first half of 2016, we also wanted to take a fresh look at investors’ hedge fund investment activity at the mid-year point as well as at their levels of interest goi ...

UK FUNDS MARKET PRACTICE GROUP INVESTMENT

... practice and implementation of ISO 20022 messages in the UK investment fund space. It is aimed primarily at: ...

... practice and implementation of ISO 20022 messages in the UK investment fund space. It is aimed primarily at: ...

Annual Report - PEBA - Government of Saskatchewan

... The Board, which consists of three members appointed by the Lieutenant Governor in Council, is responsible for the administration of the Public Service Superannuation Act. The Public Employees Benefits Agency (PEBA) has responsibility for the operation, administration and management of several super ...

... The Board, which consists of three members appointed by the Lieutenant Governor in Council, is responsible for the administration of the Public Service Superannuation Act. The Public Employees Benefits Agency (PEBA) has responsibility for the operation, administration and management of several super ...

View COLL 6.3 as PDF

... (2) The prospectus of a scheme must contain information about its regular valuation points for the purposes of dealing in units in accordance with ■ COLL 4.2.5R (16) (Table: contents of the prospectus). (3) Where a scheme operates limited redemption arrangements, (1) does not apply and the valuation ...

... (2) The prospectus of a scheme must contain information about its regular valuation points for the purposes of dealing in units in accordance with ■ COLL 4.2.5R (16) (Table: contents of the prospectus). (3) Where a scheme operates limited redemption arrangements, (1) does not apply and the valuation ...

View as DOCX (12/2) 1019 KB

... specified in governing legislation. The required levels of employee contributions are also specified in the Regulations. The Fund, like many other similar public and private sector funded schemes, has a gap between its assets and pension liabilities which this strategy addresses. A number of factors ...

... specified in governing legislation. The required levels of employee contributions are also specified in the Regulations. The Fund, like many other similar public and private sector funded schemes, has a gap between its assets and pension liabilities which this strategy addresses. A number of factors ...

Venture Capital Fund

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... power with respect to the shares of the Issuer held by the The Gabelli Asset Fund, The Gabelli Equity Trust, Inc., The Gabelli Growth Fund, The Gabelli Convertible Securities Fund, The Gabelli Value Fund Inc., The Gabelli Small Cap Growth Fund , The Gabelli Equity Income Fund, ,The Gabelli ABC Fund, ...

... power with respect to the shares of the Issuer held by the The Gabelli Asset Fund, The Gabelli Equity Trust, Inc., The Gabelli Growth Fund, The Gabelli Convertible Securities Fund, The Gabelli Value Fund Inc., The Gabelli Small Cap Growth Fund , The Gabelli Equity Income Fund, ,The Gabelli ABC Fund, ...

Report 52 - Fixed Maturity EUR Industrial Bond Funds

... Until December 31st, 2011 returns of all institutional mandates were presented net of fees, namely actual custody fees, management commissions and transaction costs. There are no performance based fees. For the mutual funds, and institutional mandates from January 1st, 2012, the returns are prese ...

... Until December 31st, 2011 returns of all institutional mandates were presented net of fees, namely actual custody fees, management commissions and transaction costs. There are no performance based fees. For the mutual funds, and institutional mandates from January 1st, 2012, the returns are prese ...

Understanding private equity and private equity funds

... requiring more capital than one individual or family could supply ...

... requiring more capital than one individual or family could supply ...

ApplicAtion for A collective investment Account (ciA)

... where you can provide this information. We also need to obtain `a self-certification’ that the information provided is true and complete - this is contained in the declaration in section 8. We may have to provide this information to HMRC who may share it with overseas tax authorities. We may contact ...

... where you can provide this information. We also need to obtain `a self-certification’ that the information provided is true and complete - this is contained in the declaration in section 8. We may have to provide this information to HMRC who may share it with overseas tax authorities. We may contact ...

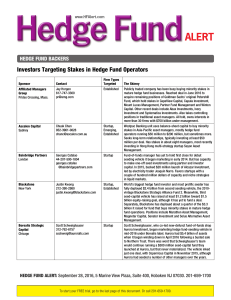

Hedge Fund Backers

... After buying Jefferies in 2013, formed asset-management division that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill A ...

... After buying Jefferies in 2013, formed asset-management division that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill A ...

Form AUT – PFS Public Fund supplement

... PF25. Full name of the Public Fund to which this registration relates. PF26. Please advise which of the elements of the criteria for a Public Fund in Article 16(1) of the Collective Investment Law applies to you, i.e. It has, or intends to have, more than 100 Unitholders Some or all of its Units are ...

... PF25. Full name of the Public Fund to which this registration relates. PF26. Please advise which of the elements of the criteria for a Public Fund in Article 16(1) of the Collective Investment Law applies to you, i.e. It has, or intends to have, more than 100 Unitholders Some or all of its Units are ...

The Impact of Leverage on Hedge Fund Performance

... Leverage is a unique feature of hedge fund culture, unlike other managed investments such as mutual funds and exchange-traded funds. The goal of most hedge funds is to achieve maximum returns with controlled risks. Hedge fund investors can use margin accounts and credit lines to borrow money from a ...

... Leverage is a unique feature of hedge fund culture, unlike other managed investments such as mutual funds and exchange-traded funds. The goal of most hedge funds is to achieve maximum returns with controlled risks. Hedge fund investors can use margin accounts and credit lines to borrow money from a ...

BUDGET TREATMENT OF FUTURE FUND COSTS IN THE AUSTRALIAN Background

... been included. However, gross earnings do not reflect the amount available for reinvestment as all of the Future Fund’s operating costs are paid from its earnings, as required under the Future Fund Act 2006. Over the first few years of its operation, Future Fund costs had a relatively small impact o ...

... been included. However, gross earnings do not reflect the amount available for reinvestment as all of the Future Fund’s operating costs are paid from its earnings, as required under the Future Fund Act 2006. Over the first few years of its operation, Future Fund costs had a relatively small impact o ...

An Introduction to Hedge Fund Strategies

... broadly. Sometimes, it is used to refer to the securities issued by companies which have defaulted and filed for credit protection. Other times, the term is used in a wider sense to include securities that are priced at a high premium over their safer counterparts. Hedge funds following a distressed ...

... broadly. Sometimes, it is used to refer to the securities issued by companies which have defaulted and filed for credit protection. Other times, the term is used in a wider sense to include securities that are priced at a high premium over their safer counterparts. Hedge funds following a distressed ...

NextGen College Investing Plan® Client Direct Series

... provide legal, tax or accounting advice. You should consult your own legal and/or tax advisors before making any financial decisions. ...

... provide legal, tax or accounting advice. You should consult your own legal and/or tax advisors before making any financial decisions. ...