True Diversifiers: The Case for Multi-Strategy, Multi

... challenges for investors made all the more complicated by lingering emotional scars inflicted by the financial crisis. The universe of alternative investments offers investors a potentially attractive diversification option, which has helped drive the rapid growth of this asset class. What’s more, t ...

... challenges for investors made all the more complicated by lingering emotional scars inflicted by the financial crisis. The universe of alternative investments offers investors a potentially attractive diversification option, which has helped drive the rapid growth of this asset class. What’s more, t ...

PDF

... you on two ongoing European legislative initiatives impacting private equity funds. First, we follow up on our extensive previous reporting on the European Alternative Investment Fund Managers Directive (AIFMD), which is to be implemented by July 22, 2013, with a more detailed discussion of its impa ...

... you on two ongoing European legislative initiatives impacting private equity funds. First, we follow up on our extensive previous reporting on the European Alternative Investment Fund Managers Directive (AIFMD), which is to be implemented by July 22, 2013, with a more detailed discussion of its impa ...

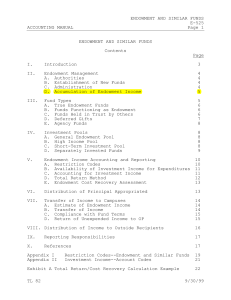

Endowment and Similar Funds

... Funds, the Long Term Income Fund (LTIP) and the General Endowment Pool Balanced Growth Fund (GEPBG). ...

... Funds, the Long Term Income Fund (LTIP) and the General Endowment Pool Balanced Growth Fund (GEPBG). ...

policy for nonprofit endowment funds

... The East Texas Communities Foundation ("Foundation") encourages donors to create Nonprofit Endowment Funds for support of the charitable purposes of various nonprofit organizations ("Nonprofits"). However, in order to protect its status as a public charity and the corresponding tax deductions of its ...

... The East Texas Communities Foundation ("Foundation") encourages donors to create Nonprofit Endowment Funds for support of the charitable purposes of various nonprofit organizations ("Nonprofits"). However, in order to protect its status as a public charity and the corresponding tax deductions of its ...

Challenges of Financing Infrastructure

... MySuper: The introduction of MySuper as the default superannuation for members that do not make a choice will result in reduced fees. It is likely that there will be significant pressure on investment managers, including infrastructure investors to reduce investment fees. Risk Profiles: A move away ...

... MySuper: The introduction of MySuper as the default superannuation for members that do not make a choice will result in reduced fees. It is likely that there will be significant pressure on investment managers, including infrastructure investors to reduce investment fees. Risk Profiles: A move away ...

Results of DNB investment surveys into alternative investments by

... 1 http://www.dnb.nl/binaries/Brief%20Resultaten%20DNB%20onderzoeken%20innovatieve%20beleggingen_tcm46-274786.pdf 2 Within the framework of the thematic survey of innovative investments and the survey on investments in private equity and hedge ...

... 1 http://www.dnb.nl/binaries/Brief%20Resultaten%20DNB%20onderzoeken%20innovatieve%20beleggingen_tcm46-274786.pdf 2 Within the framework of the thematic survey of innovative investments and the survey on investments in private equity and hedge ...

AON CORP (Form: 11-K, Received: 07/01/1996 00

... for the year. The Plan requires that a Participant be actively employed and contributing to the Plan as of the last day of the Plan year in order to receive a Company contribution. F. INVESTMENT PROVISIONS Contributions to the Plan may be invested in one or more of the following investment funds: Mo ...

... for the year. The Plan requires that a Participant be actively employed and contributing to the Plan as of the last day of the Plan year in order to receive a Company contribution. F. INVESTMENT PROVISIONS Contributions to the Plan may be invested in one or more of the following investment funds: Mo ...

L. Favre, A. Signer. "The difficulties of measuring the benefits of hedge funds" Journal of Alternative Investment (Summer 2002)

... AM = Arithmetic mean; sum total of the values weighted with relative frequencies f i = Frequency; frequency with which a specific value x occurs Negative skewness and positive excess kurtosis are unwelcome distribution features for the investor, but these are not taken into account in a mean varianc ...

... AM = Arithmetic mean; sum total of the values weighted with relative frequencies f i = Frequency; frequency with which a specific value x occurs Negative skewness and positive excess kurtosis are unwelcome distribution features for the investor, but these are not taken into account in a mean varianc ...

Types of structured equity products

... Providing a precise definition of what constitutes a structured equity product is difficult. Indeed, there are probably almost as many definitions for structured equity products as there are products themselves. This chapter looks at the more common types of equity structured products and considers ...

... Providing a precise definition of what constitutes a structured equity product is difficult. Indeed, there are probably almost as many definitions for structured equity products as there are products themselves. This chapter looks at the more common types of equity structured products and considers ...

WITAN INVESTMENT TRUST

... which specialise in investing in a particular region or market sector are more risky than those which hold a very broad spread of investments. Funds investing in overseas securities are exposed to and can hold currencies other than Sterling. As a result, exchange rate movements may cause the value o ...

... which specialise in investing in a particular region or market sector are more risky than those which hold a very broad spread of investments. Funds investing in overseas securities are exposed to and can hold currencies other than Sterling. As a result, exchange rate movements may cause the value o ...

NBER WORKING PAPER SERIES INDIVIDUAL INVESTOR MUTUAL-FUND FLOWS Zoran Ivkovich Scott Weisbenner

... redemption side. That notion, however, is not grounded in a direct inquiry into the patterns of inflows and outflows, and it might well be that redemptions are related to past performance. Also, inflows and outflows might be related to other fund characteristics very differently. This paper studies ...

... redemption side. That notion, however, is not grounded in a direct inquiry into the patterns of inflows and outflows, and it might well be that redemptions are related to past performance. Also, inflows and outflows might be related to other fund characteristics very differently. This paper studies ...

Study on Obstacles and Solutions to China’s Low-Carbon Industrial Investment Fund

... organize sales in the same time, as a result, high risk is its essential character. Banks and other traditional financing sources are widespread in resource allocation on an adverse selection problem, they tend to invest the funds to the enterprises which are more mature development, less risk and t ...

... organize sales in the same time, as a result, high risk is its essential character. Banks and other traditional financing sources are widespread in resource allocation on an adverse selection problem, they tend to invest the funds to the enterprises which are more mature development, less risk and t ...

The Changing Chemistry Between Hedge Funds and Investors

... more than HNWIs, who see return enhancement as a greater driver for hedge fund investment. Increasingly, the drive for yield in the era of low interest rates is leading institutional firms into more diverse strategies, so investing in hedge funds has become relatively mainstream. For fund managers, ...

... more than HNWIs, who see return enhancement as a greater driver for hedge fund investment. Increasingly, the drive for yield in the era of low interest rates is leading institutional firms into more diverse strategies, so investing in hedge funds has become relatively mainstream. For fund managers, ...

Endowment Policy

... and the University. Because it is critical to maintain the highest standards of stewardship over a long time horizon, and in consideration of the generosity and commitment from our donors, the Endowment Policy is revised from time to time. This assists to avoid unforeseen issues for these long‐ ...

... and the University. Because it is critical to maintain the highest standards of stewardship over a long time horizon, and in consideration of the generosity and commitment from our donors, the Endowment Policy is revised from time to time. This assists to avoid unforeseen issues for these long‐ ...

ExamView - Quiz # 6.tst

... a. both the equilibrium interest rate and the equilibrium quantity of loanable funds to fall. b. both the equilibrium interest rate and the equilibrium quantity of loanable funds to rise. c. the equilibrium interest rate to rise and the equilibrium quantity of loanable funds to fall. d. the equilibr ...

... a. both the equilibrium interest rate and the equilibrium quantity of loanable funds to fall. b. both the equilibrium interest rate and the equilibrium quantity of loanable funds to rise. c. the equilibrium interest rate to rise and the equilibrium quantity of loanable funds to fall. d. the equilibr ...

Slide 1

... peers resulting in most of the segments in the economy constrained in terms of capacity availability. • Infrastructure investment in India for FY2009 is estimated at US$67.6 billion (5.8% of GDP) as compared to China’s Infrastructure investment estimate of US$389.6 billion (9% of GDP) over the same ...

... peers resulting in most of the segments in the economy constrained in terms of capacity availability. • Infrastructure investment in India for FY2009 is estimated at US$67.6 billion (5.8% of GDP) as compared to China’s Infrastructure investment estimate of US$389.6 billion (9% of GDP) over the same ...

NATIONAL PENN BANCSHARES INC

... based upon an award schedule, which is approved annually by the Compensation Committee of the Board of Directors and is based upon the Company’s achievement of certain financial targets. Participants direct all contributions, including Company matching contributions and discretionary profit sharing ...

... based upon an award schedule, which is approved annually by the Compensation Committee of the Board of Directors and is based upon the Company’s achievement of certain financial targets. Participants direct all contributions, including Company matching contributions and discretionary profit sharing ...

Portfolio Performance, Discount Dynamics, and the Turnover of Closed-End Fund Mangers

... in many cases, priced transparently by the market almost continuously throughout each business day. For example, stocks held by U.S. closed-end equity funds (with the exception of very small issues) are traded frequently during the open hours of the New York Stock Exchange or Nasdaq. Further, each b ...

... in many cases, priced transparently by the market almost continuously throughout each business day. For example, stocks held by U.S. closed-end equity funds (with the exception of very small issues) are traded frequently during the open hours of the New York Stock Exchange or Nasdaq. Further, each b ...

Challenges arising from alternative investment management

... respects. First, it is distinct in terms of both its targets – aiming to achieve an absolute performance, regardless of trends in underlying markets – and its strategies, in particular exploiting inefficiencies in the valuation of financial assets via opportunistic and discretionary positions. It al ...

... respects. First, it is distinct in terms of both its targets – aiming to achieve an absolute performance, regardless of trends in underlying markets – and its strategies, in particular exploiting inefficiencies in the valuation of financial assets via opportunistic and discretionary positions. It al ...

Annual Report

... Because the assets supporting the Promina Active division, the Promina Pension division and the Suncorp Staff division are different, their investment performance will likely be different. However, it is important to note that investment performance in this context has no impact at all on Promina Pe ...

... Because the assets supporting the Promina Active division, the Promina Pension division and the Suncorp Staff division are different, their investment performance will likely be different. However, it is important to note that investment performance in this context has no impact at all on Promina Pe ...

Endowments, Foundations, and Investment Management

... XYZ Partners utilizes a long-term, value-based approach paired with extensive due-diligence. XYZ Partners takes a holistic view in the investment decision-making process by evaluating the fundamental quality, sustainability, valuation, timing, volatility and size of the individual positions within t ...

... XYZ Partners utilizes a long-term, value-based approach paired with extensive due-diligence. XYZ Partners takes a holistic view in the investment decision-making process by evaluating the fundamental quality, sustainability, valuation, timing, volatility and size of the individual positions within t ...

View Article

... ports, while other funds focus on socio-economic projects, such as infrastructure development. Some funds are designed to help protect future pension obligations, while others are intended to diversify the vast wealth generated by non-renewable resources, such as oil, or to put to use vast budget su ...

... ports, while other funds focus on socio-economic projects, such as infrastructure development. Some funds are designed to help protect future pension obligations, while others are intended to diversify the vast wealth generated by non-renewable resources, such as oil, or to put to use vast budget su ...

The SEI Strategic Portfolios We have prepared the following

... generate excess returns. SEI look for sources of excess return that have demonstrated consistent long term results across multiple markets in a given geographic region. Alpha sources are classified into four categories, which allow SEI to create portfolios that are not simply diversified between equ ...

... generate excess returns. SEI look for sources of excess return that have demonstrated consistent long term results across multiple markets in a given geographic region. Alpha sources are classified into four categories, which allow SEI to create portfolios that are not simply diversified between equ ...

Sovereign Wealth Funds in the Pacific Island Countries

... While the recent public interest in sovereign wealth funds derives largely from the largest funds’ potential impact on international financial markets, from a domestic policymaker’s viewpoint, a more fundamental question is whether SWFs can be a useful instrument to achieve domestic policy goals. Wh ...

... While the recent public interest in sovereign wealth funds derives largely from the largest funds’ potential impact on international financial markets, from a domestic policymaker’s viewpoint, a more fundamental question is whether SWFs can be a useful instrument to achieve domestic policy goals. Wh ...