mySTART® Nominated Securities and Funds

... The guiding philosophy of the QuayStreet Balanced SRI Fund is to endeavour to have a diversified portfolio of investments that are deemed to be environmentally and socially sustainable, whilst still applying our traditional portfolio investment criteria. The Fund invests in a diversified portfolio o ...

... The guiding philosophy of the QuayStreet Balanced SRI Fund is to endeavour to have a diversified portfolio of investments that are deemed to be environmentally and socially sustainable, whilst still applying our traditional portfolio investment criteria. The Fund invests in a diversified portfolio o ...

Fund Summary Sheet TMLS Singapore Cash Fund

... making process, the giving of advice, or the conduct of research or analysis, and custodial service in relation to the investments managed for clients. Soft-dollar commissions received shall not include travel, accommodation, entertainment, general administrative goods and services, general office ...

... making process, the giving of advice, or the conduct of research or analysis, and custodial service in relation to the investments managed for clients. Soft-dollar commissions received shall not include travel, accommodation, entertainment, general administrative goods and services, general office ...

TrustSM Target Date Collective Investment Funds

... Funds. Each risk is managed differently, depending on the time horizon for each of the Target Date Funds. The resulting framework encompasses a total investment time horizon of roughly 80 years, including up to a 50-year working career and more than 25 years in retirement. Over time, Principal Trust ...

... Funds. Each risk is managed differently, depending on the time horizon for each of the Target Date Funds. The resulting framework encompasses a total investment time horizon of roughly 80 years, including up to a 50-year working career and more than 25 years in retirement. Over time, Principal Trust ...

- Columbia Business School

... exist skilled fund managers who have more accurate information, and they will use their current information about the market to identify who are actually skilled. The outperformance of the funds with MT-sensitive inflows when compared to various alternative investments supports this idea. This is re ...

... exist skilled fund managers who have more accurate information, and they will use their current information about the market to identify who are actually skilled. The outperformance of the funds with MT-sensitive inflows when compared to various alternative investments supports this idea. This is re ...

diversified growth funds - Pensions and Lifetime Savings Association

... are a fund of alternative funds with Tactical Asset Allocation (TAA). These can contain hedge funds, private equity, commodities, currencies, infrastructure and real estate but do not include traditional assets such as global equity and fixed income. They are designed to sit alongside a pension fund ...

... are a fund of alternative funds with Tactical Asset Allocation (TAA). These can contain hedge funds, private equity, commodities, currencies, infrastructure and real estate but do not include traditional assets such as global equity and fixed income. They are designed to sit alongside a pension fund ...

Resolution Amending Authorized Representatives

... WHereas, the texas Local government investment pool (“texpool/ texpool prime”), a public funds investment pool, were created on behalf of entities whose investment objective in order of priority are preservation and safety of principal, liquidity, and yield consistent with the public funds investmen ...

... WHereas, the texas Local government investment pool (“texpool/ texpool prime”), a public funds investment pool, were created on behalf of entities whose investment objective in order of priority are preservation and safety of principal, liquidity, and yield consistent with the public funds investmen ...

Appetite for co-investment opportunities has never been greater

... A “co-investment opportunity” is an option to invest alongside a primary private equity fund in an investment that may otherwise be too large for the fund. A “sidecar” is an investment vehicle organized by the sponsor of the primary fund to participate in one or more co-investment opportunities. LPs ...

... A “co-investment opportunity” is an option to invest alongside a primary private equity fund in an investment that may otherwise be too large for the fund. A “sidecar” is an investment vehicle organized by the sponsor of the primary fund to participate in one or more co-investment opportunities. LPs ...

Superannuation funds and alternative asset investment

... both domestically and internationally, and that there is a limited number of fund managers with the expertise and resources to manage this asset class successfully. This can result in a ‘first mover’ advantage where the higher quality investment opportunities are secured by those funds with a longer ...

... both domestically and internationally, and that there is a limited number of fund managers with the expertise and resources to manage this asset class successfully. This can result in a ‘first mover’ advantage where the higher quality investment opportunities are secured by those funds with a longer ...

The Securities Market in Vietnam

... Bonds. An issuer of bonds must have paid-up capital of at least VND10 billion at the time of registration of the PO, must have made a profit in the year prior to the PO, must not have accumulated losses as at the year of registration of the offer and must not have more than 100 overdue debts payable ...

... Bonds. An issuer of bonds must have paid-up capital of at least VND10 billion at the time of registration of the PO, must have made a profit in the year prior to the PO, must not have accumulated losses as at the year of registration of the offer and must not have more than 100 overdue debts payable ...

CI LifeCycle Portfolios

... CI LifeCycle Portfolios CI LifeCycle Portfolios are sophisticated multi-asset class, multi-manager target date retirement funds offered exclusively by CI Institutional Asset Management as an option for pension plan sponsors and members. Each of the nine funds combines the portfolio construction and ...

... CI LifeCycle Portfolios CI LifeCycle Portfolios are sophisticated multi-asset class, multi-manager target date retirement funds offered exclusively by CI Institutional Asset Management as an option for pension plan sponsors and members. Each of the nine funds combines the portfolio construction and ...

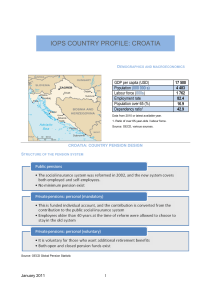

IOPS COUNTRY PROFILE: CROATIA

... There are therefore both open and closed funds. The state provides an annual subsidy of up to HRK 1,250 and allows a deduction of up to HRK 1,050 per month from personal taxable income. This means that there is a double benefit – state subsidy and tax deduction – for these contributions. Contributio ...

... There are therefore both open and closed funds. The state provides an annual subsidy of up to HRK 1,250 and allows a deduction of up to HRK 1,050 per month from personal taxable income. This means that there is a double benefit – state subsidy and tax deduction – for these contributions. Contributio ...

2016 Preqin Global Real Estate Report

... managers of private equity real estate funds now have a large amount of dry powder at their disposal ($202bn). This, coupled with more institutional investors making direct investments, means competition for assets is growing: 67% of fund managers are finding it more difficult to find attractive inv ...

... managers of private equity real estate funds now have a large amount of dry powder at their disposal ($202bn). This, coupled with more institutional investors making direct investments, means competition for assets is growing: 67% of fund managers are finding it more difficult to find attractive inv ...

The Case for the Continuous Commodity Index Fund

... It is worth noting that GCC is taxed like a partnership and will generate a K-1, usually issued by March 1. Additionally, commodity futures are taxed on mark-to-market gains and losses as of December 31, at a blended rate of 60% long-term and 40% short-term capital gains. WISDOMTREE CONTINUOUS COMMO ...

... It is worth noting that GCC is taxed like a partnership and will generate a K-1, usually issued by March 1. Additionally, commodity futures are taxed on mark-to-market gains and losses as of December 31, at a blended rate of 60% long-term and 40% short-term capital gains. WISDOMTREE CONTINUOUS COMMO ...

Hedge Fund Risk and Return Modeling

... • General problem: model risk and return for portfolios of hedge fund investments. • Hedge fund returns have unique properties that present interesting challenges for modeling. © Eric Zivot 2011 ...

... • General problem: model risk and return for portfolios of hedge fund investments. • Hedge fund returns have unique properties that present interesting challenges for modeling. © Eric Zivot 2011 ...

Establishing China`s Green Financial System Detailed

... Bank lending served as an early means of attracting private capital into the environmental protection sector. Therefore, within the green finance policy system, green credit was launched the ...

... Bank lending served as an early means of attracting private capital into the environmental protection sector. Therefore, within the green finance policy system, green credit was launched the ...

Trustee Corporations Association of Australia

... responsibilities of the Australian Prudential Regulation Authority (APRA). Funds defined as Self Managed Superannuation Funds (SMSFs) are an exception, and are regulated by the Australian Taxation Office (ATO) for compliance with the retirement incomes policy of the Superannuation Industry (Supervis ...

... responsibilities of the Australian Prudential Regulation Authority (APRA). Funds defined as Self Managed Superannuation Funds (SMSFs) are an exception, and are regulated by the Australian Taxation Office (ATO) for compliance with the retirement incomes policy of the Superannuation Industry (Supervis ...

Download attachment

... Closed and open funds also differ in governance structures. In the case of closed pension funds set up in the trust form, the administration of the fund is the responsibility of a board of trustees that represent the interests of the beneficiaries. The composition and responsibilities of the board v ...

... Closed and open funds also differ in governance structures. In the case of closed pension funds set up in the trust form, the administration of the fund is the responsibility of a board of trustees that represent the interests of the beneficiaries. The composition and responsibilities of the board v ...

Mutual Fund Assets and Flows in 1999

... communications stocks performed well. However, other sectors of the U.S. stock market posted losses, and more than half of all stocks experienced price decreases for the year. Furthermore, rising interest rates led to one of the largest annual declines in bond prices in 30 years. Outside the U.S, ma ...

... communications stocks performed well. However, other sectors of the U.S. stock market posted losses, and more than half of all stocks experienced price decreases for the year. Furthermore, rising interest rates led to one of the largest annual declines in bond prices in 30 years. Outside the U.S, ma ...

Q1 - 2017 Commentary - The Canadian ETF Association

... posted double digit asset growth of 35.1%, while mutual fund assets grew by 15.0%—a still powerful result given the size and level of maturity of the product. In terms of sales, ETFs accounted for 25.7% of all net flows into investment funds during the first two months of 2017, compared to 22.9% ove ...

... posted double digit asset growth of 35.1%, while mutual fund assets grew by 15.0%—a still powerful result given the size and level of maturity of the product. In terms of sales, ETFs accounted for 25.7% of all net flows into investment funds during the first two months of 2017, compared to 22.9% ove ...

Investing in Exchange Traded Funds (ETFs):

... average MER on a broadly based Canadian or U.S. mutual fund actively managed by a Canadian based investment firm is 2.72%. In contrast, the MER on iUnits on the S&P/TSX 60 Index is only 0.17% and the MER on SPYDRs is only 0.10%. • More tax efficient than actively managed investments. Capital gains d ...

... average MER on a broadly based Canadian or U.S. mutual fund actively managed by a Canadian based investment firm is 2.72%. In contrast, the MER on iUnits on the S&P/TSX 60 Index is only 0.17% and the MER on SPYDRs is only 0.10%. • More tax efficient than actively managed investments. Capital gains d ...

A Cross-sectional Analysis Of Malaysian Unit Trust Fund Expense

... authors find that while there is a positive relation between fees and performance for high quality managers, a negative relation exists for low quality managers. Consistent with earlier studies, fund size and the number of funds within the management group are found to be negatively related to fund ...

... authors find that while there is a positive relation between fees and performance for high quality managers, a negative relation exists for low quality managers. Consistent with earlier studies, fund size and the number of funds within the management group are found to be negatively related to fund ...

Sprott Bridging Income Fund LP Overview

... Sprott Asset Management LP is the investment manager to the Sprott Funds (collectively, the “Funds”). The Sprott Bridging Income Fund LP (the “Fund”) is offered on a private placement basis pursuant to an offering memorandum and is only available to investors who meet certain eligibility or minimum ...

... Sprott Asset Management LP is the investment manager to the Sprott Funds (collectively, the “Funds”). The Sprott Bridging Income Fund LP (the “Fund”) is offered on a private placement basis pursuant to an offering memorandum and is only available to investors who meet certain eligibility or minimum ...

(Amendment) Law, 2015 - Cayman Islands Monetary Authority

... AIFM of shares, trust units or partnership interests of an EU Connected Fund it manages to or with investors domiciled or with a registered office in the EU; “Member State” means a state which is (a) a member of the EU; or (b) a part of the EEA in which the AIFMD has been implemented;”; and “regulat ...

... AIFM of shares, trust units or partnership interests of an EU Connected Fund it manages to or with investors domiciled or with a registered office in the EU; “Member State” means a state which is (a) a member of the EU; or (b) a part of the EEA in which the AIFMD has been implemented;”; and “regulat ...

Sample Endowment Fund policy

... inquire as to any current holdings affected by this restriction and determine an appropriate strategy for divesting the affected holdings within a reasonable time frame. Portfolio Diversification: The investment objectives should be achieved through a diversified portfolio, which may include but it ...

... inquire as to any current holdings affected by this restriction and determine an appropriate strategy for divesting the affected holdings within a reasonable time frame. Portfolio Diversification: The investment objectives should be achieved through a diversified portfolio, which may include but it ...

15 April Overview of Microfinance Investment Funds

... Prasad Viswanatha has 20 years of experience in the mainstream financial sector, of which the last 8 years have been spent in microfinance. He is the founder of Caspian Capital Partners, an Indian fund management company and co-founder of The Bellwether Microfinance Fund which was established in 20 ...

... Prasad Viswanatha has 20 years of experience in the mainstream financial sector, of which the last 8 years have been spent in microfinance. He is the founder of Caspian Capital Partners, an Indian fund management company and co-founder of The Bellwether Microfinance Fund which was established in 20 ...