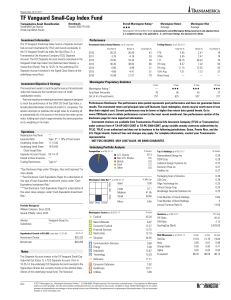

TF Vanguard Small-Cap Index Fund

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

Alternative Investment Fund Managers Directive

... complying could force managers to either merge their funds with other firms or close them entirely.”19 C. ...

... complying could force managers to either merge their funds with other firms or close them entirely.”19 C. ...

Trends in Institutional Investor Use of Fixed Income ETFs

... permanent holdings.” – Insurance company ...

... permanent holdings.” – Insurance company ...

GENCORP INC (Form: SC 13D/A, Received: 10/26/2010 14:01:42)

... directly or indirectly controls or for which he acts as chief investment officer. These entities engage in various aspects of the securities business, primarily as investment adviser to various institutional and individual clients, including registered investment companies and pension plans, and as ...

... directly or indirectly controls or for which he acts as chief investment officer. These entities engage in various aspects of the securities business, primarily as investment adviser to various institutional and individual clients, including registered investment companies and pension plans, and as ...

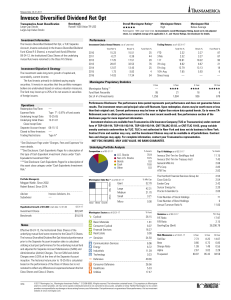

Invesco Diversified Dividend Ret Opt

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

CRA Investment Fund Audited Financial Statements

... 2. Summary of si gnificant accounting pol icies and nature of operations (continued) Concentration of credit risk The Companies maintain cash in bank deposit accounts that, at times, may exceed federally insured limits. The Companies have not experienced any losses in such accounts. The Companies be ...

... 2. Summary of si gnificant accounting pol icies and nature of operations (continued) Concentration of credit risk The Companies maintain cash in bank deposit accounts that, at times, may exceed federally insured limits. The Companies have not experienced any losses in such accounts. The Companies be ...

The University of Akron Investment Policy Statement for Endowment Funds

... written disclosure of all affiliations, cross-ownership arrangements, referral arrangements, discounts, compensation arrangements, and any other business relationships then existing or then being negotiated between the investment consultant candidate and any investment manager within the universe of ...

... written disclosure of all affiliations, cross-ownership arrangements, referral arrangements, discounts, compensation arrangements, and any other business relationships then existing or then being negotiated between the investment consultant candidate and any investment manager within the universe of ...

Venture Capita Report

... because they fail to raise further funds for investment or because they change their investment strategy. In order to provide an accurate picture of dependable suppliers of venture finance to SMEs, it was important to limit the scope of the project to those that were consistently active during the s ...

... because they fail to raise further funds for investment or because they change their investment strategy. In order to provide an accurate picture of dependable suppliers of venture finance to SMEs, it was important to limit the scope of the project to those that were consistently active during the s ...

Hedge Funds and the Technology Bubble

... 1978 all institutions with more than $100 million under discretionary management are required to disclose their holdings to the SEC each quarter on form 13F. This concerns all long positions in section 13(f) securities greater than 10,000 shares or $200,000, over which the manager exercises sole or ...

... 1978 all institutions with more than $100 million under discretionary management are required to disclose their holdings to the SEC each quarter on form 13F. This concerns all long positions in section 13(f) securities greater than 10,000 shares or $200,000, over which the manager exercises sole or ...

malta 2016 - HFM Global

... 2015 at 29 within 12 Protected Cell Companies. The Authority also granted certificates of registration to two retirement schemes and two retirement scheme administrators. COMPANIES AND TRUSTS The Registry of Companies registered over 5,500 new companies in 2015. Nine new authorisations were issued i ...

... 2015 at 29 within 12 Protected Cell Companies. The Authority also granted certificates of registration to two retirement schemes and two retirement scheme administrators. COMPANIES AND TRUSTS The Registry of Companies registered over 5,500 new companies in 2015. Nine new authorisations were issued i ...

Deactivating Active Share

... Share captures stock selection while tracking error captures factor timing (e.g., section 1.3 of the former and pp. 74-77 of the latter paper). This is an interesting conjecture, but it does not help explain why one of these types of active management leads to outperformance but the other one does n ...

... Share captures stock selection while tracking error captures factor timing (e.g., section 1.3 of the former and pp. 74-77 of the latter paper). This is an interesting conjecture, but it does not help explain why one of these types of active management leads to outperformance but the other one does n ...

Islamic Insurance takaful

... of the policyholders. As such, it is entitled to a known remuneration. It incurs all the operational expenses on behalf of its principal. The distinct features of this model are: 1. Policyholders pay premium that is credited to a policyholders’ fund. 2. The takaful operator company assumes the rol ...

... of the policyholders. As such, it is entitled to a known remuneration. It incurs all the operational expenses on behalf of its principal. The distinct features of this model are: 1. Policyholders pay premium that is credited to a policyholders’ fund. 2. The takaful operator company assumes the rol ...

IDRT

... The investment committee of ABC, LLC has decided to make the following changes to the investment options currently available to plan participants. We understand plan sponsors of participant directed defined contribution plans subject to ERISA are required to provide at least 30 days but not more tha ...

... The investment committee of ABC, LLC has decided to make the following changes to the investment options currently available to plan participants. We understand plan sponsors of participant directed defined contribution plans subject to ERISA are required to provide at least 30 days but not more tha ...

Living Annuity 3.4MB

... The 10X Top 60 SA Share Index and 10X SA Property Index (the “Indices”) is the property of 10X Investments (Pty) Ltd, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Indices are not sponsored by S&P Dow Jones Indices or its ...

... The 10X Top 60 SA Share Index and 10X SA Property Index (the “Indices”) is the property of 10X Investments (Pty) Ltd, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Indices are not sponsored by S&P Dow Jones Indices or its ...

Co-investments in funds of funds and separate accounts

... the legal documents. These include documents used to acquire the subject company, as well as the documents governing the terms between the equity sponsor and co-investor(s). The legal documents used to acquire the company include the purchase agreement, debt documents and employment agreements. The ...

... the legal documents. These include documents used to acquire the subject company, as well as the documents governing the terms between the equity sponsor and co-investor(s). The legal documents used to acquire the company include the purchase agreement, debt documents and employment agreements. The ...

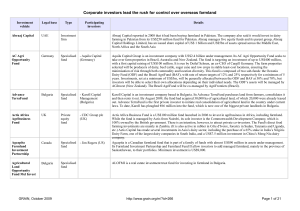

The new farm owners table

... Agrifirma was launched in 2008 to acquire land in Brazil and bring it into agricultural production. The principal shareholders formerly managed the mining investment company Galahad Gold plc from 2003 to 2007. "We are building a portfolio of land where we can successfully apply our capital, technolo ...

... Agrifirma was launched in 2008 to acquire land in Brazil and bring it into agricultural production. The principal shareholders formerly managed the mining investment company Galahad Gold plc from 2003 to 2007. "We are building a portfolio of land where we can successfully apply our capital, technolo ...

PRIVATE EQUITY FOR THE COMMON MAN

... These returns noted above are quoted prior to inclusion of transaction costs and fees. Front-end loads on these investments are remarkably high (typically 14 percent), with an initial booked share price that is net of the up-front fees (say $8.60 per share based on a posted share price of $10 per sh ...

... These returns noted above are quoted prior to inclusion of transaction costs and fees. Front-end loads on these investments are remarkably high (typically 14 percent), with an initial booked share price that is net of the up-front fees (say $8.60 per share based on a posted share price of $10 per sh ...

Statement of investment principles

... in a single asset class. NEST diversifies scheme members’ money across different types of investment by using their contributions to buy units in each of these funds in varying proportions. ...

... in a single asset class. NEST diversifies scheme members’ money across different types of investment by using their contributions to buy units in each of these funds in varying proportions. ...

Russell Investments` 2012 Global Survey on Alternative Investing

... Consistent with our practice in past editions, we have incorporated selected comments gathered from one-on-one interviews of Survey respondents. These comments are meant to illustrate the diversity of perspectives uncovered by the Survey, rather than to reinforce any specific conclusions. To respect ...

... Consistent with our practice in past editions, we have incorporated selected comments gathered from one-on-one interviews of Survey respondents. These comments are meant to illustrate the diversity of perspectives uncovered by the Survey, rather than to reinforce any specific conclusions. To respect ...

Guidance Note 1/05 - Central Bank of Ireland

... All relevant parties to the UCITS must be identified i.e. manager, fund administrator, trustee, investment manager, investment adviser, promoter, auditor. In the case of a self-managed investment company, the directors of the company must be identified. Include details of where additional informatio ...

... All relevant parties to the UCITS must be identified i.e. manager, fund administrator, trustee, investment manager, investment adviser, promoter, auditor. In the case of a self-managed investment company, the directors of the company must be identified. Include details of where additional informatio ...

Seasons Series Trust - Mid Cap Value Portfolio - Annuities

... shareholder reports are incorporated into and made part of this Summary Prospectus by reference. The Portfolio is offered only to the separate accounts of certain affiliated and unaffiliated life insurance companies and is not intended for use by other investors. Before you invest, you may want to r ...

... shareholder reports are incorporated into and made part of this Summary Prospectus by reference. The Portfolio is offered only to the separate accounts of certain affiliated and unaffiliated life insurance companies and is not intended for use by other investors. Before you invest, you may want to r ...

Gold ETF - Sangai Investments

... Investors are requested to note that there will be a lock - in period of 3 years for each SIP ...

... Investors are requested to note that there will be a lock - in period of 3 years for each SIP ...

One Hat Too Many? Investment Desegregation in Private Equity

... individuals deciding to offer their labor (and often their money) as asset managers through an investment advisory entity that will raise funds, identify investment opportunities, and subsequently oversee equity investments in target firms. The investment adviser, however, does not do the investing ...

... individuals deciding to offer their labor (and often their money) as asset managers through an investment advisory entity that will raise funds, identify investment opportunities, and subsequently oversee equity investments in target firms. The investment adviser, however, does not do the investing ...