Janus Capital Funds Plc Prospectus

... that the respective objectives of the Funds will be achieved and that the value of the Shares of any Fund, and the income earned on such Shares, may fall as well as rise. An investment in the Funds should not constitute a substantial proportion of an investment portfolio and may not be appropriate f ...

... that the respective objectives of the Funds will be achieved and that the value of the Shares of any Fund, and the income earned on such Shares, may fall as well as rise. An investment in the Funds should not constitute a substantial proportion of an investment portfolio and may not be appropriate f ...

Ind-AS Illustrative financial statements for the year ended 31 March

... companies. Users of this publication are encouraged to select disclosures relevant to their circumstances and tailor them appropriately. Users should also keep in mind that transactions not envisaged in the illustrative financial statements are likely to require additional disclosures. This set of i ...

... companies. Users of this publication are encouraged to select disclosures relevant to their circumstances and tailor them appropriately. Users should also keep in mind that transactions not envisaged in the illustrative financial statements are likely to require additional disclosures. This set of i ...

Final decision - Review of electricity transmission and distribution

... The National Electricity Rules (NER) provide that the Australian Energy Regulator (AER) must review the weighted average cost of capital (WACC) parameters to be adopted in reset determinations for electricity transmission and distribution network service providers (TNSPs and DNSPs). Reviews are to b ...

... The National Electricity Rules (NER) provide that the Australian Energy Regulator (AER) must review the weighted average cost of capital (WACC) parameters to be adopted in reset determinations for electricity transmission and distribution network service providers (TNSPs and DNSPs). Reviews are to b ...

a quantitative study

... Accounting Standards Board of Japan (ASBJ) issued a Discussion Paper on accounting and disclosure requirements on goodwill to contribute to the debate. Following the replies from constituents and publication of a feedback statement, EFRAG concluded that it would be helpful to collect data on the amo ...

... Accounting Standards Board of Japan (ASBJ) issued a Discussion Paper on accounting and disclosure requirements on goodwill to contribute to the debate. Following the replies from constituents and publication of a feedback statement, EFRAG concluded that it would be helpful to collect data on the amo ...

Corporate Personality - University at Albany

... to expand the employee base to 300 and lead to revenues of DM 100 Million or 52 million in dollars (sap.com). Shortly after reaching this milestone, IBM’s new generation of servers made SAP’s software available to midsize customers. In order to effectively support these new costumers, SAP establish ...

... to expand the employee base to 300 and lead to revenues of DM 100 Million or 52 million in dollars (sap.com). Shortly after reaching this milestone, IBM’s new generation of servers made SAP’s software available to midsize customers. In order to effectively support these new costumers, SAP establish ...

threadneedle investment funds icvc - Columbia Threadneedle Investments

... fees in respect of investments in other Threadneedle funds. Any such target funds themselves bear a management fee, which reduces the values of those funds from what they otherwise would be. The rebate mechanism operates to ensure that investors in the funds bear only the fee validly applicable to t ...

... fees in respect of investments in other Threadneedle funds. Any such target funds themselves bear a management fee, which reduces the values of those funds from what they otherwise would be. The rebate mechanism operates to ensure that investors in the funds bear only the fee validly applicable to t ...

Pillar 3 Risk and Capital Management Report 2016

... prepared in accordance with board approved internal control processes and in accordance with the Nedbank Group Public Disclosure Policy, which can be accessed on nedbank.co.za. A Nedbank Group Internal Audit (GIA) review was completed, with no material issues raised. ...

... prepared in accordance with board approved internal control processes and in accordance with the Nedbank Group Public Disclosure Policy, which can be accessed on nedbank.co.za. A Nedbank Group Internal Audit (GIA) review was completed, with no material issues raised. ...

printmgr file

... to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. The Fund currently seeks to achieve its investment objective by investing a substantial portion of its assets in one underlying fund, the iShares MSCI EAFE ETF. ...

... to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. The Fund currently seeks to achieve its investment objective by investing a substantial portion of its assets in one underlying fund, the iShares MSCI EAFE ETF. ...

Fair Value Measurement (Topic 820)

... entity’s shareholders’ equity. The amendments include requirements specific to measuring the fair value of those instruments, such as equity interests issued as consideration in a business combination. Those amendments are consistent with the requirements for measuring the fair value of liabilities ...

... entity’s shareholders’ equity. The amendments include requirements specific to measuring the fair value of those instruments, such as equity interests issued as consideration in a business combination. Those amendments are consistent with the requirements for measuring the fair value of liabilities ...

Nordea Annual Report 2016

... Towards the summer, Retail Banking was divided into two new business areas – Personal Banking and Commercial & Business Banking. This change will adapt the organisation more clearly to different customer needs, sharpen customer focus and strengthen execution capacity in each of the two new business ...

... Towards the summer, Retail Banking was divided into two new business areas – Personal Banking and Commercial & Business Banking. This change will adapt the organisation more clearly to different customer needs, sharpen customer focus and strengthen execution capacity in each of the two new business ...

Building on Our Proud Heritage

... I am proud of this team. Allianz is a different company today from the one I joined in 2008. Besides being more profitable, we have become more versatile, more efficient and more responsive. This is the lasting legacy of Michael Diekmann, my predecessor as Chairman of the Board of Management. In ...

... I am proud of this team. Allianz is a different company today from the one I joined in 2008. Besides being more profitable, we have become more versatile, more efficient and more responsive. This is the lasting legacy of Michael Diekmann, my predecessor as Chairman of the Board of Management. In ...

Australian Valuation Practices Survey 2015

... it will offer a unique reference point for corporate financiers and financial analysts, providing insight into the valuation parameters and approaches currently being used. For the first time, the survey also covers real estate and tangible asset valuations. It became evident that the survey was fil ...

... it will offer a unique reference point for corporate financiers and financial analysts, providing insight into the valuation parameters and approaches currently being used. For the first time, the survey also covers real estate and tangible asset valuations. It became evident that the survey was fil ...

Pension Savings: The Real Return

... Michael Klages is an economist who graduated in international finance and banking & finance from the Leibniz University of Hanover. He joined the INSEAD OEE Data Services in 2011, where he is responsible for data analysis and complementary data calculations, research publications and ...

... Michael Klages is an economist who graduated in international finance and banking & finance from the Leibniz University of Hanover. He joined the INSEAD OEE Data Services in 2011, where he is responsible for data analysis and complementary data calculations, research publications and ...

Overview of Investment Management Fees

... – Strategies that involve fundamental research require bigger staffs versus quantitative or modeldriven strategies. – Strategies may have higher implicit and explicit costs versus others (i.e., external research, larger broker/dealer spreads (e.g., EMD), high legal costs (e.g., high yield bonds), et ...

... – Strategies that involve fundamental research require bigger staffs versus quantitative or modeldriven strategies. – Strategies may have higher implicit and explicit costs versus others (i.e., external research, larger broker/dealer spreads (e.g., EMD), high legal costs (e.g., high yield bonds), et ...

Chen_uta_2502D_12115

... equity markets. While their findings suggest informational based trading by institutional traders is the major force driving the upward trend, it is still worthwhile to consider other possibilities, such as investor overconfidence. 1.1 Motivation The understanding of reasons to trade is of interest ...

... equity markets. While their findings suggest informational based trading by institutional traders is the major force driving the upward trend, it is still worthwhile to consider other possibilities, such as investor overconfidence. 1.1 Motivation The understanding of reasons to trade is of interest ...

The market pricing of accruals quality

... patterns in average returns not explained by the CAPM (Fama and French, 1996). Specifically, this research shows that firms with relatively (high) low magnitudes of signed accruals, or signed abnormal accruals, earn (negative) positive risk-adjusted returns (e.g., Sloan, 1996; Xie, 2001; Chan et al., ...

... patterns in average returns not explained by the CAPM (Fama and French, 1996). Specifically, this research shows that firms with relatively (high) low magnitudes of signed accruals, or signed abnormal accruals, earn (negative) positive risk-adjusted returns (e.g., Sloan, 1996; Xie, 2001; Chan et al., ...

Mergers and Acquisitions in Australia: Reasons and Timing

... An acquisition followed by the divestiture of some or all of the operating units of the acquired firm, which can be sold at prices greater than their current value. ...

... An acquisition followed by the divestiture of some or all of the operating units of the acquired firm, which can be sold at prices greater than their current value. ...

Griffin Institutional Access Real Estate Fund

... plan accounts. The Fund reserves the right to waive investment minimums. The Fund’s Shares are offered through ALPS Distributors, Inc. (the “Distributor”), as the distributor. In addition, certain institutions (including banks, trust companies, brokers and investment advisers) may be authorized to a ...

... plan accounts. The Fund reserves the right to waive investment minimums. The Fund’s Shares are offered through ALPS Distributors, Inc. (the “Distributor”), as the distributor. In addition, certain institutions (including banks, trust companies, brokers and investment advisers) may be authorized to a ...

American International Group, Inc. 2016 Annual Report

... such measures to the most comparable GAAP measures in accordance with Regulation G are included within this Annual Report, AIG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (included herein) or in the Fourth Quarter 2016 Financial Supplement available in the Investor Infor ...

... such measures to the most comparable GAAP measures in accordance with Regulation G are included within this Annual Report, AIG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (included herein) or in the Fourth Quarter 2016 Financial Supplement available in the Investor Infor ...

Form N-30D HARTFORD LIFE INSURANCE CO

... The first 6-months of the year have been extremely volatile for investors. Until halfway through March it looked as though we were headed for a down first quarter in the market in spite of excellent earnings prospects and continued low inflation. The only game in town seemed to be technology with li ...

... The first 6-months of the year have been extremely volatile for investors. Until halfway through March it looked as though we were headed for a down first quarter in the market in spite of excellent earnings prospects and continued low inflation. The only game in town seemed to be technology with li ...

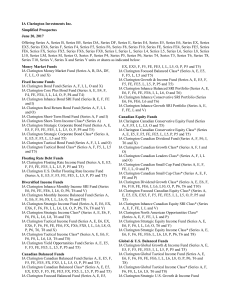

IA Clarington Investments Inc. Simplified Prospectus June 20, 2017

... Series T10, Series V, Series X and Series Y units or shares as indicated below: Money Market Funds IA Clarington Money Market Fund (Series A, B, DA, DF, F, I, L, O and X) Fixed Income Funds IA Clarington Bond Fund (Series A, F, I, L, O and X) IA Clarington Core Plus Bond Fund (Series A, E, E4, F, F4 ...

... Series T10, Series V, Series X and Series Y units or shares as indicated below: Money Market Funds IA Clarington Money Market Fund (Series A, B, DA, DF, F, I, L, O and X) Fixed Income Funds IA Clarington Bond Fund (Series A, F, I, L, O and X) IA Clarington Core Plus Bond Fund (Series A, E, E4, F, F4 ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.