Westpac Trust Preferred Securities

... responsibility for the content of this PDS nor for the merits of the investment to which this PDS relates. This PDS relates to the offer of Westpac TPS at an Issue Price of $100 each to raise approximately $700 million with the ability to raise more or less (Offer). Westpac TPS are preferred units i ...

... responsibility for the content of this PDS nor for the merits of the investment to which this PDS relates. This PDS relates to the offer of Westpac TPS at an Issue Price of $100 each to raise approximately $700 million with the ability to raise more or less (Offer). Westpac TPS are preferred units i ...

181300000 Class A Senior Secured Floating Rate Notes due 2031

... are persons falling within Article 49(2)(a) to (d) (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or who otherwise fall within an exemption set forth in such Order so that Section 21(1) of the Financial Ser ...

... are persons falling within Article 49(2)(a) to (d) (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or who otherwise fall within an exemption set forth in such Order so that Section 21(1) of the Financial Ser ...

ACCOUNTING FOR GOODWILL: A CRITICAL EVALUATION

... A further problem concerning the goodwill debate, which is really due to the disagreement as to its nature, is whether purchased goodwill should be recognised as an asset in the financial statements, and if so, whether it should be amortised in any way. Lee ( 1 971 : 324), for example considers the ...

... A further problem concerning the goodwill debate, which is really due to the disagreement as to its nature, is whether purchased goodwill should be recognised as an asset in the financial statements, and if so, whether it should be amortised in any way. Lee ( 1 971 : 324), for example considers the ...

IMPORTANT NOTICE THIS OFFERING IS AVAILABLE

... This Offering Circular constitutes a prospectus for: (a) the purpose of Article 5 of the Prospectus Directive and (b) the purpose of giving information with regard to the Bank and the Notes that, according to the particular nature of the Bank and the Notes, is necessary to enable investors to make ...

... This Offering Circular constitutes a prospectus for: (a) the purpose of Article 5 of the Prospectus Directive and (b) the purpose of giving information with regard to the Bank and the Notes that, according to the particular nature of the Bank and the Notes, is necessary to enable investors to make ...

Final decision - Review of electricity transmission and distribution

... statement, in forming its final decision on the revised WACC parameter values, methods and credit rating. Following a very extensive engagement with stakeholders since the explanatory statement and detailed review of additional market data and specific business information, the AER in this final dec ...

... statement, in forming its final decision on the revised WACC parameter values, methods and credit rating. Following a very extensive engagement with stakeholders since the explanatory statement and detailed review of additional market data and specific business information, the AER in this final dec ...

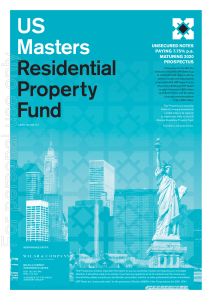

US Masters Residential Property Fund

... responsible entity for the US Masters Residential Property Fund (URF or the Fund), I am pleased to invite you to subscribe for unsecured notes being issued by the Responsible Entity solely in its capacity as responsible entity for the US Masters Residential Property Fund (URF Notes II). The URF Note ...

... responsible entity for the US Masters Residential Property Fund (URF or the Fund), I am pleased to invite you to subscribe for unsecured notes being issued by the Responsible Entity solely in its capacity as responsible entity for the US Masters Residential Property Fund (URF Notes II). The URF Note ...

2013/14 Assessment of ASX Clearing and Settlement Facilities September 2014 Contents

... account structures for both OTC derivatives and exchange-traded futures. Sitting alongside the pre-existing omnibus client account structure for exchange-traded products, the new arrangements give clients a choice in the level of protection they receive and the likelihood that positions and associat ...

... account structures for both OTC derivatives and exchange-traded futures. Sitting alongside the pre-existing omnibus client account structure for exchange-traded products, the new arrangements give clients a choice in the level of protection they receive and the likelihood that positions and associat ...

important notice this offering is available only to investors

... Confirmation of your representation: In order to be eligible to view the attached offering memorandum or make an investment decision with respect to the securities being offered, prospective investors must be non-U.S. persons (as defined in Regulation S) located outside the United States and to the ...

... Confirmation of your representation: In order to be eligible to view the attached offering memorandum or make an investment decision with respect to the securities being offered, prospective investors must be non-U.S. persons (as defined in Regulation S) located outside the United States and to the ...

reuters fundamentals

... equipment. Thomson Reuters, its agents and employees, shall not be held liable to or through any user for any loss or damage whatsoever resulting from reliance on the information contained herein. This document contains information proprietary to Thomson Reuters and may not be reproduced, disclosed, ...

... equipment. Thomson Reuters, its agents and employees, shall not be held liable to or through any user for any loss or damage whatsoever resulting from reliance on the information contained herein. This document contains information proprietary to Thomson Reuters and may not be reproduced, disclosed, ...

Corrigendum to Regulation (EU) No 575•/•2013 of the European

... the time limit for such a Council decision is set to one month. If the Council, after having examined the proposal by the Commission to reject the proposed national measures in depth, comes to the conclusion that the conditions laid down in this Regulation for the rejec tion of the national measure ...

... the time limit for such a Council decision is set to one month. If the Council, after having examined the proposal by the Commission to reject the proposed national measures in depth, comes to the conclusion that the conditions laid down in this Regulation for the rejec tion of the national measure ...

Griffin Institutional Access Real Estate Fund

... The Adviser . The Fund’s investment adviser is Griffin Capital Advisor, LLC (the “Adviser”), a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Adviser has engaged Aon Hewitt Investment Consulting, Inc. (“Aon Hewitt”, “AHIC” or the “Priva ...

... The Adviser . The Fund’s investment adviser is Griffin Capital Advisor, LLC (the “Adviser”), a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Adviser has engaged Aon Hewitt Investment Consulting, Inc. (“Aon Hewitt”, “AHIC” or the “Priva ...

threadneedle investment funds icvc - Columbia Threadneedle Investments

... In addition to any direct charge for management fees within the funds, there would occur, in the absence of a rebate mechanism, an indirect charge for management fees in respect of investments in other Threadneedle funds. Any such target funds themselves bear a management fee, which reduces the valu ...

... In addition to any direct charge for management fees within the funds, there would occur, in the absence of a rebate mechanism, an indirect charge for management fees in respect of investments in other Threadneedle funds. Any such target funds themselves bear a management fee, which reduces the valu ...

Trading in Secu

... owing by or to the Client effected through telegraphic transfer, direct debit or any other electronic means offered by a Licensed Financial Institution; “Electronic Payment for Shares Service” means the service involving trading of securities whereby payments are facilitated via Electronic Payment o ...

... owing by or to the Client effected through telegraphic transfer, direct debit or any other electronic means offered by a Licensed Financial Institution; “Electronic Payment for Shares Service” means the service involving trading of securities whereby payments are facilitated via Electronic Payment o ...

asx release

... on Monday, 21 November 2016 and will close on Tuesday, 22 November 2016. Eligible institutional shareholders can choose to take up their Entitlement in whole, in part or not at all. Institutional entitlements (“Institutional Entitlements”) cannot be traded or sold on the ASX. As the Entitlement Offe ...

... on Monday, 21 November 2016 and will close on Tuesday, 22 November 2016. Eligible institutional shareholders can choose to take up their Entitlement in whole, in part or not at all. Institutional entitlements (“Institutional Entitlements”) cannot be traded or sold on the ASX. As the Entitlement Offe ...

0001053532-15-000012 - Lasalle Hotel Properties

... known and unknown risks, uncertainties and other factors that are, in some cases, beyond the Company’s control and which could materially affect actual results, performances or achievements. Factors that may cause actual results to differ materially from current expectations include, but are not lim ...

... known and unknown risks, uncertainties and other factors that are, in some cases, beyond the Company’s control and which could materially affect actual results, performances or achievements. Factors that may cause actual results to differ materially from current expectations include, but are not lim ...

CHF 400000000 1.125 per cent. Notes due 18

... (ii) Pursuant to Clause 2.2 of the Trust Deed, obtaining the covenants from the Issuer that it will, as and when the Notes becomes due to be redeemed in accordance with the relevant Conditions, unconditionally pay or procure to be paid to or to the order of the Trustee in the relevant currency in im ...

... (ii) Pursuant to Clause 2.2 of the Trust Deed, obtaining the covenants from the Issuer that it will, as and when the Notes becomes due to be redeemed in accordance with the relevant Conditions, unconditionally pay or procure to be paid to or to the order of the Trustee in the relevant currency in im ...

Taiwan Stock Exchange Market Observation Post System: http

... designs with higher performance and lower power consumption. Because TSMC’s 28-nanometer solutions are highly competitive in both technology and cost, we saw increasing number of customer product tape-outs in 2015 and believe we should be able to maintain our substantial (above 70 percent) market sh ...

... designs with higher performance and lower power consumption. Because TSMC’s 28-nanometer solutions are highly competitive in both technology and cost, we saw increasing number of customer product tape-outs in 2015 and believe we should be able to maintain our substantial (above 70 percent) market sh ...