Janus Capital Funds Plc Prospectus

... inform themselves of, and observe, all applicable laws and regulations of any relevant jurisdictions. The placement of a subscription order for Shares shall constitute an acknowledgment that the investor, including Institutional Investor and any Distribution Agent, have so informed themselves and th ...

... inform themselves of, and observe, all applicable laws and regulations of any relevant jurisdictions. The placement of a subscription order for Shares shall constitute an acknowledgment that the investor, including Institutional Investor and any Distribution Agent, have so informed themselves and th ...

Final decision - Review of electricity transmission and distribution

... associated with the global financial crisis. Similarly, the AER has taken a cautious approach to the interpretation of empirical evidence on the equity beta of a benchmark electricity network business by adopting a value that is above the range indicated by empirical estimates. In response to the is ...

... associated with the global financial crisis. Similarly, the AER has taken a cautious approach to the interpretation of empirical evidence on the equity beta of a benchmark electricity network business by adopting a value that is above the range indicated by empirical estimates. In response to the is ...

Griffin Institutional Access Real Estate Fund

... enables the Adviser to allocate between public and private real estate securities, and allows the Fund to invest across a diversified set of investment managers and strategies as well as providing investment exposure across property types and geographies. Under normal circumstances, at least 80% of ...

... enables the Adviser to allocate between public and private real estate securities, and allows the Fund to invest across a diversified set of investment managers and strategies as well as providing investment exposure across property types and geographies. Under normal circumstances, at least 80% of ...

Essays on the Forecasting Power of Implied Volatility

... same volatility for all European options with the same exercise price and time to maturity. But in reality, due to either Black-Scholes not being the correct model or to the existence of market frictions and measurement problems, we observe different implied volatilities for options on the same unde ...

... same volatility for all European options with the same exercise price and time to maturity. But in reality, due to either Black-Scholes not being the correct model or to the existence of market frictions and measurement problems, we observe different implied volatilities for options on the same unde ...

DREYFUS INTERNATIONAL VALUE FUND

... or that derive a significant portion of their revenue or profits from businesses, investments or sales, outside the United States. The Fund typically invests in companies in at least ten foreign countries, and limits its investments in any single company to no more than 5% of its assets at the time ...

... or that derive a significant portion of their revenue or profits from businesses, investments or sales, outside the United States. The Fund typically invests in companies in at least ten foreign countries, and limits its investments in any single company to no more than 5% of its assets at the time ...

Determinants of Dividend Policy in Sweden

... dividend remain one of the thorniest puzzles in corporate finance”. Contradictory to the Irrelevance Theory, Lintner’s (1956) Bird-in-Hand Theory states that dividend payments would increase a firm’s value. The theory suggests that investors prefer to have one bird in the hand (dividend), rather tha ...

... dividend remain one of the thorniest puzzles in corporate finance”. Contradictory to the Irrelevance Theory, Lintner’s (1956) Bird-in-Hand Theory states that dividend payments would increase a firm’s value. The theory suggests that investors prefer to have one bird in the hand (dividend), rather tha ...

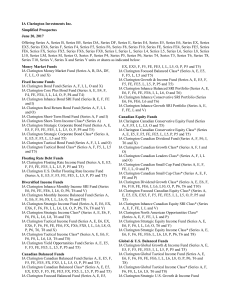

IA Clarington Investments Inc. Simplified Prospectus June 20, 2017

... Series T10, Series V, Series X and Series Y units or shares as indicated below: Money Market Funds IA Clarington Money Market Fund (Series A, B, DA, DF, F, I, L, O and X) Fixed Income Funds IA Clarington Bond Fund (Series A, F, I, L, O and X) IA Clarington Core Plus Bond Fund (Series A, E, E4, F, F4 ...

... Series T10, Series V, Series X and Series Y units or shares as indicated below: Money Market Funds IA Clarington Money Market Fund (Series A, B, DA, DF, F, I, L, O and X) Fixed Income Funds IA Clarington Bond Fund (Series A, F, I, L, O and X) IA Clarington Core Plus Bond Fund (Series A, E, E4, F, F4 ...

Overview of Investment Management Fees

... – Strategies that involve fundamental research require bigger staffs versus quantitative or modeldriven strategies. – Strategies may have higher implicit and explicit costs versus others (i.e., external research, larger broker/dealer spreads (e.g., EMD), high legal costs (e.g., high yield bonds), et ...

... – Strategies that involve fundamental research require bigger staffs versus quantitative or modeldriven strategies. – Strategies may have higher implicit and explicit costs versus others (i.e., external research, larger broker/dealer spreads (e.g., EMD), high legal costs (e.g., high yield bonds), et ...

MSCI ID Sign In

... concentration risk. We delve into the US and Europe cases in greater detail, examining a range of criteria which reflect the risks of these two entities. In our analysis we treat Europe as a single bloc given its integrated economy. While there remains a risk to the continuation of the Euro zone, at ...

... concentration risk. We delve into the US and Europe cases in greater detail, examining a range of criteria which reflect the risks of these two entities. In our analysis we treat Europe as a single bloc given its integrated economy. While there remains a risk to the continuation of the Euro zone, at ...

Heptagon Fund plc

... being redeemed. Details of any such charge with respect to any Fund will be set out in the relevant Supplement. Where a redemption fee is charged, investors should view an investment in the relevant Fund as medium to long term. INVESTMENT RISKS Investment in the Company carries with it a degree of r ...

... being redeemed. Details of any such charge with respect to any Fund will be set out in the relevant Supplement. Where a redemption fee is charged, investors should view an investment in the relevant Fund as medium to long term. INVESTMENT RISKS Investment in the Company carries with it a degree of r ...

OECD Benchmark Definition of Foreign Direct Investment

... right policy framework, FDI can provide financial stability, promote economic development and enhance the well being of societies. Reliable FDI statistics have always been essential for policy makers faced with the challenges of attracting and making the most of international investment. In the earl ...

... right policy framework, FDI can provide financial stability, promote economic development and enhance the well being of societies. Reliable FDI statistics have always been essential for policy makers faced with the challenges of attracting and making the most of international investment. In the earl ...

Words - Nasdaq`s INTEL Solutions

... estimated initial public offering price range set forth on the cover page of this prospectus). OFS Capital We are an externally managed, closed-end, non-diversified management investment company formed in March 2001. Our investment objective is to provide our stockholders with both current income an ...

... estimated initial public offering price range set forth on the cover page of this prospectus). OFS Capital We are an externally managed, closed-end, non-diversified management investment company formed in March 2001. Our investment objective is to provide our stockholders with both current income an ...

the first six decades - International Finance Corporation

... the changing needs of the times. Although mandated from the outset to invest, advise, and mobilize capital for private sector development, IFC began in 1956 with a primary emphasis on loans. Equity investment and loan syndication functions were soon added. As more countries joined IFC and demand inc ...

... the changing needs of the times. Although mandated from the outset to invest, advise, and mobilize capital for private sector development, IFC began in 1956 with a primary emphasis on loans. Equity investment and loan syndication functions were soon added. As more countries joined IFC and demand inc ...

placement agreement - Camlin Fine Sciences

... federal or state securities commission or regulatory authority. As such, this Preliminary Placement Document does not constitute, and may not be used for or in connection with, an offer or solicitation by any one in any jurisdiction in which such offer or solicitation is not authorised or to any per ...

... federal or state securities commission or regulatory authority. As such, this Preliminary Placement Document does not constitute, and may not be used for or in connection with, an offer or solicitation by any one in any jurisdiction in which such offer or solicitation is not authorised or to any per ...

Dynamic Private Investment Pools

... WHAT IS A MUTUAL FUND AND WHAT ARE THE RISKS OF INVESTING IN A MUTUAL FUND? ..... 2 WHAT IS THE MAIN PURPOSE OF A MUTUAL FUND? ................................................................................................. 2 WHAT DO MUTUAL FUNDS INVEST IN? ....................................... ...

... WHAT IS A MUTUAL FUND AND WHAT ARE THE RISKS OF INVESTING IN A MUTUAL FUND? ..... 2 WHAT IS THE MAIN PURPOSE OF A MUTUAL FUND? ................................................................................................. 2 WHAT DO MUTUAL FUNDS INVEST IN? ....................................... ...

5.45% Series J Cumulative Preferred Stock

... amended (the “1940 Act”). The Fund’s primary investment objective is to achieve long term growth of capital by investing primarily in a portfolio of equity securities consisting of common stock, preferred stock, convertible or exchangeable securities, and warrants and rights to purchase such securit ...

... amended (the “1940 Act”). The Fund’s primary investment objective is to achieve long term growth of capital by investing primarily in a portfolio of equity securities consisting of common stock, preferred stock, convertible or exchangeable securities, and warrants and rights to purchase such securit ...

music broadcast limited

... In terms of Rule 19(2)(b)(ii) of the Securities Contracts (Regulation) Rules, 1957, as amended (the “SCRR”), this is an Offer for at least such percentage of the post-Offer paid-up Equity Share capital of our Company which will be equivalent to ` 4,000.00 million calculated at the Offer Price and th ...

... In terms of Rule 19(2)(b)(ii) of the Securities Contracts (Regulation) Rules, 1957, as amended (the “SCRR”), this is an Offer for at least such percentage of the post-Offer paid-up Equity Share capital of our Company which will be equivalent to ` 4,000.00 million calculated at the Offer Price and th ...

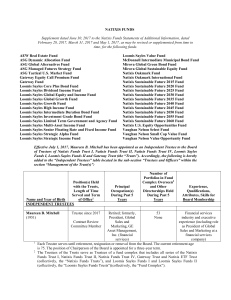

LOOMIS SAYLES VALUE FUND Supplement dated April 19, 2017 to

... This Statement of Additional Information (“Statement”) contains specific information that may be useful to investors but that is not included in the Statutory Prospectus of the series of Natixis Funds Trust I, Loomis Sayles Funds I or Loomis Sayles Funds II listed above (each, a “Trust” and together ...

... This Statement of Additional Information (“Statement”) contains specific information that may be useful to investors but that is not included in the Statutory Prospectus of the series of Natixis Funds Trust I, Loomis Sayles Funds I or Loomis Sayles Funds II listed above (each, a “Trust” and together ...

Azure Power Global Ltd (Form: F-1/A, Received: 10/07

... rated capacity of solar power plants pursuant to customer power purchase agreements, or PPAs, signed or allotted or where we have been declared as one of the winning bidders, but not yet commissioned and operational as of the reporting date. We are targeting having 520MW operating by December 31, 20 ...

... rated capacity of solar power plants pursuant to customer power purchase agreements, or PPAs, signed or allotted or where we have been declared as one of the winning bidders, but not yet commissioned and operational as of the reporting date. We are targeting having 520MW operating by December 31, 20 ...

Morningstar Guide

... a lower-rated or non-rated offering might now employ a manager who produced excellent results with other managed investment products. Also, because ratings are based on performance within specific categories, it’s important to note that not all five-star offerings are equal or even interchangeable. ...

... a lower-rated or non-rated offering might now employ a manager who produced excellent results with other managed investment products. Also, because ratings are based on performance within specific categories, it’s important to note that not all five-star offerings are equal or even interchangeable. ...

Predicting Mutual Fund Performance: The Win

... skill. We find that these measures in the literature also correlate with our win-loss record indicating that there are more than just a few ways of locating skilled fund managers. Another branch of the literature attempts to differentiate lucky managers from skilled managers. Kosowski, Timmermann, ...

... skill. We find that these measures in the literature also correlate with our win-loss record indicating that there are more than just a few ways of locating skilled fund managers. Another branch of the literature attempts to differentiate lucky managers from skilled managers. Kosowski, Timmermann, ...

Noah Holdings Ltd (Form: 20-F, Received: 04/27

... investment fund products and insurance products. For purposes of clarification only, when we refer to our wealth management business, we mainly refer to our distribution-related business which may include the distribution of both wealth management products and asset management products. Mutual fund ...

... investment fund products and insurance products. For purposes of clarification only, when we refer to our wealth management business, we mainly refer to our distribution-related business which may include the distribution of both wealth management products and asset management products. Mutual fund ...

The Kay Review of UK Equity Markets and Long–Term Decision

... In 2010, only 11.5 per cent of UK shares were owned directly by individuals. In the early 1960s this figure was as high as 54 per cent. The major investment decisions which affect British companies are now taken by asset fund managers around the world who work for firms which control billions, often ...

... In 2010, only 11.5 per cent of UK shares were owned directly by individuals. In the early 1960s this figure was as high as 54 per cent. The major investment decisions which affect British companies are now taken by asset fund managers around the world who work for firms which control billions, often ...

ECB Unconventional Monetary Policy Actions: Market Impact

... destabilizing international spillovers by leading to volatility swings in capital flows and asset prices. Therefore, they call for more policy coordination and cooperation across the globe. On the other hand, policy makers in advanced economies argue that, while there are indeed risks associated wit ...

... destabilizing international spillovers by leading to volatility swings in capital flows and asset prices. Therefore, they call for more policy coordination and cooperation across the globe. On the other hand, policy makers in advanced economies argue that, while there are indeed risks associated wit ...

Hedge Funds and Systemic Risk

... and institutions but not to the general public. In part because of this restriction, hedge funds have, until recently, been subject to reduced reporting and oversight regulations. They have also been reluctant to provide even general information on their operations and strategies to the public, fear ...

... and institutions but not to the general public. In part because of this restriction, hedge funds have, until recently, been subject to reduced reporting and oversight regulations. They have also been reluctant to provide even general information on their operations and strategies to the public, fear ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.