2013/14 Assessment of ASX Clearing and Settlement Facilities September 2014 Contents

... carries out periodic assessments of how well each clearing and settlement (CS) facility licensee is complying with applicable Financial Stability Standards (FSS) determined by the Bank and the more general obligation to do all other things necessary to reduce systemic risk.1 The Bank’s findings are ...

... carries out periodic assessments of how well each clearing and settlement (CS) facility licensee is complying with applicable Financial Stability Standards (FSS) determined by the Bank and the more general obligation to do all other things necessary to reduce systemic risk.1 The Bank’s findings are ...

Study on the remuneration provisions applicable to credit institutions

... staff from unregulated sectors could not be verified. Problems have been found with regard to clawback clauses in the context of national employment law. Other problems concern the need for rules that are better adapted to the business scale. The rules work well in the case of big and significant in ...

... staff from unregulated sectors could not be verified. Problems have been found with regard to clawback clauses in the context of national employment law. Other problems concern the need for rules that are better adapted to the business scale. The rules work well in the case of big and significant in ...

2012 Form 20-F ING Groep N.V.

... * Listed, not for trading or quotation purposes, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission ...

... * Listed, not for trading or quotation purposes, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission ...

THU VI?N PHÁP LU?T

... 1. Forms of public offering of securities include the first-time public offering of securities, additional offering of shares or rights to buy shares to the public, and other forms. 2. The Government shall specify the forms of public offering of securities. Article 12.- Conditions for public offeri ...

... 1. Forms of public offering of securities include the first-time public offering of securities, additional offering of shares or rights to buy shares to the public, and other forms. 2. The Government shall specify the forms of public offering of securities. Article 12.- Conditions for public offeri ...

Document

... This is the Annual Report for 2016 of ABN AMRO, which consists of ABN AMRO Group N.V. and its consolidated Financial Statements. The financial information contained in this Annual Report has been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the Europe ...

... This is the Annual Report for 2016 of ABN AMRO, which consists of ABN AMRO Group N.V. and its consolidated Financial Statements. The financial information contained in this Annual Report has been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the Europe ...

NELNET INC

... December 31, 2003, our software was used to service $46 billion in student loans, which included $27 billion serviced by third parties using our software. We earn software license and maintenance fees annually from third-party clients for use of this software. We also provide computer consulting, cu ...

... December 31, 2003, our software was used to service $46 billion in student loans, which included $27 billion serviced by third parties using our software. We earn software license and maintenance fees annually from third-party clients for use of this software. We also provide computer consulting, cu ...

Joint Report to Congress: Economic Growth and Regulatory

... unnecessary regulatory requirements imposed on insured depository institutions (IDIs). In conducting this review, the statute requires the FFIEC or the agencies to categorize their regulations by type and, at regular intervals, provide notice and solicit public comment on categories of regulations, ...

... unnecessary regulatory requirements imposed on insured depository institutions (IDIs). In conducting this review, the statute requires the FFIEC or the agencies to categorize their regulations by type and, at regular intervals, provide notice and solicit public comment on categories of regulations, ...

Pillar 3 Risk and Capital Management Report 2016

... calculation of the groups capital adequacy ratio (CAR) through the application of the threshold deduction method, detail of which can be found on the next page. Implementation of the SAM regime is only expected during the second half of 2017. The insurance businesses are on track with their SAM impl ...

... calculation of the groups capital adequacy ratio (CAR) through the application of the threshold deduction method, detail of which can be found on the next page. Implementation of the SAM regime is only expected during the second half of 2017. The insurance businesses are on track with their SAM impl ...

Alterna Savings and Credit Union Limited

... conducting its affairs in a way that might be expected to harm the interests of members, depositors or shareholders or that tends to increase the risk of claims against the deposit insurer, but that Supervision by DICO as stabilization authority would, in this case, not be appropriate; (2) A credit ...

... conducting its affairs in a way that might be expected to harm the interests of members, depositors or shareholders or that tends to increase the risk of claims against the deposit insurer, but that Supervision by DICO as stabilization authority would, in this case, not be appropriate; (2) A credit ...

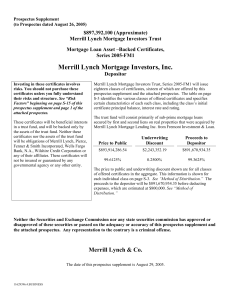

Merrill Lynch Mortgage Investors, Inc.

... If the 10% optional termination does not occur by the first distribution date on which it may occur, the margin on each of the class A-1A, class A-1B, class A-2A, class A-2B, class A-2C, class A-2D and class R certificates will increase to 2 times its respective margin shown above. If the 10% option ...

... If the 10% optional termination does not occur by the first distribution date on which it may occur, the margin on each of the class A-1A, class A-1B, class A-2A, class A-2B, class A-2C, class A-2D and class R certificates will increase to 2 times its respective margin shown above. If the 10% option ...

Preferred Shares - Investing For Me

... for 7.25% of the market, up from 6% the previous year. Rate reset preferred shares make up the majority (60%) of the preferred share market and the negative performance experienced during 2015 helped drag the Index lower. The price moves seen in this sector can be described as volatile with signific ...

... for 7.25% of the market, up from 6% the previous year. Rate reset preferred shares make up the majority (60%) of the preferred share market and the negative performance experienced during 2015 helped drag the Index lower. The price moves seen in this sector can be described as volatile with signific ...

99 COMPANY XYZ LIMITED

... The convening and conduct of shareholders meetings are governed by the Articles of Association of the Company and the Companies Acts. Although the Directors may convene an extraordinary general meeting of the Company at any time, the Directors of the Company are required to convene a general meeting ...

... The convening and conduct of shareholders meetings are governed by the Articles of Association of the Company and the Companies Acts. Although the Directors may convene an extraordinary general meeting of the Company at any time, the Directors of the Company are required to convene a general meeting ...

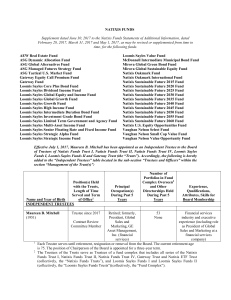

LOOMIS SAYLES VALUE FUND Supplement dated April 19, 2017 to

... This Statement of Additional Information (“Statement”) contains specific information that may be useful to investors but that is not included in the Statutory Prospectus of the series of Natixis Funds Trust I, Loomis Sayles Funds I or Loomis Sayles Funds II listed above (each, a “Trust” and together ...

... This Statement of Additional Information (“Statement”) contains specific information that may be useful to investors but that is not included in the Statutory Prospectus of the series of Natixis Funds Trust I, Loomis Sayles Funds I or Loomis Sayles Funds II listed above (each, a “Trust” and together ...

Retirement Date Fund

... money is an important factor to consider. Typically, younger workers can handle a more aggressive investment strategy. Since they have time before they’ll need their money, they can often ride out the market’s ups and downs. Older workers, however, are closer to retirement and often need a more cons ...

... money is an important factor to consider. Typically, younger workers can handle a more aggressive investment strategy. Since they have time before they’ll need their money, they can often ride out the market’s ups and downs. Older workers, however, are closer to retirement and often need a more cons ...

Cash management behavior of firms and its structural

... Table 7. Priority order (po) of the conflicts between cash management and other departments of a firm and Gini coefficient......................................... 73 Table 8. Centralization of cash management. ................................................................... 74 Table 9. Centraliz ...

... Table 7. Priority order (po) of the conflicts between cash management and other departments of a firm and Gini coefficient......................................... 73 Table 8. Centralization of cash management. ................................................................... 74 Table 9. Centraliz ...

The Development of Microfinance Institutions in a Multi

... with experimental initiatives to lend to the rural poor of Bangladesh and Brazil, microfinance turned out to be one of the most successful development efforts of the last decades (Ledgerwood, 1998). Main funding sources of early MFIs were grants and subsidies provided by donors and development insti ...

... with experimental initiatives to lend to the rural poor of Bangladesh and Brazil, microfinance turned out to be one of the most successful development efforts of the last decades (Ledgerwood, 1998). Main funding sources of early MFIs were grants and subsidies provided by donors and development insti ...

Nordea Annual Report 2016

... we operate today. At the same time we remain fully committed to operating in each country, and decisions will still be made close to the customer, as they have always been. A simpler structure reduces complexity and enables us to focus on delivering the best possible experience to customers. ...

... we operate today. At the same time we remain fully committed to operating in each country, and decisions will still be made close to the customer, as they have always been. A simpler structure reduces complexity and enables us to focus on delivering the best possible experience to customers. ...

Proposed Rule: Money Market Fund Reform

... per share (“NAV”). The second alternative proposal would require money market funds to impose a liquidity fee (unless the fund’s board determines that it is not in the best interest of the fund) if a fund’s liquidity levels fell below a specified threshold and would permit the funds to suspend redem ...

... per share (“NAV”). The second alternative proposal would require money market funds to impose a liquidity fee (unless the fund’s board determines that it is not in the best interest of the fund) if a fund’s liquidity levels fell below a specified threshold and would permit the funds to suspend redem ...

(PDF 4.7 MB)

... third of the seats on the Supervisory Board elected by the Shareholders’ Meeting. The lists must be accompanied by the following: 1) a list of the persons submitting the voting lists, duly signed and containing information as to their identity, with a statement of the total number of the Bank’s sha ...

... third of the seats on the Supervisory Board elected by the Shareholders’ Meeting. The lists must be accompanied by the following: 1) a list of the persons submitting the voting lists, duly signed and containing information as to their identity, with a statement of the total number of the Bank’s sha ...

SLC STUDENT LOAN RECEIVABLES I INC

... comparable words. Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual results to differ from the projected results. Those risks and uncertainties include, among others, general economic and business conditions, regulatory initiatives and compliance ...

... comparable words. Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual results to differ from the projected results. Those risks and uncertainties include, among others, general economic and business conditions, regulatory initiatives and compliance ...

date - Rabobank

... Terms used herein shall be deemed to be defined as such for the purposes of the Conditions set forth in the Offering Circular (the ‘Offering Circular’) dated May 8, 2009 which constitutes a base prospectus for the purposes of the Prospectus Directive (Directive 2003/71/EC) (the ‘Prospectus Directive ...

... Terms used herein shall be deemed to be defined as such for the purposes of the Conditions set forth in the Offering Circular (the ‘Offering Circular’) dated May 8, 2009 which constitutes a base prospectus for the purposes of the Prospectus Directive (Directive 2003/71/EC) (the ‘Prospectus Directive ...

Investment and Investment Finance in Europe

... The importance of investment for economic growth has long been recognised. On the one hand, investment in a nation’s capital stock may contribute to increased productivity and hence stronger economic growth in the medium term. This holds true for both the formation of tangible fixed assets such as m ...

... The importance of investment for economic growth has long been recognised. On the one hand, investment in a nation’s capital stock may contribute to increased productivity and hence stronger economic growth in the medium term. This holds true for both the formation of tangible fixed assets such as m ...

Stock and Bond Market Liquidity: A Long-Run

... therefore adopt a flexible approach and study three maturity classes separately. We find that cross-market illiquidity spillover occurs along the whole yield curve (i.e., across maturities of all ranges). The effect is especially pronounced for illiquidity of short-term maturities, the most liquid a ...

... therefore adopt a flexible approach and study three maturity classes separately. We find that cross-market illiquidity spillover occurs along the whole yield curve (i.e., across maturities of all ranges). The effect is especially pronounced for illiquidity of short-term maturities, the most liquid a ...

Studies on the Validation of Internal Rating Systems

... “Basel II” or the “revised Framework”). When following the “internal ratings-based” (IRB) approach to Basel II, banking institutions will be allowed to use their own internal measures for key drivers of credit risk as primary inputs to their minimum regulatory capital calculation, subject to meeting ...

... “Basel II” or the “revised Framework”). When following the “internal ratings-based” (IRB) approach to Basel II, banking institutions will be allowed to use their own internal measures for key drivers of credit risk as primary inputs to their minimum regulatory capital calculation, subject to meeting ...