Working Paper No. 14 -Studies on the Validation of Internal Rating

... “Basel II” or the “revised Framework”). When following the “internal ratings-based” (IRB) approach to Basel II, banking institutions will be allowed to use their own internal measures for key drivers of credit risk as primary inputs to their minimum regulatory capital calculation, subject to meeting ...

... “Basel II” or the “revised Framework”). When following the “internal ratings-based” (IRB) approach to Basel II, banking institutions will be allowed to use their own internal measures for key drivers of credit risk as primary inputs to their minimum regulatory capital calculation, subject to meeting ...

- Franklin Templeton Investments

... jointly and primarily responsible for the day-to-day management of the Fund's portfolio. They have equal authority over all aspects of the Fund's investment portfolio, including but not limited to, purchases and sales of individual securities, portfolio risk assessment, and the management of daily c ...

... jointly and primarily responsible for the day-to-day management of the Fund's portfolio. They have equal authority over all aspects of the Fund's investment portfolio, including but not limited to, purchases and sales of individual securities, portfolio risk assessment, and the management of daily c ...

International Competitor Analysis and Benchmarking

... The background to the report is the ongoing debate on annuities policy and the view, which has been expressed in some quarters, that annuities represent poor value for money for consumers. This is in the context of trends which have significantly increased the cost of annuities. Given growth in the ...

... The background to the report is the ongoing debate on annuities policy and the view, which has been expressed in some quarters, that annuities represent poor value for money for consumers. This is in the context of trends which have significantly increased the cost of annuities. Given growth in the ...

The Swiss National Bank 1907 – 2007

... One hundred years have passed since the Swiss National Bank first opened its doors for business on 20 June 1907. In looking back over the SNB’s history, we are picking up the thread of the last three anniversary publications – those of 1932, 1957 and 1982. This time, however, we are not only prese ...

... One hundred years have passed since the Swiss National Bank first opened its doors for business on 20 June 1907. In looking back over the SNB’s history, we are picking up the thread of the last three anniversary publications – those of 1932, 1957 and 1982. This time, however, we are not only prese ...

A Cross-sectional Analysis Of Malaysian Unit Trust Fund Expense

... authors find that while there is a positive relation between fees and performance for high quality managers, a negative relation exists for low quality managers. Consistent with earlier studies, fund size and the number of funds within the management group are found to be negatively related to fund ...

... authors find that while there is a positive relation between fees and performance for high quality managers, a negative relation exists for low quality managers. Consistent with earlier studies, fund size and the number of funds within the management group are found to be negatively related to fund ...

International Bank for Reconstruction and Development

... fixed and variable terms, and in multiple currencies; though borrowers have generally preferred loans denominated in U.S dollars and euros. IBRD also supports its borrowers by providing access to risk management tools such as derivative instruments, including currency and interest rate swaps and int ...

... fixed and variable terms, and in multiple currencies; though borrowers have generally preferred loans denominated in U.S dollars and euros. IBRD also supports its borrowers by providing access to risk management tools such as derivative instruments, including currency and interest rate swaps and int ...

Subnational Capital Markets in Developing Countries

... This book examines institutional aspects of subnational capital markets and presents case studies of subnational borrowing, showing what has worked, what has not, and why. As decentralization continues and urbanization spreads, local authorities need to provide more services with fewer resources fro ...

... This book examines institutional aspects of subnational capital markets and presents case studies of subnational borrowing, showing what has worked, what has not, and why. As decentralization continues and urbanization spreads, local authorities need to provide more services with fewer resources fro ...

Seminar Paper No. 680 HOW SHOULD MONETARY POLICY BE by

... inferior way of maintaining price stability. Instead, forecast targeting, which is indeed already practiced by successful central banks, seems to be the best way of maintaining price stability.1 An era of price stability will not only bring low and stable in‡ation but also low and stable in‡ation ex ...

... inferior way of maintaining price stability. Instead, forecast targeting, which is indeed already practiced by successful central banks, seems to be the best way of maintaining price stability.1 An era of price stability will not only bring low and stable in‡ation but also low and stable in‡ation ex ...

Public-Sector Loans to Private-Sector Businesses

... development goals and lending program outcomes, if they have good information on how results are influenced by the types of loans they make and to which kinds of borrowers. Second, local program administrators may be able to increase substantially the funding available to pursue community developmen ...

... development goals and lending program outcomes, if they have good information on how results are influenced by the types of loans they make and to which kinds of borrowers. Second, local program administrators may be able to increase substantially the funding available to pursue community developmen ...

Statement of Investment Policy and Objectives

... Where Smartshares makes investment decisions for a fund, Smartshares will generally not vote in respect of the assets held by the fund. However, Smartshares may vote when it considers that not voting will have a material adverse effect on investors (taking into consideration the size of the managed ...

... Where Smartshares makes investment decisions for a fund, Smartshares will generally not vote in respect of the assets held by the fund. However, Smartshares may vote when it considers that not voting will have a material adverse effect on investors (taking into consideration the size of the managed ...

Federal Deposit Insurance Corporation Risk Management Manual of

... Maintaining public confidence in the integrity of the banking system is essential because customer deposits are a primary funding source, without which banks would be unable to meet fundamental objectives, such as providing financial services. The financial stability of an institution or the existen ...

... Maintaining public confidence in the integrity of the banking system is essential because customer deposits are a primary funding source, without which banks would be unable to meet fundamental objectives, such as providing financial services. The financial stability of an institution or the existen ...

WESTPAC BANKING CORP (Form: 6-K, Received

... management involves taking an integrated approach to risk and reward, and enables us to both increase financial growth opportunities and mitigate potential loss or damage. We adopt a Three Lines of Defence approach to risk management (see page 11) which reflects our culture of ‘risk is everyone’s bu ...

... management involves taking an integrated approach to risk and reward, and enables us to both increase financial growth opportunities and mitigate potential loss or damage. We adopt a Three Lines of Defence approach to risk management (see page 11) which reflects our culture of ‘risk is everyone’s bu ...

Does the Market Risk Premium (MRP) Change Over Time?

... Historical Vs Expected Return Going Forward When expected returns change over time historical averages can be a poor measure of the expected return going forward ...

... Historical Vs Expected Return Going Forward When expected returns change over time historical averages can be a poor measure of the expected return going forward ...

Enhancing Financial Stability and Resilience

... tools, such as countercyclical capital buffers, with flexible parameters that adjust either automatically or change in response to business cycle developments. A fixed approach uses tools, such as gross leverage ratios and core funding ratios, that are not adjusted during the course of the economic ...

... tools, such as countercyclical capital buffers, with flexible parameters that adjust either automatically or change in response to business cycle developments. A fixed approach uses tools, such as gross leverage ratios and core funding ratios, that are not adjusted during the course of the economic ...

ECB Unconventional Monetary Policy Actions: Market Impact

... yields, changes in risk measures and capital flows across countries in a panel model over the period May 2007 to September 2012, using daily data. Using daily data allows for a more precise identification of the effects of unconventional monetary policy on financial variables (Wright, Scotti and Rog ...

... yields, changes in risk measures and capital flows across countries in a panel model over the period May 2007 to September 2012, using daily data. Using daily data allows for a more precise identification of the effects of unconventional monetary policy on financial variables (Wright, Scotti and Rog ...

Prospectus 1 June 2016

... of issue of the Notes of such Tranche and will also be published on the website of the London Stock Exchange through a regulatory information service (the “RNS website”). In the case of Exempt Notes, notice of the aggregate nominal amount of Notes, interest (if any) payable in respect of Notes, the ...

... of issue of the Notes of such Tranche and will also be published on the website of the London Stock Exchange through a regulatory information service (the “RNS website”). In the case of Exempt Notes, notice of the aggregate nominal amount of Notes, interest (if any) payable in respect of Notes, the ...

FORM 20-F GRUPO FINANCIERO SANTANDER MÉXICO, S.A.B. de

... Exchange rates and translation into U.S. dollars. This annual report on Form 20-F contains translations of certain peso amounts into U.S. dollars at specified rates solely for your convenience. These translations should not be construed as representations by us that the peso amounts actually represe ...

... Exchange rates and translation into U.S. dollars. This annual report on Form 20-F contains translations of certain peso amounts into U.S. dollars at specified rates solely for your convenience. These translations should not be construed as representations by us that the peso amounts actually represe ...

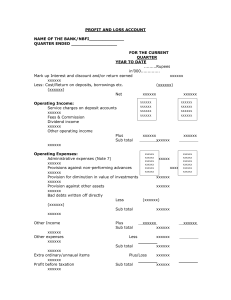

profit and loss account - State Bank of Pakistan

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

Hedge Funds and Systemic Risk

... Hedge funds are investment pools open to high-net-worth investors and institutions but not to the general public. In part because of this restriction, hedge funds have, until recently, been subject to reduced reporting and oversight regulations. They have also been reluctant to provide even general ...

... Hedge funds are investment pools open to high-net-worth investors and institutions but not to the general public. In part because of this restriction, hedge funds have, until recently, been subject to reduced reporting and oversight regulations. They have also been reluctant to provide even general ...

UNITED STATES SECURITIES AND EXCHANGE

... sources: B3, or (“’B3”, ex-BM&FBOVESPA); Brazilian Association of Credit Card Companies and Services (Associação Brasileira das Empresas de Cartão de Crédito e Serviços), or ("ABECS"); Brazilian Association of Leasing Companies (Associação Brasileira de Empresas de Leasing), or ("ABEL"); Brazilian A ...

... sources: B3, or (“’B3”, ex-BM&FBOVESPA); Brazilian Association of Credit Card Companies and Services (Associação Brasileira das Empresas de Cartão de Crédito e Serviços), or ("ABECS"); Brazilian Association of Leasing Companies (Associação Brasileira de Empresas de Leasing), or ("ABEL"); Brazilian A ...

Quid pro quo? What factors influence IPO allocations to

... A benign interpretation sees underpricing as an equilibrium phenomenon. Given the asymmetry of information about the valuation of companies, investment banks reward investors who reveal useful pricing information by making preferential allocations of underpriced shares to them (Benveniste and Spindt ...

... A benign interpretation sees underpricing as an equilibrium phenomenon. Given the asymmetry of information about the valuation of companies, investment banks reward investors who reveal useful pricing information by making preferential allocations of underpriced shares to them (Benveniste and Spindt ...

International Convergence of Capital Measures and Capital

... Undisclosed reserves..................................................................................14 ...

... Undisclosed reserves..................................................................................14 ...

Risk and Long-Run IPO Returns - Berkeley-Haas

... Loughran and Ritter (1995) draw their sample of 4,753 IPOs from the period 1970{1990, while the total sample of 4,622 IPOs in Brav, Geczy, and Gompers (2000) is from the 1975{1992 period. Moreover, these other studies do not restrict their samples to Nasdaq IPOs. The Nasdaq-only restriction excludes ...

... Loughran and Ritter (1995) draw their sample of 4,753 IPOs from the period 1970{1990, while the total sample of 4,622 IPOs in Brav, Geczy, and Gompers (2000) is from the 1975{1992 period. Moreover, these other studies do not restrict their samples to Nasdaq IPOs. The Nasdaq-only restriction excludes ...

NATIONAL WESTMINSTER BANK PLC /ENG/ (Form: 6-K

... agencies, creditors and other stakeholders of the credit strength of some of the RFB entities (including the Bank) or other RBS Group entities outside the RFB on a standalone basis and the ability of the RFB (of which the Group will be part) to meet funding and capital prudential requirements will b ...

... agencies, creditors and other stakeholders of the credit strength of some of the RFB entities (including the Bank) or other RBS Group entities outside the RFB on a standalone basis and the ability of the RFB (of which the Group will be part) to meet funding and capital prudential requirements will b ...

Structural Features of Australian Residential Mortgage

... accounts used to temporarily store payments made on these mortgages, constitute the majority of the assets of the RMBS trust. (A schematic description of the cash flows in an RMBS is provided in Figure 1 and the structural features shown there are discussed in detail throughout the rest of this arti ...

... accounts used to temporarily store payments made on these mortgages, constitute the majority of the assets of the RMBS trust. (A schematic description of the cash flows in an RMBS is provided in Figure 1 and the structural features shown there are discussed in detail throughout the rest of this arti ...