profit and loss account - State Bank of Pakistan

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

Study on the remuneration provisions applicable to credit institutions

... management. Deferral of variable pay, malus arrangements and a maximum ratio for the variable pay of risk-taking personnel are seen to be effective incentives even at this early stage. Competitive disadvantages with regard to attracting and retaining staff from unregulated sectors could not be verif ...

... management. Deferral of variable pay, malus arrangements and a maximum ratio for the variable pay of risk-taking personnel are seen to be effective incentives even at this early stage. Competitive disadvantages with regard to attracting and retaining staff from unregulated sectors could not be verif ...

Bermuda Monetary Authority (Collective Investment Scheme

... (3) A United Kingdom class scheme which is in existence at the commencement of these Regulations or is formed after the coming into force of the Regulations shall— (a) continue to be operated as such in accordance with the relevant regulations under the Act until such date as shall be specified by t ...

... (3) A United Kingdom class scheme which is in existence at the commencement of these Regulations or is formed after the coming into force of the Regulations shall— (a) continue to be operated as such in accordance with the relevant regulations under the Act until such date as shall be specified by t ...

Management Fee Evaluation

... Janus and Henderson to integrate their organizations. The Board also received information regarding the impact of the Transaction on each of INTECH, Perkins and Janus Singapore. In connection with the Board’s approval of New Advisory Agreements and New Sub-Advisory Agreements at its December 8, 201 ...

... Janus and Henderson to integrate their organizations. The Board also received information regarding the impact of the Transaction on each of INTECH, Perkins and Janus Singapore. In connection with the Board’s approval of New Advisory Agreements and New Sub-Advisory Agreements at its December 8, 201 ...

FAQs by Issuers

... A credit rating assesses these factors from a debt-holder's perspective, which is very different and sometimes opposite to an equity-holder's perspective. For instance, companies that raise far more equity than they need in an IPO and hence suffer a depressed return on equity (RoE) are likely to be ...

... A credit rating assesses these factors from a debt-holder's perspective, which is very different and sometimes opposite to an equity-holder's perspective. For instance, companies that raise far more equity than they need in an IPO and hence suffer a depressed return on equity (RoE) are likely to be ...

MSCI Equity Indexes February 2016 Index Review

... Without limiting any of the foregoing and to the maximum extent permitted by applicable law, in no event shall any Information Provider have any liability regarding any of the Information for any direct, indirect, special, punitive, consequential (including lost profits) or any other damages even if ...

... Without limiting any of the foregoing and to the maximum extent permitted by applicable law, in no event shall any Information Provider have any liability regarding any of the Information for any direct, indirect, special, punitive, consequential (including lost profits) or any other damages even if ...

Managed Futures: Portfolio Diversification Opportunities

... experience during a market retrenchment, are an inevitable part of any investment. However, because managed futures trading advisors can go long or short — and typically adhere to strict stop-loss limits — managed futures funds have historically limited their drawdowns more effectively than many oth ...

... experience during a market retrenchment, are an inevitable part of any investment. However, because managed futures trading advisors can go long or short — and typically adhere to strict stop-loss limits — managed futures funds have historically limited their drawdowns more effectively than many oth ...

News from CFA Sacramento

... acknowledged for reaching their 5, 10, 15, or 20 plus year membership anniversary in 2012 (See the last section for the names of members recognized). The CFASS board is especially grateful to these members who have helped build a solid foundation for our local society and who continue to reflect th ...

... acknowledged for reaching their 5, 10, 15, or 20 plus year membership anniversary in 2012 (See the last section for the names of members recognized). The CFASS board is especially grateful to these members who have helped build a solid foundation for our local society and who continue to reflect th ...

NBER WORKING PAPER SERIES INDIVIDUAL INVESTOR MUTUAL-FUND FLOWS Zoran Ivkovich Scott Weisbenner

... Individuals’ mutual fund share redemption decisions in both their taxable and tax-deferred accounts might also be sensitive to investment costs. The literature to date has not focused on these sensitivities at the individual-investor level. Rather, as in Barber, Odean, and Zheng (2005), analyses foc ...

... Individuals’ mutual fund share redemption decisions in both their taxable and tax-deferred accounts might also be sensitive to investment costs. The literature to date has not focused on these sensitivities at the individual-investor level. Rather, as in Barber, Odean, and Zheng (2005), analyses foc ...

Do Smooth Earnings Lower Investors` Perceptions of Investment Risk?

... argue that investors limit their attention to the earnings line item due to a number of factors. For example, the presence of a separate line item for earnings suggests that earnings are a ‘summary statistic’ for the various components of earnings. We expect that the presence of a separate line item ...

... argue that investors limit their attention to the earnings line item due to a number of factors. For example, the presence of a separate line item for earnings suggests that earnings are a ‘summary statistic’ for the various components of earnings. We expect that the presence of a separate line item ...

Investor Preferences and Demand for Active Management

... rank-dependent utility model of Quiggin (1983) and Yaari (1987) and cumulative prospect theory of Kahneman and Tversky (1991). ...

... rank-dependent utility model of Quiggin (1983) and Yaari (1987) and cumulative prospect theory of Kahneman and Tversky (1991). ...

Retirement Date Fund

... money is an important factor to consider. Typically, younger workers can handle a more aggressive investment strategy. Since they have time before they’ll need their money, they can often ride out the market’s ups and downs. Older workers, however, are closer to retirement and often need a more cons ...

... money is an important factor to consider. Typically, younger workers can handle a more aggressive investment strategy. Since they have time before they’ll need their money, they can often ride out the market’s ups and downs. Older workers, however, are closer to retirement and often need a more cons ...

In this Rule - ACT Legislation Register

... Betting Account Card means a card or such other like device as may be used by a person to access a Betting Account. Bet Types means the types of Bets offered by the Corporation as amended from time to time. Branch means any owned or leased premises of the Corporation, occupied by or on behalf of the ...

... Betting Account Card means a card or such other like device as may be used by a person to access a Betting Account. Bet Types means the types of Bets offered by the Corporation as amended from time to time. Branch means any owned or leased premises of the Corporation, occupied by or on behalf of the ...

417KB

... established to manage the business. In addition, with the aim of further enhancing our capability to capture and support projects in environmental, natural resources, water and new energy industries, which are expected to show high growth, the internal project team for these industries and Environme ...

... established to manage the business. In addition, with the aim of further enhancing our capability to capture and support projects in environmental, natural resources, water and new energy industries, which are expected to show high growth, the internal project team for these industries and Environme ...

Book CHI IPE 141 13628.indb

... sourced components from vendors around the globe and set up a production facility in China, he was not able to fill all of his crowdfunded orders until May 2013.2 Anticipating these types of problems (and worse), the JOBS Act stipulated that equity crowdfunding required rules be set by the Securitie ...

... sourced components from vendors around the globe and set up a production facility in China, he was not able to fill all of his crowdfunded orders until May 2013.2 Anticipating these types of problems (and worse), the JOBS Act stipulated that equity crowdfunding required rules be set by the Securitie ...

HSBC Jintrust Large Cap Equity Securities Investment Fund

... The Fund focuses on analysing large cap companies’ unique competitive advantages. The Fund Manager conducts a comprehensive value and growth analysis on the primarily selected stocks and further combines the research results with industry position analysis to select undervalued leading large-cap blu ...

... The Fund focuses on analysing large cap companies’ unique competitive advantages. The Fund Manager conducts a comprehensive value and growth analysis on the primarily selected stocks and further combines the research results with industry position analysis to select undervalued leading large-cap blu ...

The European Commission`s Push to Consolidate and Expand ISDS

... Transatlantic Trade and Investment Partnership (TTIP), for which no public text is available.1 For the other two agreements, a public text is available, although the agreements have not been signed or ratified. These are the proposed Canada-Europe Comprehensive Economic and Trade Agreement (CETA) 2 ...

... Transatlantic Trade and Investment Partnership (TTIP), for which no public text is available.1 For the other two agreements, a public text is available, although the agreements have not been signed or ratified. These are the proposed Canada-Europe Comprehensive Economic and Trade Agreement (CETA) 2 ...

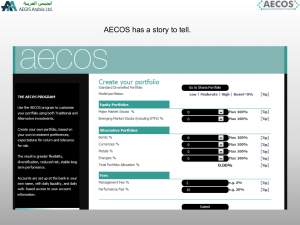

Portfolio Comparisons. - Artex Component System

... who ignore these rules can pay a dear price. We recommend viewers use the AECOS system to locate a suitable combination of sectors and leverage to meet their investment objectives. Results will vary for each ...

... who ignore these rules can pay a dear price. We recommend viewers use the AECOS system to locate a suitable combination of sectors and leverage to meet their investment objectives. Results will vary for each ...

Open Joint-Stock Company “ALFA-BANK” Alfa Diversified Payment

... or “blue sky” laws of any state of the United States or any other U.S., Russian, Luxembourg or other jurisdiction. Each Investor, by purchasing an Offered Note (or a beneficial interest therein), agrees that the Offered Notes (or beneficial interests therein) may be reoffered, resold, pledged or oth ...

... or “blue sky” laws of any state of the United States or any other U.S., Russian, Luxembourg or other jurisdiction. Each Investor, by purchasing an Offered Note (or a beneficial interest therein), agrees that the Offered Notes (or beneficial interests therein) may be reoffered, resold, pledged or oth ...

The Choice between Non-Callable and Callable Bonds

... In recent years, many observers note that the popularity of callable bonds is declining. For example, Kalotay (2008) and Banko and Zhou (2010) observe that the portion of callable bonds have been declining over the last 20 years and their popularity has shifted towards the below investment grade seg ...

... In recent years, many observers note that the popularity of callable bonds is declining. For example, Kalotay (2008) and Banko and Zhou (2010) observe that the portion of callable bonds have been declining over the last 20 years and their popularity has shifted towards the below investment grade seg ...

Read full article - Harvard International Law Journal

... investment treaties to directly sue states before international tribunals for violations of international law. There have now been hundreds of such lawsuits, with tribunals occasionally granting investors massive damage awards. In the process of resolving these disputes, tribunals announce and apply ...

... investment treaties to directly sue states before international tribunals for violations of international law. There have now been hundreds of such lawsuits, with tribunals occasionally granting investors massive damage awards. In the process of resolving these disputes, tribunals announce and apply ...

volatility as an asset class

... is influenced by both market volatility and the performance of the underlying asset and hence is not a plain investment strategy for volatility. » Delta neutral: The delta neutral strategy basically aims to separate the return generated by volatility from the influence of the underlying asset by inv ...

... is influenced by both market volatility and the performance of the underlying asset and hence is not a plain investment strategy for volatility. » Delta neutral: The delta neutral strategy basically aims to separate the return generated by volatility from the influence of the underlying asset by inv ...

Download paper (PDF)

... investors and general probability distributions (not necessarily the normal distribution). Next I elaborate on the economic intuition for my results. First, I find that, if the disclosure friction is sufficiently high, firms making more voluntary disclosures have a lower cost of capital. The rationa ...

... investors and general probability distributions (not necessarily the normal distribution). Next I elaborate on the economic intuition for my results. First, I find that, if the disclosure friction is sufficiently high, firms making more voluntary disclosures have a lower cost of capital. The rationa ...