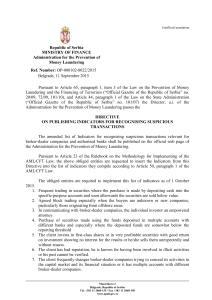

Broker-dealer Companies Indicators

... 16. Trading in securities for the benefit of offshore legal entities using custody bank services for maintaining shareowner’s accounts and settlement of transactions. 17. The client makes an unusual request to protect privacy especially concerning the information on its identity, business activity, ...

... 16. Trading in securities for the benefit of offshore legal entities using custody bank services for maintaining shareowner’s accounts and settlement of transactions. 17. The client makes an unusual request to protect privacy especially concerning the information on its identity, business activity, ...

Title in Arial bold Subhead in Arial

... – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

... – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

Weekly Economic Update - flight wealth management

... & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerl ...

... & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerl ...

Investment banks to face multi-billion pound CDS claims in

... risk associated with these complex claims against the large banks. Our direct banking experience and our focus on funding claims relating to financial markets, as well as our involvement with the US class action, give us a unique edge in pursuing this action” -EndsNotes for Editors: Credit default s ...

... risk associated with these complex claims against the large banks. Our direct banking experience and our focus on funding claims relating to financial markets, as well as our involvement with the US class action, give us a unique edge in pursuing this action” -EndsNotes for Editors: Credit default s ...

Hybrids: What you need to know

... The features should ensure that investors are aware of the risks associated with the hybrids market, most notably the credit, interest rate, liquidity and early redemption risks. In order to mitigate these risks as best they can, investors need to form an outlook on interest rates and ensure the iss ...

... The features should ensure that investors are aware of the risks associated with the hybrids market, most notably the credit, interest rate, liquidity and early redemption risks. In order to mitigate these risks as best they can, investors need to form an outlook on interest rates and ensure the iss ...

Canada`s international transactions in securities

... Canadian investment in foreign securities focuses on US instruments Canadian investors added $2.1 billion of foreign securities to their holdings in October, led by acquisitions of US corporate securities. Canadian acquisitions of foreign shares amounted to $1.7 billion and reflected a $3.2 billion ...

... Canadian investment in foreign securities focuses on US instruments Canadian investors added $2.1 billion of foreign securities to their holdings in October, led by acquisitions of US corporate securities. Canadian acquisitions of foreign shares amounted to $1.7 billion and reflected a $3.2 billion ...

US subprime credit crisis and its implications from a corporate

... The drop in M&A volumes has been accompanied by a sharp drop in activity in the debt and equity markets The unfavourable stock price levels globally motivate potential sellers to put off deals until market recovery The end of the credit boom and wild swings in the stock market have made M&A de ...

... The drop in M&A volumes has been accompanied by a sharp drop in activity in the debt and equity markets The unfavourable stock price levels globally motivate potential sellers to put off deals until market recovery The end of the credit boom and wild swings in the stock market have made M&A de ...

Chapter 22

... Accepting Banks Created by all four groups of banks money center banks regional banks Japanese banks Yankee banks ...

... Accepting Banks Created by all four groups of banks money center banks regional banks Japanese banks Yankee banks ...

Are you wondering why a company pulled your credit

... Multiple inquiries from the same company can happen when you are applying for credit. Here are a few examples: At loan origination – in order to determine the best loan product, rates, etc. After a Rapid Rescore® – in order to show the new credit score after trade lines have been revised or correcte ...

... Multiple inquiries from the same company can happen when you are applying for credit. Here are a few examples: At loan origination – in order to determine the best loan product, rates, etc. After a Rapid Rescore® – in order to show the new credit score after trade lines have been revised or correcte ...

VIT Multi-Strategy Alternatives Portfolio

... *All data as of June 30, 2016 unless noted otherwise. Assets Under Supervision (AUS) includes assets under management and other client assets for which Goldman Sachs does not have full discretion. A drawdown is the peak-to-trough decline during a specific recorded period of an investment. Goldman Sa ...

... *All data as of June 30, 2016 unless noted otherwise. Assets Under Supervision (AUS) includes assets under management and other client assets for which Goldman Sachs does not have full discretion. A drawdown is the peak-to-trough decline during a specific recorded period of an investment. Goldman Sa ...

Date of Submission: 17-11-2014 FIN 460 Section: 02 Submitted by

... equities/shares of some companies. So we went to ‘BLI Securities Ltd.’ which is a brokerage firm to open a Beneficiary Owners (BO) account to invest in companies. It is mandatory to open a BO account with a brokerage firm to be an investor. ‘BLI Securities Ltd.’ is a Full-Service Broker. They advise ...

... equities/shares of some companies. So we went to ‘BLI Securities Ltd.’ which is a brokerage firm to open a Beneficiary Owners (BO) account to invest in companies. It is mandatory to open a BO account with a brokerage firm to be an investor. ‘BLI Securities Ltd.’ is a Full-Service Broker. They advise ...

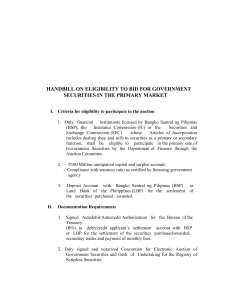

handbill on eligibility to bid for government securities in the primary

... UNIMPAIRED CAPITAL AND SURPLUS means the combined capital accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside fo ...

... UNIMPAIRED CAPITAL AND SURPLUS means the combined capital accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside fo ...

PART 1 - ADFIP

... - An unconditional promise to pay to the holder of the note a fixed amount (face value) at a fixed date (maturity date). Defined more fully in the Bills of Exchange act as: "an unconditional promise in writing by one person to another, signed by the maker, engaging to pay on demand or at a fixed or ...

... - An unconditional promise to pay to the holder of the note a fixed amount (face value) at a fixed date (maturity date). Defined more fully in the Bills of Exchange act as: "an unconditional promise in writing by one person to another, signed by the maker, engaging to pay on demand or at a fixed or ...

What Are Financial Intermediaries Paid For?

... did Treasuries or investment-grade bonds, with lower levels of risk. Return was measured by the expected return, and risk by the standard deviation of return. So junk bonds looked like a ‘‘dominant’’ security with respect to Treasuries: more return with less risk. The logical extension of that idea ...

... did Treasuries or investment-grade bonds, with lower levels of risk. Return was measured by the expected return, and risk by the standard deviation of return. So junk bonds looked like a ‘‘dominant’’ security with respect to Treasuries: more return with less risk. The logical extension of that idea ...

Disruption in the Capital Markets: What Happened? Joseph P. Forte

... investor; broadening the asset classes beyond residential; “educating” the new players; and testing new securitization structures. Initially a Wall Street investment bank business, which the money center banks quickly joined, it eventually attracted insurance companies and most other institutional i ...

... investor; broadening the asset classes beyond residential; “educating” the new players; and testing new securitization structures. Initially a Wall Street investment bank business, which the money center banks quickly joined, it eventually attracted insurance companies and most other institutional i ...

Chapter 5

... equity market, but less transparent • Interdealer market not competitive – large spreads and infrequent trading: Saunders, Srinivasan & Walter (2002) • Noisy prices: Hancock & Kwast (2001) • More noise in senior than subordinated issues: Bohn (1999) • In addition to credit spreads, bond yields inclu ...

... equity market, but less transparent • Interdealer market not competitive – large spreads and infrequent trading: Saunders, Srinivasan & Walter (2002) • Noisy prices: Hancock & Kwast (2001) • More noise in senior than subordinated issues: Bohn (1999) • In addition to credit spreads, bond yields inclu ...

The Subprime Crisis And The Yin and Yang of Financial

... increasingly large pipelines of these exposures, without adequately considering or managing their pipeline risks Originators that do not have contractual obligations still provided voluntary support to off-balance sheet financing vehicles, such as SIVs and ABCP’s ...

... increasingly large pipelines of these exposures, without adequately considering or managing their pipeline risks Originators that do not have contractual obligations still provided voluntary support to off-balance sheet financing vehicles, such as SIVs and ABCP’s ...

The International Spillover effects of pension finance in an EMU

... capturing the fraction of stocks held by the buyand-hold investor, η(t), and the “exchange rate” between the consumption of both investors, λ(t) ...

... capturing the fraction of stocks held by the buyand-hold investor, η(t), and the “exchange rate” between the consumption of both investors, λ(t) ...

R3160 - East Lynne 40 School District

... repurchase agreements. In order to anticipate market changes and provide a level of security for all funds, the market value (including accrued interest) of the collateral should be at least 100%. For certificates of deposit, the market value of collateral must be at least 100% or greater of the amo ...

... repurchase agreements. In order to anticipate market changes and provide a level of security for all funds, the market value (including accrued interest) of the collateral should be at least 100%. For certificates of deposit, the market value of collateral must be at least 100% or greater of the amo ...

Private Debt Financing

... borrower will default or have trouble making the payments? What is the risk profile of the borrower? Structuring/Underwriting: What is the duration and length of the loan? How does the debt fit within the capital stack? Does the investor have covenants on the loan? Priority of payments vs other capi ...

... borrower will default or have trouble making the payments? What is the risk profile of the borrower? Structuring/Underwriting: What is the duration and length of the loan? How does the debt fit within the capital stack? Does the investor have covenants on the loan? Priority of payments vs other capi ...

No Slide Title

... • Contracts to exchange something at an agreed time in the future at a price agreed upon today – Swaps • Contracts between two counterparties to exchange cash flows on a notional principal amount at regular intervals during a stated period – OTC options • Contracts that give the buyer, in exchange f ...

... • Contracts to exchange something at an agreed time in the future at a price agreed upon today – Swaps • Contracts between two counterparties to exchange cash flows on a notional principal amount at regular intervals during a stated period – OTC options • Contracts that give the buyer, in exchange f ...

With new “Vaccine Bonds” Japanese Investors will have the

... • In addition to the purchase price of a financial instrument, our company will collect a trading commission* for each transaction as agreed beforehand with you. Since commissions may be included in the purchase price or may not be charged for certain transactions, we recommend that you confirm the ...

... • In addition to the purchase price of a financial instrument, our company will collect a trading commission* for each transaction as agreed beforehand with you. Since commissions may be included in the purchase price or may not be charged for certain transactions, we recommend that you confirm the ...

Form 4 Statement of Changes in Beneficial Ownership of Securities

... (1) This Form 4 is filed by Elliott Associates, L.P. (the "Reporting Person"). The Reporting Person may be deemed to be a member of a Section 13(d) group that collectively beneficially owns more than 10% of the Issuer's outstanding shares of Common Stock. The Reporting Person disclaims beneficial ow ...

... (1) This Form 4 is filed by Elliott Associates, L.P. (the "Reporting Person"). The Reporting Person may be deemed to be a member of a Section 13(d) group that collectively beneficially owns more than 10% of the Issuer's outstanding shares of Common Stock. The Reporting Person disclaims beneficial ow ...

3. Define financial Meaning of Investment

... Hybrid securities, often referred to as "hybrids" generally combine both debt and equity characteristics. The most common type of hybrid security is a convertible bond that has features of an ordinary bond but is heavily influenced by the price movements of the stock into which it is convertible. ...

... Hybrid securities, often referred to as "hybrids" generally combine both debt and equity characteristics. The most common type of hybrid security is a convertible bond that has features of an ordinary bond but is heavily influenced by the price movements of the stock into which it is convertible. ...