Banking and FIs 10

... trade for the bank Joe trades 3-year bonds which have a delta of $250 ie if Joe owns $1m bonds and interest rates rise by 1 basis point (or o.o1%) Joe will lose ~$250 on a market valuation Joe’s Risk Management team tells him based on their VAR models the 3-year bond is assumed to move a maximum ...

... trade for the bank Joe trades 3-year bonds which have a delta of $250 ie if Joe owns $1m bonds and interest rates rise by 1 basis point (or o.o1%) Joe will lose ~$250 on a market valuation Joe’s Risk Management team tells him based on their VAR models the 3-year bond is assumed to move a maximum ...

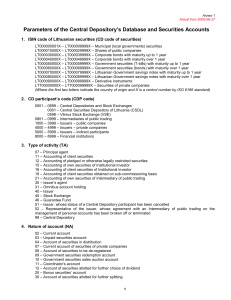

1. ISIN code of Lithuanian securities (CD code of securities)

... 015 – Stock exchange securities transactions with a postponed settlement day (T+x) 016 – Public sale of a block of state-owned shares 017 – Public sale of a block of non-state-owned shares 018 – Execution of a voluntary tender offer carrying settlement in cash 019 – Execution of a competitive tender ...

... 015 – Stock exchange securities transactions with a postponed settlement day (T+x) 016 – Public sale of a block of state-owned shares 017 – Public sale of a block of non-state-owned shares 018 – Execution of a voluntary tender offer carrying settlement in cash 019 – Execution of a competitive tender ...

Formosa Bonds

... Also known as international bonds in Taiwan. Some investors use a narrower definition that refers only to international bonds listed in Taipei and denominated in Chinese yuan. All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, intere ...

... Also known as international bonds in Taiwan. Some investors use a narrower definition that refers only to international bonds listed in Taipei and denominated in Chinese yuan. All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, intere ...

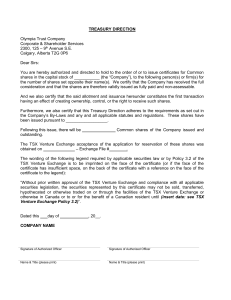

treasury direction - Olympia Trust Company

... You are hereby authorized and directed to hold to the order of or to issue certificates for Common shares in the capital stock of ___________ (the “Company”), to the following person(s) or firm(s) for the number of shares set opposite their name(s). We certify that the Company has received the full ...

... You are hereby authorized and directed to hold to the order of or to issue certificates for Common shares in the capital stock of ___________ (the “Company”), to the following person(s) or firm(s) for the number of shares set opposite their name(s). We certify that the Company has received the full ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requir ...

... *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requir ...

New Issue of Securities (Chapter 6 of Listing Requirements): Fund

... 22,243,000 new ordinary shares of RM0.10 each in Cuscapi to be issued pursuant to the Proposed Private Placement, on the ACE Market of Bursa Securities, subject to the following conditions:(i) Cuscapi and KIBB must fully comply with the relevant provisions under Bursa Securities ACE Market Listing R ...

... 22,243,000 new ordinary shares of RM0.10 each in Cuscapi to be issued pursuant to the Proposed Private Placement, on the ACE Market of Bursa Securities, subject to the following conditions:(i) Cuscapi and KIBB must fully comply with the relevant provisions under Bursa Securities ACE Market Listing R ...

united states securities and exchange commission - corporate

... subsidiaries of the Company, upsized and priced their private offering of $375.0 million aggregate principal amount of 8.125% senior unsecured notes due 2025 (the “Notes”) to be co-issued by the Issuers and initially guaranteed only by the Company on a senior unsecured basis. The offering was upsize ...

... subsidiaries of the Company, upsized and priced their private offering of $375.0 million aggregate principal amount of 8.125% senior unsecured notes due 2025 (the “Notes”) to be co-issued by the Issuers and initially guaranteed only by the Company on a senior unsecured basis. The offering was upsize ...

semester v cm05bba05 – investment management

... d. None of the above 76. …………….. is an organized market for trading securities a. Stock exchange b. Primary market c. New issue market d. None of the above 77. Carry over the transactions /settlement of share purchase to the next day is called ………………. a. Badla b. Call c. Spot delivery d. Hand delive ...

... d. None of the above 76. …………….. is an organized market for trading securities a. Stock exchange b. Primary market c. New issue market d. None of the above 77. Carry over the transactions /settlement of share purchase to the next day is called ………………. a. Badla b. Call c. Spot delivery d. Hand delive ...

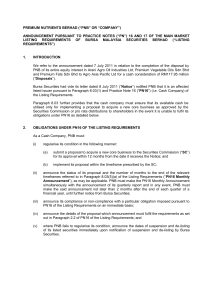

PREMIUM NUTRIENTS BERHAD (“PNB” OR “COMPANY

... Announcement”), as may be applicable. PNB must make the PN16 Monthly Announcement simultaneously with the announcement of its quarterly report and in any event, PNB must make the said announcement not later than 2 months after the end of each quarter of a financial year, until further notice from Bu ...

... Announcement”), as may be applicable. PNB must make the PN16 Monthly Announcement simultaneously with the announcement of its quarterly report and in any event, PNB must make the said announcement not later than 2 months after the end of each quarter of a financial year, until further notice from Bu ...

lecture-notes-2-1

... corporate bonds and mortgages. They also purchase stocks, but are restricted in the amount that they can hold. They are among the largest of the contractual savings institutions ...

... corporate bonds and mortgages. They also purchase stocks, but are restricted in the amount that they can hold. They are among the largest of the contractual savings institutions ...

Certain statements in the below referenced discussion

... (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), and/or the Private Securities Litigation Reform Act of 1995 (the “PSLRA”), as may be amended from time to time. Statements contained in such discussion that are not historical facts, including statements ...

... (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), and/or the Private Securities Litigation Reform Act of 1995 (the “PSLRA”), as may be amended from time to time. Statements contained in such discussion that are not historical facts, including statements ...

Funds that seek to make money in rising and falling markets

... SEC regulations limit hedge funds to 99 investors, and at least 65 of them must be accredited ($1 million net worth). Therefore, hedge funds were out of reach for average investors. Now though, mutual funds companies have registered hedge funds that invest in unregistered, private hedge funds. These ...

... SEC regulations limit hedge funds to 99 investors, and at least 65 of them must be accredited ($1 million net worth). Therefore, hedge funds were out of reach for average investors. Now though, mutual funds companies have registered hedge funds that invest in unregistered, private hedge funds. These ...

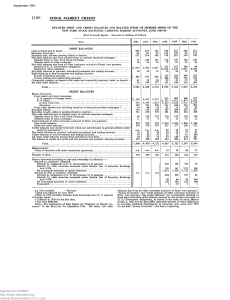

Detailed Debit and Credit Balances and Related Items of Member

... Credit balances of other customers exclusive of firms' own partners: Free credit balances Other net credit balances Credit balances and money borrowed which are subordinated to general creditors under approved agreements 2 Net credit balances in partners' individual investment and trading accounts C ...

... Credit balances of other customers exclusive of firms' own partners: Free credit balances Other net credit balances Credit balances and money borrowed which are subordinated to general creditors under approved agreements 2 Net credit balances in partners' individual investment and trading accounts C ...

Who Holds Municipal Bonds?

... discussion from Nov. 13, 2013, that mentioned $166 billion. That figure included data for 116 hedge funds in North America. Other fixed income could be mixed into that number. On the other hand, certain large debtfocused hedge funds were excluded from the count. These investments have likely grown s ...

... discussion from Nov. 13, 2013, that mentioned $166 billion. That figure included data for 116 hedge funds in North America. Other fixed income could be mixed into that number. On the other hand, certain large debtfocused hedge funds were excluded from the count. These investments have likely grown s ...

Investment Securities Internal Control Questionnaire

... broker/dealer’s confirmation (12 CFR 12.5)? If not, does the bank use one of the alternate procedures described in 12 CFR 12.5? 54. Unless specifically exempted by regulation, does the bank have established written policies and procedures ensuring: a. That bank officers and employees who make invest ...

... broker/dealer’s confirmation (12 CFR 12.5)? If not, does the bank use one of the alternate procedures described in 12 CFR 12.5? 54. Unless specifically exempted by regulation, does the bank have established written policies and procedures ensuring: a. That bank officers and employees who make invest ...

Far Horizon Investments - Penn State Smeal College of Business

... could stand to lose a large sum. Since FHI would make this bet many times on many different countries, as long as the occurrence of defaults is not very positively correlated, the distribution of returns should be approximately normal. The nature of FHI’s investments is also, for the most part, fair ...

... could stand to lose a large sum. Since FHI would make this bet many times on many different countries, as long as the occurrence of defaults is not very positively correlated, the distribution of returns should be approximately normal. The nature of FHI’s investments is also, for the most part, fair ...

Comments on “Risk Allocation, Debt Fueled Expansion and Financial Crisis,” Beaudry

... Asymmetric Information and Adverse Selection Some years ago, many MBS where rated AAA –with minimal risk of default. Buyers did not worry about the quality of the exact composition of assets of the bundle, because the stream of payments was (perceived) as safe. House prices decline, the owners of M ...

... Asymmetric Information and Adverse Selection Some years ago, many MBS where rated AAA –with minimal risk of default. Buyers did not worry about the quality of the exact composition of assets of the bundle, because the stream of payments was (perceived) as safe. House prices decline, the owners of M ...

Entry into the First Ever Pure-play Online Securities Business in

... SBI Thai Online Securities, which is owned 55% by the SBI Group and 45% by Finansia Syrus Securities, will provide securities services such as stock trading and derivatives trading over the Internet to local investors including Japanese living in Thailand. While securities trading services are alrea ...

... SBI Thai Online Securities, which is owned 55% by the SBI Group and 45% by Finansia Syrus Securities, will provide securities services such as stock trading and derivatives trading over the Internet to local investors including Japanese living in Thailand. While securities trading services are alrea ...

ice clear credit llc exhibit h: portfolio approach to cds margining and

... corresponding index-derived positions in such a way that the Risky PV01 (the present value of 1 (one) basis point of risky annuity paid or received, until the earlier of a credit event, or the maturity of the CDS contract) remains constant after change of notional. Once the opposite positions have t ...

... corresponding index-derived positions in such a way that the Risky PV01 (the present value of 1 (one) basis point of risky annuity paid or received, until the earlier of a credit event, or the maturity of the CDS contract) remains constant after change of notional. Once the opposite positions have t ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... [X] Rule 13d-1(b) [ ] Rule 13d-1(c) [ ] Rule 13d-1(d) *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures ...

... [X] Rule 13d-1(b) [ ] Rule 13d-1(c) [ ] Rule 13d-1(d) *The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures ...

2012 News - GoldQuest Corporation

... from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and act ...

... from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and act ...

Chapter 19 -- The Capital Market

... The issuing company selects an investment banking firm and works directly with the firm to determine the essential features of the issue. Together they discuss and negotiate a price for the security and the timing of the issue. Depending on the size of the issue, the investment banker may invite oth ...

... The issuing company selects an investment banking firm and works directly with the firm to determine the essential features of the issue. Together they discuss and negotiate a price for the security and the timing of the issue. Depending on the size of the issue, the investment banker may invite oth ...

Triple-A Failure

... The loans in Subprime XYZ were issued in early spring 2006 — what would turn out to be the peak of the boom. They were originated by a West Coast company that Moody’s identified as a “nonbank lender.” Traditionally, people have gotten their mortgages from banks, but in recent years, new types of le ...

... The loans in Subprime XYZ were issued in early spring 2006 — what would turn out to be the peak of the boom. They were originated by a West Coast company that Moody’s identified as a “nonbank lender.” Traditionally, people have gotten their mortgages from banks, but in recent years, new types of le ...

Chapter 15 PowerPoint Presentation

... 1. Debt and equity securities not classified as trading or held-to-maturity 2. Not actively managed 3. Report as: a) Short-term investments if the intent is to sell the securities within one year or the normal operating cycle, whichever is longer. b) Long-term investments if securities do not meet s ...

... 1. Debt and equity securities not classified as trading or held-to-maturity 2. Not actively managed 3. Report as: a) Short-term investments if the intent is to sell the securities within one year or the normal operating cycle, whichever is longer. b) Long-term investments if securities do not meet s ...

1. Application for quotation of added securities

... section 724 or section 1016E of the Act does not apply to any applications received by the listee in relation to any securities to be quoted and that no one has any right to return any securities to be quoted under sections 737, 738 or 1016F of the Act at the time that of this request that the secur ...

... section 724 or section 1016E of the Act does not apply to any applications received by the listee in relation to any securities to be quoted and that no one has any right to return any securities to be quoted under sections 737, 738 or 1016F of the Act at the time that of this request that the secur ...