Managing a Matching Adjustment Portfolio

... of good risk management”. This clarification is still subject to interpretation. Clearly, selling assets to rebalance a portfolio back to adequate levels of matching, or back to within a targeted credit rating mix, could be considered ‘good risk management’. But what about more proactive risk manage ...

... of good risk management”. This clarification is still subject to interpretation. Clearly, selling assets to rebalance a portfolio back to adequate levels of matching, or back to within a targeted credit rating mix, could be considered ‘good risk management’. But what about more proactive risk manage ...

Hindalco EGM Notice - 2015

... investors, Indian and/or multilateral financial institutions, mutual funds, insurance companies, non-resident Indians, stabilizing agents, pension funds and/or any other categories of investors, whether they be holders of equity shares of the Company or not (collectively called the “Investors”) as m ...

... investors, Indian and/or multilateral financial institutions, mutual funds, insurance companies, non-resident Indians, stabilizing agents, pension funds and/or any other categories of investors, whether they be holders of equity shares of the Company or not (collectively called the “Investors”) as m ...

Aluvion Professional Corporation - Notice This sample Term Sheet

... purposes only and does not constitute advertising, a solicitation, or legal advice. Neither the transmission of this sample Term Sheet nor the transmission of any information contained in this website is intended to create, and receipt hereof or thereof does not constitute formation of, a lawyer-cli ...

... purposes only and does not constitute advertising, a solicitation, or legal advice. Neither the transmission of this sample Term Sheet nor the transmission of any information contained in this website is intended to create, and receipt hereof or thereof does not constitute formation of, a lawyer-cli ...

Insights into Evaluating Exchange Traded Funds

... implemented through the purchase of total return swaps (there are fund structures in Hong Kong using notes to obtain index performance) where the provider enters into an agreement with one or more investment banks or counterparties.3 The counterparty agrees to deliver the return of the underlying in ...

... implemented through the purchase of total return swaps (there are fund structures in Hong Kong using notes to obtain index performance) where the provider enters into an agreement with one or more investment banks or counterparties.3 The counterparty agrees to deliver the return of the underlying in ...

Government National Mortgage Association

... Determination of HECM MBS Rate; Calculation of Interest Each Security will accrue interest at the HECM MBS Rate set forth on the cover of this prospectus supplement for the initial Distribution Date, but will adjust as described herein. The HECM MBS Rate is generally equal to the weighted average o ...

... Determination of HECM MBS Rate; Calculation of Interest Each Security will accrue interest at the HECM MBS Rate set forth on the cover of this prospectus supplement for the initial Distribution Date, but will adjust as described herein. The HECM MBS Rate is generally equal to the weighted average o ...

PRESS RELEASE UniCredit Board approves rights issue terms and

... associated companies, or for any loss arising from any use of this announcement or its contents or in connection therewith. They will not regard any other person as their respective clients in relation to the rights issue and will not be responsible to anyone other than UniCredit for providing the p ...

... associated companies, or for any loss arising from any use of this announcement or its contents or in connection therewith. They will not regard any other person as their respective clients in relation to the rights issue and will not be responsible to anyone other than UniCredit for providing the p ...

Document

... include the following: 1. Current generally accepted accounting principles are a hybrid of varying measurement methods that often conflict with each other. (continued) ...

... include the following: 1. Current generally accepted accounting principles are a hybrid of varying measurement methods that often conflict with each other. (continued) ...

Securities Trading Policy

... institutional investors and journalists. It is important that all Restricted Persons be aware that selective disclosure of non-public information may result in a breach of the insider trading rules. It is important to emphasise that it is the mere fact of conveyance of the material nonpublic informa ...

... institutional investors and journalists. It is important that all Restricted Persons be aware that selective disclosure of non-public information may result in a breach of the insider trading rules. It is important to emphasise that it is the mere fact of conveyance of the material nonpublic informa ...

URL Address

... orders, customers, risks, and market situations on a daily basis. The fast-changing nature of the financial markets necessitates high speed data processing. The accuracy of data is crucial in order to avoid losses and to manage risk, as securities brokerage business deals with thousands of millions ...

... orders, customers, risks, and market situations on a daily basis. The fast-changing nature of the financial markets necessitates high speed data processing. The accuracy of data is crucial in order to avoid losses and to manage risk, as securities brokerage business deals with thousands of millions ...

AP8200-investment

... persons of prudence, discretion and intelligence exercise in the management of their own affairs, not for speculation, but for investment, considering the probable safety of their capital as well as the probable income to the derived. The standard of prudence to be used by investment officials shall ...

... persons of prudence, discretion and intelligence exercise in the management of their own affairs, not for speculation, but for investment, considering the probable safety of their capital as well as the probable income to the derived. The standard of prudence to be used by investment officials shall ...

FORM 4

... and each of them individually, his true and lawful attorney-in-fact to: (1) execute for and on behalf of the undersigned, in the undersigned's capacity as an officer, director and/or 10% or greater stockholder of REVA Medical, Inc. (the "Company"), any and all Form 3, 4 and 5 reports required to be ...

... and each of them individually, his true and lawful attorney-in-fact to: (1) execute for and on behalf of the undersigned, in the undersigned's capacity as an officer, director and/or 10% or greater stockholder of REVA Medical, Inc. (the "Company"), any and all Form 3, 4 and 5 reports required to be ...

CHAPTER 12

... We use the equity method when the investor owns less than 51% of the voting shares, and therefore can’t control the investee, but can exercise “significant influence” over the operating and financial policies of an investee. It should be presumed, in the absence of evidence to the contrary, that the ...

... We use the equity method when the investor owns less than 51% of the voting shares, and therefore can’t control the investee, but can exercise “significant influence” over the operating and financial policies of an investee. It should be presumed, in the absence of evidence to the contrary, that the ...

What are commercial mortgage-backed securities?

... is conducted to project bond and transaction cash flows under base, favorable and stress scenarios. Each CMBS class is assigned a fundamental rating. These ratings are communicated across the broader IFI team. Performance of collateral pools is monitored and ratings changes are broadcast to the team ...

... is conducted to project bond and transaction cash flows under base, favorable and stress scenarios. Each CMBS class is assigned a fundamental rating. These ratings are communicated across the broader IFI team. Performance of collateral pools is monitored and ratings changes are broadcast to the team ...

Clearing house of the year

... That cost of capital is passed through to clients on their own portfolios, incentivising them to compress as well. Compression could also be key in allowing non-banks, which do not clear for themselves and are reliant on the limits provided by clearing members, to make markets in cleared OTC derivat ...

... That cost of capital is passed through to clients on their own portfolios, incentivising them to compress as well. Compression could also be key in allowing non-banks, which do not clear for themselves and are reliant on the limits provided by clearing members, to make markets in cleared OTC derivat ...

Available-for-Sale Securities

... from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions. Because trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. ...

... from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions. Because trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. ...

This press release and any information contained herein shall not

... an accelerated bookbuilt offering. The transaction will be settled upon delivery of shares and payment of consideration on April 9, 2013. Gross proceeds from the placement amounted to € 185.2 million, resulting in a capital gain of approximately € 143 million, which translates into an increase in th ...

... an accelerated bookbuilt offering. The transaction will be settled upon delivery of shares and payment of consideration on April 9, 2013. Gross proceeds from the placement amounted to € 185.2 million, resulting in a capital gain of approximately € 143 million, which translates into an increase in th ...

The Securities Market in Vietnam

... Bonds. An issuer of bonds must have paid-up capital of at least VND10 billion at the time of registration of the PO, must have made a profit in the year prior to the PO, must not have accumulated losses as at the year of registration of the offer and must not have more than 100 overdue debts payable ...

... Bonds. An issuer of bonds must have paid-up capital of at least VND10 billion at the time of registration of the PO, must have made a profit in the year prior to the PO, must not have accumulated losses as at the year of registration of the offer and must not have more than 100 overdue debts payable ...

Lecture 1 - Department of Systems Engineering and Engineering

... item. The underlying asset of the future contract does not appear on the FI’s balance sheet when the contract commences. The asset will only be part of the balance sheet when the asset delivery is really occurred. ...

... item. The underlying asset of the future contract does not appear on the FI’s balance sheet when the contract commences. The asset will only be part of the balance sheet when the asset delivery is really occurred. ...

Rating Funding Agreement-Backed Securities Programs

... the illiquid GIC/FA products, allowing companies to diversify funding sources and reduce their overall cost of funds. Also, the notes offer investors access to highquality issuers at a level higher up in the capital structure than senior bondholders, with attractive relative spreads. In broad terms, ...

... the illiquid GIC/FA products, allowing companies to diversify funding sources and reduce their overall cost of funds. Also, the notes offer investors access to highquality issuers at a level higher up in the capital structure than senior bondholders, with attractive relative spreads. In broad terms, ...

The Alternatives to Registration Chart has been created to fit on

... over $5,000,000 total assets or owned solely by accredited investors. For the net worth test, an investor’s net worth must be decreased by the amount of any debt secured by the principal residence incurred within 60 days prior to the date on which the investment is made, unless the debt was incurred ...

... over $5,000,000 total assets or owned solely by accredited investors. For the net worth test, an investor’s net worth must be decreased by the amount of any debt secured by the principal residence incurred within 60 days prior to the date on which the investment is made, unless the debt was incurred ...

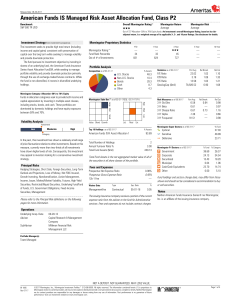

American Funds IS Managed Risk Asset Allocation Fund

... or endorsed by, any bank and is not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other U.S. governmental agency. Growth Investing Growth securities may be subject to increased volatility as the value of these securities is highly sensitive to market fluctua ...

... or endorsed by, any bank and is not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other U.S. governmental agency. Growth Investing Growth securities may be subject to increased volatility as the value of these securities is highly sensitive to market fluctua ...

a diversified portfolio of alternative strategies

... fees and expenses carefully before investing. This and other important information can be found in the Fund’s prospectus, and if available summary prospectus, which you can obtain by calling 877.628.2583. Please read the prospectus, and if available the summary prospectus, carefully before making an ...

... fees and expenses carefully before investing. This and other important information can be found in the Fund’s prospectus, and if available summary prospectus, which you can obtain by calling 877.628.2583. Please read the prospectus, and if available the summary prospectus, carefully before making an ...

this instrument and any securities issuable pursuant hereto have not

... termination of such service provider’s employment or services; or (ii) repurchases of Capital Stock in connection with the settlement of disputes with any stockholder. “Dissolution Event” means (i) a voluntary termination of operations, (ii) a general assignment for the benefit of the Company’s cred ...

... termination of such service provider’s employment or services; or (ii) repurchases of Capital Stock in connection with the settlement of disputes with any stockholder. “Dissolution Event” means (i) a voluntary termination of operations, (ii) a general assignment for the benefit of the Company’s cred ...

What Happens to Bondholders When a Company Files for Bankruptcy

... are held in your name, then you should receive information directly from the company. Investors should also contact their brokers or investment advisor if they do not receive any information from the company. Investors may be asked to vote on a company's reorganization plan. Before you do, you shou ...

... are held in your name, then you should receive information directly from the company. Investors should also contact their brokers or investment advisor if they do not receive any information from the company. Investors may be asked to vote on a company's reorganization plan. Before you do, you shou ...

Credit Product Conventions - The Australian Financial Markets

... All AFMA Financial Markets Members and Partner Members1 are expected to observe the Code and operate with integrity, professionalism and competence. The Code is designed to support behaviors that put the interests of clients, the firm and the wider community ahead of personal or individual interests ...

... All AFMA Financial Markets Members and Partner Members1 are expected to observe the Code and operate with integrity, professionalism and competence. The Code is designed to support behaviors that put the interests of clients, the firm and the wider community ahead of personal or individual interests ...