Bancroft - NYU School of Law

... o May not issue a public sales campaign prior to the filing of the registration statement. (ie publicity may have effect of conditioning market – this is an “offer”). o Example 1: Underwriter arranging mining public financing distributes brochure describing in “glowing generalities” the future possi ...

... o May not issue a public sales campaign prior to the filing of the registration statement. (ie publicity may have effect of conditioning market – this is an “offer”). o Example 1: Underwriter arranging mining public financing distributes brochure describing in “glowing generalities” the future possi ...

Notice of the Ministry of Labor and Social Security and China

... minimum limitation of clearing reserve as checked and ratified by the China Clearing Corporation. Article 19 The securities transactions on enterprise annuity fund shall be carried out through special transaction seats. After the market is closed in each transaction day (T day), the China Clearing C ...

... minimum limitation of clearing reserve as checked and ratified by the China Clearing Corporation. Article 19 The securities transactions on enterprise annuity fund shall be carried out through special transaction seats. After the market is closed in each transaction day (T day), the China Clearing C ...

CHAPTER 11

... making a net investment. A trivial example of an arbitrage opportunity would arise if shares of a stock sold for different prices on two different exchanges. ...

... making a net investment. A trivial example of an arbitrage opportunity would arise if shares of a stock sold for different prices on two different exchanges. ...

Supervision of Credit Rating Agencies: The Role of Credit Rating

... important reason for this was the official status that the big three CRAs received, mostly through the American Government. Starting from 1975, the big three CRAs received the status of Nationally Recognized Statistical Rating Organization (NRSRO) in the United States. The granting of the NRSRO stat ...

... important reason for this was the official status that the big three CRAs received, mostly through the American Government. Starting from 1975, the big three CRAs received the status of Nationally Recognized Statistical Rating Organization (NRSRO) in the United States. The granting of the NRSRO stat ...

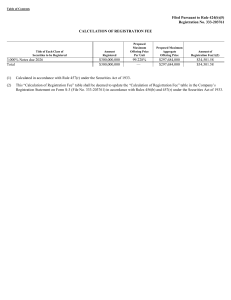

SOUTHWEST AIRLINES CO

... entitled to share ratably with the holders of the notes in any proceeds distributed upon our insolvency, liquidation, reorganization, dissolution, or other winding up. This may have the effect of reducing the amount of proceeds paid to you. If there are not sufficient assets remaining to pay all of ...

... entitled to share ratably with the holders of the notes in any proceeds distributed upon our insolvency, liquidation, reorganization, dissolution, or other winding up. This may have the effect of reducing the amount of proceeds paid to you. If there are not sufficient assets remaining to pay all of ...

Introduction to Portfolio Selection and Capital Market Theory: Static Analysis BaoheWang

... with random variable returns ( X1 , X M ) is said to span the space of portfolios contained in the set if and only if for any portfolio in with return denoted by Z p M there exist numbers (1 , M ) , 1 i 1 such that Z p 1M j X j ...

... with random variable returns ( X1 , X M ) is said to span the space of portfolios contained in the set if and only if for any portfolio in with return denoted by Z p M there exist numbers (1 , M ) , 1 i 1 such that Z p 1M j X j ...

Download Dissertation

... How should the option trader use her partially misspecified model? This paper proposes an estimation method (referred to as “robust parametric method” in this paper) and the resulting estimator has the following properties: (i) robustness – the estimator is consistent and the estimation error is at ...

... How should the option trader use her partially misspecified model? This paper proposes an estimation method (referred to as “robust parametric method” in this paper) and the resulting estimator has the following properties: (i) robustness – the estimator is consistent and the estimation error is at ...

forward contract

... The manager believes interest rates will rise, causing the each bond price to fall. The manager can: 1. Sell bonds and hold cash till the threat of rising interest rates pass, or until the change in rates has occurred, and then repurchase the bonds 2. Sell long term bonds and replace with shorter te ...

... The manager believes interest rates will rise, causing the each bond price to fall. The manager can: 1. Sell bonds and hold cash till the threat of rising interest rates pass, or until the change in rates has occurred, and then repurchase the bonds 2. Sell long term bonds and replace with shorter te ...

Hybrid Securities: A Basic Look at Monthly Income Preferred

... Disadvantages of MIPS Although MIPS have several advantages, they do have some negative features. The securities do not possess the same level of investment security as corporate bonds. MIPS are generally subordinated to all of the parent corporation’s debt, making the MIPS more risky. Unlike a bond ...

... Disadvantages of MIPS Although MIPS have several advantages, they do have some negative features. The securities do not possess the same level of investment security as corporate bonds. MIPS are generally subordinated to all of the parent corporation’s debt, making the MIPS more risky. Unlike a bond ...

Pricing Volatility Derivatives with General Risk Functions Alejandro Balbás University Carlos III

... Introduction • They are traded because: –They easily provide diversification. They don’t depend on prices evolution, but on how fast prices are changing. –As the empirical evidence points out, they provide adequate hedging when facing market turmoil, which usually implies correlations quite close t ...

... Introduction • They are traded because: –They easily provide diversification. They don’t depend on prices evolution, but on how fast prices are changing. –As the empirical evidence points out, they provide adequate hedging when facing market turmoil, which usually implies correlations quite close t ...

Form 6-K BARCLAYS PLC - N/A Filed: May 05, 2016 (period: May

... Powered by Morningstar Document Research. ...

... Powered by Morningstar Document Research. ...

The Cost of Capital for Alternative Investments

... strategies (e.g. distressed investing, leveraged buyouts) are essentially betting on business turnarounds at firms that have serious operating or financial problems. In the aggregate these assets are likely to perform well when purchased cheaply so long as market conditions do not get too bad. Howev ...

... strategies (e.g. distressed investing, leveraged buyouts) are essentially betting on business turnarounds at firms that have serious operating or financial problems. In the aggregate these assets are likely to perform well when purchased cheaply so long as market conditions do not get too bad. Howev ...

NP 2012 COC 1 Q.

... stocks, global stocks, emerging market stocks, corporate bonds, long-term U.S. government bonds and Treasury bills, the number of input estimates would be reduced from 20,300 to 35. Given the importance of the asset mix decision and the significant reductions in required estimates obtainable by cons ...

... stocks, global stocks, emerging market stocks, corporate bonds, long-term U.S. government bonds and Treasury bills, the number of input estimates would be reduced from 20,300 to 35. Given the importance of the asset mix decision and the significant reductions in required estimates obtainable by cons ...

14. procedure for application and allotment

... a. An application for a minor must include the full names and date of birth of the minor, as well as the full names and address of the adult (Parent or Guardian) making the application on such minor’s behalf. b. An application from a corporate body must bear the corporate body’s common seal and be c ...

... a. An application for a minor must include the full names and date of birth of the minor, as well as the full names and address of the adult (Parent or Guardian) making the application on such minor’s behalf. b. An application from a corporate body must bear the corporate body’s common seal and be c ...

1) If a bank manager chooses to hedge his portfolio of treasury

... A short contract requires that the investor sell securities in the future. buy securities in the future. hedge in the future. close out his position in the future. Question Status: Previous Edition A contract that requires the investor to sell securities on a future date is called a short contract. ...

... A short contract requires that the investor sell securities in the future. buy securities in the future. hedge in the future. close out his position in the future. Question Status: Previous Edition A contract that requires the investor to sell securities on a future date is called a short contract. ...

Hedge Funds - Presentation to BNM

... Hedge fund managers aim for ABSOLUTE RETURNS rather than benchmarking performance. ...

... Hedge fund managers aim for ABSOLUTE RETURNS rather than benchmarking performance. ...

COM SEC(2009)

... COM/2008/0602 final - COD 2008/0191 amending Directives 2006/48/EC and 2006/49/EC as regards banks affiliated to central institutions, certain own funds items, large exposures, supervisory arrangements, and crisis management. Although it may vary significantly from one segment to another. The same c ...

... COM/2008/0602 final - COD 2008/0191 amending Directives 2006/48/EC and 2006/49/EC as regards banks affiliated to central institutions, certain own funds items, large exposures, supervisory arrangements, and crisis management. Although it may vary significantly from one segment to another. The same c ...

policy xx – escrow and vendor consideration

... any other New Listing refers to the Resulting Issuer (as defined in Policy 5.1 - Changes of Business and Reverse Take-Overs or Policy 2.4 - Capital Pool Companies). “Option” means an option, warrant, right of conversion or exchange, or other right to acquire an equity security of an Issuer, but does ...

... any other New Listing refers to the Resulting Issuer (as defined in Policy 5.1 - Changes of Business and Reverse Take-Overs or Policy 2.4 - Capital Pool Companies). “Option” means an option, warrant, right of conversion or exchange, or other right to acquire an equity security of an Issuer, but does ...

An Introduction to Hedge Fund Strategies

... Equity long/short is the same as equity market neutral except without any explicit promise to maintain market neutrality. This increases the flexibility of the manager to choose net-long or net-short (positive beta or negative beta) market exposure, while still focussing primarily on stock-selection ...

... Equity long/short is the same as equity market neutral except without any explicit promise to maintain market neutrality. This increases the flexibility of the manager to choose net-long or net-short (positive beta or negative beta) market exposure, while still focussing primarily on stock-selection ...

Policy for Securities Trading

... Employees and their Family Members may not buy Securities issued by Moody’s on margin or in any account in which the financial firm lends the customer cash to purchase securities, regardless of whether they are in possession of any Non-public Information (Material or otherwise) about Moody’s. Other ...

... Employees and their Family Members may not buy Securities issued by Moody’s on margin or in any account in which the financial firm lends the customer cash to purchase securities, regardless of whether they are in possession of any Non-public Information (Material or otherwise) about Moody’s. Other ...

SAST - VCP Value Portfolio Summary Prospectus

... The Portfolio invests primarily in equity and fixed income securities, derivatives and other instruments that have economic characteristics similar to such securities that it believes will decrease the volatility level of the Portfolio’s annual returns. Under normal circumstances, the Portfolio inve ...

... The Portfolio invests primarily in equity and fixed income securities, derivatives and other instruments that have economic characteristics similar to such securities that it believes will decrease the volatility level of the Portfolio’s annual returns. Under normal circumstances, the Portfolio inve ...

Moody`s Credit Opinion - Together Housing Group

... from each original housing group and, (3) access wider range of funding options and development projects. While the consolidation process has been progressing well so far and many important milestones successfully reached, some implementation risk still exists and uncertainty remains as to whether a ...

... from each original housing group and, (3) access wider range of funding options and development projects. While the consolidation process has been progressing well so far and many important milestones successfully reached, some implementation risk still exists and uncertainty remains as to whether a ...

nextera energy, inc. - corporate

... Debentures of the Thirty-Second Series, or the applicable portion of the principal amount thereof, will not recognize income, gain or loss for United States federal income tax purposes as a result of the satisfaction and discharge of the Company’s indebtedness in respect thereof and will be subject ...

... Debentures of the Thirty-Second Series, or the applicable portion of the principal amount thereof, will not recognize income, gain or loss for United States federal income tax purposes as a result of the satisfaction and discharge of the Company’s indebtedness in respect thereof and will be subject ...

Credit Default Swaps -new regulations and conversion

... in two ways, either by a so called physical settlement or by a cash settlement. The physical settlement simply means that the CDS buyer delivers the bond to the CDS seller, which pays the face value of the delivered bond. Cash settlement means that the CDS seller pays the lost amount of the bond, i. ...

... in two ways, either by a so called physical settlement or by a cash settlement. The physical settlement simply means that the CDS buyer delivers the bond to the CDS seller, which pays the face value of the delivered bond. Cash settlement means that the CDS seller pays the lost amount of the bond, i. ...

ING Group Inaugural AT1 Roadshow (PDF 0,4 Mb)

... • We will aim to maintain a comfortable buffer above the minimum 10% to absorb regulatory changes and potential volatility ...

... • We will aim to maintain a comfortable buffer above the minimum 10% to absorb regulatory changes and potential volatility ...