Collective Investment Schemes Control Act: Determination on

... "netting arrangements" means a combination of trades in terms of which long and short assets with exactly the same exposure may be netted before calculating the exposure; ...

... "netting arrangements" means a combination of trades in terms of which long and short assets with exactly the same exposure may be netted before calculating the exposure; ...

chapter 8

... An offer of securities does not need disclosure if the minimum amount payable for the securities on acceptance of the offer is at least $500 000: s 708(8)(a). An exemption is also available where the amount payable by the investor for the securities on acceptance of the offer and the amounts previou ...

... An offer of securities does not need disclosure if the minimum amount payable for the securities on acceptance of the offer is at least $500 000: s 708(8)(a). An exemption is also available where the amount payable by the investor for the securities on acceptance of the offer and the amounts previou ...

Coalition Slide Presentation to House Agriculture Committee

... • All swaps, whether cleared or uncleared, must be reported to an SDR, including internal transactions related to the risk management activities within a particular company. • Most swap data will be publicly disseminated (on an anonymous basis) for those that want to view or use the data. Margin for ...

... • All swaps, whether cleared or uncleared, must be reported to an SDR, including internal transactions related to the risk management activities within a particular company. • Most swap data will be publicly disseminated (on an anonymous basis) for those that want to view or use the data. Margin for ...

The Securities Claim Exemption in Bankruptcy

... exemption.15 In fact, under the securities claim exemption, there is no deadline for an investor to obtain a determination on whether the debt due under a Rule 10b-5 claim is dischargeable.16 The investor could even wait until after the bankruptcy proceeding has been closed before obtaining a determ ...

... exemption.15 In fact, under the securities claim exemption, there is no deadline for an investor to obtain a determination on whether the debt due under a Rule 10b-5 claim is dischargeable.16 The investor could even wait until after the bankruptcy proceeding has been closed before obtaining a determ ...

Unconstrained fixed income: generating consistent returns

... For those Defined Contribution (DC) pension plan members, and for those individual savers, that have shorter-term time horizons and lower tolerance for losses, UFI can be a valuable strategy. These investors need to be prepared to accept meaningful levels of risk over a 3-year timescale; however a w ...

... For those Defined Contribution (DC) pension plan members, and for those individual savers, that have shorter-term time horizons and lower tolerance for losses, UFI can be a valuable strategy. These investors need to be prepared to accept meaningful levels of risk over a 3-year timescale; however a w ...

primary dealership in ghana

... In 1996, Bank of Ghana (BOG) introduced a system of Primary Dealers (PDs) in the Government Securities (G-Secs) Market which was intended to enhance the ability of BOG to achieve efficient funding of the Government of Ghana’s (GOG) Public Sector Borrowing Requirement (PSBR) through the development o ...

... In 1996, Bank of Ghana (BOG) introduced a system of Primary Dealers (PDs) in the Government Securities (G-Secs) Market which was intended to enhance the ability of BOG to achieve efficient funding of the Government of Ghana’s (GOG) Public Sector Borrowing Requirement (PSBR) through the development o ...

UDR, Inc. - Barchart.com

... regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required under the U.S. securities laws. This press release and these forward-looking statements include UDR’s analysis and conclusions and reflect UDR’s ju ...

... regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required under the U.S. securities laws. This press release and these forward-looking statements include UDR’s analysis and conclusions and reflect UDR’s ju ...

Disclosure of Interest/ Changes in Interest of Substantial

... This form and Form C, are to be completed electronically and sent to the Listed Issuer via an electronic medium such as an e-mail attachment. The Listed Issuer will attach both forms to the prescribed SGXNet announcement template for dissemination as required under section 137G(1), 137R(1) or 137ZC( ...

... This form and Form C, are to be completed electronically and sent to the Listed Issuer via an electronic medium such as an e-mail attachment. The Listed Issuer will attach both forms to the prescribed SGXNet announcement template for dissemination as required under section 137G(1), 137R(1) or 137ZC( ...

In the Matters of DELAWARE MANAGEMENT COMPANY, INC

... securities purchased by investment companies and reduce the amount the investment companies receive for portfolio securities sold as compared with the costs of purchase and proceeds of sale they might reasonably have expected to realize had a bona fide effort been made to execute transactions at the ...

... securities purchased by investment companies and reduce the amount the investment companies receive for portfolio securities sold as compared with the costs of purchase and proceeds of sale they might reasonably have expected to realize had a bona fide effort been made to execute transactions at the ...

Amendment No 3 dated August 10, 2016 to the Simplified Prospectus

... ee) On page 117, the following paragraph is added after the paragraph beginning with “The fund may use derivative consistent with its investment objective…” under “Investment strategies”: “The fund also uses derivatives to hedge the exposure of its investments denominated in foreign currencies attr ...

... ee) On page 117, the following paragraph is added after the paragraph beginning with “The fund may use derivative consistent with its investment objective…” under “Investment strategies”: “The fund also uses derivatives to hedge the exposure of its investments denominated in foreign currencies attr ...

Urgent Notice for non-EU issuers of Securities

... However, if the issuer has given notice pursuant to Article 30.1, the choice made by that notice cannot be overridden by a later issue. If the issuer has Equity or Low Denomination securities listed on more than one EU exchange in two or more Member States at the date of entry into force of the Dire ...

... However, if the issuer has given notice pursuant to Article 30.1, the choice made by that notice cannot be overridden by a later issue. If the issuer has Equity or Low Denomination securities listed on more than one EU exchange in two or more Member States at the date of entry into force of the Dire ...

Morgan Stanley

... secured lending markets – Caused by: • Disruption of the financial markets • Negative views about the financial services industry • Negative perception of long or short term financial prospects – Large trading losses, downgraded or negative watch by rating agencies, decline in business activity, act ...

... secured lending markets – Caused by: • Disruption of the financial markets • Negative views about the financial services industry • Negative perception of long or short term financial prospects – Large trading losses, downgraded or negative watch by rating agencies, decline in business activity, act ...

Reporting Form SRF 536.0 Repurchase Agreements Instructions

... holding gains (and losses) and income generated by the security remains with the original holder. Repos and securities lending/borrowing both occur at a specified price with a commitment to repurchase the same or similar securities at a fixed price on a future date, which is specified in the contrac ...

... holding gains (and losses) and income generated by the security remains with the original holder. Repos and securities lending/borrowing both occur at a specified price with a commitment to repurchase the same or similar securities at a fixed price on a future date, which is specified in the contrac ...

Read full ASX announcement – pdf

... If we are a trust, we warrant that no person has the right to return the +securities to be quoted under section 1019B of the Corporations Act at the time that we request that the +securities be quoted. We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or ex ...

... If we are a trust, we warrant that no person has the right to return the +securities to be quoted under section 1019B of the Corporations Act at the time that we request that the +securities be quoted. We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or ex ...

FIN 377L – Portfolio Analysis and Management

... 1. Completely Unhedged: Froot (1993) argues that over the long term, real exchange rates will revert to their means according to the Purchasing Power Parity Theorem, suggesting currency exposure is a zero-sum game. Further, over shorter time frames—when exchange rates can deviate from long-term equi ...

... 1. Completely Unhedged: Froot (1993) argues that over the long term, real exchange rates will revert to their means according to the Purchasing Power Parity Theorem, suggesting currency exposure is a zero-sum game. Further, over shorter time frames—when exchange rates can deviate from long-term equi ...

preferred securities - Janney Montgomery Scott LLC

... are perpetual), the overwhelming majority of preferreds have early redemption features whereby issuers may call a preferred at par any time subsequent to five years from their issue date. A smaller number of preferreds have calls which begin ten years after the issue date. •• Credit/Suspension Risk: ...

... are perpetual), the overwhelming majority of preferreds have early redemption features whereby issuers may call a preferred at par any time subsequent to five years from their issue date. A smaller number of preferreds have calls which begin ten years after the issue date. •• Credit/Suspension Risk: ...

Part I:

... • Credit exposures of traditional instruments (bonds, loans): – Face value • Credit risk of derivatives (e.g. swaps): – Involves detailed analysis of market risk interacting with credit risk (exposure changes with time) • Controlling – Limits on Notionals, Credit lines – Limits on current and potent ...

... • Credit exposures of traditional instruments (bonds, loans): – Face value • Credit risk of derivatives (e.g. swaps): – Involves detailed analysis of market risk interacting with credit risk (exposure changes with time) • Controlling – Limits on Notionals, Credit lines – Limits on current and potent ...

The Asset-Backed Securities Markets, the Crisis

... more generally. It started with a decrease in house price appreciation and an increase in subprime-mortgages defaults. As more uncertainty about the housing market developed, residential investment started declining and residential borrowing and lending dropped. In July 2007, ABS issues backed by re ...

... more generally. It started with a decrease in house price appreciation and an increase in subprime-mortgages defaults. As more uncertainty about the housing market developed, residential investment started declining and residential borrowing and lending dropped. In July 2007, ABS issues backed by re ...

8 - Maryland Public Service Commission

... Commission”) in the above styled matter dated November 5, 1999, Applicant was granted authority to issue, prior to December 31, 2002, up to $200 million in the aggregate principal amount of first mortgage bonds (the New Bonds), secured or unsecured medium term notes (the Notes), unsecured debentures ...

... Commission”) in the above styled matter dated November 5, 1999, Applicant was granted authority to issue, prior to December 31, 2002, up to $200 million in the aggregate principal amount of first mortgage bonds (the New Bonds), secured or unsecured medium term notes (the Notes), unsecured debentures ...

Securities markets regulators in transition

... The Agency of the Republic of Kazakhstan Financial Supervision was established in January 2004 pursuant to the Law on State Regulation and Supervision of Financial Markets and Financial Organisations, adopted in July 2003. The Agency is the banking, insurance and securities regulator in Kazakhstan. ...

... The Agency of the Republic of Kazakhstan Financial Supervision was established in January 2004 pursuant to the Law on State Regulation and Supervision of Financial Markets and Financial Organisations, adopted in July 2003. The Agency is the banking, insurance and securities regulator in Kazakhstan. ...

Commodities and the Inflation/Deflation Debate

... energy, to avoid unintentionally over-allocating to any one area. Investors should also closely monitor the cash management portion of any commodities investment to ensure unnecessary duration or credit risk is not being taken in an attempt to outperform a collateral benchmark. This can add addition ...

... energy, to avoid unintentionally over-allocating to any one area. Investors should also closely monitor the cash management portion of any commodities investment to ensure unnecessary duration or credit risk is not being taken in an attempt to outperform a collateral benchmark. This can add addition ...

Disclosure Annex for Asset-Backed Security Derivative

... MBS indices may be differentiated based on whether the mortgage loans underlying the underlying MBSs are residential or commercial, among other characteristics. You should carefully review and understand the characteristics of the MBSs underlying any Credit Transaction you may enter into. MBS indice ...

... MBS indices may be differentiated based on whether the mortgage loans underlying the underlying MBSs are residential or commercial, among other characteristics. You should carefully review and understand the characteristics of the MBSs underlying any Credit Transaction you may enter into. MBS indice ...

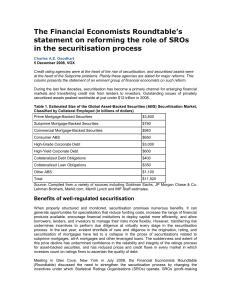

Roundtable`s Evaluation of the SEC`s Proposals for Reform

... appeared in the US. An active corporate bond market, largely in debt issued by railroad companies, emerged in the middle of the 19th century in the US more than half a century before the first SRO opened for business. SROs remained largely US-focused until the 1970s, when global capital markets bega ...

... appeared in the US. An active corporate bond market, largely in debt issued by railroad companies, emerged in the middle of the 19th century in the US more than half a century before the first SRO opened for business. SROs remained largely US-focused until the 1970s, when global capital markets bega ...

security

... Securities issued by any government in the U.S. Short-term notes and drafts that have a maturity date that does not exceed nine months Securities issued by nonprofit issuers Securities of financial institutions that are regulated by the appropriate banking authorities Securities issued by common car ...

... Securities issued by any government in the U.S. Short-term notes and drafts that have a maturity date that does not exceed nine months Securities issued by nonprofit issuers Securities of financial institutions that are regulated by the appropriate banking authorities Securities issued by common car ...