* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Commodities and the Inflation/Deflation Debate

Survey

Document related concepts

Transcript

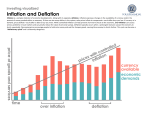

Asset Management How Commodities Can Help Investors Face The Uncertainty of the Inflation/Deflation Debate December 2010 WHITE PAPER Executive Summary Nelson Louie Global Head, Commodities Group In the wake of the 2007–2009 global financial crisis there have been heated debates among economists, central banks and investors over which is the greater macroeconomic risk facing the world’s developed economies: inflation or deflation. The case has been made for each side of the debate: on the one hand, some believe that quantitative easing in the United States, Japan and the United Kingdom could precipitate an inflationary environment; on the other hand, some argue that deflation is the main concern because of slack capacity in developed economies, low aggregate demand, deleveraging in the private sector and fiscal restraint in some countries. The lack of consensus on the outlook for inflation presents a challenge to investors: how to prepare for unexpected shifts in the global inflationary environment? We believe that the uncertainty increases the risk that any rise in inflation will be “unexpected” (i.e., it will not be properly priced into market valuations). We believe that exposure to real assets such as commodities can help investors address this challenge. Christopher Burton Portfolio Manager, Commodities Group In this light, we believe that an allocation to commodities should not be seen as a tactical move, but rather as a strategic choice investors can make to help protect their portfolios against changing inflation environments over the long run. Our analysis shows that long-term investments in commodities have historically provided inflation-hedging benefits to investors. For more information or to comment on any views expressed here, please write to us at ir.betastrategies @credit-suisse.com Another important potential benefit to investors is the diversification that the asset class can provide to investors’ portfolios due to their low correlations over time with equities. Return drivers for commodities are often quite different than those of stocks and bonds, and relate to their idiosyncratic supply-and-demand fluctuations. In our view, this diversification is best achieved using a broad basket of commodities to smooth out the volatility of individual commodities, such as oil or gold. How Commodities Can Help Investors Face the Uncertainty of the Inflation/Deflation Debate Hedging Inflation With Commodities Commodities are part of the “real asset” class that can help protect against the impairment of future value of portfolio assets from rising inflation.1 In recent years, an increasing number of investors have been taking an interest in these assets, particularly those with heavy exposures to assets that are sensitive to loss of value because of inflation, including equities and traditional bonds. unexpected. One reason that stocks may suffer during rising inflation periods is increasing raw material costs may reduce corporate profit margins if companies are unable to pass price increases along to consumers. Lower margins may have a negative impact on equity valuations. Rising inflation impacts bonds because it diminishes the purchasing power of a bond’s future interest payments and principal. As such, Treasury Inflation Protected Securities (TIPS) have emerged as a popular inflation hedging tool. Similar to standard Treasury bonds, TIPS pay interest at regular intervals as well as the principal upon the bond’s maturity. However, unlike standard Treasury bonds, both the interest payments and principal amount are automatically increased during periods of rising inflation as determined by the CPI. While TIPS provide targeted insurance against inflation, they do not exhibit the same low correlations with bonds as commodities, and therefore may not provide the same level of diversification within a portfolio. Next, we discuss the difference between expected versus unexpected inflation, and how commodities work as an inflation hedge in each of these environments. Commodities’ high correlation with inflation, which provides purchasing power protection against rising prices (Display 1), can help address this concern. The protection comes from the fact that commodities reflect prices in areas such as energy, industrial metals and agricultural commodities. As such, commodities are directly linked to the components of inflation (a common measure of which in the US is the Consumer Price Index, or CPI), and therefore tend to increase in price during inflationary periods. We note, however, that commodities prices can be volatile, so this correlation to inflation is better captured by the asset class in aggregate rather than a single commodity. On the other hand, financial assets such as stocks and bonds tend to face headwinds when inflation rises, particularly if it is Display 1: Commodities correlations with inflation may help provide purchasing power protection 2 Unexpected Inflation Inflation 0.5 0.4 0.41 0.34 0.3 Correlation 0.2 0.1 0.0 -0.1 -0.08 -0.2 -0.18 -0.3 -0.21 -0.34 -0.4 S&P GSCI Ibbotson Intermediate Term Bond S&P 500 S&P GSCI Ibbotson Intermediate Term Bond S&P 500 Based on average annual returns: January 1970-December 2009 Source: Credit SuisseAsset Management, Ibbotson and Bloomberg. A widely used, broad measure of inflation is the Consumer Price Index (CPI), which consists of the average price of a broad basket of goods and services that includes housing, transportation (e.g., vehicles, energy, airfares), food, recreation, apparel and medical care, among other things. 2 Unexpected inflation is based on the historical relationship between1 month Treasury bills and CPI. The S&P Goldman Sachs Commodities Index (S&P GSCI) is a composite index of commodity sector returns, representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The Ibbotson Intermediate-Term Government Bond Index is a one-bond portfolio with a maturity near 5 years. The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of US companies with market capitalization in excess of $3 billion and generally representative of the US stock market. 1 2 | Credit Suisse Asset Management How Commodities Can Help Investors Face the Uncertainty of the Inflation/Deflation Debate Commodities in Expected versus Unexpected Inflation Environments Commodities are most effective at hedging “unexpected” inflation, which represents the difference between expected (or projected) inflation and realized inflation. In other words, commodities prices perform better when realized inflation has not been properly priced into market valuations. Display 2 shows that Commodities, as represented by S&P GSCI Risk Premium returns (i.e., the return of the S&P GSCI Total Return Index minus the risk-free rate), outperform equities, as represented by the S&P 500 Risk Premium returns, by almost 3% in periods of extreme high unexpected inflation.3 One of the reasons Commodities perform better in this environment is that commodities indices invest in futures contracts. While they reflect where spot prices are expected to be in the future, the prices of these futures’ contracts also move in response to unexpected changes to market conditions. As a result, commodities indices may fluctuate in concert with unexpected deviations from components of inflation.5 As a driver of inflation, commodities inherently rise with it. Stocks and bonds, however, tend to perform better when the rate of inflation is stable or slowing. This is usually because the market has already discounted the impact of expected inflation, and therefore “expected” changes to inflation may not have a dramatic effect on the performance of these traditional assets. As a result, we believe that the primary risk to investment portfolios exposed to these assets is one where prices change unexpectedly. Since our research suggests that commodities can provide protection to portfolios in unexpected inflation environments, the next question we address is the risk of inflation versus that of deflation. Display 2: Commodities returns historically outperform equities in periods of extreme unexpected inflation4 Average Monthly Returns with Extreme Unexpected Inflation 2.0 1.82% 1.5 Returns (%) 1.0 0.37% 0.5 0.0 -0.5 -1.0 -0.97% -1.5 -2.0 -1.59% Extreme Higher-Than-Expected Inflation S&P GSCI Risk Premium Extreme Lower-Than-Expected Inflation S&P 500 Risk Premium Based on average annual returns: January 1970 – December 2009 Source: Credit Suisse Asset Management, Bloomberg, Federal Reserve of Saint Louis 3 S&P GSCI Risk Premium returns are calculated by subtracting the risk-free rate of return from the S&P GSCI Total Return Index. Similarly, the S&P 500 Risk Premium returns are calculated by subtracting the risk-free rate of return from the S&P 500 Total Return Index. The Federal Funds Rate, as quoted by the Federal Reserve of Saint Louis, was used to represent the risk-free rate in both calculations. 4 Unexpected inflation estimates are based on the historical relationships between 3-month Treasury Bills and CPI. Extreme unexpected occurrences of inflation are defined as those which fall one standard deviation from the mean in either direction. 5 Gorton, Gary and Rouwenhorst, K. Geert. “Facts and Fantasies about Commodity Futures.” The Wharton School, University of Pennsylvannia/School of Management, Yale University. 2004. Credit Suisse Asset Management |3 How Commodities Can Help Investors Face the Uncertainty of the Inflation/Deflation Debate Analyzing the Inflation/ Deflation Debate Incorporating Commodities Into a Portfolio An inflation/deflation debate is taking place among many policy makers and investors in developed markets. These debates encompass a number of economic, fiscal and financial factors that could potentially affect the path that inflation takes. Some believe that new rounds of stimulus spending by governments are needed to forestall deflation with its falling prices and wages. On the other side are those who believe that additional government borrowing could foster a rising inflation environment. Here is a short summary of these two positions: When considering a commodities investment, investors should carefully evaluate their current portfolio holdings to determine their existing exposure to certain commodities sectors, such as energy, to avoid unintentionally over-allocating to any one area. Investors should also closely monitor the cash management portion of any commodities investment to ensure unnecessary duration or credit risk is not being taken in an attempt to outperform a collateral benchmark. This can add additional risk while diminishing the diversification benefits offered by a commodities investment. For example, holding short duration bonds will likely reduce the impact of interest rate fluctuations on the overall portfolio. By contrast, credit exposures, as well as long duration bonds, including TIPS, can result in increased volatility and correlations to fixed income markets. Inflationary risks: US Federal Reserve Chairman Ben Bernanke announced $600 billion in quantitative easing (QE) on November 3 in an effort to boost GDP growth. The prospect of this monetary easing by the Fed, as well as similar initiatives in other countries such as Japan and the UK, has renewed expectations of inflation for many. Deflationary risks: Concerns about deflation in developed nations stem primarily from the following drivers: a) a strong deleveraging process; b) high unemployment; c) idle industrial capacity; and d) fiscal restraint on the part of some governments. These forces can potentially exert downward pressure on broader consumer price indicators and lead to lower costs and higher inventory levels for raw materials. It’s worth noting that much of this “slack” has been picked up by faster-growing emerging economies in the current cycle. In fact, emerging markets have been strong buyers of industrial metals and agricultural products, a move that may continue to bolster commodities prices. We believe that no matter which of the two forces prevails in developed economies, one thing appears clear: the inflationary outcome is likely to be “unexpected.” Our view is that this supports the argument that commodities can help hedge a diversified portfolio against changing inflation conditions, particularly when unexpected. 4 | Credit Suisse Asset Management Conclusion We believe debates will continue among economists, central banks and investors over which is the greater macroeconomic risk that we face: inflation or deflation. Reconciling these opposing views can present a challenge to investors. The lack of clarity on the inflation outlook also lends support to the idea that as new inflationary environments develop around the world, they will likely be unexpected. As our analysis shows that commodities futures tend to be more highly correlated to periods of unexpected inflation, we believe this creates a compelling case for incorporating commodities in an asset allocation framework. Finally, the inclusion of commodity futures into a portfolio context may also provide diversification benefits based on their historical low correlations to traditional asset classes which may help improve an investor’s overall risk/return profile. How Commodities Can Help Investors Face the Uncertainty of the Inflation/Deflation Debate Credit Suisse Asset Management Publications The Anatomy of a Modern Emerging Markets Portfolio November 2010—This paper examines the quickly evolving emerging markets investment landscape and argues that the proliferation of sophisticated investment vehicles in these markets presents an opportunity for investors to augment the efficiency of their emerging markets portfolios. Credit Suisse Asset Management’s Tactical Quarterly November 2010—Credit Suisse Asset Management’s Tactical Quarterly offers important insights from our leading Alternative portfolio managers on the trends and opportunities shaping today’s financial markets. Investment strategies covered in this quarterly publication include quantitative and fundamental hedge funds, private equity, credit strategies and commodities. Robert Parker, Credit Suisse Senior Advisor November Market Update November 2010—The Market Update provides Bob’s views on global financial markets and economic trends, including the November announcement by the US Fed on quantitative easing, global monetary policy expectations, the challenges facing the Eurozone’s peripheral economies and market implications across equities, bonds, commodities and currencies. Liquid Alternative Beta: Enhancing Liquidity in Alternative Portfolios June 2010—How to increase a portfolio’s liquidity without sacrificing returns, especially in a post-crisis, low-yield environment? The paper illustrates how institutional investors can use Liquid Alternative Beta to seek to enhance portfolio liquidity, increase portfolio transparency, short hedge fund sectors and gain hedge-fund-like exposure when investment policies restrict direct hedge fund investments. Can Infrastructure Investing Enhance Portfolio Efficiency? May 2010—The paper provides an in-depth look at infrastructure as an investment tool, and analyzes what role the asset class might play in institutional portfolios. Specifically, the paper examines whether infrastructure can be an effective tool to mitigate inflation and duration risks, reduce funding gaps, and enhance portfolio efficiency. Gaining Efficient Hedge Fund Exposure Through Passive Investing January 2010—This paper examines the benefits of an indexbased approach to hedge fund investing: Cost efficient access to the broad hedge fund industry, strong performance versus active fund of funds, reduced manager-specific risk and a simplified core holding. Credit Portfolio Management in 2010: A Nimble Approach Needed January 2010—Tracking and timing credit cycles can be challenging, particularly since today’s credit environment appears to be going through increasingly rapid cycle changes. We believe that fixed income investors need to be increasingly nimble and tactical in 2010, while at the same time considering strategic preparations for medium-to-longer-term regime changes in interest rates and inflation. Risk Management: A Changing Paradigm November 2009—Renewed interest in risk management and the creation of a culture of risk awareness are driving current investment committee meeting agendas. This should come as no surprise in light of market events in 2008 and early 2009. While experience and judgment that have been battle-tested under various market conditions prepares CIOs for uncertainty in the future, how do they implement risk-based solutions while facing real-world events? Risk Parity—A Risk-Based Approach to Portfolio Structuring November 2009—This paper discusses a different approach to portfolio risk management, called risk parity, which aims to equate the contribution of risk across asset classes and, as a result, create a portfolio which performs better in a variety of market conditions. In Search of Liquidity and Transparency: Managed Accounts, Single Investor Funds and Custom Portfolios October 2009—Investor interest in managed accounts has grown. This paper outlines four investment structures which may offer investors a range of solutions for greater liquidity and transparency in their hedge fund investments. Preparing for Inflation—Is It Too Early to Position Your Portfolio? September 2009—As governments continue to implement stimulus programs, some investors worry about potential future inflation. Positioning your portfolio for increasing inflation before it strikes is critical. Equity Market Neutral—Diversifier Across Market Cycles September 2009—This paper examines the role that the Equity Market Neutral strategy can play in an alternatives portfolio, as it was one of the few strategies that remained uncorrelated to other asset classes during the 4Q 2008 market dislocation. The views and opinions expressed within these publications are those of the authors, are based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date hereof. For a copy of any of these papers, please contact your relationship manager or visit our website at www.credit-suisse.com. Credit Suisse Asset Management |5 How Commodities Can Help Investors Face the Uncertainty of the Inflation/Deflation Debate About the Authors Nelson Louie, Managing Director, is Global Head of the Commodities Group. Mr. Louie re-joined Credit Suisse Asset Management, LLC in August 2010. From May 2009 to August 2010 he was an Executive Director in the Commodity Index Products area at UBS Securities, LLC. From June 2007 to May 2009 he was a Managing Director at AIG Financial Products responsible for North American Marketing of commodities-based solutions. From April 1993 to June 2007 he held various positions within Credit Suisse Asset Management, LLC. He was a Senior Portfolio Manager overseeing a team that was responsible for enhanced commodity and equity index strategies, option based hedging solutions and option arbitrage products. He was a team member of the commodity funds from their inception through June 2007. Mr. Louie holds a Bachelor of Arts degree in Economics from Union College. Christopher Burton, Director, is a Portfolio Manager and Trader for the Commodities Group within Credit Suisse Asset Management. In this role, Mr. Burton is responsible for analyzing and implementing the team’s hedging strategies, indexing strategies, and excess return strategies. Prior to joining Credit Suisse in 2005, Mr. Burton served as an Analyst and Derivatives Strategist with Putnam Investments, where he developed the team’s analytical tools and managed their optionsbased yield enhancement strategies, as well as exposure management strategies. Mr. Burton earned a B.S. in Economics with concentrations in Finance and Accounting from the University of Pennsylvania’s Wharton School of Business. Additionally, Mr. Burton holds the Chartered Financial Analyst designation and has achieved Financial Risk Manager® Certification through the Global Association of Risk Professionals (GARP). 6 | Credit Suisse Asset Management How Commodities Can Help Investors Face the Uncertainty of the Inflation/Deflation Debate Important Legal Information This material has been prepared by Credit Suisse Asset Management, LLC (“Credit Suisse”) or an affiliate or subsidiary thereof on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. Credit Suisse has not sought to independently verify information taken from public and third party sources and does not make any representation or warranty as to the accuracy, completeness, or reliability of the information contain herein. This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The securities identified and described do not represent all of the securities purchased, sold, or recommended for client accounts. The reader should not assume that any investments in companies, securities, sectors, strategies, and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. This material is presented solely for informational purposes and is not to be constructed as a forecast, recommendation, solicitation or offer regarding any markets, securities or investment products. Nothing herein constitutes investment, legal, accounting or tax advice or a personal recommendation, and no representation is being made as to whether any investment or strategy is suitable or appropriate for a particular individual. Investment return will fluctuate and may be volatile, especially over short time horizons. A complete list of investments for the preceding year is available upon request. Each investor’s portfolio is individually managed and may vary from the information shown in terms of portfolio holdings, characteristics and performance. Current and future portfolio compositions may be significantly different from the information shown herein. Investing entails risks, including possible loss of some or all of the investor’s principal. The investment views and market opinions/analyses expressed herein may not reflect those of Credit Suisse as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties. Commodity markets are highly volatile. The risk of loss in trading commodities can be substantial. There is a high degree of leverage in commodity trading that can lead to large losses. The asset management business of Credit Suisse Group AG is comprised of a network of entities around the world. Each legal entity is subject to distinct regulatory requirements and certain asset management products and services may not be available in all jurisdictions or to all client types. There is no intention to offer products or services in countries or jurisdictions where such offer would be unlawful under the relevant domestic law. The charts, tables and graphs contained in this document are not intended to be used to assist the reader in determining which securities to buy or sell or when to buy or sell securities. Benchmarks are used solely for purposes of comparison and the comparison does not mean that there will necessarily be a correlation between the returns described herein and the benchmarks. There are limitations in using financial indices for comparison purposes because, among other reasons, such indices may have different volatility, diversification, credit and other material characteristics (such as number or type of instrument or security). The strategies described may help to decrease the risk of your investments; however, they may also limit the upside potential of your investments. For more information regarding these risks, please contact Credit Suisse. Certain information contained in this document constitutes “Forward-Looking Statements” (including observations about markets and industry and regulatory trends as of the original date of this document), which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe”, or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties eyond our control, actual events, results or performance may differ materially from those reflected or contemplated in such forwardlooking statements. Readers are cautioned not to place undue reliance on such statements. Credit Suisse has no obligation to update any of the forward-looking statements in this document. Credit Suisse Asset Management |7 Copyright © 2010. Credit Suisse Group and/or its affiliates. All rights reserved.