Topic 1. Introduction to financial derivatives

... item. The underlying asset of the future contract does not appear on the FI’s balance sheet when the contract commences. The asset will only be part of the balance sheet when the asset delivery is really occurred. ...

... item. The underlying asset of the future contract does not appear on the FI’s balance sheet when the contract commences. The asset will only be part of the balance sheet when the asset delivery is really occurred. ...

WHOLE FOODS MARKET INC (Form: 8-K, Received

... FEBRUARY 24, 1998. AUSTIN, TX (FOR IMMEDIATE RELEASE). The Company announced today the pricing of its zero coupon convertible subordinated debentures. The debentures, priced with an annual accretion rate of 5% and an initial conversion premium of 23.90%, will result in gross proceeds to the Company ...

... FEBRUARY 24, 1998. AUSTIN, TX (FOR IMMEDIATE RELEASE). The Company announced today the pricing of its zero coupon convertible subordinated debentures. The debentures, priced with an annual accretion rate of 5% and an initial conversion premium of 23.90%, will result in gross proceeds to the Company ...

Emerging Market Repo

... country, coupon or maturity type) in the repo market. They are used as collateral when dealers raise cash to finance their matched books or dealer desk inventories. The specific issues market revolves around the investment community's need to borrow specific fixed income securities. It becomes speci ...

... country, coupon or maturity type) in the repo market. They are used as collateral when dealers raise cash to finance their matched books or dealer desk inventories. The specific issues market revolves around the investment community's need to borrow specific fixed income securities. It becomes speci ...

Derivatives: The Good, The Bad and … the Necessary?

... Futures are standardized contracts made today for settlement (delivery) at a future date. The contracts are linked to “cash market” products. Futures are regulated by the CFTC and the NFA in the United States and by the FSA in the UK and similar bodies worldwide. Futures contracts are traded o ...

... Futures are standardized contracts made today for settlement (delivery) at a future date. The contracts are linked to “cash market” products. Futures are regulated by the CFTC and the NFA in the United States and by the FSA in the UK and similar bodies worldwide. Futures contracts are traded o ...

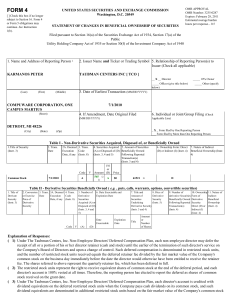

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Directors and upon a change of control. Such deferred compensation is denominated in restricted stock units, and the number of restri ...

... receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Directors and upon a change of control. Such deferred compensation is denominated in restricted stock units, and the number of restri ...

An Empirical Analysis of Counterparty Risk in CDS Prices

... of failing to make the periodic payments by protection buyer. A higher default correlation between reference entity and protection seller leads to a lower CDS spread since protection seller in this case offers less protection on the reference entity. By Leung and Kwok (2005), if reference entity has ...

... of failing to make the periodic payments by protection buyer. A higher default correlation between reference entity and protection seller leads to a lower CDS spread since protection seller in this case offers less protection on the reference entity. By Leung and Kwok (2005), if reference entity has ...

Pilot Provisions on the Formation of Subsidiary Companies by

... 1. for the latest 12 months, all its risk control indicators have reached the prescribed standards and its net capital has been 120 million yuan or more; 2. it has a relatively strong operation and management capability, and, if it has set up a subsidiary company to operate securities brokerage, sec ...

... 1. for the latest 12 months, all its risk control indicators have reached the prescribed standards and its net capital has been 120 million yuan or more; 2. it has a relatively strong operation and management capability, and, if it has set up a subsidiary company to operate securities brokerage, sec ...

Paulson Confronts Goldman Fallout

... said Brad Alford, who runs Alpha Capital Management. "I felt reassured that he did nothing wrong." "It's not a rush for the doors," said another investor in Paulson & Co. who has communicated with larger Paulson investors since Friday, when the government unveiled its Goldman case. Mr. Paulson sent ...

... said Brad Alford, who runs Alpha Capital Management. "I felt reassured that he did nothing wrong." "It's not a rush for the doors," said another investor in Paulson & Co. who has communicated with larger Paulson investors since Friday, when the government unveiled its Goldman case. Mr. Paulson sent ...

Margin Handbook

... Wealthfront Margin Disclosure Statement, continued • We can sell your securities or other assets without contacting you. Some investors mistakenly believe that a firm must contact them for a margin call to be valid, and that the firm cannot liquidate securities or other assets in their accounts to ...

... Wealthfront Margin Disclosure Statement, continued • We can sell your securities or other assets without contacting you. Some investors mistakenly believe that a firm must contact them for a margin call to be valid, and that the firm cannot liquidate securities or other assets in their accounts to ...

Nippon Sheet Glass Decides to Issue Preferred Shares— Outcome

... through third-party allocation. The allocation will made to a fund centered on Sumitomo Mitsui Banking Corporation, the Company’s main financing bank, along with other entities. The proceeds from the issuance will be appropriated for debt repayment and capital investments related to the manufacturin ...

... through third-party allocation. The allocation will made to a fund centered on Sumitomo Mitsui Banking Corporation, the Company’s main financing bank, along with other entities. The proceeds from the issuance will be appropriated for debt repayment and capital investments related to the manufacturin ...

Ocean Rig UDW Inc.

... the future. These statements may be identified by the use of words like “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should,” “seek,” and similar expressions. Forward-looking statements reflect Ocean Rig’s current views and assumptions with respect to future ev ...

... the future. These statements may be identified by the use of words like “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should,” “seek,” and similar expressions. Forward-looking statements reflect Ocean Rig’s current views and assumptions with respect to future ev ...

WORD

... c. The GreTai Securities Market publicly announces the information on the Market Information System website. d. Coverage of the information in two or more daily national newspapers on non-local news pages, national television news, or electronic newspapers issued by any the aforesaid media. In the ...

... c. The GreTai Securities Market publicly announces the information on the Market Information System website. d. Coverage of the information in two or more daily national newspapers on non-local news pages, national television news, or electronic newspapers issued by any the aforesaid media. In the ...

amherst securities group and pierpont securities merge to create

... Austin, TX and Stamford, CT July 1, 2014 - Amherst Securities Group, LP (“Amherst Securities”), a fixedincome broker-dealer focused on mortgage-related, asset-backed and structured finance investments, and Pierpont Securities LLC (“Pierpont”), a fixed-income broker-dealer focused on rates and credit ...

... Austin, TX and Stamford, CT July 1, 2014 - Amherst Securities Group, LP (“Amherst Securities”), a fixedincome broker-dealer focused on mortgage-related, asset-backed and structured finance investments, and Pierpont Securities LLC (“Pierpont”), a fixed-income broker-dealer focused on rates and credit ...

Following the press release issued on 23 February 2017, UniCredit

... therefore, the subscription of the related New Shares shall be carried out, under penalty of forfeiture, by and no later than the third trading day following the early closing notification, and, hence, by 2 March 2017. The Unexercised Rights will be made available to purchasers through authorized in ...

... therefore, the subscription of the related New Shares shall be carried out, under penalty of forfeiture, by and no later than the third trading day following the early closing notification, and, hence, by 2 March 2017. The Unexercised Rights will be made available to purchasers through authorized in ...

ANIXTER INTERNATIONAL INC

... a Delaware corporation (the “Company”), to exchange $1,000 principal amount at maturity of the Company’s Zero Coupon Convertible Securities due 2033 (the “New Securities”) plus an exchange fee of $1.00 in cash for each $1,000 principal amount at maturity of validly tendered and accepted outstanding ...

... a Delaware corporation (the “Company”), to exchange $1,000 principal amount at maturity of the Company’s Zero Coupon Convertible Securities due 2033 (the “New Securities”) plus an exchange fee of $1.00 in cash for each $1,000 principal amount at maturity of validly tendered and accepted outstanding ...

Collective action and securities law in the UK

... reliance is frequently sought to be established or substituted for on a class- or group-wide basis. The question of reliance is the subject of notably divergent approaches in different jurisdictions. In the US, the Supreme Court recently affirmed that the reliance requirement can be satisfied on a c ...

... reliance is frequently sought to be established or substituted for on a class- or group-wide basis. The question of reliance is the subject of notably divergent approaches in different jurisdictions. In the US, the Supreme Court recently affirmed that the reliance requirement can be satisfied on a c ...

Financial Statement Analysis and Security Valuation

... available for sale included in a separate shareholders’ equity account The change during the period in the net unrealized holding gain or loss on trading securities included in earnings ...

... available for sale included in a separate shareholders’ equity account The change during the period in the net unrealized holding gain or loss on trading securities included in earnings ...

Canadian Investment Grade Corporate Fixed Income Strategy

... Rounding discrepancies possible. The Canadian Investment Grade Corporate Fixed Income strategy provides a bond portfolio offering superior income compared to traditional bond funds. The Fund invests primarily in Canadian corporate bonds. The portfolio of the Fund has an average credit rating of at l ...

... Rounding discrepancies possible. The Canadian Investment Grade Corporate Fixed Income strategy provides a bond portfolio offering superior income compared to traditional bond funds. The Fund invests primarily in Canadian corporate bonds. The portfolio of the Fund has an average credit rating of at l ...

Chapter 1: An Introduction to Corporate Finance

... • The integration of swap markets with the forward market has fuelled expansion of the market • Firms wanting to change a floating rate liability into a fixed rate liability, for example, simply call their bank and execute an interest rate swap as a secondary market transaction against a line of cre ...

... • The integration of swap markets with the forward market has fuelled expansion of the market • Firms wanting to change a floating rate liability into a fixed rate liability, for example, simply call their bank and execute an interest rate swap as a secondary market transaction against a line of cre ...

PSF Portfolio Optimization Conservative

... For individual subaccounts, the purpose of these sections is to provide an analysis of the individual subaccount. Morningstar prepares this information based on publicly available holdings information. Generally, each underlying subaccount's holdings are for the prior month end; however, certain und ...

... For individual subaccounts, the purpose of these sections is to provide an analysis of the individual subaccount. Morningstar prepares this information based on publicly available holdings information. Generally, each underlying subaccount's holdings are for the prior month end; however, certain und ...

Why should a company use a broker

... unregistered broker must therefore either admit they used the unregistered broker (and therefore subject themselves to the potential pitfalls) or file a false Form D (which can subject principals of the issuer to substantial penalties under Section 24 of the Securities Act of 1933). ► If an unregist ...

... unregistered broker must therefore either admit they used the unregistered broker (and therefore subject themselves to the potential pitfalls) or file a false Form D (which can subject principals of the issuer to substantial penalties under Section 24 of the Securities Act of 1933). ► If an unregist ...

Online Quizzes and Answers for Business Law Today

... company to be a sophisticated investor with a large income or net worth. c. Incorrect. Although a family farmer might have a large net worth, in this group, a family farmer is less likely than an insurance company to be a sophisticated investor. d. Incorrect. Someone just out of college is unlikely ...

... company to be a sophisticated investor with a large income or net worth. c. Incorrect. Although a family farmer might have a large net worth, in this group, a family farmer is less likely than an insurance company to be a sophisticated investor. d. Incorrect. Someone just out of college is unlikely ...

ICICI-Prudential-Fixed-Maturity-Plan-Series 73

... The Scheme will not have any exposure to Securitised Debt. The tenure of the Scheme is 392 days from the date of the allotment. 1. The Scheme shall endeavour to invest in instruments having credit rating as indicated above or higher. 2. In case instruments/securities as indicated above are not avail ...

... The Scheme will not have any exposure to Securitised Debt. The tenure of the Scheme is 392 days from the date of the allotment. 1. The Scheme shall endeavour to invest in instruments having credit rating as indicated above or higher. 2. In case instruments/securities as indicated above are not avail ...

U.S. Treasury Department Unveils New Reporting Requirement for

... monthly basis, information relating to foreign “long-term” securities held by U.S. residents, as well as information relating to U.S. long-term securities owned by foreign residents. Reporting on the new “TIC Form SLT” will be required of major U.S. companies, funds and their investment advisers, an ...

... monthly basis, information relating to foreign “long-term” securities held by U.S. residents, as well as information relating to U.S. long-term securities owned by foreign residents. Reporting on the new “TIC Form SLT” will be required of major U.S. companies, funds and their investment advisers, an ...