Filing of Preliminary Prospectus for Initial Public

... successful. Accordingly actual results may differ materially from those currently anticipated in such statements. The Company has made numerous assumptions regarding, among other things: the effectiveness of its products; the demand for its products and the stability of economic and market conditio ...

... successful. Accordingly actual results may differ materially from those currently anticipated in such statements. The Company has made numerous assumptions regarding, among other things: the effectiveness of its products; the demand for its products and the stability of economic and market conditio ...

THIS RELEASE (AND THE INFORMATION CONTAINED

... independent advice as to the legal, regulatory, tax, accounting, financial, credit and other related advice prior to making an investment. Any investment in Jackpotjoy's securities should be made solely on the basis of the information contained in the Prospectus issued by Jackpotjoy in connection wi ...

... independent advice as to the legal, regulatory, tax, accounting, financial, credit and other related advice prior to making an investment. Any investment in Jackpotjoy's securities should be made solely on the basis of the information contained in the Prospectus issued by Jackpotjoy in connection wi ...

Municipal Bond Monthly

... 56 basis points, since late January. With the 10-year UST within a hair’s breadth of 2%, it sits just a touch above the middle of that range. Given this wide range and the attendant volatility, patient investors have been afforded numerous opportunities to pick their spots, whether it be selling vul ...

... 56 basis points, since late January. With the 10-year UST within a hair’s breadth of 2%, it sits just a touch above the middle of that range. Given this wide range and the attendant volatility, patient investors have been afforded numerous opportunities to pick their spots, whether it be selling vul ...

State of Connecticut Stable Value Fund

... * The Barclays Capital U.S. Intermediate Aggregate Index is an unmanaged index of intermediate duration fixed-income securities. The index reflects reinvestment of all distributions and changes in market prices. Investors cannot invest directly in an index. ** The Barclays Capital U.S. Aggregate Bon ...

... * The Barclays Capital U.S. Intermediate Aggregate Index is an unmanaged index of intermediate duration fixed-income securities. The index reflects reinvestment of all distributions and changes in market prices. Investors cannot invest directly in an index. ** The Barclays Capital U.S. Aggregate Bon ...

HECHO RELEVANTE

... 49(2)(a) to (d) (“high net worth companies, unincorporated associations etc.”) of the Order (all such persons together being referred to as “Relevant Persons”). In the United Kingdom, any investment activity to which this document relates is only available to, and will be engaged in only with Releva ...

... 49(2)(a) to (d) (“high net worth companies, unincorporated associations etc.”) of the Order (all such persons together being referred to as “Relevant Persons”). In the United Kingdom, any investment activity to which this document relates is only available to, and will be engaged in only with Releva ...

1 WORKDAY, INC. POLICY ON HEDGING IN SECURITIES The

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

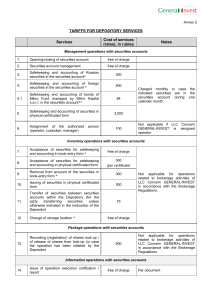

Tariffs depository

... 1. Settlement period shall be a calendar month; the calculation is carried out for each securities account of the Depositor. 2. All rates do not include any overhead costs and services of third parties (parent depositories, registrars). 3. Payment for Depository services shall be made by the Deposit ...

... 1. Settlement period shall be a calendar month; the calculation is carried out for each securities account of the Depositor. 2. All rates do not include any overhead costs and services of third parties (parent depositories, registrars). 3. Payment for Depository services shall be made by the Deposit ...

Treasury Terminology

... ‘Society for Worldwide Interbank Financial Telecommunication’ is a cooperative society created under Belgian law and having its Corporate Office at Brussels. The Society, which has been in operation since May 1977 and covers most of Western Europe and North America, operates a computer-guided commun ...

... ‘Society for Worldwide Interbank Financial Telecommunication’ is a cooperative society created under Belgian law and having its Corporate Office at Brussels. The Society, which has been in operation since May 1977 and covers most of Western Europe and North America, operates a computer-guided commun ...

Short-term investments - McGraw Hill Higher Education

... If the intent is to sell available-for-sale securities within the longer of one year or operating cycle, they are classified as short-term investments. Otherwise, they are classified as long-term. Adjust the cost of available-for-sale securities to reflect changes in fair value. This is done wit ...

... If the intent is to sell available-for-sale securities within the longer of one year or operating cycle, they are classified as short-term investments. Otherwise, they are classified as long-term. Adjust the cost of available-for-sale securities to reflect changes in fair value. This is done wit ...

Measure of Market Risk

... Counterparty deafult is an extreme case, but losses can also occur when a counterparty’s credit quality decreases. Credit risk is an issue even when the bank holds only payment obligations. ¾ Liquidity Risk. The risk of losses because of travel-time delays of assets. ¾ Operational Risk. Fraud. ...

... Counterparty deafult is an extreme case, but losses can also occur when a counterparty’s credit quality decreases. Credit risk is an issue even when the bank holds only payment obligations. ¾ Liquidity Risk. The risk of losses because of travel-time delays of assets. ¾ Operational Risk. Fraud. ...

National Settlement Depository

... ● Full range of settlement services for securities and cash ● Accelerated and optimized settlement process ● Opportunity to introduce new services, including securities lending and collateral management ...

... ● Full range of settlement services for securities and cash ● Accelerated and optimized settlement process ● Opportunity to introduce new services, including securities lending and collateral management ...

Why Bail-In Securities Are Fool`s Gold

... failure—like the 1995 collapse of Baring Brothers, which was the result of a single rogue trader. But they do not make sense in the more common and intractable case where many banks get into trouble at roughly the same time as the assets they own go bad. On such occasions these securities, which may ...

... failure—like the 1995 collapse of Baring Brothers, which was the result of a single rogue trader. But they do not make sense in the more common and intractable case where many banks get into trouble at roughly the same time as the assets they own go bad. On such occasions these securities, which may ...

The Role of Short Selling in Equity Markets

... Is it completely negative when the short interest exceeds 30% of shares outstanding? Yes and no. A 30% short interest is clearly a negative investor sentiment indictor, but do not forget short interest is an incomplete transaction. The short seller is contractually obligated to cover the borrowed sh ...

... Is it completely negative when the short interest exceeds 30% of shares outstanding? Yes and no. A 30% short interest is clearly a negative investor sentiment indictor, but do not forget short interest is an incomplete transaction. The short seller is contractually obligated to cover the borrowed sh ...

Comments to NAIC on Securities Listed by the Securities Valuation

... leadership, objective expertise, and actuarial advice on risk and financial security issues. The Academy also sets qualification, practice, and professionalism standards for actuaries in the United States. ...

... leadership, objective expertise, and actuarial advice on risk and financial security issues. The Academy also sets qualification, practice, and professionalism standards for actuaries in the United States. ...

jointly hedging jump-to-default risk and mark-to

... a choice to pick the one that is most convenient for us. (b) Mark-to-market (MTM) risk. The risk of a loss in the position that is due to a change of the market’s opinion about company A’s creditworthiness. These changing opinions can be tracked on a daily basis by monitoring the fluctuations of cre ...

... a choice to pick the one that is most convenient for us. (b) Mark-to-market (MTM) risk. The risk of a loss in the position that is due to a change of the market’s opinion about company A’s creditworthiness. These changing opinions can be tracked on a daily basis by monitoring the fluctuations of cre ...

The Law of Ukraine On Securities and Stock Market of 23.02.2006

... Bill of exchange is a security, which certifies an undoubted bill of debt of issuer of a bill of exchange or his order to the third party to pay the defined sum to the owner of the bill of exchange (billholder) after the beginning of the term of payment. Bill of exchanges may be simple bill of exch ...

... Bill of exchange is a security, which certifies an undoubted bill of debt of issuer of a bill of exchange or his order to the third party to pay the defined sum to the owner of the bill of exchange (billholder) after the beginning of the term of payment. Bill of exchanges may be simple bill of exch ...

state residents urged to be on guard against affinity fraud

... some CDs aren't what they seem. That's the message behind a handy checklist now available from the Agency. With many elderly investors complaining they've been misled into buying "callable" CDs with 10- to 30 -year maturities, State securities regulators hope investors will use the checklist to avoi ...

... some CDs aren't what they seem. That's the message behind a handy checklist now available from the Agency. With many elderly investors complaining they've been misled into buying "callable" CDs with 10- to 30 -year maturities, State securities regulators hope investors will use the checklist to avoi ...

Introduction of Mega Solar Project Bond Trust

... ‘This material’ was not prepared by the Global Investment Research. This material is provided solely for information purpose. This material does not constitute an offer to sell the securities or loans named herein and should not be construed as investment advice. Accordingly you should not use this ...

... ‘This material’ was not prepared by the Global Investment Research. This material is provided solely for information purpose. This material does not constitute an offer to sell the securities or loans named herein and should not be construed as investment advice. Accordingly you should not use this ...

Gift of Publicly Listed Securities Form (Dec 2015)

... I understand that I will receive a Gift-in-Kind tax receipt for these securities from Big Brothers Big Sisters of Toronto for the closing price, on the date these securities are received in BBBST’s account. These securities have been donated to BBBST without restriction and can be sold by BBBST at a ...

... I understand that I will receive a Gift-in-Kind tax receipt for these securities from Big Brothers Big Sisters of Toronto for the closing price, on the date these securities are received in BBBST’s account. These securities have been donated to BBBST without restriction and can be sold by BBBST at a ...

Default risk and spread risk

... The correlation between default risks of different borrowers is generally low (that is, low joint default frequency), though it can be significant for related companies, and smaller companies within the same domestic industry sector. ...

... The correlation between default risks of different borrowers is generally low (that is, low joint default frequency), though it can be significant for related companies, and smaller companies within the same domestic industry sector. ...

Lenders One adds two Preferred Investors and Expands Product

... services. Members of the St. Louis-based platform originated $200 billion in mortgages in 2014; collectively ranking as one of the largest retail mortgage origination entities in the U.S. Lenders One, more than 280 lender members strong, is managed by a subsidiary of Altisource Portfolio Solutions, ...

... services. Members of the St. Louis-based platform originated $200 billion in mortgages in 2014; collectively ranking as one of the largest retail mortgage origination entities in the U.S. Lenders One, more than 280 lender members strong, is managed by a subsidiary of Altisource Portfolio Solutions, ...

SEBI

... company or a public company which intends to get its securities listed on any recognised stock exchange where the Board has reasonable grounds to believe that such company has been indulging in insider trading or fraudulent and unfair trade practices relating to securities market. While exercising ...

... company or a public company which intends to get its securities listed on any recognised stock exchange where the Board has reasonable grounds to believe that such company has been indulging in insider trading or fraudulent and unfair trade practices relating to securities market. While exercising ...

risk management strategies

... This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodology. The customer gets limits commensurate with the credit available in his account. Every order is routed invariably through the CTCL system. Online MTM of top N losers are monitored and appropriate ...

... This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodology. The customer gets limits commensurate with the credit available in his account. Every order is routed invariably through the CTCL system. Online MTM of top N losers are monitored and appropriate ...

English

... Jean Pierre Cuoni, Chairman of EFG International, has announced his intention to step down as chairman by not seeking re-election at the Annual General Meeting in 2015, the twentieth anniversary year of the company he co-founded in 1995. He has taken this decision on account of his age (77). While h ...

... Jean Pierre Cuoni, Chairman of EFG International, has announced his intention to step down as chairman by not seeking re-election at the Annual General Meeting in 2015, the twentieth anniversary year of the company he co-founded in 1995. He has taken this decision on account of his age (77). While h ...

Smart Tracker 1 - BlackBee investments

... unexpected losses. Bank capital is often defined in tiers or categories with Tier 1 and Core Tier 1 being the most commonly cited and is usually the ratio of the bank’s equity capital to its total risk-weighted assets. Investment grade: Securities and Issuers that are viewed as suitable debt investm ...

... unexpected losses. Bank capital is often defined in tiers or categories with Tier 1 and Core Tier 1 being the most commonly cited and is usually the ratio of the bank’s equity capital to its total risk-weighted assets. Investment grade: Securities and Issuers that are viewed as suitable debt investm ...