* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

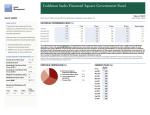

Download Daily Liquid Assets - Goldman Sachs Asset Management

Environmental, social and corporate governance wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Stock trader wikipedia , lookup

Asset-backed commercial paper program wikipedia , lookup

Quantitative easing wikipedia , lookup

Securitization wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Financial crisis wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Private equity secondary market wikipedia , lookup

Socially responsible investing wikipedia , lookup

Interbank lending market wikipedia , lookup

Private money investing wikipedia , lookup

Systemically important financial institution wikipedia , lookup

Fund governance wikipedia , lookup

Troubled Asset Relief Program wikipedia , lookup

Mutual fund wikipedia , lookup

The following report provides the percentage of the daily and weekly liquid assets for the Financial Square Money Market Funds and the VIT Money Market Fund. This is provided for shareholder information purposes only. Rule 2a-7 of the Investment Company Act of 1940 provides that money market funds may not acquire any security other than a “weekly liquid asset” unless, immediately following such purchase, at least 30% of its total assets would be invested in weekly liquid assets. In addition, the Rule provides that taxable money market funds may not acquire any security other than a “daily liquid asset” unless, immediately following such purchase, at least 10% of its total assets would be invested in daily liquid assets. The percentage of the daily and weekly liquid assets of the Funds may change from day to day. As of (Date) Daily Liquid Assets (%)1 Weekly Liquid Assets (%)2 Fund Net Assets ($MM)3 Financial Square Money Market Fund 4/12/16 35% 43% $43,584.2 Financial Square Prime Obligations Fund 4/12/16 29% 38% $15,668.4 Financial Square Government Fund 4/12/16 27% 53% $43,809.9 Financial Square Treasury Obligations Fund 4/12/16 69% 98% $16,859.4 Financial Square Treasury Solutions Fund 4/12/16 100% 100% $10,204.7 Financial Square Federal Instruments Fund 4/12/16 39% 59% $635.0 Financial Square Treasury Instruments Fund 4/12/16 100% 100% $54,660.9 VIT Money Market Fund 4/12/16 60% 65% $335.0 Investor Money Market Fund 4/12/16 37% 40% $10.0 Investor Tax-Exempt Money Market 4/12/16 90% $3,911.5 Financial Square Tax-Exempt Money Market 4/12/16 91% $3.0 Financial Square Tax-Exempt California 4/12/16 100% $166.4 Financial Square Tax-Exempt New York 4/12/16 95% $88.6 Goldman Sachs Fund 1__ _ Liquid Assets are presented as a percentage of the fund’s total assets as of 5:00 p.m. Eastern Time on the date stated. Daily Liquid Assets includes (i) cash; (ii) direct obligations of the U.S. Government; and (iii) securities that will mature or are subject to a demand feature that is exercisable and payable within one business day. Daily Liquid Assets also includes receivables from sales of portfolio securities. The requirement to maintain Daily Liquid Assets does not apply to tax exempt funds. 1Daily Liquid Assets are presented as a percentage of the fund’s total assets as of 5:00 p.m. Eastern Time on the date stated. Weekly Liquid Assets includes (i) cash; (ii) direct obligations of the U.S. Government; (iii) Government Securities issued by a person controlled or supervised by and acting as an instrumentality of the Government of the United States pursuant to authority granted by the Congress of the United States, that are issued at a discount to the principal amount to be repaid at maturity and have a remaining maturity of 60 days or less; and (iv) securities that will mature or are subject to a demand feature that is exercisable and payable within five business days. Weekly Liquid Assets also includes receivables from sales of portfolio securities. 2Weekly 3 Fund Net Assets are presented on a net basis using amortized cost valuation methodology as of 3:00 p.m. Eastern Time on the date stated. An investment in a money market portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market portfolio seeks to preserve the value of an investment at $1.00 per share, it is possible to lose money by investing in a money market portfolio. A summary prospectus, if available, or a Prospectus for the Fund containing more information may be obtained from your authorized dealer or from Goldman, Sachs & Co. by calling (retail - 1-800-526-7384) (institutional – 1-800-621-2550). Please consider a fund's objectives, risks, and charges and expenses, and read the summary prospectus, if available, and the Prospectus carefully before investing. The summary prospectus, if available, and the Prospectus contains this and other information about the Fund. Financial Square Funds(SM) is a registered service mark of Goldman, Sachs Co. Goldman, Sachs & Co. is the distributor of the Goldman Sachs Funds and the Goldman Sachs Variable Insurance Trust Funds.. ©2015 Goldman Sachs. All rights reserved. 168210.MF.MED.TMPL/8/2015 Date of first use: August 25,2015 2__ _