* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Impacts of New SEC Climate Change Disclosure Guidance on

Stern Review wikipedia , lookup

Myron Ebell wikipedia , lookup

Global warming controversy wikipedia , lookup

Mitigation of global warming in Australia wikipedia , lookup

Low-carbon economy wikipedia , lookup

Soon and Baliunas controversy wikipedia , lookup

2009 United Nations Climate Change Conference wikipedia , lookup

Michael E. Mann wikipedia , lookup

Climate change feedback wikipedia , lookup

Fred Singer wikipedia , lookup

Global warming wikipedia , lookup

Economics of climate change mitigation wikipedia , lookup

Heaven and Earth (book) wikipedia , lookup

Climatic Research Unit email controversy wikipedia , lookup

German Climate Action Plan 2050 wikipedia , lookup

General circulation model wikipedia , lookup

Effects of global warming on human health wikipedia , lookup

ExxonMobil climate change controversy wikipedia , lookup

Climate resilience wikipedia , lookup

Climate sensitivity wikipedia , lookup

Climate change denial wikipedia , lookup

Politics of global warming wikipedia , lookup

Global Energy and Water Cycle Experiment wikipedia , lookup

Climatic Research Unit documents wikipedia , lookup

Climate engineering wikipedia , lookup

Attribution of recent climate change wikipedia , lookup

Climate change in Australia wikipedia , lookup

Solar radiation management wikipedia , lookup

Effects of global warming wikipedia , lookup

Climate change adaptation wikipedia , lookup

United Nations Framework Convention on Climate Change wikipedia , lookup

Climate governance wikipedia , lookup

Climate change in Tuvalu wikipedia , lookup

Economics of global warming wikipedia , lookup

Citizens' Climate Lobby wikipedia , lookup

Climate change and agriculture wikipedia , lookup

Climate change in the United States wikipedia , lookup

Media coverage of global warming wikipedia , lookup

Scientific opinion on climate change wikipedia , lookup

Carbon Pollution Reduction Scheme wikipedia , lookup

Public opinion on global warming wikipedia , lookup

Business action on climate change wikipedia , lookup

Climate change and poverty wikipedia , lookup

Effects of global warming on humans wikipedia , lookup

Climate change, industry and society wikipedia , lookup

IPCC Fourth Assessment Report wikipedia , lookup

Surveys of scientists' views on climate change wikipedia , lookup

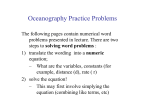

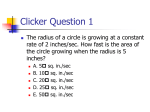

By: Rikard D. Lundberg 303-223-1232 [email protected] The SEC’s Guidance on Climate Change Disclosures Presented September 16, 2010 Copyright © 2010 Rikard Lundberg bhfs.com A Sampling from the 2010 Proxy Season 101 climate and energy-related resolutions with 88 U.S. and Canadian companies (approx. 50% increase) Majority votes: Massey Energy (adoption of quantitative goals for reducing GHG emissions) and Layne Christensen (issuance of report on environmental, social and governance (ESG) issues, including GHG emissions) Proposals testing SEC’s new guidance at ExxonMobil (withdrawn), Chevron (8.6%) and ConocoPhillips (7.5%) calling for a report on the financial risks from climate change Note: May not exclude proposal under "ordinary business operation" exclusion in Exchange Act Rule 14a-8(i)(7) if significant policy issues and sufficient nexus between proposal and registrant (Staff Legal Bulletin 14E) 2 The SEC’s New Guidance on Climate Change SEC Interpretive Release 33-9106, effective on February 8, 2010: “Commission Guidance Regarding Disclosure Related to Climate Change” Guidance on existing rules as opposed to new rules Practical impacts – a lot is changing: SEC and investors will examine filings for climate change information Original petitioners and investors will probe underreporting Competitors may disclose information to their advantage Need for in-house staff or outside consultants to monitor new legislation/regulation, assess “legislative likelihoods” and evaluate climate change impacts Need to expand disclosure controls, disclosure committees, sources of information and communication channels 3 SEC Disclosure Framework for Climate Change Sources of climate change disclosure obligations SEC guidance on climate change disclosure Regulation S-K (non-financial statement disclosures) Regulation S-X and GAAP (financial statement disclosures) SEC Release 33-5170, “Disclosures Pertaining to Matters Involving the Environment and Civil Rights” (July 19, 1971) SEC reporting framework for public companies Periodic reports on Forms 10-K and 10-Q Current reports on Form 8-K Registration statements CEO and CFO certifications under SOX 4 Climate Change Disclosures and Regulation S-K Item 101: Description of business Item 103: Legal proceedings Item 303: Management’s discussion and analysis of financial condition and results of operations Item 503(c): Risk factors Securities Act Rule 408 and Exchange Act Rule 12b-20: other material information Form 8-K (Items 1.01 and 2.06) 5 Materiality “Materiality” remains a fundamental concept for climate change disclosure Specific materiality thresholds (e.g., Item 103 of Reg S-K) Information is material if there is a “substantial likelihood that a reasonable investor would consider it important in making an investment decision” When in doubt, disclose Compliance will require substantial data gathering and analysis to make materiality determination 6 Areas of Disclosure under SEC’s Climate Change Guidance Impact of legislation and regulations, including pending legislation and regulations Impact of international accords Physical impacts of climate change Indirect consequences of regulation or business trends 7 Impact of Legislation and Regulation Increases in costs of doing business: compliance costs, energy costs (other pass-throughs), alternative production costs Increases in capital expenditures to comply with new laws or regulations Item 303 Reg S-K: assess effect of enacted climate change legislation or regulation: “known uncertainty” Reasonable likelihood of enactment Reasonable likelihood of material effect on registrant Profits from sale of allowance under cap and trade system 8 Impact of International Accords Impacts on international companies or companies sourcing internationally EU, Japan, China, Australia, New Zealand all are enacting GHG emission reduction laws Impact of renewable energy laws in other countries and impacts on competitiveness Retaliatory tariffs on U.S. products? 9 Physical Impacts of Climate Change (Direct/Indirect) Disclosable information may include both the impact and its consequences measures the registrant may take to combat those impacts Examples Altered weather patterns Rising seas, flooding Drought and water shortages Agricultural shifts Human health impacts National and International security concerns 10 Indirect Consequences of Regulation or Business Trends Risks of legal, technological, political and scientific developments regarding climate change Decreased/increased demand for and use of carbon-intensive/less carbonintensive products or services Impact on reputation (green, clean, good business) Pass-throughs from impacted suppliers Competitiveness factors are being recognized Energy Supply/Distribution Market access Responsiveness Indirect consequences can create risks and opportunities across the value chain 11 Financial Reporting Considerations Materiality under Regulation S-X traditionally has been more quantitatively focused SAB 99 – The omission or misstatement of an item in a financial report is material if, in the light of surrounding circumstances, the magnitude of the item is such that it is probable that the judgment of a reasonable person relying upon the report would have been changed or influenced by the inclusion or correction of the item SFAS No. 5 – If it is probable that a loss has been incurred and the amount of the loss can be reasonably estimated, the loss contingency must be accrued by a charge to income and the nature of the contingency must be described in a footnote to the financial statements 12 Internal Disclosure Controls and Procedures Management must: monitor legislative/regulatory developments collect data analyze data make materiality determinations/quantify uncertainties disclose Speak with one voice in overlapping fora Criminal liability for certifying officers for false certifications 13 Internal Review Protocols for Climate Change Avoid boilerplate Use plain English Be consistent in reporting Coordinate accounting, legal and valuation disciplines Establish/expand disclosure committees Hire inside climate change experts or engage outside experts to monitor proposed legislation, assess potential enactment Consider relevance for privately held companies 14 Examples of Sources for Guidance on Climate Change Disclosure SEC filings made by utility, oil and gas, insurance or other companies already reporting American Society for Testing and Materials (ASTM) Standard: “Guide for Financial Disclosures Attributed to Climate Change” Climate Disclosure Standards Board (CDSB) Corporate responsibility/sustainability reporting National Association of Insurance Commissioners (NAIC) mandatory climate risk disclosure for insurance companies with annual premiums over $500 million EPA GHG inventory beginning in 2011 for 10,000 facilities that emit more than 25,000 metric tons of GHG annually 15 Likely Responses to Climate Change Reporting Ordinary course review by SEC staff, with new emphasis Outside review/critique by NGOs and investors, etc. Increased volume of shareholder proposals More “green” proxy battles More detailed, refined disclosures 16 Climate Change Analysis and Disclosures for Private Companies Private companies may choose to follow disclosure practices of public companies In preparation for IPOs As a result of developing best practices in offering documents To become more attractive to a public company acquiror For competitive, social or other reasons Pressure from the public, investors and regulators 17 Climate Change Disclosure and Enterprise Valuation Climate change has reportable risks based on customer demand, competition, seasonality and regulatory compliance expenditures Value impacts can be measured Impact of legislation and regulation – green energy vs. power generation sectors Physical impacts of climate change – agriculture, forestry and ski industries Seasonality risks impacts captured within market prices Impact of climate change risks on corporate decisions 18 Conclusions Rejecting the SEC’s guidance will buck a significant disclosure trend Compliance will require substantial data gathering and analysis to make materiality determinations Companies should pay attention to the composition and procedures of disclosure committees Companies should consider retention of outside advisors for climate change impact analysis and disclosures Companies operating or sourcing internationally may need outside assistance to analyze impact of international or foreign climate change regulations Companies’ disclosures in SEC documents should be consistent with all other public disclosures Disclosure of carbon footprint is not mandated 19 Contact Information Rikard Lundberg Brownstein Hyatt Farber Schreck, LLP 410 Seventeenth Street, Suite 2200 Denver, CO 80202 Ph: 303-223-1232 Fax: 303-223-8032 Email: [email protected] Brownstein Hyatt Farber Schreck, LLP 20