* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Diapositive 1 - Goldman Sachs

International investment agreement wikipedia , lookup

Stock trader wikipedia , lookup

Short (finance) wikipedia , lookup

Interbank lending market wikipedia , lookup

Corporate venture capital wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Rate of return wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Private equity wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Early history of private equity wikipedia , lookup

Money market fund wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

Private equity secondary market wikipedia , lookup

Socially responsible investing wikipedia , lookup

Fund governance wikipedia , lookup

Mutual fund wikipedia , lookup

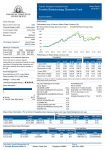

root\Projects\IMD\LN\GSAM\Marketing\eFunds\eFunds Site Content\Fund Information\MFUs\2015\2015 04\RHBIM\mfu_usbleq_en_my.ppt A sub-fund of Goldman Sachs Funds, SICAV Performance (%) Investment Profile Investor objective Capital appreciation with no need for income. Position in your overall investment portfolio* The fund can form a core holding in your portfolio. The fund is designed for: The fund is designed for investors seeking diversified US equity exposure. Fund (USD) Index Sector Allocation (%) 2013 32.5 31.5 2014 12.4 13.0 2015 -3.0 0.7 11.6 12.7 25.3 24.6 12.2 14.8 -14.7 -6.8 21.6 24.2 8.3 28.7 10.7 -9.5 22.8 1 3 2 4 3 Fund Data No. of holdings Calendar Year Performance (%) 2012 15.2 15.2 Performance Summary (%) 28-Feb12 - 28-Feb-13- 28-Feb-14 - 28-Feb-15- 29-Feb-1628-Feb-13 28-Feb-14 28-Feb-15 29-Feb-16 28-Feb-17 Fund (USD) Index Morningstar Sector av.(1) Morningstar Quartile(1) 2016 2.1 11.2 54 40 12.29 47 % in top 10 Historical Volatility Portfolio - 3 yrs Turnover ratio (%) Historical Tracking error - 3 yrs 4.38 -4.79 Excess returns - 3 yrs R 2- 3 yrs Beta - 3 yrs Transaction Costs (%) Commissions (%) Other Costs (%) Swing Pricing (%) Subscription (%) 0.88 1.13 0.05 0.05 0.00 0.06 0.06 Redemption (%) Initial Sales Charge: up to (%) Performance Fee (%) Total Expense Ratio (TER) (%)(2) Management Fee (%) Distribution Fee (%) 5.50 N/A 1.69 1.50 0.00 Fund Facts Cumulative Base Shares Distribution(3) S&P 500 Net Return (USD) (4) US Large-Cap Blend EquitySector av. (1) Quartile Position in Sector (1) OCS (Acc.) (EUR-Hdgd)(3) S&P 500 (NTR, 100% Hgd to EUR) (4) Base Shares (Acc.)(3) LU0234587219 ISIN - OCS (Acc.) (EUR-Hdgd) ISIN - Base Shares (Acc.) Bloomberg Ticker - Base Shares Distribution Bloomberg Ticker - OCS (Acc.) (EUR-Hdgd) Bloomberg Ticker - Base Shares (Acc.) Dividend Distribution Frequency Dealing and valuation LU0433926036 LU0234588027 GSUSBBA LX GSUSEEH LX GSUBEBA LX Annually daily 30 November S&P 500 Net Return (USD) T+3 Since Launch 99.80 119.41 82.68 1 119.60 172.39 99.40 1 Mth 4.28 3.90 3.52 1 4.22 3.88 4.29 Annualised 3 Mths 8.06 7.87 7.24 1 7.65 7.45 8.02 Financial Information YTD 6.11 5.83 5.54 1 5.83 5.59 6.06 1 Yr 21.61 24.17 22.80 3 20.07 22.33 21.59 3 Yrs 5.14 9.93 7.63 4 4.79 9.13 5.15 5 Yrs 10.20 13.27 11.15 3 9.73 12.45 10.19 10 Yrs 5.88 6.92 5.28 2 5.86 Performance (Indexed) Net Asset Value (NAV ) - Base Shares Distribution Net Asset Value (NAV) - OCS (Acc.) (EUR-Hdgd) USD 19.98 EUR 21.96 Net Asset Value (NAV) - Base Shares (Acc.) Total Net Assets (m) USD 19.94 USD 934 Fund Characteristics Currency - Base Shares Distribution Currency - OCS (Acc.) (EUR-Hdgd) Currency - Base Shares (Acc.) Inception Date - Base Shares Distribution Inception Date - OCS (Acc.) (EUR-Hdgd) Inception Date - Base Shares (Acc.) Fund Domicile USD EUR USD 03-Feb-06 17-Jun-09 03-Feb-06 Luxembourg This is an actively managed fund that is not designed to track its reference benchmark. Therefore the performance of the fund and the performance of its reference benchmark may diverge. In addition stated reference benchmark returns do not reflect any management or other charges to the fund, whereas stated returns of the fund do. Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of capital may occur. Top 10 Holdings(5) Security ISIN - Base Shares Distribution Reporting year end Reference Benchmark Settlement 0217 Overall Morningstar RatingTM ★★★ Goldman Sachs US Equity Portfolio Apple Inc Wells Fargo & Co Alphabet Inc Bank of America Corp Costco Wholesale Corp NIKE Inc General Electric Co Mastercard Inc Amazon.com Inc JPMorgan Chase & Co % 6.2 5.0 4.5 4.0 3.6 Country United States United States United States United States United States Activity Technology Hardware & Equipment Banks Software & Services Banks Food & Staples Retailing 3.6 United States Consumer Durables & Apparel 3.5 3.5 3.4 2.9 United States United States United States United States Capital Goods Software & Services Retailing Banks Please see Additional Notes. All performance and holdings data as at 28-February-17. * We identify two broad categories of funds to help investors think about how to construct their overall investment portfolio. We describe the following as “Core”: (A) Equity funds with a global investment remit or those mainly focused on US and European markets, given the size and transparency of these markets. (B) Fixed income funds with a global investment remit or those mainly focused on US, European and UK markets and invest predominantly in investment grade debt, including government. (C) Multi asset funds with a multi asset benchmark. All other funds we describe as “Complements”. Both Core and Complement funds can vary in risk level and those terms are not meant to indicate the risk level of the funds. For regionally focussed investment portfolios we understand that the categorisation may be different from the perspective of different investors. Consult your financial adviser before investing to help determine if an investment in this fund and the amount of the investment would be suitable. Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of capital may occur. (1) The Morningstar sector average figures are calculated using all open funds available in the universe at the indicated time period. The number of funds in a Morningstar sector varies over time as new funds are launched and funds close. Source: Morningstar ©2017 Morningstar, Inc. All Rights Reserved. (2) The total expense ratio is based on fees and expenses during the month. The Ongoing Charges (OC) details can be found in the Key Investor Information Document. . (3) Fund returns are shown net of applicable ongoing fees within the portfolio, with dividends re-invested using the ex-dividend NAV. These returns are for comparison of performance against specified index. As the investor may be liable to other fees, charges and taxes, they are not meant to provide a measure of actual return to investors. The performance data do not take account of the commissions and costs incurred on the issue and redemption of shares. (4) The S&P 500 Net Return Index, is quoted at month-end with income reinvested and, in contrast to the Portfolio, shown without the deduction of any expenses. (5) Portfolio holdings may not represent current, future investments or all of the portfolio's holdings. Future portfolio holdings may not be profitable.For RHBIM’s Use Only and Not For Distribution To The General Public. Please note that Goldman Sachs Asset Management does not maintain any licenses, authorizations or registrations in Asia ex Japan, except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore, Malaysia, Korea, and India Goldman Sachs (Malaysia) Sdn Bhd is licensed in Malaysia to undertake the regulated activity of fund management. Goldman Sachs has no GSAM funds registered in Malaysia and securities may not be offered or sold in Malaysia unless it comes within the ambit of its licensed activities in Malaysia.