Management Fee Evaluation

... “Trust”), each of whom serves as an “independent” Trustee (the “Board” or the “Trustees”), of its intent to seek a strategic combination of its advisory business with Henderson Group plc (“Henderson”). The Board met with the Chief Executive Officer of Janus, who outlined the proposed combination and ...

... “Trust”), each of whom serves as an “independent” Trustee (the “Board” or the “Trustees”), of its intent to seek a strategic combination of its advisory business with Henderson Group plc (“Henderson”). The Board met with the Chief Executive Officer of Janus, who outlined the proposed combination and ...

HSBC Jintrust Large Cap Equity Securities Investment Fund

... resources and with fundamental analysis, etc. 3. Equity investment strategy The Fund focuses on analysing large cap companies’ unique competitive advantages. The Fund Manager conducts a comprehensive value and growth analysis on the primarily selected stocks and further combines the research results ...

... resources and with fundamental analysis, etc. 3. Equity investment strategy The Fund focuses on analysing large cap companies’ unique competitive advantages. The Fund Manager conducts a comprehensive value and growth analysis on the primarily selected stocks and further combines the research results ...

Retirement Date Fund

... When the market goes down, I see it as a buying opportunity I’m comfortable building and maintaining my portfolio I don’t get emotional about investing ...

... When the market goes down, I see it as a buying opportunity I’m comfortable building and maintaining my portfolio I don’t get emotional about investing ...

Deactivating Active Share

... In general, if the universe of mutual fund managers holds the market portfolio, we know that the market clears: before fees, every dollar of outperformance must be offset by a dollar of underperformance. Low Active Share investors who simply track the market (“Closet Indexers”) should match market r ...

... In general, if the universe of mutual fund managers holds the market portfolio, we know that the market clears: before fees, every dollar of outperformance must be offset by a dollar of underperformance. Low Active Share investors who simply track the market (“Closet Indexers”) should match market r ...

Venture Capita Report

... • Historically, specialists have had a focus on early stage investing but recent years have seen a shift towards the later stages as a means of mitigating risk. The study found that during 2003 and 2004 more than a third of specialists had been investing predominantly at the growth capital stage, m ...

... • Historically, specialists have had a focus on early stage investing but recent years have seen a shift towards the later stages as a means of mitigating risk. The study found that during 2003 and 2004 more than a third of specialists had been investing predominantly at the growth capital stage, m ...

Hedging With Futures Contract

... been criticized for not taking into account the expected return which is inconsistent with the mean-variance framework. Since the selection of a hedge ratio is dependent on the hedgers’ objective in the hedging position, this will be different for various participants in the carbon market. For exam ...

... been criticized for not taking into account the expected return which is inconsistent with the mean-variance framework. Since the selection of a hedge ratio is dependent on the hedgers’ objective in the hedging position, this will be different for various participants in the carbon market. For exam ...

NBER WORKING PAPER SERIES INDIVIDUAL INVESTOR MUTUAL-FUND FLOWS Zoran Ivkovich Scott Weisbenner

... trades investors in the sample made over the six-year period. They are second only to common stocks (which account for around two-thirds of the overall value of the investments in the sample). A number of households have multiple accounts (such as one taxable and one-tax-deferred account); the medi ...

... trades investors in the sample made over the six-year period. They are second only to common stocks (which account for around two-thirds of the overall value of the investments in the sample). A number of households have multiple accounts (such as one taxable and one-tax-deferred account); the medi ...

Investor Preferences and Demand for Active Management

... active management, as proxied by the Active Share measure (Cremers and Petajisto, 2009). Since more active funds should be more appealing to investors seeking upside potential or downside protection given that they are more likely to exhibit those distributional differences in performance between ac ...

... active management, as proxied by the Active Share measure (Cremers and Petajisto, 2009). Since more active funds should be more appealing to investors seeking upside potential or downside protection given that they are more likely to exhibit those distributional differences in performance between ac ...

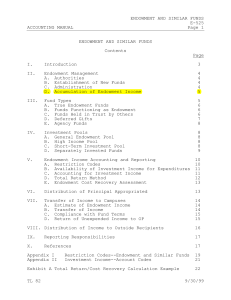

Endowment and Similar Funds

... designated revenue accounts (J-239590-3XXXX). Participation is based on a daily weighted average for the month--which is ascertained from the STIP history file. The total STIP income available for the month is distributed in proportion to the weighted average. Endowment income balances, however, par ...

... designated revenue accounts (J-239590-3XXXX). Participation is based on a daily weighted average for the month--which is ascertained from the STIP history file. The total STIP income available for the month is distributed in proportion to the weighted average. Endowment income balances, however, par ...

Understanding Investor Preferences for Mutual Fund Information

... » On average, investors consider nine discrete pieces of information about a fund before purchasing shares. Nearly three-quarters of recent fund investors wanted to know about the fund’s fees and expenses prior to purchasing shares in the fund, and more than two-thirds reviewed or asked questions ab ...

... » On average, investors consider nine discrete pieces of information about a fund before purchasing shares. Nearly three-quarters of recent fund investors wanted to know about the fund’s fees and expenses prior to purchasing shares in the fund, and more than two-thirds reviewed or asked questions ab ...

Portfolio Performance, Discount Dynamics, and the Turnover of Closed-End Fund Mangers

... after replacement. Second, we document an interesting relation between the discount return (the return to closed-end fund investors that is due to changes in the discount) and manager turnover, especially for the U.S. domestic closed-end funds. While the discount return, lagged two years, helps to p ...

... after replacement. Second, we document an interesting relation between the discount return (the return to closed-end fund investors that is due to changes in the discount) and manager turnover, especially for the U.S. domestic closed-end funds. While the discount return, lagged two years, helps to p ...

Form AUT – PFS Public Fund supplement

... before carrying out a Fund Manager’s instructions, that those instructions comply with the requirements of CIR 7.1.3. PF16. Please advise of the arrangements that the Trustee / Custody Provider will implement to ensure that the Fund’s unitholder register is maintained in accordance with CIR 8.7. and ...

... before carrying out a Fund Manager’s instructions, that those instructions comply with the requirements of CIR 7.1.3. PF16. Please advise of the arrangements that the Trustee / Custody Provider will implement to ensure that the Fund’s unitholder register is maintained in accordance with CIR 8.7. and ...

Costs of Eliminating Discretionary Broker Voting on Uncontested

... to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for example, have a duty of care requirement to monitor corporate actions and vote client proxies in many instances. Fiduciaries to private pension plans—typically plan sponsors—are subject ...

... to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for example, have a duty of care requirement to monitor corporate actions and vote client proxies in many instances. Fiduciaries to private pension plans—typically plan sponsors—are subject ...

- Columbia Business School

... of sophisticated mutual fund investors in the market. Mutual fund flows, on average, have been considered to proxy for investor sentiments. Teo and Woo (2004) and Frazzini and Lamont (2008) show the “dumb money” effect where investors’ reallocation of wealth across different mutual funds reduce the ...

... of sophisticated mutual fund investors in the market. Mutual fund flows, on average, have been considered to proxy for investor sentiments. Teo and Woo (2004) and Frazzini and Lamont (2008) show the “dumb money” effect where investors’ reallocation of wealth across different mutual funds reduce the ...

A Cross-sectional Analysis Of Malaysian Unit Trust Fund Expense

... and the presence of a 12b-1 fees before investing. Their findings show that larger and more mature funds have lower expense ratio. On average, load funds and 12b-1 funds have higher expense ratios than no-load and non-12b-1 funds. Additionally, funds that belong to a large fund family have lower exp ...

... and the presence of a 12b-1 fees before investing. Their findings show that larger and more mature funds have lower expense ratio. On average, load funds and 12b-1 funds have higher expense ratios than no-load and non-12b-1 funds. Additionally, funds that belong to a large fund family have lower exp ...

Foundation Business Policy

... A minimum commitment of $10,000 is required to establish an endowed fund. A new nonendowed fund should only be established for a unique purpose and should be expected to be used for a period of not less than two years. To reduce the number of Foundation funds to be administered, new gifts can often ...

... A minimum commitment of $10,000 is required to establish an endowed fund. A new nonendowed fund should only be established for a unique purpose and should be expected to be used for a period of not less than two years. To reduce the number of Foundation funds to be administered, new gifts can often ...

Fund Summary Sheet TMLS Singapore Cash Fund

... not necessarily indicative of the future performance. Investment in the Underlying Fund is generally designed to produce returns over the long-term and is not suitable for short-term speculation. Investors should not expect to obtain short-term gains from such investment although money market Funds ...

... not necessarily indicative of the future performance. Investment in the Underlying Fund is generally designed to produce returns over the long-term and is not suitable for short-term speculation. Investors should not expect to obtain short-term gains from such investment although money market Funds ...

Implications of Behavioural Economics for Mandatory

... were invested in stocks, while in schemes offering a majority of fixed income funds most saving were invested in interest-bearing securities. Furthermore, they find a positive relationship at the plan level between the fraction of equity funds offered by the plan and the fraction of individual portf ...

... were invested in stocks, while in schemes offering a majority of fixed income funds most saving were invested in interest-bearing securities. Furthermore, they find a positive relationship at the plan level between the fraction of equity funds offered by the plan and the fraction of individual portf ...

Revenue Sharing Fund Families

... provided. We process transactions with most fund families on an omnibus basis, which means we consolidate our clients’ trades into one daily trade with the fund, and therefore maintain all pertinent individual shareholder information for the fund. Trading in this manner requires that we maintain the ...

... provided. We process transactions with most fund families on an omnibus basis, which means we consolidate our clients’ trades into one daily trade with the fund, and therefore maintain all pertinent individual shareholder information for the fund. Trading in this manner requires that we maintain the ...

Sound Practice Guidelines

... b) Subscription, transfer and redemption procedures. Cut off times for redemption notice and deadlines for receipt of subscription application forms and monies should be clearly stated. c) Anti Money laundering (AML), ‘Know Your Customer’ (KYC) and all other regulatory issues. AML and KYC procedure ...

... b) Subscription, transfer and redemption procedures. Cut off times for redemption notice and deadlines for receipt of subscription application forms and monies should be clearly stated. c) Anti Money laundering (AML), ‘Know Your Customer’ (KYC) and all other regulatory issues. AML and KYC procedure ...

MFSA Guidance Note for Shariah Compliant Funds

... standards in the management of its assets. Members of the Shariah Advisory Board are to be independent from the Manager. The fund may opt to appoint a legal entity as a Shariah Advisor, which would in turn appoint a Shariah Advisory Board to carry out the above functions, and which may replace, at i ...

... standards in the management of its assets. Members of the Shariah Advisory Board are to be independent from the Manager. The fund may opt to appoint a legal entity as a Shariah Advisor, which would in turn appoint a Shariah Advisory Board to carry out the above functions, and which may replace, at i ...

Trustee Corporations Association of Australia

... Notwithstanding doubts being raised about auditors’ integrity and competence as a result of developments such as HIH and Enron, we would not suggest that financial auditors lose the right to undertake this work. However, we submit that the compliance monitoring role for superannuation funds should n ...

... Notwithstanding doubts being raised about auditors’ integrity and competence as a result of developments such as HIH and Enron, we would not suggest that financial auditors lose the right to undertake this work. However, we submit that the compliance monitoring role for superannuation funds should n ...

Mutual fund

... Discuss types of funds available to investors and the different kinds of investors services offered by mutual funds and exchange traded funds. Gain an understanding of the variables that should be considered when selecting funds for investment purposes. Identify the sources of return and calculate r ...

... Discuss types of funds available to investors and the different kinds of investors services offered by mutual funds and exchange traded funds. Gain an understanding of the variables that should be considered when selecting funds for investment purposes. Identify the sources of return and calculate r ...

Financial Accounting and Accounting Standards

... Government Fund-Based Reporting Governments are required only to report the major funds in separate columns, but have flexibility to report more funds separately if desired. Individual governmental funds and proprietary funds are major funds if the total assets, liabilities, revenues, or expenditur ...

... Government Fund-Based Reporting Governments are required only to report the major funds in separate columns, but have flexibility to report more funds separately if desired. Individual governmental funds and proprietary funds are major funds if the total assets, liabilities, revenues, or expenditur ...