Filmifunding Some numbers reflect the bottom line. Some

... banking risk based model rather than funds investment a production corporate model. We attempt will be to create a scenario that will invest in projects through specific offers viewers more choice of selection special purpose vehicles (spvs) which and looks beyond the traditional 'Star' system," exp ...

... banking risk based model rather than funds investment a production corporate model. We attempt will be to create a scenario that will invest in projects through specific offers viewers more choice of selection special purpose vehicles (spvs) which and looks beyond the traditional 'Star' system," exp ...

how hedge funds are structured

... vehicles. Hedge funds typically charge investors a management fee, usually a percentage of the assets managed. Most hedge funds also charge a performance fee of anywhere between 10-20 percent of fund profits. Managers only collect this fee when the fund is profitable, exceeding the fund's previous h ...

... vehicles. Hedge funds typically charge investors a management fee, usually a percentage of the assets managed. Most hedge funds also charge a performance fee of anywhere between 10-20 percent of fund profits. Managers only collect this fee when the fund is profitable, exceeding the fund's previous h ...

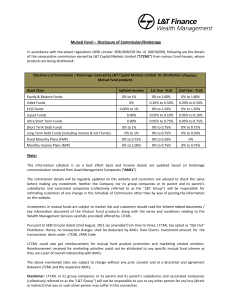

Mutual Fund – Disclosure of Commission/Brokerage Note:

... The commission details will be regularly updated on this website and customers are advised to check the same before making any investment. Neither the Company nor its group companies or its parent and its parent’s subsidiaries and associated companies (collectively referred to as the "L&T Group”) wi ...

... The commission details will be regularly updated on this website and customers are advised to check the same before making any investment. Neither the Company nor its group companies or its parent and its parent’s subsidiaries and associated companies (collectively referred to as the "L&T Group”) wi ...

download

... Confusion reigned supreme this RRSP season. Canadians rushed to top up their contributions before the March 3 deadline, but now lay awake wondering what to do with all the new cash in their investment accounts. The markets are depressed, the US economy seems headed for a double-dip recession, and th ...

... Confusion reigned supreme this RRSP season. Canadians rushed to top up their contributions before the March 3 deadline, but now lay awake wondering what to do with all the new cash in their investment accounts. The markets are depressed, the US economy seems headed for a double-dip recession, and th ...

Declaration of hedge fund business as a Collective Investment

... of which members of the public are invited or permitted to invest money or other assets and which uses any strategy or takes any position which could result in the arrangement incurring losses greater than its aggregate market value at any point in time, and which strategies or positions include but ...

... of which members of the public are invited or permitted to invest money or other assets and which uses any strategy or takes any position which could result in the arrangement incurring losses greater than its aggregate market value at any point in time, and which strategies or positions include but ...

Hedge Fund Vs Mutual Fund

... already rich. Hedge funds are open only to 'accredited investors' defined as those with net worth of more than $1.5 million, or income in excess of $200,000 in each of the past two years. The good ones demand $1 million or more of investment. ...

... already rich. Hedge funds are open only to 'accredited investors' defined as those with net worth of more than $1.5 million, or income in excess of $200,000 in each of the past two years. The good ones demand $1 million or more of investment. ...

PDF - 50 South Capital

... Designed to replicate the exposure and achieve returns of a balanced portfolio with less volatility. The solution is typically blended across equities, fixed income, foreign exchange and commodities. ...

... Designed to replicate the exposure and achieve returns of a balanced portfolio with less volatility. The solution is typically blended across equities, fixed income, foreign exchange and commodities. ...

Gravitational waves

... us with a sheet to fill out that isn’t relevant to our industry. These are things that we, as an alternatives industry, need to overcome, and efficiently. It’s difficult when different long-only investors have different reporting requirements that they must report to their regulator,” said D’Onofrio ...

... us with a sheet to fill out that isn’t relevant to our industry. These are things that we, as an alternatives industry, need to overcome, and efficiently. It’s difficult when different long-only investors have different reporting requirements that they must report to their regulator,” said D’Onofrio ...

Ikarian Capital Graduate/Post

... -Above all factors, we are looking for motivated candidates with a strong work ethic that are hungry and interested in learning what it takes for a hedge fund to succeed. Opportunity The bottom line is that this opportunity will allow the candidates to learn how to use their scientific backgrounds t ...

... -Above all factors, we are looking for motivated candidates with a strong work ethic that are hungry and interested in learning what it takes for a hedge fund to succeed. Opportunity The bottom line is that this opportunity will allow the candidates to learn how to use their scientific backgrounds t ...

Are hedge funds a suitable investment for taxable investors?

... taxable gain will incorporate multiple years of unrealized appreciation, creating an even larger tax burden. The hedge fund industry’s growth is reflected in the current 10,000 individual hedge funds, with more than $2.7 trillion dollars in assets under management. High net worth individuals, or tax ...

... taxable gain will incorporate multiple years of unrealized appreciation, creating an even larger tax burden. The hedge fund industry’s growth is reflected in the current 10,000 individual hedge funds, with more than $2.7 trillion dollars in assets under management. High net worth individuals, or tax ...

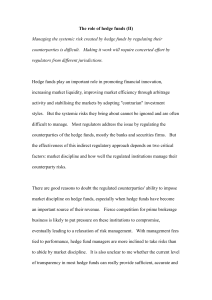

The role of hedge funds (II)

... manage to accumulate highly concentrated positions in the energy futures markets without the market knowing it suggests that counterparty-risk management may not be working as well as most regulators would have expected. The incident also shows how the opaqueness of hedge funds can prevent early det ...

... manage to accumulate highly concentrated positions in the energy futures markets without the market knowing it suggests that counterparty-risk management may not be working as well as most regulators would have expected. The incident also shows how the opaqueness of hedge funds can prevent early det ...

Using Low Volatility Hedge Funds as a Complement to Fixed

... contrast and analyze the impact in regards to their overall portfolio and cash flow requirements. ...

... contrast and analyze the impact in regards to their overall portfolio and cash flow requirements. ...

File

... institutional investor of the year, distributors of the year, asset manager of the year and asset manager of the year – alternatives. Summaries of the prizes will be published in the June edition of AsianInvestor magazine. Congratulations to the winners. Hedge fund awards Asia-Pacific CAI Global Fun ...

... institutional investor of the year, distributors of the year, asset manager of the year and asset manager of the year – alternatives. Summaries of the prizes will be published in the June edition of AsianInvestor magazine. Congratulations to the winners. Hedge fund awards Asia-Pacific CAI Global Fun ...

How can Hedge Funds take advantage of inefficiencies and

... In the last financial crisis, some of these funds bet against the housing market through the credit default swap market. While these complex derivatives did the job in this situation, having instruments that allow an investor to directly express an opinion about either residential or commercial real ...

... In the last financial crisis, some of these funds bet against the housing market through the credit default swap market. While these complex derivatives did the job in this situation, having instruments that allow an investor to directly express an opinion about either residential or commercial real ...

Keeping Up with the (Paul Tudor) Joneses: a Hedge

... FIRST OF (W)ALL (OF TEXT) Hedge funds are private partnerships in which the manager or general partner (GP) has a significant personal stake in the fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverag ...

... FIRST OF (W)ALL (OF TEXT) Hedge funds are private partnerships in which the manager or general partner (GP) has a significant personal stake in the fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverag ...

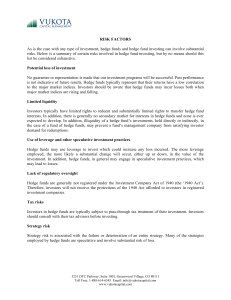

RISK FACTORS As is the case with any type of investment, hedge

... expected to develop. In addition, illiquidity of a hedge fund’s investments, held directly or indirectly, in the case of a fund of hedge funds, may prevent a fund’s management company from satisfying investor demand for redemptions. Use of leverage and other speculative investment practices Hedge fu ...

... expected to develop. In addition, illiquidity of a hedge fund’s investments, held directly or indirectly, in the case of a fund of hedge funds, may prevent a fund’s management company from satisfying investor demand for redemptions. Use of leverage and other speculative investment practices Hedge fu ...