MFS MERIDIAN ® FUNDS ― GLOBAL - fund

... required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to invest. OBJECTIVE AND INVESTMENT POLICY Objective The fund’s investment objective is to seek total return, measured in US dollar ...

... required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to invest. OBJECTIVE AND INVESTMENT POLICY Objective The fund’s investment objective is to seek total return, measured in US dollar ...

Chapter 18

... Investment funds allow investors to pool their resources under professional managers Closed-end a fixed number of shares, and purchasers and sellers of shares must deal with each other (via brokers) Open-end fund are more prevalent • Ready to sell new shares or buy back old shares ...

... Investment funds allow investors to pool their resources under professional managers Closed-end a fixed number of shares, and purchasers and sellers of shares must deal with each other (via brokers) Open-end fund are more prevalent • Ready to sell new shares or buy back old shares ...

What does teR mean and What is it foR?

... Investors have a good understanding as to the cost structure of their investments. TER specifically discloses performance fees. Investors are able to compare differently structured investment solutions, e.g. costs related to investing in funds of funds versus investing in single or multi-manag ...

... Investors have a good understanding as to the cost structure of their investments. TER specifically discloses performance fees. Investors are able to compare differently structured investment solutions, e.g. costs related to investing in funds of funds versus investing in single or multi-manag ...

MS Word - Securities Commission Malaysia

... 10. For item (3) of Section C, please state clearly and concisely the product differentiation / distinction between the proposed fund and the applicant’s existing funds. The information submitted must allow the SC to ascertain the difference between the funds. If the space provided is insufficient f ...

... 10. For item (3) of Section C, please state clearly and concisely the product differentiation / distinction between the proposed fund and the applicant’s existing funds. The information submitted must allow the SC to ascertain the difference between the funds. If the space provided is insufficient f ...

Investment Fund Overview

... Seeks to track the performance of a benchmark index that measures the investment return of stocks of companies located in developed and emerging markets around the world. The fund employs a “passive management” – or indexing-investment approach designed to track the performance of the FTSE All-World ...

... Seeks to track the performance of a benchmark index that measures the investment return of stocks of companies located in developed and emerging markets around the world. The fund employs a “passive management” – or indexing-investment approach designed to track the performance of the FTSE All-World ...

register your private contractual investment fund in armenia

... The fund manager of a PCF can be any legal entity chosen by investors. If the PCF is set up under the Remote regime, the fund manager can be any corporate entity of the investors choosing, whether established in Armenia or in a third country. There are no restrictions on the location of the Central ...

... The fund manager of a PCF can be any legal entity chosen by investors. If the PCF is set up under the Remote regime, the fund manager can be any corporate entity of the investors choosing, whether established in Armenia or in a third country. There are no restrictions on the location of the Central ...

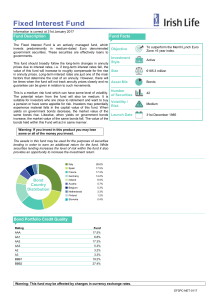

Fixed Interest Fund - Irish Life Corporate Business

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

Goldman Sachs Absolute Return Tracker Portfolio

... on US and European markets, given the size and transparency of these markets. (B) Fixed income funds with a global investment remit or those mainly focused on US, European and UK markets and invest predominantly in investment grade debt, including government. (C) Multi asset funds with a multi asset ...

... on US and European markets, given the size and transparency of these markets. (B) Fixed income funds with a global investment remit or those mainly focused on US, European and UK markets and invest predominantly in investment grade debt, including government. (C) Multi asset funds with a multi asset ...

Key Investor Information Document

... This document provides you with key investor information about this fund (the “Fund”). It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whe ...

... This document provides you with key investor information about this fund (the “Fund”). It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whe ...

MFS MERIDIAN ® FUNDS ― EMERGING MARKETS DEBT LOCAL

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

Key investor information.

... category does not mean a risk-free investment. Equity funds in general are more volatile than bond funds. Equity funds with a focus on small and midcap listed companies are more volatile as price movements of shares within this category tend to have a larger impact on the value of the fund. ...

... category does not mean a risk-free investment. Equity funds in general are more volatile than bond funds. Equity funds with a focus on small and midcap listed companies are more volatile as price movements of shares within this category tend to have a larger impact on the value of the fund. ...

ASB Investment Funds World Fixed Interest Fund Update

... See the Product Disclosure Statement (PDS) for more information about the risks associated with investing in this fund. The risk indicator may not be a reliable indicator of the risk or returns that a fund is likely to experience in the future. For example, the risk indicator may be different if it ...

... See the Product Disclosure Statement (PDS) for more information about the risks associated with investing in this fund. The risk indicator may not be a reliable indicator of the risk or returns that a fund is likely to experience in the future. For example, the risk indicator may be different if it ...

Hedge Fund Directive clashes with Irish regulations If the European

... assets acquired by the AIF. The registered office of the valuation agent must be in the EU, although the Commission intends to make a determination where the valuation rules and standards used by a valuation agent located in a third country are equivalent to those in the EU. Unfortunately, we cannot ...

... assets acquired by the AIF. The registered office of the valuation agent must be in the EU, although the Commission intends to make a determination where the valuation rules and standards used by a valuation agent located in a third country are equivalent to those in the EU. Unfortunately, we cannot ...

Key Investor Information AMP Capital Global Listed Infrastructure

... > Luxembourg’s taxation regime may have an impact on the personal tax position of shareholders. > MDO Management Company S.A. may be held liable solely on the basis of any statement contained in this document that is misleading, inaccurate or inconsistent with the relevant parts of the Fund Prospect ...

... > Luxembourg’s taxation regime may have an impact on the personal tax position of shareholders. > MDO Management Company S.A. may be held liable solely on the basis of any statement contained in this document that is misleading, inaccurate or inconsistent with the relevant parts of the Fund Prospect ...

Mercer Low Volatility Equity Fund M3 GBP

... The investment objective of the Fund is to seek long-term growth of capital and income. The Fund will primarily invest in a diversified range of global shares and equity interests, either directly, or it can invest up to 100% of its assets in other funds ('Underlying Funds') which are consistent wit ...

... The investment objective of the Fund is to seek long-term growth of capital and income. The Fund will primarily invest in a diversified range of global shares and equity interests, either directly, or it can invest up to 100% of its assets in other funds ('Underlying Funds') which are consistent wit ...

Five-Year Ranking: Pimco Leads 10

... its $2.4 trillion under management. “We don’t have that concern because we’re in both spaces.” While our ranking excludes some notable SPDR funds—including the original, the $225 billion SPDR S&P 500 (SPY)—the firm’s strength across everything from diversified ETFs to regional funds buoyed its overa ...

... its $2.4 trillion under management. “We don’t have that concern because we’re in both spaces.” While our ranking excludes some notable SPDR funds—including the original, the $225 billion SPDR S&P 500 (SPY)—the firm’s strength across everything from diversified ETFs to regional funds buoyed its overa ...

Absa Multi Managed Bond Fund - Absa | Wealth And Investment

... the benefit of the investor. AFM has a right to close the fund to new investors in order to manage it more efficiently in accordance with its mandate. The investor understands that the legal and tax environment is continually changing, and that AFM cannot be held responsible for any changes to the l ...

... the benefit of the investor. AFM has a right to close the fund to new investors in order to manage it more efficiently in accordance with its mandate. The investor understands that the legal and tax environment is continually changing, and that AFM cannot be held responsible for any changes to the l ...

CIT Investment Discl..

... invests in equities, the principal risk is stock market risk, that is, the risk that the price of the stocks in which the Fund invests may fluctuate or fall in response to economic events or trends. The prices of bonds in which a Fund may invest may fall because of a rise in interest rates. Investme ...

... invests in equities, the principal risk is stock market risk, that is, the risk that the price of the stocks in which the Fund invests may fluctuate or fall in response to economic events or trends. The prices of bonds in which a Fund may invest may fall because of a rise in interest rates. Investme ...

JPMorgan Large Cap Growth Fund

... daily net assets. This waiver is in effect through 10/31/2017, at which time the adviser and/or its affiliates will determine whether to renew or revise it. The difference between net and gross fees includes all applicable fee waivers and expense reimbursements. INDEXES Mutual funds have fees that r ...

... daily net assets. This waiver is in effect through 10/31/2017, at which time the adviser and/or its affiliates will determine whether to renew or revise it. The difference between net and gross fees includes all applicable fee waivers and expense reimbursements. INDEXES Mutual funds have fees that r ...

OLD MUTUAL FIXED INTEREST TRACKER LIFE FUND

... Old Mutual is a Licensed Financial Services Provider. The information and opinions contained in this guide are made in good faith and are based on sources believed to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The op ...

... Old Mutual is a Licensed Financial Services Provider. The information and opinions contained in this guide are made in good faith and are based on sources believed to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The op ...

KSCVX Cusip Change 12 31 07

... In an effort to enhance operating efficiency and product offerings, the Keeley Funds implemented the following changes to their family of funds effective December 31, 2007. 1 - The Keeley Small Cap Value Fund, Inc. was merged into a newly created series of the Keeley Funds, Inc., the KEELEY Small Ca ...

... In an effort to enhance operating efficiency and product offerings, the Keeley Funds implemented the following changes to their family of funds effective December 31, 2007. 1 - The Keeley Small Cap Value Fund, Inc. was merged into a newly created series of the Keeley Funds, Inc., the KEELEY Small Ca ...

MANULIFE CANADIAN MONTHLY INCOME FUND

... Canadian Fixed Income United States Equity Cash & Equivalents United States Fixed Income Foreign Equity Foreign Fixed Income Other ...

... Canadian Fixed Income United States Equity Cash & Equivalents United States Fixed Income Foreign Equity Foreign Fixed Income Other ...

Investment Strategy Net Monthly Returns (1)

... representative of the segment of the hedge fund universe representing equity market neutral investment strategies seeking to generate consistent returns in both up and down markets. These strategies typically maintain net equity market exposure no greater than 10% long or short. (3) The MSCI World I ...

... representative of the segment of the hedge fund universe representing equity market neutral investment strategies seeking to generate consistent returns in both up and down markets. These strategies typically maintain net equity market exposure no greater than 10% long or short. (3) The MSCI World I ...

North Carolina Fixed Income Fund

... the group trust, including the deduction of an investment management fee of 0.16% and an operating fee of approximately 0.03% (inclusive of an administrative fee of 2.5bp and custodial fees). The plan charges a separate $31 annual recordkeeping and communications fee that is not reflected in perform ...

... the group trust, including the deduction of an investment management fee of 0.16% and an operating fee of approximately 0.03% (inclusive of an administrative fee of 2.5bp and custodial fees). The plan charges a separate $31 annual recordkeeping and communications fee that is not reflected in perform ...