ZI Barings Developed and Emerging Markets High Yield Bond

... liabilities to its policy owners, up to 90% of the liability to the protected policy owner will be met. ...

... liabilities to its policy owners, up to 90% of the liability to the protected policy owner will be met. ...

New York, New York TUESDAY, DECEMBER 8, 2009

... firms with regard to all aspects of their business. Immediately prior to joining K&L Gates in May 2007, Mr. Eisert was a Senior Vice President and the General Corporate Counsel of Fiduciary Trust Company International, a FDIC insured institution and subsidiary of Franklin Templeton, where he adv ...

... firms with regard to all aspects of their business. Immediately prior to joining K&L Gates in May 2007, Mr. Eisert was a Senior Vice President and the General Corporate Counsel of Fiduciary Trust Company International, a FDIC insured institution and subsidiary of Franklin Templeton, where he adv ...

Dynamic Global Value Fund Series G

... [‡] Risk rating measures the degree of uncertainty that an investor can handle regarding fluctuations in the value of their portfolio. The amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfol ...

... [‡] Risk rating measures the degree of uncertainty that an investor can handle regarding fluctuations in the value of their portfolio. The amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfol ...

Mariner Investment Group Adds Fourth Portfolio Team to Mariner

... "Mariner provides a proven institutional infrastructure for derivatives portfolio management, as well as a substantial and reputable strategic partner for building and growing our business together,” said Mr. Loflin. “Investment banks have long been the dominant players in exploiting relative-value ...

... "Mariner provides a proven institutional infrastructure for derivatives portfolio management, as well as a substantial and reputable strategic partner for building and growing our business together,” said Mr. Loflin. “Investment banks have long been the dominant players in exploiting relative-value ...

To: Clients and Friends June 30, 2004 The articles below contain

... survey defined a hedge fund adviser as an advisory firm in which hedge funds represent 75% or more of the firm’s advisory clients. According to the survey, the number of registered hedge fund advisers rose from 508 a year ago to 601 this year, an increase of 18%. The registered hedge fund advisers m ...

... survey defined a hedge fund adviser as an advisory firm in which hedge funds represent 75% or more of the firm’s advisory clients. According to the survey, the number of registered hedge fund advisers rose from 508 a year ago to 601 this year, an increase of 18%. The registered hedge fund advisers m ...

Activity 2:

... Slovakia is one of the following states of the Czechoslovak republic and was for more than 40 years negatively affected by the communist system, which has deeply destroyed the economic and social system. The country became a NATO and an EU member state last year but is still in a middle of the trans ...

... Slovakia is one of the following states of the Czechoslovak republic and was for more than 40 years negatively affected by the communist system, which has deeply destroyed the economic and social system. The country became a NATO and an EU member state last year but is still in a middle of the trans ...

- SlideBoom

... loads and 12b-1 fees, each in a different share class. Typical classes are: • Class A: traditional load shares with high front-end load and low 12b-1 fee. • Class B: high 12b-1 fee and CDSC. No front-end load. No longer offered by many funds. • Class C: level load shares that combine a high 12b-1 fe ...

... loads and 12b-1 fees, each in a different share class. Typical classes are: • Class A: traditional load shares with high front-end load and low 12b-1 fee. • Class B: high 12b-1 fee and CDSC. No front-end load. No longer offered by many funds. • Class C: level load shares that combine a high 12b-1 fe ...

bastion worldwide flexible fund of funds bastion

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

Submission - Review of the managed investments act 1998

... (CSA), an umbrella group representing the thirteen provincial and territorial securities regulators, following extensive research and industry consultations. “The proposal represents a forward-looking solution to the potential conflicts of interest inherent in most mutual fund structures,” said Rebe ...

... (CSA), an umbrella group representing the thirteen provincial and territorial securities regulators, following extensive research and industry consultations. “The proposal represents a forward-looking solution to the potential conflicts of interest inherent in most mutual fund structures,” said Rebe ...

Active Management can help make these kinds of market declines

... is negotiated between the client and his or her advisor. As a result, the MERs and performance of Series F funds may differ from those of other series of the same fund and the performance may be superior to other series of the same fund as a result of the potentially lower MERs. For information on t ...

... is negotiated between the client and his or her advisor. As a result, the MERs and performance of Series F funds may differ from those of other series of the same fund and the performance may be superior to other series of the same fund as a result of the potentially lower MERs. For information on t ...

Job Description - Private Equity

... Support the origination, development, due diligence, approval and implementation of commerciallyoriented private equity investment opportunities (both fund and direct co-investments originated by investee funds) that support ADB’s development objectives for the private sector and overall goal of red ...

... Support the origination, development, due diligence, approval and implementation of commerciallyoriented private equity investment opportunities (both fund and direct co-investments originated by investee funds) that support ADB’s development objectives for the private sector and overall goal of red ...

Euro High Yield Bond Class A-sek h

... primarily issued by companies of the EU, OECD-countries or any other of Western or Eastern Europe, Asia, Oceania, the American countries or Africa, and denominated in Euro. The investment strategy is active. The currency risk is limited since the fund aims to hedge currency risks of non-euro denomin ...

... primarily issued by companies of the EU, OECD-countries or any other of Western or Eastern Europe, Asia, Oceania, the American countries or Africa, and denominated in Euro. The investment strategy is active. The currency risk is limited since the fund aims to hedge currency risks of non-euro denomin ...

Hedge funds have attracted significant capital inflows in the last few

... Alpha and risk exposures are estimated with multiple OLS regressions. MSCI World Total Return is a proxy for international equities. MSCI World cumulative 12M is the cumulative performance of the MSCI World Total Return Index computed on a rolling basis over the last 12 months. The size spread fa ...

... Alpha and risk exposures are estimated with multiple OLS regressions. MSCI World Total Return is a proxy for international equities. MSCI World cumulative 12M is the cumulative performance of the MSCI World Total Return Index computed on a rolling basis over the last 12 months. The size spread fa ...

Diapositive 1 - Goldman Sachs

... given the size and transparency of these markets. (B) Fixed income funds with a global investment remit or those mainly focused on US, European and UK markets and invest predominantly in investment grade debt, including government. (C) Multi asset funds with a multi asset benchmark. All other funds ...

... given the size and transparency of these markets. (B) Fixed income funds with a global investment remit or those mainly focused on US, European and UK markets and invest predominantly in investment grade debt, including government. (C) Multi asset funds with a multi asset benchmark. All other funds ...

August 2016 FUND NAME ESTIMATED PRICE ESTIMATED

... In bond markets UK gilts were strong after the Bank of England extended its quantitative easing and asset purchase programmes. ...

... In bond markets UK gilts were strong after the Bank of England extended its quantitative easing and asset purchase programmes. ...

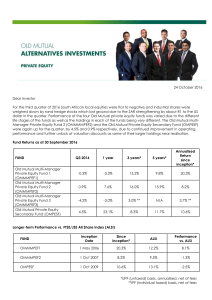

24 October 2016 Dear Investor For the third quarter of 2016 South

... OMMMPEF1 was down 0.3% for the quarter and 3.3% down over the last year. Despite the recent pullback, the fund is up 13.2% per year over the last three years and has been a superb creator of wealth for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has ...

... OMMMPEF1 was down 0.3% for the quarter and 3.3% down over the last year. Despite the recent pullback, the fund is up 13.2% per year over the last three years and has been a superb creator of wealth for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has ...

News Release - First American Funds

... Bancorp affiliate, nor are they insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency. An investment in such products involves investment risk, including possible loss of principal. A Fund’s sponsor has no legal obligation to provide financial support t ...

... Bancorp affiliate, nor are they insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency. An investment in such products involves investment risk, including possible loss of principal. A Fund’s sponsor has no legal obligation to provide financial support t ...

Standard Life MyFolio Market Funds

... investments over five risk profiles. The Market portfolios are the lower cost investment solution, investing in a portfolio of passive funds. The MyFolio Market funds are managed by Bambos Hambi, who has many years’ experience in multimanager investing. He is backed by investment director James Mill ...

... investments over five risk profiles. The Market portfolios are the lower cost investment solution, investing in a portfolio of passive funds. The MyFolio Market funds are managed by Bambos Hambi, who has many years’ experience in multimanager investing. He is backed by investment director James Mill ...

Diversification – Too Much of a Good Thing is a Bad Thing

... often mimic an index fund. This is galling as the investment manager is charging a fee ostensibly to construct a unique portfolio and then ends up creating an index fund – at a cost far in excess of what a standard index fund fee is! Another related issue in the portfolio management sphere was broug ...

... often mimic an index fund. This is galling as the investment manager is charging a fee ostensibly to construct a unique portfolio and then ends up creating an index fund – at a cost far in excess of what a standard index fund fee is! Another related issue in the portfolio management sphere was broug ...

North America Enhanced Index Fund G (AIF)

... The assets are invested mainly in an enhanced index fund managed by State Street Global Advisors, whose assets are mainly invested in the equities and equity-linked securities of North American companies. The fund is a non-UCITS fund, whose assets can be less diversified than in an ordinary mutual f ...

... The assets are invested mainly in an enhanced index fund managed by State Street Global Advisors, whose assets are mainly invested in the equities and equity-linked securities of North American companies. The fund is a non-UCITS fund, whose assets can be less diversified than in an ordinary mutual f ...

What does the Fund invest in? FUND PERFORMANCE REPORT

... the earlier years and shifts to wealth preservation to reduce exposure to risk as the maturity of the fund approaches. ...

... the earlier years and shifts to wealth preservation to reduce exposure to risk as the maturity of the fund approaches. ...

January 10, 2012 FOR IMMEDIATE RELEASE GuideStone

... The MyDestination Funds (“Funds”) attempt to achieve their objectives by investing in the GuideStone Select Funds. The Funds are managed to a retirement date (“target date”) by adjusting the percentage of fixed income securities and equity securities to become more conservative each year until reach ...

... The MyDestination Funds (“Funds”) attempt to achieve their objectives by investing in the GuideStone Select Funds. The Funds are managed to a retirement date (“target date”) by adjusting the percentage of fixed income securities and equity securities to become more conservative each year until reach ...

Global Equity Fund (Hexavest)

... fundamentally driven top-down investment approach. Portfolio managers determine which regions, countries, currencies, sectors and industries to favour based on their analysis of the macroeconomic environment, valuation factors and investor sentiment (which often results in a contrarian view and valu ...

... fundamentally driven top-down investment approach. Portfolio managers determine which regions, countries, currencies, sectors and industries to favour based on their analysis of the macroeconomic environment, valuation factors and investor sentiment (which often results in a contrarian view and valu ...

Current Trends and Issues in Financial Planning

... – market cap of income trusts increased by 50% in 2004, to over $121 billion – more than 175 income trusts listed on the TSX, making up 9% of total market cap ...

... – market cap of income trusts increased by 50% in 2004, to over $121 billion – more than 175 income trusts listed on the TSX, making up 9% of total market cap ...