Key Investor Information

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Equity risk: Equity prices fluctuate daily, based on many factors including general, economic, industry or company news. Liquidity risk: In difficult market conditions, the fund may ...

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Equity risk: Equity prices fluctuate daily, based on many factors including general, economic, industry or company news. Liquidity risk: In difficult market conditions, the fund may ...

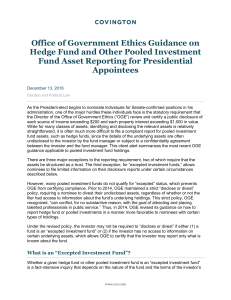

Office of Government Ethics Guidance on Hedge Fund and Other

... OGE updated its guidance in 2014 to loosen the rules on reporting hedge funds and other pooled investment funds. OGE recognized that many investors do not have access to information about the underlying assets in such funds, which effectively mitigates concerns about conflicts of interest arising ou ...

... OGE updated its guidance in 2014 to loosen the rules on reporting hedge funds and other pooled investment funds. OGE recognized that many investors do not have access to information about the underlying assets in such funds, which effectively mitigates concerns about conflicts of interest arising ou ...

Mutual Fund

... capital for the beneficiary. The objective of the scheme is to generate regular returns and/or capital appreciation / accretion with the aim of giving lump sum capital growth at the end of the chosen target period or otherwise to the Beneficiary. Principal Global Opportunities Fund It is an open-end ...

... capital for the beneficiary. The objective of the scheme is to generate regular returns and/or capital appreciation / accretion with the aim of giving lump sum capital growth at the end of the chosen target period or otherwise to the Beneficiary. Principal Global Opportunities Fund It is an open-end ...

PDF article file - Krungsri Asset Management

... contain upside at approximately 9%. Investors are advised to watch a right timing to invest for higher returns. For those who want to adjust their investment portfolios in 2017, KSAM gurus recommend an investment portfolio that focuses on investing in fixed income 37%, equities 63% - 33% in Thai sto ...

... contain upside at approximately 9%. Investors are advised to watch a right timing to invest for higher returns. For those who want to adjust their investment portfolios in 2017, KSAM gurus recommend an investment portfolio that focuses on investing in fixed income 37%, equities 63% - 33% in Thai sto ...

Vilar Gave Select Access to IPOs

... policy, Ms. Frankel questioned why Amerindo's mutual fund was buying some of the same stocks at higher prices in the months after IPOs. "The adviser should be fair to all clients," she said. The mutual fund now has about $100 million in assets, after an estimated $4.3 million was withdrawn early thi ...

... policy, Ms. Frankel questioned why Amerindo's mutual fund was buying some of the same stocks at higher prices in the months after IPOs. "The adviser should be fair to all clients," she said. The mutual fund now has about $100 million in assets, after an estimated $4.3 million was withdrawn early thi ...

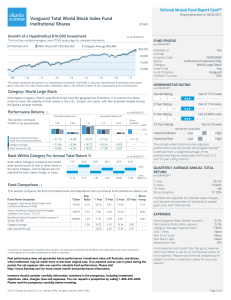

Vanguard Total World Stock Index Fund Institutional Shares

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

Karoll Capital Management is a licensed asset manager established

... proprietary research. In estimating the true value of an asset we study the firm’s ability to realize an IRR greater than the cost of capital, its shareholder structure and management capabilities, sector dynamics and overall market position. Onsite company visits are a key part of research as well. ...

... proprietary research. In estimating the true value of an asset we study the firm’s ability to realize an IRR greater than the cost of capital, its shareholder structure and management capabilities, sector dynamics and overall market position. Onsite company visits are a key part of research as well. ...

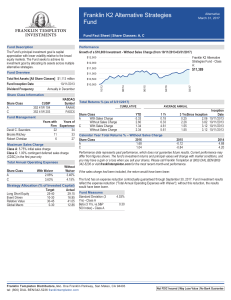

Franklin K2 Alternative Strategies Fund Fact Sheet

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

For investors who prefer a simple and accessible approach to

... Offering built-in diversification, the Funds can instantly provide an appropriate balance of risk and potential reward. They invest in a globally diversified mix of underlying assets (fixed income and equities), then dynamically manage this balance over time as market conditions change. Underlying i ...

... Offering built-in diversification, the Funds can instantly provide an appropriate balance of risk and potential reward. They invest in a globally diversified mix of underlying assets (fixed income and equities), then dynamically manage this balance over time as market conditions change. Underlying i ...

Key Investor Information

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Equity risk: Equity prices fluctuate daily, based on many factors including general, economic, industry or company news. Liquidity risk: In difficult market conditions, the fund may ...

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Equity risk: Equity prices fluctuate daily, based on many factors including general, economic, industry or company news. Liquidity risk: In difficult market conditions, the fund may ...

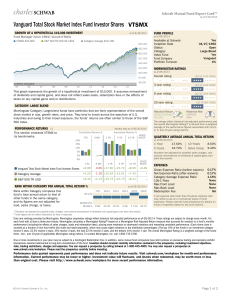

Vanguard Total Stock Market Index Fund Investor Shares

... International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Government bond fund shares are not guaranteed. Their price and investment return will fluctuate with market conditions and interest rates. Investment income f ...

... International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Government bond fund shares are not guaranteed. Their price and investment return will fluctuate with market conditions and interest rates. Investment income f ...

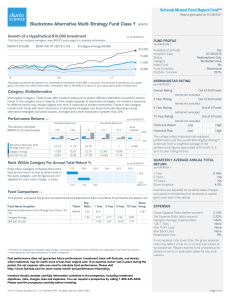

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

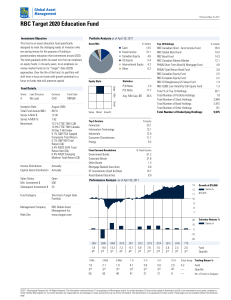

RBC Target 2020 Education Fund

... based on actual expenses for the full-year period, January 1 to December 31, 2016, expressed on an annualized basis. MER (%) for RBC Corporate Class Funds is based on actual expenses for the half-year period, April 1, 2016 to September 30, 2016, expressed on an annualized basis. Adjusted MER is prov ...

... based on actual expenses for the full-year period, January 1 to December 31, 2016, expressed on an annualized basis. MER (%) for RBC Corporate Class Funds is based on actual expenses for the half-year period, April 1, 2016 to September 30, 2016, expressed on an annualized basis. Adjusted MER is prov ...

CF Heartwood Growth Multi Asset Fund

... The fund has the discretion to invest in the investments as described above with no need to adhere to a particular ...

... The fund has the discretion to invest in the investments as described above with no need to adhere to a particular ...

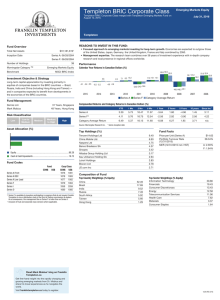

Templeton BRIC Corporate Class Series A

... • Focused approach to emerging markets investing for long-term growth. Economies are expected to outgrow those of the United States, Japan, Germany, the United Kingdom, France and Italy combined by 2050. • Management expertise. The research team combines over 38 years of investment experience with i ...

... • Focused approach to emerging markets investing for long-term growth. Economies are expected to outgrow those of the United States, Japan, Germany, the United Kingdom, France and Italy combined by 2050. • Management expertise. The research team combines over 38 years of investment experience with i ...

Passive Global Equity (inc. UK) Fund

... understanding of law and practice. We make every effort to ensure that this information is helpful, accurate and correct, but it may change or may not apply to your personal circumstances. All funds carry some risk and you should consider these risks before making an investment decision. Investment ...

... understanding of law and practice. We make every effort to ensure that this information is helpful, accurate and correct, but it may change or may not apply to your personal circumstances. All funds carry some risk and you should consider these risks before making an investment decision. Investment ...

CF Canlife Portfolio Funds

... Property Fund Investment Risk: The fund may invest in property funds that may be illiquid and more volatile, both of which can impact the value of the fund. Currency Risk: As the fund invests indirectly in overseas securities, exchange rate movements may, when not hedged, cause the value of your ...

... Property Fund Investment Risk: The fund may invest in property funds that may be illiquid and more volatile, both of which can impact the value of the fund. Currency Risk: As the fund invests indirectly in overseas securities, exchange rate movements may, when not hedged, cause the value of your ...

View Document

... long-term returns No “star” portfolio managers. Our centralized, team-based approach is rooted in the idea that good ideas can come from anyone in the investment organization and that a steady stream of fresh perspectives help us find opportunities others might miss. Disciplined, repeatable process. ...

... long-term returns No “star” portfolio managers. Our centralized, team-based approach is rooted in the idea that good ideas can come from anyone in the investment organization and that a steady stream of fresh perspectives help us find opportunities others might miss. Disciplined, repeatable process. ...

Key Investor Information This document provides you

... of ANIMA Funds plc may be obtained from the Administrator, free of charge, or by visiting www.animafunds.ie. These documents are available in English. NAV / Pricing: The Net Asset Value (“NAV”) of the Fund and Share Classes is calculated in Euro. The NAV per Share will be available from the Administ ...

... of ANIMA Funds plc may be obtained from the Administrator, free of charge, or by visiting www.animafunds.ie. These documents are available in English. NAV / Pricing: The Net Asset Value (“NAV”) of the Fund and Share Classes is calculated in Euro. The NAV per Share will be available from the Administ ...

Simplifying the LDI story by focusing on the three DB hedge ratio

... investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. Please remember that all investments carry some level of risk, including the potential ...

... investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. Please remember that all investments carry some level of risk, including the potential ...

Hedge Fund Risk and Return Modeling

... • Teach quantitative risk management in UW CF&RM program. • Risk management consultant to BlackRock Alternative Advisors, a large fund-of-hedge fund. • General problem: model risk and return for portfolios of hedge fund investments. • Hedge fund returns have unique properties that present interestin ...

... • Teach quantitative risk management in UW CF&RM program. • Risk management consultant to BlackRock Alternative Advisors, a large fund-of-hedge fund. • General problem: model risk and return for portfolios of hedge fund investments. • Hedge fund returns have unique properties that present interestin ...

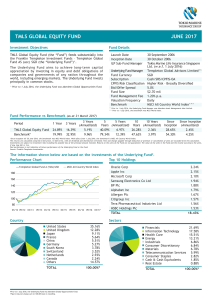

tmls global equity fund june 2017

... corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way to a more cautious view. • The portfolio underperformed its benchmark during the quarter. Market trends shifted as the pro-cycli ...

... corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way to a more cautious view. • The portfolio underperformed its benchmark during the quarter. Market trends shifted as the pro-cycli ...

measuring risk-adjusted returns in alternative investments

... portfolio of traditional assets. Equity Non-Hedge Strategy Equivalent to long position in traditional portfolio with some long outof-the-money calls and some short outof-the-money puts. Source: Favre, Laurent and Jose-Antonio Galeano, “An Analysis of Hedge Fund ...

... portfolio of traditional assets. Equity Non-Hedge Strategy Equivalent to long position in traditional portfolio with some long outof-the-money calls and some short outof-the-money puts. Source: Favre, Laurent and Jose-Antonio Galeano, “An Analysis of Hedge Fund ...

RIVERPARK INTRODUCES RIVERPARK LONG/SHORT

... registered mutual fund and was not subject to the same investment and tax restrictions as the Fund. If the annual returns for the predecessor partnership were charged the same fees and expenses as the Fund, the annual returns for the predecessor partnership would have been higher. The RiverPark Long ...

... registered mutual fund and was not subject to the same investment and tax restrictions as the Fund. If the annual returns for the predecessor partnership were charged the same fees and expenses as the Fund, the annual returns for the predecessor partnership would have been higher. The RiverPark Long ...

L. Favre, A. Signer. "The difficulties of measuring the benefits of hedge funds" Journal of Alternative Investment (Summer 2002)

... The usual approach in the mean-variance concept does not go far enough for hedge funds because various risks are ignored that are specific to hedge funds. One potential solution would be to adjust the return or the risk. As the previous discussion shows since standard deviation is not a suitable met ...

... The usual approach in the mean-variance concept does not go far enough for hedge funds because various risks are ignored that are specific to hedge funds. One potential solution would be to adjust the return or the risk. As the previous discussion shows since standard deviation is not a suitable met ...