* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download tmls global equity fund june 2017

Rate of return wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Stock trader wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Corporate venture capital wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity wikipedia , lookup

Early history of private equity wikipedia , lookup

Socially responsible investing wikipedia , lookup

Money market fund wikipedia , lookup

Private equity secondary market wikipedia , lookup

Mutual fund wikipedia , lookup

Private money investing wikipedia , lookup

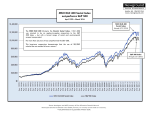

TMLS GLOBAL EQUITY FUND JUNE 2017 Investment Objectives Fund Details TMLS Global Equity Fund (the “Fund”) feeds substantially into the Franklin Templeton Investment Funds – Templeton Global Fund AS (acc) SGD (the “Underlying Fund”)^. The Underlying Fund aims to achieve long-term capital appreciation by investing in equity and debt obligations of companies and governments of any nation throughout the world, including emerging markets. The Underlying Fund invests principally in common stocks. ^ Prior to 1 July 2016, the Underlying Fund was Aberdeen Global Opportunities Fund. Launch Date 30 September 2006 Inception Date 30 October 2006 ILP Sub-Fund Manager Tokio Marine Life Insurance Singapore Ltd. (w.e.f. 1 July 2016) Underlying Fund Manager Templeton Global Advisors Limited^^ Fund Currency SGD Subscription Cash/SRS/CPFIS-OA CPFIS Risk Classification Higher Risk – Broadly Diversified Bid/Offer Spread 5.0% Fund Size $2.70 mil Fund Management Fee 1.20% p.a. Valuation Frequency Daily Benchmark MSCI All Country World Index^^^ ^^ Prior to 1 July 2016, the Underlying Fund Manager was Aberdeen Asset Management Asia Limited. ^^^ Prior to 1 July 2016, the benchmark was MSCI World Index. Fund Performance vs Benchmark (as at 31 March 2017) 3 Years 5 5 Years 10 10 Years Since Since Inception Period 1 Year 3 Years (Annualized) Years (Annualized) Years (Annualized)Inception (Annualized) TMLS Global Equity Fund 24.89% 16.39% 5.19% 40.09% 6.97% 26.28% 2.36% 28.65% 2.45% Benchmark* 19.99% 32.95% 9.96% 79.34% 12.39% 47.63% 3.97% 54.30% 4.25% *Since inception till 30 June 2016, the benchmark was MSCI World Index. With effect from 1 July 2016, the benchmark is MSCI All Country World Index. The returns are calculated using bid-to-bid prices, in SGD terms, with all dividends and distribution reinvested. Fees and charges payable through deduction of premium or cancellation of units are excluded from this calculation. Investments are subject to investment risks including the possible loss of the principal amount invested. Returns on the units of the Fund are not guaranteed. The value of the units in the Fund and the income accruing to the units, if any, may fall or rise. Past performance is not indicative of future performance of the Underlying Fund or the Fund. Source: Franklin Templeton Investments. The information shown below are based on the investments of the Underlying Fund#. Performance Chart Top 10 Holdings Templeton Global Fund A (Ydis) USD MSCI All Country World Index 180 160 140 120 100 80 03/12 09/12 03/13 09/13 03/14 09/14 03/15 09/15 03/16 09/16 03/17 Country Sectors United States 35.16% United Kingdom 12.28% Japan9.11% France5.64% China5.51% Germany5.27% South Korea 3.78% Switzerland3.52% Netherlands2.93% Canada2.24% Others14.57% Financials21.69% Information Technology 17.58% Health Care 15.51% Energy13.21% Industrials6.86% Consumer Discretionary 6.84% Materials6.78% Telecommunication Services 5.99% Consumer Staples 2.82% Cash & Cash Equivalents 1.85% Real Estate 0.88% TOTAL100.00%* TOTAL100.00%* Prior to 1 July 2016, the Underlying Fund was Aberdeen Global Opportunities Fund. *Figure may not always sum to 100.00% due to rounding. # Oracle Corp 2.24% Apple Inc 2.15% Microsoft Corp 2.10% Samsung Electronics Co Ltd 1.94% BP Plc 1.88% Alphabet Inc 1.79% Allergan Plc 1.67% Citigroup Inc 1.57% Teva Pharmaceutical Industries Ltd 1.56% HSBC Holdings Plc 1.53% TOTAL18.43% TMLS GLOBAL EQUITY FUND JUNE 2017 Underlying Fund Manager’s Report • Global equities advanced in the first quarter of 2017 as investors weighed a broadening global economic recovery and continued corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way to a more cautious view. • The portfolio underperformed its benchmark during the quarter. Market trends shifted as the pro-cyclical “reflation trade” that accelerated in November following Donald Trump’s election win gave way to a more cautious view. While markets solidly advanced and global value stocks posted strong absolute gains, value lagged growth during the quarter by the most in two years as heightened political uncertainty and rising equity risk premiums weighed on lowly valued stocks. • From a regional standpoint, stock-specific weakness in Europe (in which the portfolio was overweight) and the US detracted from relative performance. We believe European equities discount a level of pessimism inconsistent with improving fundamentals. An overweight and stock selection in South Korea was the most significant contributor to relative performance for the quarter. Please take note that Underlying Fund Manager’s Report comments are not necessarily indicative of the future or likely performance of the Underlying Fund or the Fund. Disclaimer: This factsheet should not be construed as an offer, or solicitation to deal in any funds. The information shown is strictly for reference only and is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract. Past performance is not indicative of future performance. Investments are subject to investment risks including the possible loss of the principal amount invested. Returns on the units of the Fund are not guaranteed. The value of the units in the Fund and the income accruing to the units, if any, may fall or rise. The fees and charges payable through deduction of premium or cancellation of units are excluded in the calculation of fund returns. Potential investors should read the product summary or seek relevant professional advice before making any investment decision. The above is based on information available as at 31/3/2017, unless otherwise stated. Tokio Marine Life Insurance Singapore Ltd. (Company Reg. No.: 194800055D) 20 McCallum Street, #07-01 Tokio Marine Centre, Singapore 069046 T: (65) 6592 6100 F: (65) 6223 9120 W: tokiomarine.com E&OE MEDIALINK /JUN2017