* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Global Equity Fund (Hexavest)

Stock trader wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Leveraged buyout wikipedia , lookup

Rate of return wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Corporate venture capital wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Money market fund wikipedia , lookup

International investment agreement wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Private equity wikipedia , lookup

Investment banking wikipedia , lookup

Socially responsible investing wikipedia , lookup

Private equity secondary market wikipedia , lookup

Early history of private equity wikipedia , lookup

Mutual fund wikipedia , lookup

Private money investing wikipedia , lookup

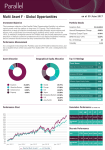

Fixed Income Balanced Equity Specialty As at March 31, 2017 Global Equity Fund (Hexavest) Fund Details Performance (for periods ending March 31) Fund Type Global Equity Fund Manager Hexavest Asset Management 120% Gross Cumulative Returns 80 Fund Underlying Fund Name Hexavest World 40 Inception at Standard Life November 2009 Standard Life Fund Size $573.45 million Underlying Fund Size $4.41 billion Fund Operating Expenses 0.02% Underlying Fund Operating Expenses 0.19% 0 -40 -80 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 -9.70 -13.31 -17.72 -29.13 25.41 23.49 3.12 8.86 5.29 4.06 14.99 14.62 24.17 30.25 22.71 22.14 5.05 -0.43 16.45 18.21 as at March 31 Annual Returns Risk Factor Low High Investment Objective The Fund seeks to provide investors with capital appreciation and/or income generation. Strategy/Style The investment team relies primarily on a fundamentally driven top-down investment approach. Portfolio managers determine which regions, countries, currencies, sectors and industries to favour based on their analysis of the macroeconomic environment, valuation factors and investor sentiment (which often results in a contrarian view and value bias). Proprietary quantitative tools are employed to support and validate fundamental research. The Fund invests in a diversified portfolio comprised primarily of equity securities of mid to large-cap companies of the world’s developed countries. 0-10% Cash & Equivalents; 90-100% Equity exposure & Funds; 40-100% Foreign currency exposure. Maximum investment in a single company: 10%. Maximum investment in countries not included in the MSCI World Index: 10%. Fund % Benchmark % Annualized Returns (as at March 31, 2017) Qtr* YTD* 1 Year 2 Year 3 Year 4 Year 5 Year 10 Year Fund Benchmark 4.16 5.51 4.16 5.51 16.45 18.21 10.60 8.49 14.50 12.86 16.85 16.98 16.47 16.50 8.05 6.31 Benchmark: MSCI World (Can$) Index Disclosure Statement: The above data represents past performance and is not indicative of future results. Returns are calculated on a time-weighted basis. The line of the graph represents the gross performance of the Standard Life fund while the shaded area shows the corresponding benchmark return. Where applicable, the dotted graph line and shaded data in the returns table pertain to the underlying fund. Returns are calculated after fund operating expenses (such as fund audit, custodial fees, interest charges and taxes) but before investment management fees. If you are a plan member, call 1 800 242-1704, refer to your enrolment material and/or the VIP Room Web site at www.standardlife.ca for an explanation of the different types of investment funds and related risks, market indices, investment and plan related fees. *Returns for periods less than one year are not annualized. Portfolio Analysis Top Holdings Apple Inc Johnson & Johnson Pfizer Inc AT&T Inc Wal-Mart Stores Inc Verizon Communications Inc Cisco Systems Inc CalAtlantic Group Inc Microsoft Corp Nestle SA Total Top Holdings % Total Number of Holdings Geographic Allocation ? Underlying Fund Benchmark % Asset Composition 2.97 1.88 1.83 1.67 1.30 1.28 1.17 0.99 0.99 0.98 15.05 3,841 % Asset Canada 12.79 United States Japan United Kingdom Australia Switzerland Other 48.76 9.30 4.56 3.64 3.62 17.34 Total Foreign Exposure % 87.21 % Asset Health Care Consumer Discretionary Consumer Staples Information Technology Financials Materials Utilities Telecommunications Services Real Estate Industrial Other Cash & Equivalents 15.17 12.51 11.27 9.88 8.71 8.35 8.29 7.53 4.38 4.22 0.81 8.89 GE12044 ©2017. The information, data, analysis and opinions contained herein (1) include the confidential and proprietary information of Standard Life and Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice and (4) are provided solely for informational purposes. No warranty is expressed or implied as to the accuracy, adequacy or completeness of the information, and neither The Standard Life Assurance Company of Canada, Morningstar Research Inc. nor the investment fund manager, as the case may be, are responsible for any errors and omissions, or for the results obtained from the use of such information. The Risk Factor is determined by Standard Life.