THU VI?N PHÁP LU?T

... 4. Fund certificate means a type of securities certifying investors' ownership over a portion of contributed capital of a public fund. 5. Right means a type of securities issued by a joint-stock company along with an additional issuance of stocks to ensure that its existing shareholders can buy new ...

... 4. Fund certificate means a type of securities certifying investors' ownership over a portion of contributed capital of a public fund. 5. Right means a type of securities issued by a joint-stock company along with an additional issuance of stocks to ensure that its existing shareholders can buy new ...

417KB

... needs, project and export finance business will be separated from Structured Finance Department and a new Project & Export Finance Department will be established to manage the business. In addition, with the aim of further enhancing our capability to capture and support projects in environmental, na ...

... needs, project and export finance business will be separated from Structured Finance Department and a new Project & Export Finance Department will be established to manage the business. In addition, with the aim of further enhancing our capability to capture and support projects in environmental, na ...

Scope and Definition

... This paper analyses the scope and definitions of international investment agreements (IIAs). IIAs must specify not only their geographical and temporal coverage, but, most importantly, their subject-matter coverage. This is done primarily through the definitions of the terms “investment” and “invest ...

... This paper analyses the scope and definitions of international investment agreements (IIAs). IIAs must specify not only their geographical and temporal coverage, but, most importantly, their subject-matter coverage. This is done primarily through the definitions of the terms “investment” and “invest ...

HSBC Jintrust Large Cap Equity Securities Investment Fund

... The Fund focuses on analysing large cap companies’ unique competitive advantages. The Fund Manager conducts a comprehensive value and growth analysis on the primarily selected stocks and further combines the research results with industry position analysis to select undervalued leading large-cap blu ...

... The Fund focuses on analysing large cap companies’ unique competitive advantages. The Fund Manager conducts a comprehensive value and growth analysis on the primarily selected stocks and further combines the research results with industry position analysis to select undervalued leading large-cap blu ...

BlackBerry Receives Investment of U.S. $1 Billion from Fairfax

... "I am pleased to join a company with as much potential as BlackBerry," said Mr. Chen. "BlackBerry is an iconic brand with enormous potential - but it's going to take time, discipline and tough decisions to reclaim our success. I look forward to leading BlackBerry in its turnaround and business model ...

... "I am pleased to join a company with as much potential as BlackBerry," said Mr. Chen. "BlackBerry is an iconic brand with enormous potential - but it's going to take time, discipline and tough decisions to reclaim our success. I look forward to leading BlackBerry in its turnaround and business model ...

OECD - Business Angels Netzwerk Deutschland eV

... therefore policy makers must take this into account. In fact, in a number of countries such as Canada and the United States, angel policies are implemented at the regional rather than the national level. In addition, angel investment can vary greatly across countries, both in terms of volume and app ...

... therefore policy makers must take this into account. In fact, in a number of countries such as Canada and the United States, angel policies are implemented at the regional rather than the national level. In addition, angel investment can vary greatly across countries, both in terms of volume and app ...

Trading Volume Reaction to the Earnings Reconciliation from IFRS

... addition, the IASB, in an effort to improve the quality of accounting standards, issued a series of new international financial reporting standards, most of which were effective on or after January 1, 2005. Thus, our paper can assess the effects of improved international accounting standards on the ...

... addition, the IASB, in an effort to improve the quality of accounting standards, issued a series of new international financial reporting standards, most of which were effective on or after January 1, 2005. Thus, our paper can assess the effects of improved international accounting standards on the ...

6. Law on the Investment Funds

... the investment fund management company where they are employed, as well as members of the closer family of the employees; 10. Persons related to the investment fund are an investment fund management company, depository bank, lawyer, auditor and tax advisor that have established relations for providi ...

... the investment fund management company where they are employed, as well as members of the closer family of the employees; 10. Persons related to the investment fund are an investment fund management company, depository bank, lawyer, auditor and tax advisor that have established relations for providi ...

Speaker Bio

... progressively more senior executive roles and has been key in developing CIBC’s channel strategies and innovation into mobile banking. Prior to this, she held various leadership roles within CIBC’s Human Resources division. Ms. Kramer is a director on the boards of CIBC FirstCaribbean International ...

... progressively more senior executive roles and has been key in developing CIBC’s channel strategies and innovation into mobile banking. Prior to this, she held various leadership roles within CIBC’s Human Resources division. Ms. Kramer is a director on the boards of CIBC FirstCaribbean International ...

Political connections, founder-managers, and

... but it is more profound in China because political connection in China represents a complicated framework with three dimensions and permeates various enterprises. First, political connection in China can be categorized into two types. One is an official-type political connection where a firm’s mana ...

... but it is more profound in China because political connection in China represents a complicated framework with three dimensions and permeates various enterprises. First, political connection in China can be categorized into two types. One is an official-type political connection where a firm’s mana ...

Why do foreign firms leave US equity markets?

... not require that firms choose to cross-list because of a bonding benefit. All that is required for that theory to be valid is the existence of a benefit from cross-listing that decreases for some firms because of competitive reasons. For such firms, cross-listing becomes a net cost rather than a ne ...

... not require that firms choose to cross-list because of a bonding benefit. All that is required for that theory to be valid is the existence of a benefit from cross-listing that decreases for some firms because of competitive reasons. For such firms, cross-listing becomes a net cost rather than a ne ...

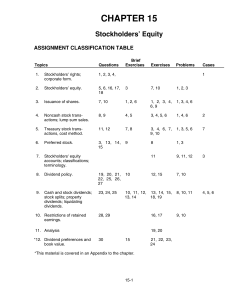

CHAPTER 15 Stockholders` Equity

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

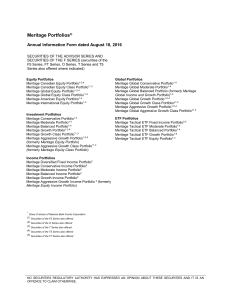

Annual Information Form

... practices are designed to ensure that the investments of the Portfolios are diversified and relatively liquid, and to ensure that the Portfolios are properly administered. The Portfolios are subject, namely, to section 4.1 of Regulation 81-102, which prohibits certain investments when certain relate ...

... practices are designed to ensure that the investments of the Portfolios are diversified and relatively liquid, and to ensure that the Portfolios are properly administered. The Portfolios are subject, namely, to section 4.1 of Regulation 81-102, which prohibits certain investments when certain relate ...

CA Clarity PPM Financial Management User Guide

... the “Documentation”) is for your informational purposes only and is subject to change or withdrawal by CA at any time. This Documentation may not be copied, transferred, reproduced, disclosed, modified or duplicated, in whole or in part, without the prior written consent of CA. This Documentation is ...

... the “Documentation”) is for your informational purposes only and is subject to change or withdrawal by CA at any time. This Documentation may not be copied, transferred, reproduced, disclosed, modified or duplicated, in whole or in part, without the prior written consent of CA. This Documentation is ...

Understanding our fees, charges and other

... Our affiliates typically pay us for referring or introducing clients or investors to them. Likewise, we typically pay our affiliates for referring certain clients and business opportunities to our Financial Advisors. Third parties to whom we introduce clients, including investment managers and inves ...

... Our affiliates typically pay us for referring or introducing clients or investors to them. Likewise, we typically pay our affiliates for referring certain clients and business opportunities to our Financial Advisors. Third parties to whom we introduce clients, including investment managers and inves ...

Venture Capita Report

... in return for a minority or a majority stake. Some newspaper reports, for example, will still refer to the very largest private equity groups, such as Permira or the US firm Kohlberg Kravis & Roberts, as being venture capitalists. There has been, however, a gradual convergence within the industry to ...

... in return for a minority or a majority stake. Some newspaper reports, for example, will still refer to the very largest private equity groups, such as Permira or the US firm Kohlberg Kravis & Roberts, as being venture capitalists. There has been, however, a gradual convergence within the industry to ...

Download paper (PDF)

... Next I elaborate on the economic intuition for my results. First, I find that, if the disclosure friction is sufficiently high, firms making more voluntary disclosures have a lower cost of capital. The rationale for this result is the relation between voluntary disclosures and investors’ updated est ...

... Next I elaborate on the economic intuition for my results. First, I find that, if the disclosure friction is sufficiently high, firms making more voluntary disclosures have a lower cost of capital. The rationale for this result is the relation between voluntary disclosures and investors’ updated est ...

Did Stop Signs Stop Investor Trading?

... the salience in which information is disclosed (Maines and McDaniel 2000; Barber and Odean 2008) and individuals pay more attention to simple versus complex messages (Lerman 2011), so using simple salient graphic to reveal disclosure levels should attract investor attention. Second, given that indi ...

... the salience in which information is disclosed (Maines and McDaniel 2000; Barber and Odean 2008) and individuals pay more attention to simple versus complex messages (Lerman 2011), so using simple salient graphic to reveal disclosure levels should attract investor attention. Second, given that indi ...

Active CDS Trading and Managers` Voluntary Disclosure

... A CDS protects the buyer of the contract against default risk in return for a periodic payment (CDS spread) over the term of the contract. The buyer is compensated if the reference entity and/or its credit instruments experience a “credit event” specified in the contract, such as default, restructur ...

... A CDS protects the buyer of the contract against default risk in return for a periodic payment (CDS spread) over the term of the contract. The buyer is compensated if the reference entity and/or its credit instruments experience a “credit event” specified in the contract, such as default, restructur ...

The Impacts of Capital Structure on Depth of Outreach in Sub

... Yet, since the beginning, MFIs have had to balance objectives of outreach and financial sustainability. Sometimes called attempting to meet the “double-bottom line,” microfinance strives to not only do-good but to pay for itself. Since MFI borrowers are charged an interest rate on credit and sometim ...

... Yet, since the beginning, MFIs have had to balance objectives of outreach and financial sustainability. Sometimes called attempting to meet the “double-bottom line,” microfinance strives to not only do-good but to pay for itself. Since MFI borrowers are charged an interest rate on credit and sometim ...

2015 Preqin Sovereign Wealth Fund Review: Exclusive Extract

... Private and alternatives markets tend to be more opaque in their activities, experience a large dispersion of investment returns, and are often linked to high costs due to their largely active management approach. Sovereign wealth funds have the necessary size to ensure that they can access such ass ...

... Private and alternatives markets tend to be more opaque in their activities, experience a large dispersion of investment returns, and are often linked to high costs due to their largely active management approach. Sovereign wealth funds have the necessary size to ensure that they can access such ass ...

Sequential Investment, Hold-up, and Ownership Structure

... (FDI) are among the fastest growing economic activities. In the fast expansion of merchandise trade, there has been an even faster growth of trade in intermediate products. This phenomenon, closely related to the growing fragmentation of production, has been investigated from various perspectives, s ...

... (FDI) are among the fastest growing economic activities. In the fast expansion of merchandise trade, there has been an even faster growth of trade in intermediate products. This phenomenon, closely related to the growing fragmentation of production, has been investigated from various perspectives, s ...

volatility as an asset class

... Volatility Index (VSTOXX), VDAX or VSMI reaching unprecedented levels, reflecting the increasing cost of buying downside protection in the form of options during the market turmoil. It is interesting to note that volatility is more than a mere measure for the level of uncertainty prevailing in finan ...

... Volatility Index (VSTOXX), VDAX or VSMI reaching unprecedented levels, reflecting the increasing cost of buying downside protection in the form of options during the market turmoil. It is interesting to note that volatility is more than a mere measure for the level of uncertainty prevailing in finan ...

Statement of Investment Policy and Objectives

... Where Smartshares makes investment decisions for a fund, Smartshares will generally not vote in respect of the assets held by the fund. However, Smartshares may vote when it considers that not voting will have a material adverse effect on investors (taking into consideration the size of the managed ...

... Where Smartshares makes investment decisions for a fund, Smartshares will generally not vote in respect of the assets held by the fund. However, Smartshares may vote when it considers that not voting will have a material adverse effect on investors (taking into consideration the size of the managed ...

Book CHI IPE 141 13628.indb

... like nonequity crowdfunders who make funding decisions based on their own interest in the offering, an equity funder must also assess the expected demand from others. To the extent that creators are able to raise capital and demonstrate demand through nonequity crowdfunding (e.g., “presales”), thus ...

... like nonequity crowdfunders who make funding decisions based on their own interest in the offering, an equity funder must also assess the expected demand from others. To the extent that creators are able to raise capital and demonstrate demand through nonequity crowdfunding (e.g., “presales”), thus ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.