* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Karoll Capital Management is a licensed asset manager established

Special-purpose acquisition company wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity wikipedia , lookup

Stock trader wikipedia , lookup

Corporate venture capital wikipedia , lookup

Interbank lending market wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Early history of private equity wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Private equity secondary market wikipedia , lookup

Money market fund wikipedia , lookup

Private money investing wikipedia , lookup

Socially responsible investing wikipedia , lookup

Mutual fund wikipedia , lookup

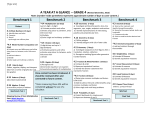

Monthly Factsheets | February 2017 UCITS-compliant mutual funds Karoll Capital Management is a licensed asset manager established in Sofia in 2003. With a clear focus on investing in Emerging Europe, the firm has evolved into one of the most progressive asset management boutiques in the region. We at Karoll Capital Management take pride in our innovative approach toward money management and product development. In 2004 we pioneered the first stock mutual fund in the country. We were the first to offer local clients investment services abroad, and at the same time access of international investors to the local market. In 2012 we became the local partner of Schroders – one of the top global asset managers. The 5 Investment Pillars of Karoll Capital Management: Crisp focus on Eastern Europe We believe new Europe offers excellent investment opportunities as the regional economies are set to grow faster that the Eurozone and given local stock exchanges’ embryonic stage of development. The positive market outlook combined with diminishing risk levels are once again starting to attract foreign investors to the region. While other Eastern European funds tend to invest in companies based elsewhere that only generate some of their revenues here, we focus solely on stocks of companies operating in the region. Solid expertise and passion for emerging markets Our in-depth local knowledge and on-the-ground presence give us an edge in analysing the economies and markets of Eastern Europe. All investment products are managed by seasoned investment specialists with solid capital markets expertise and a passion for Emerging Europe. Thanks to our location and excellent analytical capabilities we can access information quickly and easily as we visit companies on a regular basis. Karoll Capital’s portfolio managers are dedicated to constructing investment portfolios positioned to outperform regional benchmarks and peers. Long-term horizon for success At Karoll Capital Management we believe in taking a long-term view when making investment decisions. We expect Eastern Europe to continue to outperform the Eurozone in the long run due to the convergence processes related to income levels, household living standards, interest rates, etc. This conviction is reflected in our asset allocation and stock selection process, where the horizon of portfolio investment decisions is usually beyond three years. Likewise, our clients are aware of emerging market investments’ volatile nature in the short run, so normally have a long-term investment perspective (at least 3 years). Disciplined investment process and flexible allocations Each of our investment products is managed by a separate Portfolio Manager. In making asset allocation decisions, the PM is supported by a four-member Investment Committee. The team debates and decides on the asset classes comprising the portfolio, as well as the geographic and sector splits. The stock selection is performed by the fund’s PM with the help of a seasoned analyst team. Unlike most other assets managers investing in the region, we have the freedom to deviate from local indices based on our views. This gives us great flexibility in our investment choice, regularly leading to superior results and outperformance of benchmarks and peers. Meanwhile, ongoing risk management is essential to ensure excessive risk is avoided - our funds' risk measures are consistently lower than those of benchmarks. In-house valuations to ensure top picks Because of market inefficiencies we believe Emerging Europe is abundant with mispriced assets. Our analysts possess solid experience in screening the broad investment universe and identifying “hidden gems” through proprietary research. In estimating the true value of an asset we study the firm’s ability to realize an IRR greater than the cost of capital, its shareholder structure and management capabilities, sector dynamics and overall market position. Onsite company visits are a key part of research as well. In addition to employing valuation methods, we always consider investor psychology, liquidity and order flows. ADVANCE INVEST 28 February 2017 Investment Objective To seek long term capital appreciation through investments in stocks listed on the Bulgarian & Romanian markets. The fund is actively managed through bottom‐up selection of undervalued stocks with high growth potential as determined by fundamental measures. Fund Manager's Comment Fund Facts In February Advance Invest enjoyed support by Romania’s strong performance, which is one of the best performers YTD, following an unmemorable 2016. This happened against the background of the protests in Bucharest, which achieved their goal and the controversial text in the anti-corruption law - proposed by the Socialists - was removed. The outcome was several resignations and a dramatic fall in confidence in the government. In Bulgaria the election campaign for the March elections is going at full speed. As usual it’s all about strong populist promises aimed at the low income part of the population and not taking into account the views of the business. In February the market developments of portfolio components was good. The Romanian BET continued its strong YTD performance, extending its gains by 6%. Since the beginning of the year, the Romanian market is one of the best performers globally with an appreciation of 12.5%. The utilities sector joined the energy producers in their solid uptrend. Another driving force were the positive corporate reports, which restored investors’ interest. For SOFIX the consolidation below important resistance levels (615625 zone) is still in effect. During the month the index posted a small gain of 1.5%. YTD the market has advanced by 4.2% while maintaining its bullish sentiment. After an extremely successful January when Advance Invest achieved a growth of 7.44%, a slower February followed - the fund gained 0.87%, extending its YTD return to 8.37%. Emerging Europe turned out to be the best performer in the world last month, the main benchmark MSCI EFM Europe + CIS ex RU jumsping 5.83% (+8.52% YTD). Fund type Fund Manager Fund size NAV/share Launch date Benchmark Currency of account Subscription fee Management fee Redemption fee Minimum investment open-end Georgi Georgiev BGN 5.59 M BGN 1.2067 10/05/2004 MSCI EFM Europe + CIS ex RU BGN (1EUR = BGN 1.95583) up to 1.50% 2.5 % NAV p.a. none none Codes ISIN BSE Ticker Код в Bloomberg BG9000014134 5AZ ADVIMFD BU Market Breakdown Romaniа 33.6% Bulgaria 59.6% Fund performance vs Benchmark 450 400 Other 0.0% Cash 6.7% 350 300 250 Advance Invest Sector Breakdown Benchmark 200 Other 150 Utilities 100 Cash 50 Banks 0 30.04.2004 31.10.2006 30.04.2009 31.10.2011 30.04.2014 31.10.2016 Industrials Fund Results 1 month 1 year Year to Date Since Launch (annualized) Fund 0.87% 27.05% 8.37% 1.48% Benchmark 5.83% 12.31% 8.52% 2.65% Fund 10.02% -6.26% 5.61% 18.95% -5.02% -17.02% -11.73% 2.20% -66.57% 55.37% 31.20% 32.60% Benchmark -1.29% -22.13% 2.24% -16.81% 34.08% -29.75% 16.29% 51.49% -56.45% 20.71% 9.97% 51.04% Annual Performance 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 Energy Financials and real estate 20.4% 5.7% 6.7% 7.8% 11.9% 13.3% 15.9% Holdings 5 Largest Holdings ACTIV PROPERTIES (Bulgaria ), Financials and real estate CEZ (Bulgaria ), Energy MONBAT AD(Bulgaria ), Industrials CHIMIMPORT AD (Bulgaria ), Holdings FONDUL PROPRIETATEA SA (Romaniа ), Holdings 18.4% ADVANCE EASTERN EUROPE 28 February 2017 Investment Objective The goal of the fund is to ensure high investment results in the long‐term by investing in Eastern European equities in 7 regional markets. Fund Manager's Comment Most of the markets from Central and Eastern Europe finished the month higher. Russia however was on the retreat as MICEX lost nearly 9% of its value in February after very sound performance in 2016. At the same time however the Russian ruble appreciated by 3.8% against the US dollar in the past month and thus the USD denominated RTS index fell by 5.6%. Therefore MSCI MSCI EFM Europe+CIS declined slightly (-0.16%) while the benchmark excluding Russia advanced by 5.8%. Among the markets from the portfolio of Advance Eastern Europe the largest gains were posted by Ukraine (+8%) and Romania (+6%). After comparatively weak performance in 2016, the Romanian market starts the year on a strong footing as the return on the major index BET for the first two months is more than 12%. The Romanian economy is on a fast track as data published in February showed that Romania was the country with the highest GDP growth in the European Union in the last quarter of 2016 (+4.8% as compared to the same period of 2015). The Croatian market continued to rise further, CROBEX gaining another 3.7% in February, while the Bulgarian index SOFIX advanced by 1.5%. After significant volatility in 2016, the Turkish market has seen comparative stability since the beginning of the year. BIST 100 has jumped by 12% during the first two months of 2017, the major part of the gains being posted in January while in February the index gained 1.4%. At the same time the Turkish lira was much stronger in February as it jumped by 5% against the USD dollar. The increased geo-political risks in front of the country however result in significant pressure on the lira in the past months. The Turkish lira has lost 2.5% against the US dollar YTD while its 2016 loss amounts to more than 15%. Fund Facts Fund type Fund Manager open-end Nadia Nedelcheva, CFA Fund size NAV/share Launch date Benchmark* Benchmark** Currency of account Subscription fee Management fee Redemption fee Minimum investment EUR 3.25 M EUR 0.8048 04.10.2006 MSCI EFM Europe&CIS MSCI EFM Europe + CIS ex RU Euro up to 1.50% 2.5 % NAV p.a. none none Codes ISIN Bloomberg Code BG9000016063 ADVEAEU.BU Market Breakdown Russia 36.8% In February the fund’s units appreciated by 1.17% performing better than the benchmark with Russia and below the one excluding it mainly due to the high weight and strong performance of the Polish market, to which the fund has not exposure in accordance with its strategy. Serbiа 5.4% Fund Performance 170 150 Turkey 12.1% Romaniа 11.6% 130 Advance Eastern Europe 110 Benchmark* 90 Ukraine 5.0% Croatia 6.0% Benchmark** Bulgaria 12.9% 70 50 30 04.10.2006 Cash 10.0% Sector Breakdown Other 04.10.2009 04.10.2012 04.10.2015 Fund Results 1 month 1 year Year to Date Since Launch (annualized) Fund 1.17% 21.94% 3.35% -2.06% Benchmark* -0.16% 27.06% -0.64% -4.19% Benchmark** 5.83% 12.31% 8.52% -3.85% 4.1% Information services 4.3% Construction 4.5% Energy 4.8% Materials 5.8% Retail 5.9% Industrials 6.1% Holdings 6.3% Banks Cash Annual Performance 29.9% Healthcare Oil and gas 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 Other 0.2% 8.9% 9.5% 10.0% TOP 5 HOLDINGS Fund 11.31% -2.29% -4.06% 6.64% 4.07% -17.02% 18.44% 36.50% -61.94% 25.91% Benchmark* 24.40% -8.32% -22.21% -11.15% 4.86% -22.53% 21.65% 73.42% -66.63% 11.54% Benchmark** -1.29% -22.13% 2.24% -16.81% 34.08% -29.75% 16.29% 51.49% -56.45% 20.71% GMK Norliski Nikel (Russia ), Materials X5 Retail Group N.V.(Russia ), Retail JSC "NOVATEK", Common (Russia ), Oil and gas Lukoil (common) (Russia ), Oil and gas ALROSA PAO (Russia ), Non-ferrous metals ADVANCE EMERGING EUROPE OPPORTUNITIES 28 February 2017 Investment Objective The Fund invests in stocks of companies in the CEE region, and has a short-term holding horizon of the investments. Fund Manager's Comment Fund Facts The region of Central and Eastern Europe continued to post strong performance as a whole in February with the pace of advance of MSCI EFM Europe + CIS ex RU accelerating as the benchmark climbed 5.83% for the month. Thus its return YTD amounts to 8.52%, significantly above the results of the benchmark excluding Russia due to the weak performance of the Russian market since the beginning of 2017. The markets from the portfolio of Advance Emerging Europe Opportunities were a mixed bag, the top performer being Poland again as its positive trend accelerated further in February. The Polish index WIG20 jumped by 6.5% in the past month and thus its year-to-date return was above 12% by the end of February. Data published in February disclosed that Poland’s economic growth is accelerating as its GDP advanced by 3.1% y-o-y in the last quarter of 2016, which was among the highest growth rates in the European Union. The other markets did not change much in value with the performance of the Hungarian market weighing down on the monthly results of the fund. After posting solid gains in 2016 when the BUX index jumped by more than 30%, the beginning of the year has not been as strong for the Hungarian market as it depreciated by 1.3% in February. The Baltic markets were almost flat in the past month. The Czech market which finished 2016 lower (-3.6%), has been posting better results since the beginning of 2017 with the PX index advancing by 2.3% in February. The fund’s units appreciated by 1.76% in February, retaining the much better performance compared to the benchmark one year back, as well as since the launch of the fund. Fund type Fund Manager Fund size NAV/share Launch date Currency of account Subscription fee Management fee Redemption fee Minimum investment Benchmark open-end Nadia Nedelcheva, CFA EUR 1.56 M EUR 0.9296 23.11.2007 Euro up to 1.50% 2.5 % NAV p.a. none none MSCI EFM Europe + CIS ex RU Codes ISIN Bloomberg Code BG9000023077 ADVIPOF.BU Market Breakdown Poland 40.7% Lithuania 2.0% Fund Performance 110 Hungary 12.1% 100 Estonia 8.2% 90 80 Czech 13.7% 70 MF AEEO 60 Cash 11.4% Bulgaria 1.1% Benchmark Austria 8.4% Other 2.4% 50 Sector Breakdown 40 30 26.11.2007 OTHER Financials 26.11.2009 26.11.2011 26.11.2013 26.11.2015 Media Fund Results 1 month 1 year Year to Date Since Launch (annualized) Fund 1.76% 22.90% 7.18% -0.78% Benchmark 5.83% 12.31% 8.52% -6.76% 4.76% Metallurgy 4.87% Retail 5.15% Healthcare 5.41% Furniture Oil and gas Information services Banks 2016 2015 2014 2013 2012 2011 2010 2009 2008 4.28% Entertainment Cash Annual Performance 25.26% 3.66% 5.84% 7.60% 8.78% 11.43% 12.97% 5 Largest Holdings Fund 7.26% -2.27% -16.68% 3.47% 17.55% -23.26% 21.98% 2.85% -15.88% Benchmark -1.29% -22.13% -22.13% 2.24% -16.81% 34.08% -29.75% 16.29% 51.49% KRUK S.A. (Poland ), Financials CD PROJEKT SA (Poland ), Information services OTP BANK (Hungary), Banks ANY SECURITY PRINTING GO (Hungary), Printing TALLINNA KAUBAMAJA GRUPP AS (Estonia), Retail How to invest in our UCITS-compliant mutual funds? Karoll Capital Management manages four UCITS-compliant mutual funds focused on emerging Europe: Advance Invest – invests in listed companies in Bulgaria & Romania. Advance Eastern Europe – invests in stocks of companies in 6 selected markets - Bulgaria, Romania, Serbia, Croatia, Russia and Ukraine. Advance Emerging Europe Opportunities invests in stocks of companies in CEE. – Advance Conservative Fund – invests primarily in local bank deposits and fixed income instruments. How to buy and redeem fund units All funds are UCITS-IV compliant. The Fund’s NAV is calculated every business day by 5 pm local time. In order to subscribe or redeem Advance funds units, please send us an enquiry at [email protected] or fax at +359 (2) 4008426, and we will revert back with specific trading instructions. To facilitate the process of executing and settling the transactions, please provide us with the details of your local sub-custodian, if available. Fund Management Company Karoll Capital Management. The company holds a full license for fund and portfolio management services. Karoll Capital Management 1 Zlatovrah Str. Sofia, Bulgaria Tel: +359 (2) 4008 300 Fax: +359 (2) 4008 426 Email: [email protected] www.karollcapital.bg Funds structure – All Advance funds are UCITS-IV compliant Fund custody and administration - Eurobank EFG Bulgaria for Advance Invest and Advance Conservative Fund; UniCredit Bulbank for Advance Eastern Europe and Advance IPO Fund Auditor – Grant Thornton Ltd, www.gtbulgaria.com Regulator – Financial Supervision Commission, Bulgaria www.fsc.bg Dealing – The funds are open for trading every business day with cut-off at 5 PM Bulgarian time (4 PM CET). Subscriptions and redemptions accepted in BGN and EUR. Settlement – Settlement takes place as delivery against payment (DVP) within two days, either in BGN or EUR. Register of units – The units of all Advance UCITS compliant funds are registered electronically with the Bulgarian Central Depository. Custody banks details Advance Invest - Eurobank EFG Bulgaria, SWIFT: BPBIBGSF Advance Eastern Europe - Unicredit Bulbank, SWIFT: UNCRBGSF Advance Emerging Europe Opportunities - Unicredit Bulbank, SWIFT: UNCRBGSF Advance Conservative Fund - Eurobank EFG Bulgaria, SWIFT: BPBIBGSF Some custody banks that safe-keep Advance funds The following banks have opened direct sub-custody accounts in Bulgaria: Citibank, Citco Global Custody, Bank Austria Creditanstalt, Credit Suisse Securities, Deutsche Bank, Erste Bank, HSBC, ING, Raiffeisen, Societe Generale, etc. Legal Disclaimer The historical results of the mutual funds do not guarantee future results. The value of the investment and the income from it can increase as well as decrease. Profits are not guaranteed and there is a risk that investors may not receive the full amount of the invested funds. Investments in the mutual funds are not guaranteed by a state guarantee fund or any other institution. This material has been prepared by Karoll Capital Management, a licensed asset management company, a member of the Bulgarian Association of Asset Management Companies (BAAMC). It has been approved by the Compliance department at Karoll Capital Management. The prospectuses, KIIDs and Rules of the funds are publicly available at all offices of Karoll Capital Management as well as at www.karollcapital.bg.