Chapter Fifteen

... investor in the short run (less than five years), whereas annual 12b-1 charges are very costly over the long run. • Over five-year periods, lower-cost funds always deliver returns better than those offered by higher-cost funds. ...

... investor in the short run (less than five years), whereas annual 12b-1 charges are very costly over the long run. • Over five-year periods, lower-cost funds always deliver returns better than those offered by higher-cost funds. ...

Why it pays to be diversified

... portfolios perform better than primary funds for all percentiles of return distribution – and these performance benefits are further accentuated for net multiples given the impact of fees on the performance of primary funds. Figure 3 shows a side-by-side comparison of the return distributions of prim ...

... portfolios perform better than primary funds for all percentiles of return distribution – and these performance benefits are further accentuated for net multiples given the impact of fees on the performance of primary funds. Figure 3 shows a side-by-side comparison of the return distributions of prim ...

Immigrant Investor Programme - Guidelines for Funds

... to investors. While the Immigrant Investor Programme does not attach any conditions to return on investment, the Evaluation Committee will require details of the target return on investment in order to satisfy themselves that the fund and the investment strategy is at least based on viable and reali ...

... to investors. While the Immigrant Investor Programme does not attach any conditions to return on investment, the Evaluation Committee will require details of the target return on investment in order to satisfy themselves that the fund and the investment strategy is at least based on viable and reali ...

Fidelity Value (FDVLX)

... We chose this fund because we feel it returns consistently with the S&P 500. We very much enjoy how it is structured to mirror or even beat the S&P500. Also, with a beta of roughly 1.0 and good diversification into sectors we prefer, we feel this fund is hedged against the volatility of the U.S. ec ...

... We chose this fund because we feel it returns consistently with the S&P 500. We very much enjoy how it is structured to mirror or even beat the S&P500. Also, with a beta of roughly 1.0 and good diversification into sectors we prefer, we feel this fund is hedged against the volatility of the U.S. ec ...

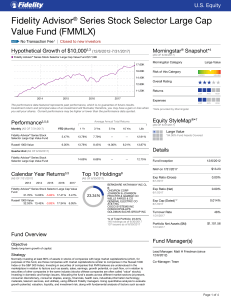

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... 8. Any holdings, asset allocation, diversification breakdowns or other composition data shown are as of the date indicated and are subject to change at any time. They may not be representative of the fund's current or future investments. The Top Ten Holdings and Top 5 Issuers do not include money ma ...

... 8. Any holdings, asset allocation, diversification breakdowns or other composition data shown are as of the date indicated and are subject to change at any time. They may not be representative of the fund's current or future investments. The Top Ten Holdings and Top 5 Issuers do not include money ma ...

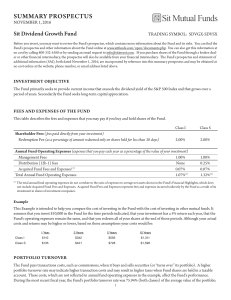

summary prospectus

... You could lose money by investing in the Fund. The principal risks of investing in the Fund are as follows: ›› Dividend Paying Company Risk: The Fund’s income objective may limit its ability to appreciate during a broad market advance because dividend paying stocks may not experience the same capita ...

... You could lose money by investing in the Fund. The principal risks of investing in the Fund are as follows: ›› Dividend Paying Company Risk: The Fund’s income objective may limit its ability to appreciate during a broad market advance because dividend paying stocks may not experience the same capita ...

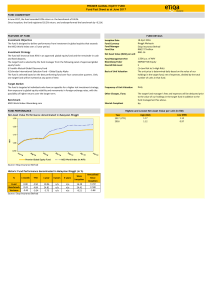

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... • In exceptional circumstances, we reserve the right to suspend the creation or cancellation of units. In such an event, a notice for suspension will be published on our website, and would be communicated to the policyholders upon any request for top-up, switching, or withdrawal to or from the fund. ...

... • In exceptional circumstances, we reserve the right to suspend the creation or cancellation of units. In such an event, a notice for suspension will be published on our website, and would be communicated to the policyholders upon any request for top-up, switching, or withdrawal to or from the fund. ...

Investment Fund Sample Portfolios

... • International and Worldwide Funds The Morningstar Category identifies funds based on their actual investment styles, as measured by their underlying portfolio holdings (portfolio statistics and compositions over the past three years). The Morningstar Category provides a more critical look at a fun ...

... • International and Worldwide Funds The Morningstar Category identifies funds based on their actual investment styles, as measured by their underlying portfolio holdings (portfolio statistics and compositions over the past three years). The Morningstar Category provides a more critical look at a fun ...

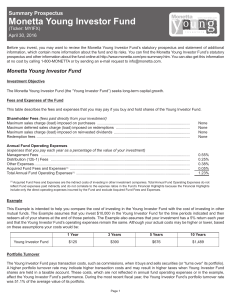

Monetta Young Investor Fund

... The stock market or stocks in the Fund’s portfolio may decline or not increase at the rate anticipated; Growth-oriented funds may under-perform when growth stocks are out of favor; The Fund may make short-term investments, without limitation, for defensive purposes, which investments may provide low ...

... The stock market or stocks in the Fund’s portfolio may decline or not increase at the rate anticipated; Growth-oriented funds may under-perform when growth stocks are out of favor; The Fund may make short-term investments, without limitation, for defensive purposes, which investments may provide low ...

How to Pick Managed Investments

... The academic definitions of value and growth are polar opposites, they usually define value stocks as being the stocks with the lowest price to earnings ratios (PER) or price to book ratios (PBR). Growth is defined as the stocks with the highest ratios. Value and growth are practically irrelevant in ...

... The academic definitions of value and growth are polar opposites, they usually define value stocks as being the stocks with the lowest price to earnings ratios (PER) or price to book ratios (PBR). Growth is defined as the stocks with the highest ratios. Value and growth are practically irrelevant in ...

IFSL Brunsdon Investment Funds brochure

... Standard Life is a trusted brand associated with credibility and reliability. Standard Life Wealth's (SLW) investment management service is built on the knowledge and experience of the Standard Life Group, which has been investing for pension funds and life assurance policies for over 180 years. SLW ...

... Standard Life is a trusted brand associated with credibility and reliability. Standard Life Wealth's (SLW) investment management service is built on the knowledge and experience of the Standard Life Group, which has been investing for pension funds and life assurance policies for over 180 years. SLW ...

Credit Suisse Mid-Year Survey of Hedge Fund Investor Sentiment

... recycle that capital to other hedge fund managers rather than other asset classes (9% reported being undecided as to where to allocate the recycled capital). Looking ahead, 76% of US investors said that they would likely make allocations to hedge funds during the second half of the year. 86% of APAC ...

... recycle that capital to other hedge fund managers rather than other asset classes (9% reported being undecided as to where to allocate the recycled capital). Looking ahead, 76% of US investors said that they would likely make allocations to hedge funds during the second half of the year. 86% of APAC ...

THEME: THE CHANGING ECONOMIC LANDSCAPE WITHIN EAC

... A sovereign wealth fund (SWF) is a state owned investment fund, often financed by foreignexchange assets, which invests globally1 in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. They are typic ...

... A sovereign wealth fund (SWF) is a state owned investment fund, often financed by foreignexchange assets, which invests globally1 in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. They are typic ...

key investor information

... accumulated. Other share classes of the Fund may distribute income. The Fund will only use a limited number of simple derivative instruments for non-complex investment purposes and/or efficient portfolio management purposes. Although the use of derivatives may give rise to an additional exposure ...

... accumulated. Other share classes of the Fund may distribute income. The Fund will only use a limited number of simple derivative instruments for non-complex investment purposes and/or efficient portfolio management purposes. Although the use of derivatives may give rise to an additional exposure ...

Evidence from Real Estate Private Equity

... is locked into the fund for several years and is only freed upon its liquidation. Because of this long-term commitment, careful selection of funds and fund managers may be of even greater importance for REPE than for investments offering a quick exit option. Our study sets out to investigate whether ...

... is locked into the fund for several years and is only freed upon its liquidation. Because of this long-term commitment, careful selection of funds and fund managers may be of even greater importance for REPE than for investments offering a quick exit option. Our study sets out to investigate whether ...

St Andrew`s Retirement Plan

... changing the net management fee for the Investors Mutual Australian Share Fund. ...

... changing the net management fee for the Investors Mutual Australian Share Fund. ...

The Impact of Leverage on Hedge Fund Performance

... emerging market hedge funds with an 8th factor that captures the return on emerging equity markets. Bollen and Whaley (2009) also contribute in the literature on performance measurement in the hedge fund industry. In order to recognize dynamics in hedge funds, two econometric techniques that accommo ...

... emerging market hedge funds with an 8th factor that captures the return on emerging equity markets. Bollen and Whaley (2009) also contribute in the literature on performance measurement in the hedge fund industry. In order to recognize dynamics in hedge funds, two econometric techniques that accommo ...

Challenges arising from alternative investment management

... potential pricing differences between the security itself and its different components 6 or take position in the underlying factors that determine the value of these particular securities. Another technique employed is “capital structure arbitrage”, whose objective is to exploit any differences in t ...

... potential pricing differences between the security itself and its different components 6 or take position in the underlying factors that determine the value of these particular securities. Another technique employed is “capital structure arbitrage”, whose objective is to exploit any differences in t ...

Mutual Fund Performance and Manager Style. J.L. Davis, FAJ, Jan

... Selection Criteria for funds to be included in the data set: 1. If a fund’s stated objective was growth, growth and income, maximum capital gains, small-cap growth, or aggressive growth; 2. Objective not listed but policy statement indicated that they primarily invested in common stocks. ...

... Selection Criteria for funds to be included in the data set: 1. If a fund’s stated objective was growth, growth and income, maximum capital gains, small-cap growth, or aggressive growth; 2. Objective not listed but policy statement indicated that they primarily invested in common stocks. ...

T t l d p t t - The University of Chicago Booth School of Business

... Consider the case of a two-year-old fund that, by the end of September of year t, has fallen 8 percentage points behind the market and is confronted by the flow-performance relationship described in Figure 1. If the fund holds its position relative to the market for the remainder of the year it will ...

... Consider the case of a two-year-old fund that, by the end of September of year t, has fallen 8 percentage points behind the market and is confronted by the flow-performance relationship described in Figure 1. If the fund holds its position relative to the market for the remainder of the year it will ...

Nationwide® Investor Destinations Conservative Fund

... WHICH DOES NOT GUARANTEE FUTURE RESULTS. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. To obtain the most recent month-end performance, go to nationwide.com/mutualfunds or call 1-800-848-0920. Class A shares have up to a 5.75% front- ...

... WHICH DOES NOT GUARANTEE FUTURE RESULTS. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. To obtain the most recent month-end performance, go to nationwide.com/mutualfunds or call 1-800-848-0920. Class A shares have up to a 5.75% front- ...

Are Funds of Funds Simply Multi-Strategy

... hedge funds compared to only $5 billion a decade ago (Atlas and Walsh [2005]). The primary reason for this enormous growth is that hedge funds offer attractive risk-adjusted returns, low correlation to traditional asset classes, and a source of alpha. Therefore, an allocation to hedge funds has the ...

... hedge funds compared to only $5 billion a decade ago (Atlas and Walsh [2005]). The primary reason for this enormous growth is that hedge funds offer attractive risk-adjusted returns, low correlation to traditional asset classes, and a source of alpha. Therefore, an allocation to hedge funds has the ...

5 key facts to consider- Ideall Absolute Return Strategies Fund (7652)

... Most conventional investment funds only reward investors when markets go up. Absolute return funds seek to deliver positive absolute returns over the medium to long term whether markets are rising or falling. ...

... Most conventional investment funds only reward investors when markets go up. Absolute return funds seek to deliver positive absolute returns over the medium to long term whether markets are rising or falling. ...