* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Five-Year Ranking: Pimco Leads 10

Stock trader wikipedia , lookup

International investment agreement wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

Interbank lending market wikipedia , lookup

Leveraged buyout wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Corporate venture capital wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Private equity wikipedia , lookup

Early history of private equity wikipedia , lookup

Money market fund wikipedia , lookup

Private equity secondary market wikipedia , lookup

Socially responsible investing wikipedia , lookup

Mutual fund wikipedia , lookup

Private money investing wikipedia , lookup

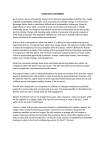

CYAN YELLOW BLACK MAGENTA Five-Year Ranking: Pimco Leads No. 2 in our one-year ranking, Pimco takes the top spot on both the five- and 10-year lists. T. Rowe Price remained in the top five, though slipped from No. 2. Natixis doesn’t have a five-year tenure in our ranking. Rank Family Weighted Score Rank Family Weighted Score Rank Family Weighted Score 1. Pimco 78.39 19. Vanguard Group 61.12 37. Deutsche Asset & Wealth Mgmt 52.22 2. Hartford Funds 73.30 20. Victory Capital Management 60.94 38. Ivy Investment Management 51.51 3. Guggenheim Investments 72.93 21. Fidelity Management & Research 59.99 39. BNY Mellon/Dreyfus 51.10 4. T. Rowe Price 71.40 22. Goldman Sachs Asset Management 59.51 40. Affiliated Managers Group 50.98 5. Putnam Investment Management 70.24 23. Principal Management 58.69 41. Franklin Templeton Investments 50.35 6. American Funds 67.97 24. Columbia Threadneedle Investments 58.57 42. UBS Asset Management 49.21 7. Dimensional Fund Advisors 67.80 25. Eaton Vance 58.22 43. MainStay Funds 48.83 8. Thrivent Financial 67.10 26. USAA Asset Management 57.96 44. American Century Invst Mgmt 48.14 9. MFS Investment Management 67.04 27. BlackRock 57.86 45. Nationwide Fund Advisors 46.95 10. Lord Abbett 66.37 28. State Street Bank & Trust 57.82 46. Virtus Investment Partners 46.67 11. PNC Funds 65.64 29. Charles Schwab Investment Mgmt 57.72 47. Prudential Investments 45.82 12. John Hancock 64.96 30. RidgeWorth Funds 57.28 48. Wells Fargo Funds Management 44.61 13. Invesco 64.54 31. AllianceBernstein 56.96 49. Foresters Investment Management 43.85 14. TIAA 64.12 32. Northern Trust Investments 55.29 50. Russell Investments 43.00 15. J.P. Morgan Asset Management 63.72 33. Delaware Management 54.92 51. Waddell & Reed Investment Mgmt 39.86 16. Nuveen Fund Advisors 63.04 34. Pioneer Investment Management 54.76 52. State Farm Investment Mgmt 28.05 17. Legg Mason 61.75 35. Federated Investors 53.04 53. AssetMark 21.41 18. OppenheimerFunds 61.49 36. SEI Investments 52.70 54. Manning & Napier Advisors 21.27 10-Year Ranking: Pimco Again, Plus Strong Showings from MFS The 10-year ranking shows more consistency; Pimco was No. 1 last year, as well, and MFS was No. 2. AMG slipped just two spots, making room for littleknown RidgeWorth Funds, which oversees $40 billion. Manning & Napier holds steady at the bottom on both our five- and 10-year lists, as it did last year. Rank Family Weighted Score Rank Family Weighted Score Rank Family Weighted Score 1. Pimco 86.92 19. Lord Abbett 61.97 37. BNY Mellon/Dreyfus 51.86 2. MFS Investment Management 79.91 20. Franklin Templeton Investments 61.02 38. Thrivent Financial 51.62 All told, just 61 asset managers out of a 3. Ivy Investment Management 76.67 21. American Funds 60.94 39. Goldman Sachs Asset Management 51.07 total of 883 in Lipper’s database had the diversified menu of equity and fixed-income funds to meet the criteria for this ranking. As in the past, there are several notable fund shops that don’t make this list, including the $197 billion Janus Capital Group (JNS), which doesn’t have a municipal-bond fund, small-company stock specialist Baron Funds, which doesn’t offer fixed-income funds, and Dodge & Cox, which doesn’t have a tax-exempt bond fund. This year, six funds dropped off the list. In July, SSGA acquired GE Asset Management, and in December, Eaton Vance (EV) acquired Calvert Investments. Four other families—Frost, Madison, Schroder, and Thornburg—no longer meet the minimum portfolio requirements. Among the largest fund complexes, Vanguard Group guided its $3.5 trillion in total assets under management through another 4. RidgeWorth Funds 76.60 22. Hartford Funds 60.17 40. OppenheimerFunds 50.61 5. Affiliated Managers Group 74.42 23. MainStay Funds 59.92 41. Putnam Investment Management 50.36 6. J.P. MorganAsset Management 74.25 24. Fidelity Management & Research 59.43 42. Foresters Investment Management 50.19 7. T. Rowe Price 73.19 25. Eaton Vance 59.12 43. Northern Trust Investments 49.86 8. John Hancock 72.80 26. Dimensional Fund Advisors 58.03 44. USAA Asset Management 47.60 9. Vanguard Group 71.84 27. Virtus Investment Partners 57.68 45. Pioneer Investment Management 47.57 10. Invesco 69.78 28. Principal Management 57.60 46. Federated Investors 45.59 11. Nuveen Fund Advisors 68.19 29. American Century Investment Mgmt 57.35 47. Nationwide Fund Advisors 45.04 12. Wells Fargo Funds Management 67.78 30. State Street Bank & Trust 57.25 48. UBS Asset Management 42.94 13. Waddell & Reed Investment Mgmt 67.31 31. Charles Schwab Investment Mgmt 56.84 49. Russell Investments 39.64 14. Delaware Management 67.01 32. Legg Mason 55.91 50. State Farm Investment Mgmt 39.13 15. Columbia Threadneedle Investments 65.02 33. PNC Funds 54.45 51. SEI Investments 38.05 16. Prudential Investments 63.58 34. Guggenheim Investments 53.59 52. Deutsche Asset & Wealth Mgmt 37.44 17. BlackRock 62.58 35. Victory Capital Management 53.13 53. Manning & Napier Advisors 30.36 18. TIAA 62.55 36. AllianceBernstein 53.12 February 13, 2017 got there,” he adds, referring not to his home team’s Super Bowl victory, but to the Standard & Poor’s 500 index’s own late-inthe-game rally to end 2016 up nearly 12%. As for Natixis’ own swift move to the front of this year’s ranking, “what hindered our performance in 2015 is what helped us in 2016,” says Hailer, who oversees a collection of more than 25 affiliated asset managers running $897 billion globally. Case in point: The firm’s largest fund, the $27 billion Oakmark International (ticker: OAKIX), beat 97% of its Lipper peers last year, posting a 7.9% return, adjusted for 12b-1 marketing and distribution fees. Herro proved his patience with deep value when he built a hefty stake in financials, consumer cyclicals, and industrial stocks at a time when investors had left them for dead. This was also the case for Switzerland-based mega-miner Glencore (GLEN.UK), which was the fund’s biggest laggard in 2015—but ended 2016 up more than 200%. Another top holding, France’s BNP Paribas (BNP.France), enjoyed a similar turn of fate. After closing in October 2013, the fund reopened to new investors last summer. It was a similar turnaround for the second-largest Natixis family fund, the $17 billion Oakmark fund (OAKMX). Led by value veteran Nygren, the fund outdid 99% of its Lipper peers in 2016 thanks to its allocation to financials and choice calls in energy—including Apache (APA), up 43% last year—and industrials, such as Cummins (CMI), and Caterpillar (CAT). Another heavy hitter and contributor to Natixis’ overall ranking was Boston-based Loomis Sayles. After trailing their peers in 2015, the $13.8 billion Loomis Sayles Bond fund (LSBRX) and the $10.7 billion Loomis Sayles Strategic Income fund (NEFZX), both co-managed by Dan Fuss, did well by making out-of-benchmark allocations to such areas as high yield, convertibles, and common stocks. Both funds ended 2016 up more than 8%. Because the Barron’s/Lipper Fund Families Ranking is asset-weighted, the results are heavily influenced by the size and category of a firm’s best- and worst-performing funds. That worked in favor of Minneapolisbased Sit Investment Associates in 2015— when the firm took the No. 1 spot—but worked against it in 2016. The main detractor is Sit’s largest fund, the $998 million Sit Dividend Growth (SDVSX), which slid to the lowest quartile of its Lipper peer group, despite ending 2016 up more than 10%. We would be remiss not to mention that the fund’s 10-year track record is still very solid, with a 7.7% average annual return. The importance of long-term returns is a BARRON’S message that bond powerhouse Pimco has long preached. The firm credits its macrodriven approach with helping it find opportunities throughout a tumultuous year—and powering its move to the second-place slot from 62nd place in 2015. “Looking back at 2016, the strategies that did the best were ones that were able to take advantage of volatility and dislocation around key events,” says the firm’s chief investment officer, Dan Ivascyn. Two standouts were the $73 billion Pimco Income fund (PONAX), up 8.7%— and co-managed by Ivascyn—and the $18.4 billion Pimco All Asset fund (PASAX), up 13.3%. While investors associate Pimco with the $76 billion Pimco Total Return fund (PTTAX), its underwhelming relative performance in 2016—up 2.6% but behind 88% of its Lipper peers—is proof that there’s more to the firm than its flagship fund. In fact, no one fund drove Pimco’s overall ranking. So much the better, says Emmanuel Roman, who joined the Newport Beach, Calif., firm as CEO last fall. A native of France, Roman favors soccer over baseball, but the latter sport’s analogies fit his philosophy for Pimco. “We like hitting singles,” he says. The results add up. Pimco’s five-year and 10-year weighted results are better than any fund family that Barron’s tracks over those periods. Although Pimco is best known for bonds, it outranked all other fund families on U.S. equity funds and world equity funds, thanks to its partnership with Research Affiliates, which sits across the street from Pimco’s headquarters. The firm’s founder and chairman, Rob Arnott, manages the Pimco All Asset fund and is a pioneer in fundamental indexing. Long before smart beta was all the rage, Arnott began looking at how to combine the efficiency, discipline, and cost-effectiveness of indexing with key tenets of investing, such as price and quality. Last year, the $1.8 billion Pimco RAE Fundamental Plus (PIXAX) ended the year up 19%, leading its large-cap core Lipper category. The $1.5 billion Pimco RAE Fundamental Emerging Markets (PEAFX) soared 32.5%. Last year’s volatility and change in leadership—both in politics and in markets— was some affirmation for believers in active management and smart beta. Yet for State Street Global Advisors, or SSGA, the year’s third-place finisher, passive paid off. In 2016, U.S. SPDR ETFs had their best year in terms of inflows since 2008, with nearly $50 billion in net new money. “There are an awful lot of people who, to borrow from Al Gore’s quote [of Upton Sinclair] in An S7 5 Years. 5 Stars. Zero Excuses. KNOW All Cap Insider Sentiment Shares Overall Morningstar Rating™ out of 371 Mid-Cap Blend funds as of 12/31/2016 based on risk adjusted return Get started today. Call 877.437.9363 or go to direxioninvestments.com/KNOW † ©2016 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. The Morningstar RatingTM for funds, or "star rating", is calculated for managed with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated Shares of Direxion Shares are bought and sold at the market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally determined) and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable. An investor should consider the investment objectives, risks, charges,and expenses of Direxion Shares carefully before investing. The prospectus and summary prospectus contain this and other information about Direxion Shares. To obtain a prospectus and summary prospectus call 866-476-7523 or visit our website at direxioninvestments.com. The prospectus and summary prospectus should be read carefully before investing. Shares of Direxion Shares are bought and sold at the market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three year period actually has the greatest impact because it is included in all three rating periods. The Direxion All Cap Insider Sentiment Shares (KNOW) was rated against the following numbers of Mid-Cap Blend funds over the following time periods: 371 funds in the last three years, and 332 funds in the last five years. As of 12/31/2016, the fund received a 5-Star rating for the 3-year period, 5-year period, and overall. Past performance is no guarantee of future results. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally determined) and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable. Risks: The Fund is non-diversified and include risks associated with concentration risk that results from the Funds' investments in a limited number of securities. Increased portfolio turnover may result in higher transaction costs and capital gains. The Fund may also invest in securities of other investment companies, including ETFs, which may involve duplication of advisory fees and certain other expenses. For other risks including replication strategy risk, index correlation/tracking risks and specific risks of exchange traded funds. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund. Distributor: Foreside Fund Services, LLC. CL,CN,CX,DL,DM,DX,EE,EU,FL,HO,KC,MW,NC,NE,NY,PH,PN,RM,SA,SC,SL,SW,TU,WB,WE BG,BM,BP,CC,CH,CK,CP,CT,DN,DR,FW,HL,LA,LD,LG,LK,MI,ML,PI,PV,TD,WO P2BW044000-0-S00700-1--------XA Composite February 13, 2017 Composite C M Y K Inconvenient Truth, find it ‘difficult to get a man to understand something if his salary depends upon his not understanding it,’ ” says Nick Good, co-head of SSGA’s Global SPDR Business, which accounts for 21% of its $2.4 trillion under management. “We don’t have that concern because we’re in both spaces.” While our ranking excludes some notable SPDR funds—including the original, the $225 billion SPDR S&P 500 (SPY)—the firm’s strength across everything from diversified ETFs to regional funds buoyed its overall ranking from 28th last year. To qualify for our fund-family ranking, now in its 22nd year, firms must offer a wide range of funds with a minimum track record of one year. This includes at least three mutual funds or ETFs in Lipper’s general U.S. equity category, one in world equity, and one in mixed-asset, as well as two taxable bond funds and one tax-exempt bond fund. Rankings are based on a firm’s funds within those respective categories. (See “How We Rank the Fund Families,” page S5, for a more detailed explanation of the methodology.) Early in the rankings, Barron’s editors opted to exclude S&P 500 index funds, which, at the time, were by far the most prevalent kind and represented the primary form of indexing. We’ve continued to keep them out of the ranking, but as indexing has evolved, fund families have added new index products that look less and less like the broad market and represent some “active” decision-making in their development. So we have included them, inasmuch as they fit into our primary categories. Of the 15,828 distinct share classes that collectively contributed to this ranking, 138 are ETFs. BARRON’S P2BW044000-0-S00700-1--------XA S10