* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

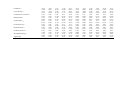

Download Limited Attention and the Uninformative Persuasion of Mutual Fund

Expenditures in the United States federal budget wikipedia , lookup

Modified Dietz method wikipedia , lookup

Pensions crisis wikipedia , lookup

Private equity wikipedia , lookup

Fundraising wikipedia , lookup

Stock trader wikipedia , lookup

Public finance wikipedia , lookup

Rate of return wikipedia , lookup

Syndicated loan wikipedia , lookup

Private equity secondary market wikipedia , lookup

Money market fund wikipedia , lookup

Fund governance wikipedia , lookup