Fiscal Policy: Lessons from the Crisis

... prospects have rekindled the debate on the role, design and priorities of fiscal policy. The limited effectiveness of monetary policy when interest rates are very low, together with the added challenge of dysfunctional credit markets, gave rise to a renewed consensus on the complementarity of moneta ...

... prospects have rekindled the debate on the role, design and priorities of fiscal policy. The limited effectiveness of monetary policy when interest rates are very low, together with the added challenge of dysfunctional credit markets, gave rise to a renewed consensus on the complementarity of moneta ...

WellCare Health Plans 2015 Annual Report

... Subsequent events and developments may cause actual results to differ, perhaps materially, from our forward-looking statements. We undertake no duty and expressly disclaim any obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or ot ...

... Subsequent events and developments may cause actual results to differ, perhaps materially, from our forward-looking statements. We undertake no duty and expressly disclaim any obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or ot ...

Limited Attention and the Uninformative Persuasion of Mutual Fund

... constrained to report HPRs over specific horizons, investor sensitivity to end-return effects should manifest only for lags specific to those horizons (specifically the 13th, 37th and 61st return lag in our setting, relating to the 1, 3 and 5 year HPR). If investors are influenced by end-return eff ...

... constrained to report HPRs over specific horizons, investor sensitivity to end-return effects should manifest only for lags specific to those horizons (specifically the 13th, 37th and 61st return lag in our setting, relating to the 1, 3 and 5 year HPR). If investors are influenced by end-return eff ...

National Infrastructure Bank Aff – 7WK

... huge highways, but with few exceptions (London among them) American traffic congestion is worse than western Europe’s. Average delays in America’s largest cities exceed those in cities like Berlin and Copenhagen. Americans spend considerably more time commuting than most Europeans; only Hungarians a ...

... huge highways, but with few exceptions (London among them) American traffic congestion is worse than western Europe’s. Average delays in America’s largest cities exceed those in cities like Berlin and Copenhagen. Americans spend considerably more time commuting than most Europeans; only Hungarians a ...

Forms of Benefit Payment at Retirement

... (notably in Central and Eastern Europe and Latin American countries) have successfully launched the capital accumulation phase. Yet, they may need to focus on the regulation of the payout phase. In particular, issues such as the choices that should be available to retiring individuals, which entitie ...

... (notably in Central and Eastern Europe and Latin American countries) have successfully launched the capital accumulation phase. Yet, they may need to focus on the regulation of the payout phase. In particular, issues such as the choices that should be available to retiring individuals, which entitie ...

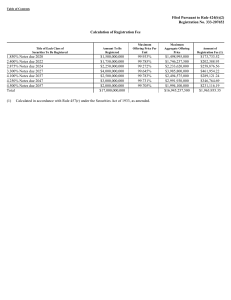

ASTRAZENECA PLC (Form: F-3ASR, Received: 11/22/2016 11:52:39)

... Because we are a holding company and currently conduct our operations through subsidiaries, your right to receive payments on our debt securities is structurally subordinated to the liabilities of our subsidiaries. We are organized as a holding company, and substantially all of our operations are ca ...

... Because we are a holding company and currently conduct our operations through subsidiaries, your right to receive payments on our debt securities is structurally subordinated to the liabilities of our subsidiaries. We are organized as a holding company, and substantially all of our operations are ca ...

May 2015- Review of Economy and Markets

... • National Debt: $18.2 trillion State & Local Debt: $3.1 trillion GDP: $17.7 trillion[calculation changed] Debt/GDP Ratio: 103% (120% Fed+State) • Unfunded Liabilities: $ 96 trillion Total National Assets: $116 trillion • Debt doesn’t include Federal Reserve, Fannie Mae + Freddie Mac and FHA obligat ...

... • National Debt: $18.2 trillion State & Local Debt: $3.1 trillion GDP: $17.7 trillion[calculation changed] Debt/GDP Ratio: 103% (120% Fed+State) • Unfunded Liabilities: $ 96 trillion Total National Assets: $116 trillion • Debt doesn’t include Federal Reserve, Fannie Mae + Freddie Mac and FHA obligat ...

MICROSOFT CORP (Form: 424B2, Received: 01/31/2017 16:20:44)

... prospectus or in any free writing prospectus filed by us with the Securities and Exchange Commission (the “SEC”). If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. We have not, and the underwriters have not, ...

... prospectus or in any free writing prospectus filed by us with the Securities and Exchange Commission (the “SEC”). If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. We have not, and the underwriters have not, ...

APPLE INC (Form: 424B2, Received: 11/04/2014 06:07:42)

... accompanying prospectus also incorporates by reference documents that are described under “Incorporation by Reference” in that prospectus. You should rely only on the information contained or incorporated by reference in this prospectus supplement, in the accompanying prospectus or in any free writi ...

... accompanying prospectus also incorporates by reference documents that are described under “Incorporation by Reference” in that prospectus. You should rely only on the information contained or incorporated by reference in this prospectus supplement, in the accompanying prospectus or in any free writi ...

Montenegro - Prospectus

... No person is authorised to give any information or make any representation not contained in this Prospectus in connection with the issue and offering of the Notes and, if given or made, such information or representation must not be relied upon as having been authorised by any of the Issuer, the Joi ...

... No person is authorised to give any information or make any representation not contained in this Prospectus in connection with the issue and offering of the Notes and, if given or made, such information or representation must not be relied upon as having been authorised by any of the Issuer, the Joi ...

IMF-Supported Macroeconomic Policies and the World Recession: A

... recommended macroeconomic policies during the course of the current world recession. In a panel discussion held on June 19, 2009, there was disagreement between the IMF and CEPR over whether or to what extent the IMF has supported pro-cyclical policies in borrowing countries during the current world ...

... recommended macroeconomic policies during the course of the current world recession. In a panel discussion held on June 19, 2009, there was disagreement between the IMF and CEPR over whether or to what extent the IMF has supported pro-cyclical policies in borrowing countries during the current world ...

public accounts and estimates committee

... The Public Accounts and Estimates Committee is a joint parliamentary committee constituted under the Parliamentary Committees Act 2003. The Committee comprises seven members of Parliament drawn from both Houses of Parliament. The Committee carries out investigations and reports to Parliament on matt ...

... The Public Accounts and Estimates Committee is a joint parliamentary committee constituted under the Parliamentary Committees Act 2003. The Committee comprises seven members of Parliament drawn from both Houses of Parliament. The Committee carries out investigations and reports to Parliament on matt ...

athens-clarke county, georgia comprehensive annual financial

... professional management approach to establishing priorities and an orderly means of directing the Government's various services. Developed on a line item basis with a focus on the cost of services, the Government's budget is adopted by the Mayor and Commission after a required public hearing and two ...

... professional management approach to establishing priorities and an orderly means of directing the Government's various services. Developed on a line item basis with a focus on the cost of services, the Government's budget is adopted by the Mayor and Commission after a required public hearing and two ...

Global Aging 2016: 58 Shades Of Gray

... could be large. Intuitively, the more distorted a country's demographic profile, the higher the increase in age-related spending is likely to be. This is, however, not always the case, because a country can significantly cushion the budgetary effects of aging by restructuring the revenue and spendin ...

... could be large. Intuitively, the more distorted a country's demographic profile, the higher the increase in age-related spending is likely to be. This is, however, not always the case, because a country can significantly cushion the budgetary effects of aging by restructuring the revenue and spendin ...

SYSCO CORP (Form: 10-Q, Received: 05/05/2015 06:07:42)

... presented in the balance sheet as a direct deduction from the carrying amount of the related debt liability, instead of being presented as an asset. Debt disclosures will include the face amount of the debt liability and the effective interest rate. The update requires retrospective application and ...

... presented in the balance sheet as a direct deduction from the carrying amount of the related debt liability, instead of being presented as an asset. Debt disclosures will include the face amount of the debt liability and the effective interest rate. The update requires retrospective application and ...

2017-2018 Budget - Generations Fund

... The Act to reduce the debt and establish the Generations Fund (CQLR, chapter R2.2.0.1) was passed on June 15, 2006. This Act set debt reduction targets and established the Generations Fund, a fund dedicated exclusively to repaying the gross debt. The Act also specifies the revenue sources dedicated ...

... The Act to reduce the debt and establish the Generations Fund (CQLR, chapter R2.2.0.1) was passed on June 15, 2006. This Act set debt reduction targets and established the Generations Fund, a fund dedicated exclusively to repaying the gross debt. The Act also specifies the revenue sources dedicated ...

Publication No. 117-34 (Revised July 2016) Illustrative Financial

... and Audit Requirements for Federal Awards, and the State Single Audit Implementation Act, are presented for purposes of additional analysis and are not a required part of the basic financial statements. The combining and individual fund statements, budgetary schedules, other schedules, and the Sched ...

... and Audit Requirements for Federal Awards, and the State Single Audit Implementation Act, are presented for purposes of additional analysis and are not a required part of the basic financial statements. The combining and individual fund statements, budgetary schedules, other schedules, and the Sched ...

Sec 0 Cover - 2 Title TOC Tabs Etc.XLS

... support of the County’s programs. The Board consists of five commissioners, elected on a staggered basis for terms of four years. The County Manager is appointed by, and serves at the pleasure of the Board as the County’s Chief Executive Officer. The Manager has appointive and removal authority over ...

... support of the County’s programs. The Board consists of five commissioners, elected on a staggered basis for terms of four years. The County Manager is appointed by, and serves at the pleasure of the Board as the County’s Chief Executive Officer. The Manager has appointive and removal authority over ...

UNITED TECHNOLOGIES CORP /DE/ (Form: 10

... The Condensed Consolidated Financial Statements at June 30, 2013 and for the quarters and six months ended June 30, 2013 and 2012 are unaudited, but in the opinion of management include all adjustments (consisting only of normal recurring adjustments) necessary for a fair presentation of the results ...

... The Condensed Consolidated Financial Statements at June 30, 2013 and for the quarters and six months ended June 30, 2013 and 2012 are unaudited, but in the opinion of management include all adjustments (consisting only of normal recurring adjustments) necessary for a fair presentation of the results ...

Economic Reform Programme for the Period 2017-2019

... Average inflation in 2016 is projected to be 0.3%, which is slightly up from 2015. The first half of 2016 was characterised by low inflation owing to the fall in energy prices, while it started to pick up in the third quarter due to the base effect of price levels from the previous year. In addition ...

... Average inflation in 2016 is projected to be 0.3%, which is slightly up from 2015. The first half of 2016 was characterised by low inflation owing to the fall in energy prices, while it started to pick up in the third quarter due to the base effect of price levels from the previous year. In addition ...

AVVISO n. 198

... Table of Contents Preservation of Defenses Nothing in this prospectus, or in any communication from the Republic, constitutes an acknowledgment or admission of the existence of any claim or any liability of the Republic to pay that claim or an acknowledgment that any ability to bring proceedings in ...

... Table of Contents Preservation of Defenses Nothing in this prospectus, or in any communication from the Republic, constitutes an acknowledgment or admission of the existence of any claim or any liability of the Republic to pay that claim or an acknowledgment that any ability to bring proceedings in ...

Citigroup HSBC Santander

... The Province of Buenos Aires (the “Province”) is offering USD 500,000,000 aggregate principal amount of its 5.750% Notes due 2019 (the “2019 Notes”). The Province is also offering USD 500,000,000 aggregate principal amount of its 7.875% Notes due 2027 (the “2027 Notes and, together with the 2019 Not ...

... The Province of Buenos Aires (the “Province”) is offering USD 500,000,000 aggregate principal amount of its 5.750% Notes due 2019 (the “2019 Notes”). The Province is also offering USD 500,000,000 aggregate principal amount of its 7.875% Notes due 2027 (the “2027 Notes and, together with the 2019 Not ...

NBER WORKING PAPER SERIES Philippe Aghion

... thereby improving welfare. Another justi…cation for countercyclical …scal policy stems from a more Keynesian view of the cycle: namely, to the extent that a recession corresponds to an increase in the ine¢ ciency of the economy, appropriate …scal or monetary policy that raises aggregate demand can b ...

... thereby improving welfare. Another justi…cation for countercyclical …scal policy stems from a more Keynesian view of the cycle: namely, to the extent that a recession corresponds to an increase in the ine¢ ciency of the economy, appropriate …scal or monetary policy that raises aggregate demand can b ...

- UniCredit Bank

... picked up sharply. The underlying fiscal stance widened by about 2.5% of GDP in January-July from a year before, even though one-off revenues, cyclically-high tax receipts, and lower interest payments helped keep the headline deficit little changed. Similarly, monetary policy has remained expansiona ...

... picked up sharply. The underlying fiscal stance widened by about 2.5% of GDP in January-July from a year before, even though one-off revenues, cyclically-high tax receipts, and lower interest payments helped keep the headline deficit little changed. Similarly, monetary policy has remained expansiona ...

Social budgeting - Social Protection Platform

... Building a health care (HC) module of the Social Budget model Australia: Number of health services utilized per capita and year by age group and sex, 1996/97 Poland: Poverty criterion and number of households below the poverty line, 1996-2020 (two alternatives) ...

... Building a health care (HC) module of the Social Budget model Australia: Number of health services utilized per capita and year by age group and sex, 1996/97 Poland: Poverty criterion and number of households below the poverty line, 1996-2020 (two alternatives) ...

Expenditures in the United States federal budget

The United States federal budget contains a number of expenditures, which include mandatory programs such as the Medicare and Social Security programs, military spending, and discretionary funding for Cabinet Departments (e.g., United States Department of Justice) and agencies (e.g., Securities & Exchange Commission).During FY2014, the federal government spent $3.504 trillion on a budget or cash basis, up $50 billion or 1% vs. FY2013 spending of $3.455 trillion. Major categories of FY 2014 spending included: Social Security ($845B or 24% of spending), Healthcare such as Medicare and Medicaid ($831B or 24%), Defense Department ($596B or 17%), non-defense discretionary spending used to run federal Departments and Agencies ($583B or 17%), other mandatory programs such as food stamps and unemployment compensation ($420B or 12%) and interest ($229B or 6.5%).Expenditures are classified as mandatory, with payments required by specific laws, or discretionary, with payment amounts renewed annually as part of the budget process. Expenditures averaged 20.4% GDP over the past 40 years, generally ranging +/-2% GDP from that level. The 2014 spend was 20.3% GDP, versus 2013 spend of 20.8% GDP and a recent 2009 peak of 24.4% GDP.CBO projects that spending for Social Security, Healthcare programs and interest costs will rise relative to GDP over the 2015-2025 period, while defense and other discretionary spending will decline relative to GDP.Over the past 40 years, mandatory spending for programs such as Medicare and Social Security has grown as a share of the budget and relative to GDP, while other discretionary categories have declined. Medicare, Medicaid and Social Security grew from 4.3% of GDP in 1971 to 10.1% of GDP in 2012.In the long-run, expenditures related to Social Security, Medicare and Medicaid are growing considerably faster than the economy overall as the population matures. The Congressional Budget Office estimates that Social Security spending will rise from 4.8% of GDP in 2009 to 6.2% of GDP by 2035, where it will stabilize. However, CBO expects Medicare and Medicaid to continue growing, rising from 5.3% GDP in 2009 to 10.0% in 2035 and 19.0% by 2082. CBO has indicated healthcare spending per beneficiary is the primary long-term fiscal challenge. Further, multiple government and private sources have indicated the overall expenditure path is unsustainable.