Westpac Trust Preferred Securities

... investor. It is important that you read the entire PDS before making any decision to apply for Westpac TPS. In particular, in considering the prospects of Westpac, it is important that you consider the risk factors that could affect the financial performance and position of Westpac. You should caref ...

... investor. It is important that you read the entire PDS before making any decision to apply for Westpac TPS. In particular, in considering the prospects of Westpac, it is important that you consider the risk factors that could affect the financial performance and position of Westpac. You should caref ...

Powers

... This Committee was established on October 28, 2001, to conduct an investigation of the related-party transactions. We have examined the specific transactions that led to the third-quarter 2001 earnings charge and the restatement. We also have attempted to examine all of the approximately two dozen o ...

... This Committee was established on October 28, 2001, to conduct an investigation of the related-party transactions. We have examined the specific transactions that led to the third-quarter 2001 earnings charge and the restatement. We also have attempted to examine all of the approximately two dozen o ...

BASE PROSPECTUS Dated 9 September 2016 NOMURA BANK

... under Regulation (EC) No. 1060/2009 (as amended) (the CRA Regulation). Their ratings have, however, been endorsed by Moody's Investors Service Limited, Standard & Poor's Credit Market Services Europe Limited (S&P CMSE) and Fitch Ratings Ltd respectively, in each case, in accordance with the CRA Regu ...

... under Regulation (EC) No. 1060/2009 (as amended) (the CRA Regulation). Their ratings have, however, been endorsed by Moody's Investors Service Limited, Standard & Poor's Credit Market Services Europe Limited (S&P CMSE) and Fitch Ratings Ltd respectively, in each case, in accordance with the CRA Regu ...

Credit Suisse AG Credit Suisse International

... than Exempt Securities) and will set out the specific details of the Securities. For example, the relevant Final Terms will specify the issue date, the maturity date, the underlying asset(s) to which the Securities are linked (if any), the applicable "Product Conditions" and/or the applicable "Asset ...

... than Exempt Securities) and will set out the specific details of the Securities. For example, the relevant Final Terms will specify the issue date, the maturity date, the underlying asset(s) to which the Securities are linked (if any), the applicable "Product Conditions" and/or the applicable "Asset ...

important notice this offering is available only to investors

... investor’’ (within the meaning of Article 2(1)(e) of Directive 2003/71/EC, as amended, and any relevant implementing measure in such Member State of the European Economic Area. The offering memorandum is being sent to you at your request, and by accessing the offering memorandum you shall be deemed ...

... investor’’ (within the meaning of Article 2(1)(e) of Directive 2003/71/EC, as amended, and any relevant implementing measure in such Member State of the European Economic Area. The offering memorandum is being sent to you at your request, and by accessing the offering memorandum you shall be deemed ...

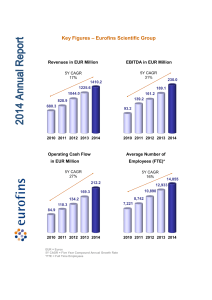

Consolidated Profit and Loss Statement

... The majority of markets where Eurofins is active remain buoyant, as reflected in the Group‟s strong performance across most of its businesses. Variations in the Group‟s results were largely driven by its own initiatives in specific markets and businesses to secure or strengthen its long-term competi ...

... The majority of markets where Eurofins is active remain buoyant, as reflected in the Group‟s strong performance across most of its businesses. Variations in the Group‟s results were largely driven by its own initiatives in specific markets and businesses to secure or strengthen its long-term competi ...

LULD Plan 12th Amendment Plan Text (FINAL with markings)

... shall be calculated by applying the Percentage Parameter for such NMS Stock to the Reference Price, with the Lower Price Band being a Percentage Parameter below the Reference Price, and the Upper Price Band being a Percentage Parameter above the Reference Price. The Price Bands shall be calculated d ...

... shall be calculated by applying the Percentage Parameter for such NMS Stock to the Reference Price, with the Lower Price Band being a Percentage Parameter below the Reference Price, and the Upper Price Band being a Percentage Parameter above the Reference Price. The Price Bands shall be calculated d ...

united states securities and exchange commission form 10 jbg smith

... market is in a different stage of its economic cycle and there are limited synergies between the two platforms. We believe that separating the two businesses, each with its own dedicated management team, board of trustees and report card (i.e., stock price), will maximize value for our shareholders. ...

... market is in a different stage of its economic cycle and there are limited synergies between the two platforms. We believe that separating the two businesses, each with its own dedicated management team, board of trustees and report card (i.e., stock price), will maximize value for our shareholders. ...

exhibit 1 - New York Stock Exchange

... The Price Bands shall be based on a Reference Price for each NMS Stock that equals the arithmetic mean price of Eligible Reported Transactions for the NMS stock over the immediately preceding five-minute period (except for periods following openings and reopenings, which are addressed below). If no ...

... The Price Bands shall be based on a Reference Price for each NMS Stock that equals the arithmetic mean price of Eligible Reported Transactions for the NMS stock over the immediately preceding five-minute period (except for periods following openings and reopenings, which are addressed below). If no ...

ESPP Prospectus 2016: 2nd offering period

... This prospectus has been prepared in compliance with the standards and requirements of the Swedish Financial Instruments Trading Act of 1991 (Sw. lagen (1991:980) om handel med finansiella instrument) (the "Trading Act"), Directive 2003/71/EC of the European Parliament and the Council (the "Prospect ...

... This prospectus has been prepared in compliance with the standards and requirements of the Swedish Financial Instruments Trading Act of 1991 (Sw. lagen (1991:980) om handel med finansiella instrument) (the "Trading Act"), Directive 2003/71/EC of the European Parliament and the Council (the "Prospect ...

Ind-AS Illustrative financial statements for the year ended 31 March

... companies. Users of this publication are encouraged to select disclosures relevant to their circumstances and tailor them appropriately. Users should also keep in mind that transactions not envisaged in the illustrative financial statements are likely to require additional disclosures. This set of i ...

... companies. Users of this publication are encouraged to select disclosures relevant to their circumstances and tailor them appropriately. Users should also keep in mind that transactions not envisaged in the illustrative financial statements are likely to require additional disclosures. This set of i ...

reuters fundamentals

... equipment. Thomson Reuters, its agents and employees, shall not be held liable to or through any user for any loss or damage whatsoever resulting from reliance on the information contained herein. This document contains information proprietary to Thomson Reuters and may not be reproduced, disclosed, ...

... equipment. Thomson Reuters, its agents and employees, shall not be held liable to or through any user for any loss or damage whatsoever resulting from reliance on the information contained herein. This document contains information proprietary to Thomson Reuters and may not be reproduced, disclosed, ...

Non-Principal Protected Unlisted Daily Cash Dividend

... reference assets in the basket perform: the potential payout on our Basket DCDC ELIs is always determined by the asset which performs worst out of all the reference assets in the basket. ...

... reference assets in the basket perform: the potential payout on our Basket DCDC ELIs is always determined by the asset which performs worst out of all the reference assets in the basket. ...

Notice of General Meeting for Shareholders

... in the United Kingdom. BofA Merrill Lynch (together with Barclays, the “Joint Global Coordinators”), which is acting as joint global coordinator and joint bookrunner in relation to the Rights Issue, HSBC (together with Barclays and BofA Merrill Lynch, the “Joint Bookrunners”), which is acting as joi ...

... in the United Kingdom. BofA Merrill Lynch (together with Barclays, the “Joint Global Coordinators”), which is acting as joint global coordinator and joint bookrunner in relation to the Rights Issue, HSBC (together with Barclays and BofA Merrill Lynch, the “Joint Bookrunners”), which is acting as joi ...

U.S.$500,000,000 8.500% Perpetual Subordinated Non

... Subordination—Definitions”), (ii) pari passu without preference among themselves and with all of Grupo Financiero Santander México’s present and future other unsecured Subordinated Non-Preferred Indebtedness and (iii) senior only to all classes of Grupo Financiero Santander México’s capital stock, ...

... Subordination—Definitions”), (ii) pari passu without preference among themselves and with all of Grupo Financiero Santander México’s present and future other unsecured Subordinated Non-Preferred Indebtedness and (iii) senior only to all classes of Grupo Financiero Santander México’s capital stock, ...

- - - - Prospectus Open Joint-Stock Company«Pharmsynthez

... register of holders of registered securities shall be made only after full payment of the Shares and not later than the last day of their placement. During the placing of securities, the prior right to acquire securities according to the provision 40 and 41 in the federal law on joint-stock companie ...

... register of holders of registered securities shall be made only after full payment of the Shares and not later than the last day of their placement. During the placing of securities, the prior right to acquire securities according to the provision 40 and 41 in the federal law on joint-stock companie ...

Timing the Treasury Bond Market

... Since the model uses indicators to decide in which security to invest, it uses patterns from historic data. Hence, the model performs a technical analysis to time the market. As opposed to fundamental analysis, which involves analyzing the intrinsic value of a company, technical analysis is the stud ...

... Since the model uses indicators to decide in which security to invest, it uses patterns from historic data. Hence, the model performs a technical analysis to time the market. As opposed to fundamental analysis, which involves analyzing the intrinsic value of a company, technical analysis is the stud ...

IAS 39 Implementation Guidance Questions and Answers

... Fair value measurement considerations for investment funds Fair value measurement: large holding ...

... Fair value measurement considerations for investment funds Fair value measurement: large holding ...

Basics of US GAAP for Life Insurers - aktuariat

... • US GAAP accounting rules for insurance companies are formulated in different Statements of Financial Accounting Standards (SFAS or short FAS) – FAS 60, FAS 97 and FAS 120 are relevant for insurance product classification • FAS 60 (issued in 1982) contains the general principles of accounting for i ...

... • US GAAP accounting rules for insurance companies are formulated in different Statements of Financial Accounting Standards (SFAS or short FAS) – FAS 60, FAS 97 and FAS 120 are relevant for insurance product classification • FAS 60 (issued in 1982) contains the general principles of accounting for i ...

Study on the remuneration provisions applicable to credit institutions

... regard to clawback clauses in the context of national employment law. Other problems concern the need for rules that are better adapted to the business scale. The rules work well in the case of big and significant institutions. For small and non-complex institutions, which are less engaged in risky ...

... regard to clawback clauses in the context of national employment law. Other problems concern the need for rules that are better adapted to the business scale. The rules work well in the case of big and significant institutions. For small and non-complex institutions, which are less engaged in risky ...

ROCKWALL CDO LTD. ROCKWALL CDO

... The Notes are offered by the Co-Issuers through Bear, Stearns & Co. Inc. ("Bear Stearns" or the "Initial Purchaser") to prospective purchasers from time to time in negotiated transactions at varying prices to be determined in each case at the time of sale. The Notes are offered when, as and if issue ...

... The Notes are offered by the Co-Issuers through Bear, Stearns & Co. Inc. ("Bear Stearns" or the "Initial Purchaser") to prospective purchasers from time to time in negotiated transactions at varying prices to be determined in each case at the time of sale. The Notes are offered when, as and if issue ...

Essays on the Forecasting Power of Implied Volatility

... volatility for future realized returns. This is presumably because in an efficient market, returns are, by definition, unforecastable. This may not be completely true, however, if we start with the assumption that implied volatility is a risk factor separate from or adding to realized volatility. In ...

... volatility for future realized returns. This is presumably because in an efficient market, returns are, by definition, unforecastable. This may not be completely true, however, if we start with the assumption that implied volatility is a risk factor separate from or adding to realized volatility. In ...

Selected french banking and financial regulations

... Excerpt from Monetary and Financial Code: Articles R. 330-1 to R. 330-3, adopted with a view to transposing Articles 6 and 10 of Directive 98/26/CE of the European Parliament and Council concerning settlement finality in payment and securities settlement systems ..................................... ...

... Excerpt from Monetary and Financial Code: Articles R. 330-1 to R. 330-3, adopted with a view to transposing Articles 6 and 10 of Directive 98/26/CE of the European Parliament and Council concerning settlement finality in payment and securities settlement systems ..................................... ...

US Masters Residential Property Fund

... In addition to reading this Prospectus in full, it is important you read these documents in full before making a decision to invest in URF Notes II. Investment Decision Applicants should read this Prospectus in its entirety before deciding to apply for URF Notes II. This Prospectus does not take int ...

... In addition to reading this Prospectus in full, it is important you read these documents in full before making a decision to invest in URF Notes II. Investment Decision Applicants should read this Prospectus in its entirety before deciding to apply for URF Notes II. This Prospectus does not take int ...

Document

... This report is presented in euros (EUR), which is ABN AMRO’s presentation currency, rounded to the nearest million, and sets out the results for the entire ABN AMRO organisation worldwide (unless otherwise stated). All financial averages present trends that are materially different from those that w ...

... This report is presented in euros (EUR), which is ABN AMRO’s presentation currency, rounded to the nearest million, and sets out the results for the entire ABN AMRO organisation worldwide (unless otherwise stated). All financial averages present trends that are materially different from those that w ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.