* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

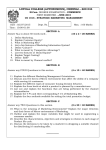

Download Financial Accounting: Assets Question 1 (30 marks) Multiple choice

Greeks (finance) wikipedia , lookup

Trading room wikipedia , lookup

Individual Savings Account wikipedia , lookup

Rate of return wikipedia , lookup

Financial economics wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity wikipedia , lookup

Interest rate wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Short (finance) wikipedia , lookup

Internal rate of return wikipedia , lookup

Financialization wikipedia , lookup

Modified Dietz method wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Global saving glut wikipedia , lookup

Business valuation wikipedia , lookup

Present value wikipedia , lookup

International investment agreement wikipedia , lookup

Stock selection criterion wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Investment management wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Early history of private equity wikipedia , lookup

Investment banking wikipedia , lookup

Land banking wikipedia , lookup

Financial Accounting: Assets Question 1 (30 marks) Multiple choice (1 mark each) a. What is an investment made in debt or equity securities solely for the purposes of generating a financial return called? 1) 2) 3) 4) Strategic investment Passive investment Investment in associate Subsidiary b. What is an investment made in equity securities for the purpose of gaining significant influence or control over the operations of the investee called? 1) 2) 3) 4) Strategic investment Passive investment Held-to-maturity investment Held for trading investment c. How would an investor classify an investment in equity securities purchased with temporary excess cash? 1) 2) 3) 4) Held-to-maturity financial asset Available for sale financial asset Held for trading financial asset Strategic investment d. What is the classification of the investment when the investment gives the investor control over the financial and operating policies of the investee? 1) 2) 3) 4) Associate Consolidated Subsidiary Related Party e. What is the minimum percentage ownership an investor must have in an investee in order to demonstrate significant influence? 1) 2) 3) 4) 20% 50% 100% There is no minimum percent f. When equity securities are acquired with non-cash assets, how is the cost of the investment determined? 1) 2) 3) 4) The fair value of the shares acquired The fair value of the non cash assets given up The average of the fair value of the shares acquired and the fair value of the non cash assets given up The carrying value of the non cash assets given up g. How is the receipt of dividends from an associate recorded when the investor records the investment in the associate using the equity method, assuming the dividends are from post acquisition accumulated profits? 1) 2) 3) 4) Debit to cash and credit to investment in associate account Credit to cash and debit to investment in associate account Debit to cash and credit to accumulated profits Debit to cash and credit to investment income h. How is the premium or discount on bonds purchased as a held-to-maturity investment accounted for? 1) 2) 3) 4) As an expense or revenue in the period the bonds are purchased As part of the cost of the investment and amortized over the life of the bond using the effective interest rate method As part of the cost of the investment and recorded as an increase or decrease to interest revenue only in the year of maturity As part of the cost of the investment until the maturity date of the bonds i. What is the impact on the investor’s annual interest revenue of bonds purchased at a premium? 1) 2) 3) 4) Annual interest revenue is equal to the annual cash interest payments received. Annual interest revenue is less than the annual cash interest payments received. Annual interest revenue is greater than the annual cash interest payments received. It depends upon which year of the investment it is. j. What method of accounting is used to account for investments in equity securities classified as held for trading? 1) 2) 3) 4) Fair value method Amortized cost method Equity method Impairment k. Which of the following is true with respect to the fair value method of accounting for held for trading investments? 1) 2) 3) 4) The investment is initially recorded at cost. At each financial reporting date, the investment is remeasured to fair value. The gain or loss on remeasurement to fair value goes to the income statement of that period. All of the above l. What is the appropriate treatment of accrued interest purchased as part of a temporary investment in debt securities? 1) 2) 3) The purchased accrued interest is part of the cost of the investment. The purchased accrued interest is expensed on date of acquisition. The purchased accrued interest is amortized over the remaining term to maturity. 4) The purchased accrued interest is recorded as interest receivable and reversed when the next interest payment is received. m. Assuming an investment in an associate is made for an amount equal to the investor’s share of the carrying value of the associate, how is the investment accounted for under the equity method? 1) 2) 3) 4) The investment account is increased by the investor’s share of the annual profit of the associate and reduced by the investor’s share of the annual dividends declared by the associate. The investment account is decreased by the investor’s share of the annual profit of the associate and increased by the investor’s share of the annual dividends declared by the associate. The investment account is increased by the investor’s share of the annual dividends declared by the associate. The investment account is increased by the investor’s share of the annual loss of the associate. n. When is goodwill recognized on an investment in an associate accounted for by the equity method? 1) 2) 3) 4) The purchase price of the investment is greater than the investor’s share of the carrying value of the investee. The purchase price of the investment is less than the investor’s share of the carrying value of the investee. The purchase price of the investment is greater than the investor’s share of the fair value of the investee. The purchase price of the investment is less than the investor’s share of the fair value of the investee. o. How is the recoverable amount of an investment in bonds, classified as a held-tomaturity investment, calculated? 1) 2) 3) 4) The present value of the expected future cash flows discounted at the bond’s original effective interest rate The present value of the expected future cash flows discounted at the bond’s current effective interest rate The non discounted amount of the expected future cash flows The carrying value of the investment less any unamortized premium p. In what section of the Cash flow statement are cash flows related to the purchase and sale of investments classified as held for trading reported? 1) 2) 3) 4) Operating activities Investing activities Financing activities Not reported (2 marks each) q. On January 1, 20X6, Card Inc. purchased 5,000 shares of XT Ltd. at a price of €6 per share plus total brokerage commission of €500. The investment is classified by Card as a held for trading financial asset. The XT shares are quoted at €7 per share on December 31, 20X6. At what amount should the investment be recorded on Card’s year-end balance sheet at December 31, 20X6? 1) 2) 3) 4) €29,500 €30,500 €34,500 €35,000 r. On April 1, 20X7, Westwin Inc. purchased €20,000 face value of Jet Ltd.’s 8%, 10 year bonds payable at 104 plus accrued interest. Westwin intends to hold the bonds to maturity. Interest is payable on the bonds semi-annually on July 1 and January 1 of each year. How much cash did Westwin spend on April 1, 20X7? What amount should be debited to the investment account on April 1, 20X7? 1) 2) 3) 4) Total cash spent Debit to investment account €20,400 €20,800 €21,200 €21,200 €20,000 €21,200 €20,800 €21,200 Use the following information to answer questions (s) and (t): Perth Inc. purchased 1,400 of the 2,000 outstanding shares of Lanark Inc.’s ordinary shares for €400,000 on January 2, 20X5. The fair values of Lanark’s net assets were equal to their book values on this date. During 20X5, Lanark declared dividends of €40,000 and reported profit for the year of €100,000. s. If Perth Inc. used the cost method of accounting for its investment in Lanark Inc., what would its Investment in Lanark account be on December 31, 20X5? 1) 2) 3) 4) €280,000 €442,000 €400,000 €228,000 t. If Perth Inc. uses the equity method of accounting for its investment in Lanark Inc., what would its Investment in Lanark account be on December 31, 20X5? 1) 2) 3) 4) €260,000 €400,000 €442,000 €470,000 u. OD Inc. purchased 100% of the shares of VB Inc. for a price of €200,000. At the date of purchase, VB’s identifiable assets had a fair value of €320,000, while its liabilities had a fair value of €175,000. The carrying value of VB’s total assets was €260,000, while the carrying value of its liabilities was equal to their fair value. What is the amount of goodwill OD should record on the purchase? 1) 2) 3) 4) €55,000 €60,000 €115,000 €120,000 Use the following information to answer questions (v) and (w): On January 1, 20X7, TRW Inc. purchased €100,000 face value of ZTL Inc.’s newly issued bonds payable. The bonds payable were issued on January 1, 20X7, pay interest at an annual rate of 10%, payable annually on December 31, and mature in 10 years on December 31, 20X16. The market rate of interest on January 1, 20X7 for bonds of similar risk was 6%. v. Approximately how much would TRW Inc. have to pay on January 1, 20X7 to acquire its investment in ZTL bonds? 1) 2) 3) 4) €100,000 €113,421 €70,559 €129,441 w. How much cash interest would TRW Inc. receive from its bond investment in 20X7? 1) 2) 3) 4) €6,000 €7,766 €10,000 €11,766 Question 2 (27 marks) Genetic Research Inc. has a significant amount of cash on hand, waiting to be invested in new research projects. Until the money is needed, the company has decided to invest some of the cash in a portfolio of equity securities. Following are the transactions in its investment portfolio during 20X6 and 20X7: March 12, 20X6 Purchased 80,000 Dytech Ltd. ordinary shares at €24 per share plus €14,000 brokerage fees June 15, 20X6 Purchased 100,000 Chromo Corp. ordinary shares at €15 per share plus €15,000 brokerage fees September 30, 20X6 Received a €0.50 per share cash dividend from Dytech Ltd. February 15, 20X7 Purchased an additional 60,000 Dytech Ltd. ordinary shares at €22 per share plus €9,000 brokerage fees March 31, 20X7 Received a €0.50 per share cash dividend from Dytech Ltd. June 22, 20X7 Sold 70,000 Dytech Ltd. ordinary shares at €26 per share and paid a brokerage fee of €12,000 September 12, 20X7 Purchased 50,000 Zytec Inc. ordinary shares for €15 per share plus €5,000 brokerage fees. Genetic Research Inc.’s year-end is December 31.The quoted market prices of the equity securities at December 31, 20X6, and December 31, 20X7, are as follows: December 31, 20X7 December 31, 20X6 Chromo Corp. Dytech Ltd. Zytec Inc. €12 €21 €11 €17 €28 €16 Required 1. (2 marks) How would Genetic Research Inc. classify its portfolio of equity securities? 2. (6 marks) Prepare the journal entries Genetic research would make to record its 20X6 transactions in equity securities, including any year-end valuation adjustments. 3. (4 marks) Show how the investment portfolio would be reported in the 20X6 balance sheet and income statement. 4. (8 marks) Prepare the journal entries Genetic research would make to record its 20X7 transactions in equity securities, including any year end valuation adjustments. 5. (4 marks) Show how the investment portfolio would be reported in the 20X7 balance sheet and income statement. 6. (3 marks) Why is it more appropriate to record investments in equity securities using the fair value method than the cost method? Question 3 (23 marks) On January 1, 20X7, AN Holdings Ltd. (AN) purchased 20% of the outstanding ordinary shares of DUN Developments Inc. (DUN) for €400,000, of which €100,000 was paid in cash and €300,000 is payable without interest on December 31, 20X9. AN’s incremental borrowing rate at the time of the purchase was 8%. AN also paid €20,000 to a business broker who helped to find a suitable business and negotiated the purchase. At the time of the acquisition, the fair values of DUN’s identifiable assets and liabilities were equal to their carrying values except for an office building, which had a fair value in excess of book value of €200,000 and an estimated remaining useful life of 20 years. Dun’s shareholders’ equity on January 1, 20X7, was €1,300,000. During 20X7, DUN reported a profit of €250,000 and paid dividends of €100,000. Required 1. (4 marks) What factor(s) should be considered in determining whether AN should classify the investment as an investment in an associate versus an available-for-sale investment? Assuming the investment is classified as an investment in an associate, what method of accounting should AN use to report its investment in DUN? 2. (4 marks) Prepare the journal entry to record AN’s investment in DUN on January 1, 20X7, and any year-end journal entries related to the loan payable. 3. Prepare all other journal entries related to the investment in DUN for 20X7 under the i) (4 marks) cost method ii) (6 marks) equity method 4. What is the balance in the Investment in DUN account at December 31, 20X7, under the i) (1 mark) cost method ii) (4 marks) equity method Question 4 (20 marks) Consolidated Resources Inc. (Consolidated) is an oil and gas exploration company. It has extensive operations in its home country and in numerous foreign countries. In addition to its own operations, Consolidated also has investments in many other oil and gas exploration related enterprises, some strategic and some passive. Details of four of its significant investments follow: A. Four years ago, Consolidated purchased 15% of the voting ordinary shares of Oil Drillers Inc. (Oil), a publicly listed domestic oil exploration company, for €7,500,000. The purchase was made at a price of €15 per share. Consolidated is the single largest shareholder of Oil, has three seats on the eight-person Board of Directors, and participates actively in all financial and operating decisions of Oil. Oil was profitable in the first year after the investment by Consolidated and paid a small dividend that year. Since then, Oil has had annual losses, paid no dividends, and its share price has slid to €3 per share as world demand for oil plummeted due to the world-wide recession. B. Three years ago, Consolidated purchased 500,000 ordinary shares of Drilling Technology Ltd (Drilling) for €12 per share. Drilling is a large publicly listed domestic company engaged in manufacturing oil drilling equipment. Consolidated’s investment represents only a tiny fraction of the total number of shares of Drilling’s outstanding ordinary shares. It is the intent of Consolidated to hold these shares indefinitely, to participate in the expected turnaround in the oil services sector. Drilling’s shares are now trading at €4 per share, again reflecting the downturn in the oil industry. C. Two years ago, Consolidated purchased 54% of the outstanding voting shares of Gas Distributors Inc. (Gas), a private foreign company in the natural gas distribution business. The purchase was made at a translated price of €24 per share. Consolidated has five seats on the eight-person Board of Directors. The foreign country has suffered through a number of years of severe economic turmoil and the government has imposed exchange restrictions that prevent money from being transferred out of the country. There is reason to believe that Consolidated’s investment in Gas is impaired. Since Gas is a private company, there is no recent information on the fair value of the ordinary shares of Gas. D. Earlier this year, Consolidated purchased a fractional ownership in the ordinary shares of Reno Oil Exploration Inc. (Reno) for €1,400,000. Reno is a publicly traded company and the shares were purchased for €4 per share. Consolidated purchased the shares of Reno because it felt that the downturn in the oil business was nearing its end and it hoped to profit from a short term increase in the price of the Reno shares. At the end of the year, Reno shares were quoted at €2.50 per share. Required For each of the four investments described above, explain how Consolidated would classify the investment, describe the required accounting treatment for each investment, and discuss the need for recording an impairment loss at the end of the current year. (5 marks each) Suggested solutions Question 1 (30 marks) Multiple choice (1 mark each) a. 2) Investments made in debt or equity securities solely to generate financial returns are called passive investments. b. 1) Investments made in debt or equity securities for the purpose of gaining control or significant influence over the operations of the investee are called strategic investments. c. 3) A held for trading financial asset is defined as one that was acquired principally for the purpose of generating profit from short-term fluctuations in price. d. 3) A company controlled by an investor is called a subsidiary. e. 4) Significant influence is normally assumed to exist if the investor holds between 20% and 50% of the voting equity of the investee. However, significant influence is defined as the power to participate in the financial and operating policy decisions of the investee, but not to control those decisions. That influence can be achieved, under certain circumstances, with any level of ownership. f. 2) Cost is normally defined as the fair value of the consideration given up to acquire the asset. g. 4) Under the equity method of accounting for investments in associates, dividends received reduce the carrying amount of the investment. h. 2) The premium or discount affects how much the investment is purchased for. Therefore, it becomes part of the cost of the investment and it is amortized over the term to maturity of the investment. i. 2) When bonds are purchased at a premium, it means that the market rate of interest is lower than the coupon rate of interest. The premium represents an amount paid for that will not be repaid upon maturity. Therefore, the premium is amortized (reduced) each year resulting in a debit (reduction) to interest revenue. j. 1) Held for trading financial assets are initially recorded at cost and subsequently remeasured to fair value at each financial reporting date. We call this the fair value method. k. 4) Under the fair value method of accounting for investments, the investment is initially recorded at cost, at each financial reporting date the investment is remeasured to fair value, and any gain or loss on remeasurement is recorded in the income statement for that period. l. 4) Purchased accrued interest is not interest revenue to the purchaser. The accrued interest belongs to the previous owner, which is why the purchaser must pay for it and account for it as interest receivable. When the purchaser receives the interest at the next interest payment date, it reverses the interest receivable. m. 1) Under the equity method of accounting, the investment account is increased (decreased) by the investor’s share of the annual profit (loss) of the investee and reduced by the investor’s share of the annual dividends declared by the investee. n. 3) Goodwill is the excess of the purchase price over the fair value of the net assets acquired. o. 1) Recoverable amount of a held-to-maturity investment in bonds is calculated as the present value of the expected future cash flows, discounted at the original effective interest rate. p. 2) Cash flows related to the purchase and sale of virtually all equity and debt securities are reported in the investing activities section of the Cash flow statement. (2 marks each) q. 4) 5,000 shares €7 Held for trading investments are remeasured at each financial reporting date at fair value, with no deduction for disposal costs. r. 3) (€20,000 1.04) + (€20,000 0.08 3/12) The accrued interest of €400 is not included as part of the investment cost. It is recorded as interest receivable and reversed on receipt of the subsequent cash interest payment. s. 3) Under the cost method, the investment remains at the initial cost unless dividends have been paid from pre acquisition accumulated profits or there is an impairment loss. t. 3) €400,000 + (70% €100,000) – (70% €40,000) Under equity accounting, the investment is carried at original cost plus or minus the investor’s share of the profit or loss of the investee minus the investor’s share of dividends from the investee. u. 1) €200,000 – (€320,000 – €175,000) Goodwill is equal to the difference between the purchase price and the fair value of the net identifiable assets acquired. v. 4) (€100,000 0.55841) + (€10,0002 7.36013) 1 Present value of €1 to be received in 10 years, discounted at 6% (From Table 1, Appendix A, Lesson 5) 2 €100,000 10% 3 Present value of an annuity of €1 to be received annually for 10 years, discounted at 6% (From Table 2, Appendix A, Lesson 5) w. 3) The cash interest received is based upon the coupon rate: (€100,000 10%) = €10,000 Question 2 (27 marks) Requirement 1 (2 marks) Genetic Research would classify its portfolio of equity securities as held for trading assets since the principal purpose of the investments is to profit from short term price fluctuations while the cash is temporarily available. Requirement 2 (6 marks) March 12, 20X6 Held for trading investments — Dytech Ltd. ........................ 1,920,000 Brokerage fees expense — Dytech Ltd ................................. 14,000 Cash ................................................................................. To record purchase of 80,000 Dytech ordinary shares: 80,000 €24 June 15, 20X6 Held for trading investments — Chromo Corp. .................... 1,500,000 Brokerage fees expense — Chromo Corp ............................. 15,000 Cash ................................................................................. To record purchase of 100,000 Chromo ordinary shares: 100,000 €15 September 30, 20X6 Cash ....................................................................................... Dividend revenue ............................................................. To record receipt of dividend on Dytech shares 1,934,000 1,515,000 40,000* 40,000 * (80,000 shares €0.50 per share) December 31, 20X6 Held for trading investments — Dytech ................................ 320,0001 Held for trading investments — Chromo .............................. 200,0002 Gain on increase in fair value of Held for trading investments To record remeasurement of marketable equity securities to fair value at December 31, 20X6 1 2 520,000 (80,000 €28) – €1,920,000 (100,000 €17) – €1,500,000 Requirement 3 (4 marks) Income statement for 20X6: Gain on increase in fair value of Held for trading investments Dividend revenue Balance sheet at December 31, 20X6: Held for trading investments, at fair value * (80,000 €28) + (100,000 €17) €520,000 40,000 €3,940,000* Requirement 4 (8 marks) February 15, 20X7 Held for trading investments — Dytech Ltd. ........................ Brokerage fees expense — Dytech Ltd ................................. Cash ................................................................................. To record purchase of 60,000 Dytech ordinary shares at €22 March 31, 20X7 Cash ....................................................................................... Dividend revenue ............................................................. To record receipt of dividend on Dytech shares 1,320,000 9,000 1,329,000 70,000* 70,000 * (140,000 shares €0.50 per share) June 22, 20X7 Cash ....................................................................................... Brokerage fees expense — Dytech Ltd ................................. Gain on sale of Held for trading investments — Dytech. Held for trading investments — Dytech .......................... To record sale of 70,000 shares of Dytech on June 22 at €26 1 1,808,000 12,000 40,000 2 1,780,000 1 Carrying value of Dytech shares at June 22, 20X7: Carrying value at December 31, 20X6 (80,000 €28) February 15, 20X7 purchase (60,000 €22) Carrying value at June 22, 20X7 prior to sale € 2,240,000 1,320,000 € 3,560,000 Since 50% of the Dytech shares (70,000 ÷ 140,000) are sold on June 22, 20X7, 50% of the carrying value at that date must be removed from the investment account 50% of €3,560,000 = €1,780,000 2 €1,820,000 – €1,780,000 September 12, 20X7 Held for trading investments — Zytec Inc. ........................... Brokerage fees expense — Zytec Ltd .................................... Cash ................................................................................. To record purchase of 50,000 Zytec ordinary shares at €15 750,000 5,000 December 31, 20X7 Loss on decrease in fair value of Held for trading investments 1,010,000 Held for trading investments — Dytech .......................... Held for trading investments — Chromo ........................ Held for trading investments — Zytec ............................ To record remeasurement of Held for trading investments to fair value at December 31, 20X7 1 2 3 (70,000 €21) – €1,780,000 (100,000 €12) – (100,000 €17) (50,000 €11) – €750,000 Requirement 5 (4 marks) Income statement for 20X7: 755,000 310,000 1 500,000 2 200,000 3 Loss on decrease in fair value of Held for trading investments Dividend revenue (€ 1,010,000) 70,000 Balance sheet at December 31, 20X7: Held for trading investments, at fair value € 3,220,000* * (70,000 €21) + (100,000 €12) + (50,000 €11) Requirement 6 (3 marks) There are a couple of reasons why it is more appropriate to record investments in equity securities at market rather than at cost. First, the fair value method provides for recognition of gains and losses on the investments when they occur, rather than only when the investment is sold. This informs the reader of the financial statements, and the enterprise itself, of the current value of the investments. This is important since it is expected that the investments will be liquidated in the near future. Secondly, the cost method allows the company the potential to manipulate profit because the gain or loss is only recognized when the investments are sold. Under the cost method, by carefully selecting the date of the sale, the enterprise is able to impact its profit or loss. This cannot be done under the fair value method since gains and losses are recorded when they occur, not triggered when the securities are sold. Question 3 (23 marks) Requirement 1 (4 marks) An associate is a company over which an investor has significant influence. Therefore, if the investment in DUN is to be classified as an investment in an associate, it must be demonstrated that AN has significant influence over the financial and operating policies of DUN. Normally, if an investor holds 20% or more of the voting equity of the investee, significant influence is assumed to exist. However, it is important to examine other factors to determine whether the 20% holding is sufficient for significant influence. Other factors that would be examined to assess whether significant influence exists would include composition of remaining share ownership (for example, whether one shareholder own the remaining 80% of the shares or ownership is widely held) representation of AN on Board of directors participation in policy making processes significant transactions between AN and DUN transfer of executive personnel between AN and DUN If these factors suggested significant influence over the financial and operating policies of DUN, the investment would be classified as an investment in an associate. If significant influence does not appear to exist, the investment would be classified as an available-for-sale investment, as long as the intent of AN is to hold the investment for a long period. If the investment is classified as an investment in an associate it will be reported by AN using the equity method of accounting. Requirement 2 (4 marks) January 1, 20X7 Investment in DUN ...................................................................... Discount on note payable1 ........................................................... Cash ....................................................................................... Note payable .......................................................................... To record investment in 20% of shares of DUN 1 120,000 300,000 (€300,000 – (€300,000 0.7938)) December 31, 20X7 Interest expense1 .......................................................................... Discount on note payable....................................................... To record interest expense on note payable for 20X7 1 358,140 61,860 19,051 19,051 €238,140 8% Requirement 3 (10 marks) i) (4 marks) If the investment is recorded in the accounting records of DUN using the cost method of accounting, the following additional entry would be made in 20X7: Cash1 ............................................................................................ Investment income ................................................................. To record receipt of dividends from DUN 1 20,000 20,000 €100,000 20% ii) (6 marks) If the investment is recorded in the accounting records of DUN using the equity method of accounting, the following additional entries for 20X7 are required: Cash1 ............................................................................................ Investment in Dun.................................................................. To record receipt of dividends from DUN 1 20,000 €100,000 20% Investment in DUN1 .................................................................... Investment income ................................................................. To record AN’s share of DUN’s adjusted profit 1 20,000 48,000 48,000 The investment income earned by AN from its investment in DUN in 20X7, under the equity method, is calculated as follows: AN’s share of DUN reported profit (20% €250,000) Extra depreciation expense (€200,000 20% 1/20) AN’s adjusted investment income from DUN € 50,000 (2,000) € 48,000 Requirement 4 (5 marks) i) (1 mark) The balance in the Investment in DUN account at December 31, 20X7, under the cost method is €358,140, the original cost amount. ii) (4 marks) The balance in the Investment in DUN account at December 31, 20X7, under the equity method is €386,140 (€358,140 + €48,000 – €20,000) Question 4 (20 marks) Case A (5 marks) Although Consolidated owns only 15% of the voting shares of Oil, the other factors suggest that Consolidated exercises significant influence over the financial and operating policies of Oil. The fact that Consolidated has three of the eight seats on the Board of directors and actively participates in all financial and operating decisions of Oil would lead us to believe that significant influence exists. Since significant influence exists, Consolidated would account for its investment in Oil using the equity method of accounting. Since Oil has experienced losses for the past three years and its share price has slid from €15 at date of acquisition to €3, there is reason to believe that the investment might be impaired. Therefore, it is necessary to compare the carrying value of the investment with the recoverable amount of the investment. Probably the best estimate of the recoverable amount would be the current market price of €3 per share. If the recoverable amount is less than the carrying value, an impairment loss should be recognized, with the loss recorded in the income statement. It is important to recognize that the carrying value of the investment in Oil, under the equity method, has already been written down to some extent by recording Consolidated’s share of the annual losses of Oil. Case B (5 marks) Consolidated has made a strategic investment in the shares of Drilling, intending to hold the shares indefinitely. However, the investment is not large enough to give Consolidated any significant influence or control over the financial and operating policies of Drilling. Therefore, the investment would be classified as an available-for-sale investment. Available-for-sale investments are accounted for by the fair value method, and any gain or loss on the annual remeasurement to fair value is either included in profit or recognized directly in equity until the investment is subsequently sold. Since the shares of Drilling have declined in value from €12 per share to their current value of €4 per share, there is reason to believe that the investment might be impaired. However, under the fair value method of accounting for the investment, the investment will already have been remeasured to its fair value of €4 per share at the end of the current year. If there was reason to believe that the value in use of the asset was less than €4 per share, then the value in use should be calculated using discounted cash flow analysis and an impairment loss recognized if the value in use is less than €4 per share. Case C (5 marks) Since Consolidated owns 54% of the voting shares of Gas and has five of the eight seats on the Board of directors, it appears obvious that Consolidated has control over the operating and financial policies of Gas. Therefore, the investment in Gas would be classified as a subsidiary by Consolidated. Normally, subsidiaries are accounted for through the preparation of consolidated financial statements. However, if the benefits of ownership are unlikely to be realized by the investor, the investment should be excluded from consolidation. Since Gas operates in a country with severe restrictions on currency transfers out of the country, Consolidated is not likely to receive dividends from Gas. Therefore, Gas probably should not be consolidated, but accounted for under the cost method. Since there is reason to believe that the investment in Gas may be impaired at the end of the current year, an estimate of the recoverable amount of the investment must be made. Since Gas is a private company and there is no market quotes for its shares, the recoverable amount must be calculated by its value in use, through a discounted cash flow analysis. If the recoverable amount is less than the carrying value, an impairment loss must be recognized. Case D (5 marks) Consolidated has made a passive investment in the shares of Reno, with the principal objective of profiting from a short-term fluctuation in the share price of Reno. This investment would, therefore, be classified as a held for trading investment. Held for trading investments are accounted for by the fair value method. Under the fair value method of accounting for the investment, the investment account has already been written down to the year-end fair value of €2.50 per share. If there was any reason to believe that there was further impairment, a value in use calculation should be performed using a discounted cash flow analysis to calculate the recoverable amount.