Order on Initial Decision and Settlement Offer

... Article 2.4 provides that, within one year of the approval of the offer, HIOS will install any needed measurement facilities on its pipeline at West Cameron Block 167, to measure deliveries to ANR Pipeline Company (ANR), Enbridge Offshore Pipeline, L.L.C. (UTOS) and Tennessee Gas Pipeline Company (T ...

... Article 2.4 provides that, within one year of the approval of the offer, HIOS will install any needed measurement facilities on its pipeline at West Cameron Block 167, to measure deliveries to ANR Pipeline Company (ANR), Enbridge Offshore Pipeline, L.L.C. (UTOS) and Tennessee Gas Pipeline Company (T ...

IAS 39 Implementation Guidance Questions and Answers

... Impairment and uncollectability of financial assets ...

... Impairment and uncollectability of financial assets ...

The required return on equity under a foundation model

... b. That approach is uncontroversial and produces an estimate of 2.75% when applied to the 20-day period ending on 30 September 2015. This estimate will eventually have to be updated to the averaging period adopted at the beginning of the relevant regulatory period. ...

... b. That approach is uncontroversial and produces an estimate of 2.75% when applied to the 20-day period ending on 30 September 2015. This estimate will eventually have to be updated to the averaging period adopted at the beginning of the relevant regulatory period. ...

czech republic

... (4) The name of an open-end unit trust shall contain the business name of the investment company that manages the unit trust and the designation “open-end unit trust”. Article 11 Issue of Unit Certificates of an Open-End Unit Trust (1) An investment company shall issue a unit certificate of an open ...

... (4) The name of an open-end unit trust shall contain the business name of the investment company that manages the unit trust and the designation “open-end unit trust”. Article 11 Issue of Unit Certificates of an Open-End Unit Trust (1) An investment company shall issue a unit certificate of an open ...

Morningstar Guide

... The Morningstar Rating is based on risk-adjusted return, which is calculated by subtracting a risk penalty from total return, after accounting for all sales charges, loads, and redemption fees. The penalty is determined by the amount of variation in monthly returns, with an emphasis on downward vari ...

... The Morningstar Rating is based on risk-adjusted return, which is calculated by subtracting a risk penalty from total return, after accounting for all sales charges, loads, and redemption fees. The penalty is determined by the amount of variation in monthly returns, with an emphasis on downward vari ...

ANSWERS TO QUESTIONS

... period. A method should be selected that will best measure the portion of services expiring each period. Once a method is selected, it may be objectively applied by using a predetermined, objectively derived formula. ...

... period. A method should be selected that will best measure the portion of services expiring each period. Once a method is selected, it may be objectively applied by using a predetermined, objectively derived formula. ...

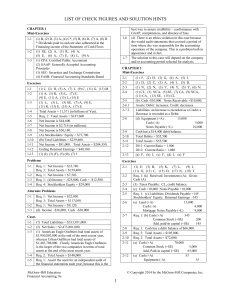

chapter 2 - McGraw Hill Higher Education - McGraw

... LIST OF CHECK FIGURES AND SOLUTION HINTS ______________________________________________________________________________ best way to assure credibility – conformance with GAAP, completeness, and absence of bias. (4) There is an ethics violation in this case because she would audit statements that cov ...

... LIST OF CHECK FIGURES AND SOLUTION HINTS ______________________________________________________________________________ best way to assure credibility – conformance with GAAP, completeness, and absence of bias. (4) There is an ethics violation in this case because she would audit statements that cov ...

Testing for Rating Consistency in Annual Default

... focusing their attention on rating consistency. To encourage and facilitate this scrutiny, Moody’s has for many years published historical default and debt recovery statistics. More recently, the rating agency has published commentary designed to provide guidance about the intended meanings of its b ...

... focusing their attention on rating consistency. To encourage and facilitate this scrutiny, Moody’s has for many years published historical default and debt recovery statistics. More recently, the rating agency has published commentary designed to provide guidance about the intended meanings of its b ...

PRINCIPLES OF FINANCIAL ENGINEERING

... This book is an introduction. It deals with a broad array of topics that fit together through a certain logic that we generally call Financial Engineering. The book is intended for beginning graduate students and practitioners in financial markets. The approach uses a combination of simple graphs, ele ...

... This book is an introduction. It deals with a broad array of topics that fit together through a certain logic that we generally call Financial Engineering. The book is intended for beginning graduate students and practitioners in financial markets. The approach uses a combination of simple graphs, ele ...

Skybridge Multi-Adviser Hedge Fund Portfolios LLC

... investment company. The investment objective of the Company’s Multi-Strategy Series G (“Series G”) is to seek capital appreciation. The Company is a fund of hedge funds and seeks to implement its objectives principally through investing in investment funds managed by third-party investment managers ...

... investment company. The investment objective of the Company’s Multi-Strategy Series G (“Series G”) is to seek capital appreciation. The Company is a fund of hedge funds and seeks to implement its objectives principally through investing in investment funds managed by third-party investment managers ...

Portfolio Comparisons. - Artex Component System

... In addition, the following results now appear with this new investment strategy: The investor now has: More options than just buying stocks A better chance of profiting in more investment sectors A better long term success strategy because of… …much less of a chance of “blowing up” the portfolio ...

... In addition, the following results now appear with this new investment strategy: The investor now has: More options than just buying stocks A better chance of profiting in more investment sectors A better long term success strategy because of… …much less of a chance of “blowing up” the portfolio ...

Real Options, Volatility, and Stock Returns∗

... of firms. Second, it does not require estimating the values of real options. Finally, it is robust to any type of real options that firms may possess. Following Leahy and Whited (1996) and Bulan (2005), we employ changes in volatility of stock returns as a proxy for changes in underlying volatility ...

... of firms. Second, it does not require estimating the values of real options. Finally, it is robust to any type of real options that firms may possess. Following Leahy and Whited (1996) and Bulan (2005), we employ changes in volatility of stock returns as a proxy for changes in underlying volatility ...

Investment Policy Manual

... representative from non-investment departments including Finance, Investment Operations, Risk Management and Legal (non-voting member). Additionally, subject matter experts (internal or external to NYSTRS) may advise the Committee depending on the investment being reviewed, but will not be voting me ...

... representative from non-investment departments including Finance, Investment Operations, Risk Management and Legal (non-voting member). Additionally, subject matter experts (internal or external to NYSTRS) may advise the Committee depending on the investment being reviewed, but will not be voting me ...

Cash management behavior of firms and its structural

... investment policies, available instruments, as well as investment strategies and techniques to minimize the cash management costs or to maximize profits. In order to invest in the money market, a firm must know when the cash is needed. This is a difficult forecasting task even for large companies. T ...

... investment policies, available instruments, as well as investment strategies and techniques to minimize the cash management costs or to maximize profits. In order to invest in the money market, a firm must know when the cash is needed. This is a difficult forecasting task even for large companies. T ...

chapter 1 - Test Bank wizard

... Which of the following is NOT a potential problem when estimating and using betas, i.e., which statement is FALSE? a. Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" o ...

... Which of the following is NOT a potential problem when estimating and using betas, i.e., which statement is FALSE? a. Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" o ...

Estimating the required return on equity

... a) The ERA’s criteria are not part of the Rules. The Rules do not state that the Fama-French model must be considered if it satisfies the ERA’s criteria, the Rules state that the FamaFrench model must be considered if it is relevant. That is, the question is not whether the Fama-French model is the ...

... a) The ERA’s criteria are not part of the Rules. The Rules do not state that the Fama-French model must be considered if it satisfies the ERA’s criteria, the Rules state that the FamaFrench model must be considered if it is relevant. That is, the question is not whether the Fama-French model is the ...