Griffin Institutional Access Real Estate Fund

... adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Adviser has engaged Aon Hewitt Investment Consulting, Inc. (“Aon Hewitt”, “AHIC” or the “Private Sub-Adviser”), an indirect wholly-owned subsidiary of Aon plc and a registered investment adviser under the Adviser ...

... adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Adviser has engaged Aon Hewitt Investment Consulting, Inc. (“Aon Hewitt”, “AHIC” or the “Private Sub-Adviser”), an indirect wholly-owned subsidiary of Aon plc and a registered investment adviser under the Adviser ...

threadneedle investment funds icvc - Columbia Threadneedle Investments

... occur, in the absence of a rebate mechanism, an indirect charge for management fees in respect of investments in other Threadneedle funds. Any such target funds themselves bear a management fee, which reduces the values of those funds from what they otherwise would be. The rebate mechanism operates ...

... occur, in the absence of a rebate mechanism, an indirect charge for management fees in respect of investments in other Threadneedle funds. Any such target funds themselves bear a management fee, which reduces the values of those funds from what they otherwise would be. The rebate mechanism operates ...

DREYFUS INTERNATIONAL VALUE FUND

... trading market is in a foreign country; or (iii) that have a majority of their assets, or that derive a significant portion of their revenue or profits from businesses, investments or sales, outside the United States. The Fund typically invests in companies in at least ten foreign countries, and lim ...

... trading market is in a foreign country; or (iii) that have a majority of their assets, or that derive a significant portion of their revenue or profits from businesses, investments or sales, outside the United States. The Fund typically invests in companies in at least ten foreign countries, and lim ...

RBC Funds (Lux) - RBC Global Asset Management

... Any change to the Articles of Incorporation must be approved by shareholders at a general meeting of the shareholders of the Fund. Annual reports, including audited financial statements of the Fund shall be published within four (4) months following the end of the fiscal year of the Fund, and unaudi ...

... Any change to the Articles of Incorporation must be approved by shareholders at a general meeting of the shareholders of the Fund. Annual reports, including audited financial statements of the Fund shall be published within four (4) months following the end of the fiscal year of the Fund, and unaudi ...

Heptagon Fund plc

... Heptagon Capital is authorised and regulated in the UK by the Financial Conduct Authority under UK laws, which differ from Australian laws. Heptagon Capital is exempt from the requirement to hold an Australian financial services licence under the Corporations Act when providing financial services to ...

... Heptagon Capital is authorised and regulated in the UK by the Financial Conduct Authority under UK laws, which differ from Australian laws. Heptagon Capital is exempt from the requirement to hold an Australian financial services licence under the Corporations Act when providing financial services to ...

Fidelity Retirement Master Trust

... for switching instruction submitted via other means, 4:00p.m. on a day which is 1 Business Day before the relevant Member’s birthday. If such switching instruction for partial switching out of the DIS received by the Trustee before the dealing cut-off time above is still being processed on the annua ...

... for switching instruction submitted via other means, 4:00p.m. on a day which is 1 Business Day before the relevant Member’s birthday. If such switching instruction for partial switching out of the DIS received by the Trustee before the dealing cut-off time above is still being processed on the annua ...

sep ira custodial agreement

... with respect to Custodial Account investments, and that Account Owner is responsible for making separate arrangements for receiving such communications. 3. The Custodian is only responsible for the custody of funds and investments as provided hereunder. The Custodian shall act only with the consent ...

... with respect to Custodial Account investments, and that Account Owner is responsible for making separate arrangements for receiving such communications. 3. The Custodian is only responsible for the custody of funds and investments as provided hereunder. The Custodian shall act only with the consent ...

English - Vanguard Global sites

... any reports) or the issue of Shares shall not, under any circumstances, create any implication that the affairs of the Company have not changed since the date hereof. The distribution of this Prospectus and the offering of Shares in certain jurisdictions may be restricted. Persons into whose possess ...

... any reports) or the issue of Shares shall not, under any circumstances, create any implication that the affairs of the Company have not changed since the date hereof. The distribution of this Prospectus and the offering of Shares in certain jurisdictions may be restricted. Persons into whose possess ...

Prospectus - TransAlta

... moneys of the Corporation properly applicable to the payment of dividends, fixed cumulative preferential cash dividends for the initial period (the "Initial Fixed Rate Period") from and including the date of issue of the Series G Shares to but excluding September 30, 2019, at an annual rate of $1.32 ...

... moneys of the Corporation properly applicable to the payment of dividends, fixed cumulative preferential cash dividends for the initial period (the "Initial Fixed Rate Period") from and including the date of issue of the Series G Shares to but excluding September 30, 2019, at an annual rate of $1.32 ...

Predicting Mutual Fund Performance: The Win

... find that among the three investment strategies they form, predictability in manager skills is the dominant source of mutual fund investment profitability. Their results suggest that active management adds significant value and investors would benefit from locating outperforming mutual funds. We hyp ...

... find that among the three investment strategies they form, predictability in manager skills is the dominant source of mutual fund investment profitability. Their results suggest that active management adds significant value and investors would benefit from locating outperforming mutual funds. We hyp ...

SP170: Did NASDAQ market makers successfully collude to

... and offers for at least 1000 shares. In addition, trades made through NASDAQ’s small order execution system (SOES, which was mandatory by the SEC after June 1988 as a result of investors’ inability to contact market makers by telephone during the 1987 market crash) could be made at the posted prices ...

... and offers for at least 1000 shares. In addition, trades made through NASDAQ’s small order execution system (SOES, which was mandatory by the SEC after June 1988 as a result of investors’ inability to contact market makers by telephone during the 1987 market crash) could be made at the posted prices ...

Optimal Asset Location and Allocation with Taxable and Tax

... accounts for the asset allocation and location decisions. This is in striking contrast to the traditional approach to financial planning, in which the interaction between the taxable and tax-deferred accounts is largely ignored. The ability to invest on a tax-deferred basis is valuable to investors ...

... accounts for the asset allocation and location decisions. This is in striking contrast to the traditional approach to financial planning, in which the interaction between the taxable and tax-deferred accounts is largely ignored. The ability to invest on a tax-deferred basis is valuable to investors ...

Scholar`s Edge Enrollment Kit

... residents only if they invest in the state’s own plan. Investors should consider before investing whether their or their designated beneficiary’s home state offers any state tax or other benefits that are only available for investments in such state’s qualified tuition program. Any state-based benef ...

... residents only if they invest in the state’s own plan. Investors should consider before investing whether their or their designated beneficiary’s home state offers any state tax or other benefits that are only available for investments in such state’s qualified tuition program. Any state-based benef ...

columbia high yield bond fund

... other funds with similar investment objectives. Changing Distribution Level Risk. The amount of the distributions paid by the Fund will vary and generally depends on the amount of interest income and/or dividends received by the Fund on the securities it holds. The Fund may not be able to pay distri ...

... other funds with similar investment objectives. Changing Distribution Level Risk. The amount of the distributions paid by the Fund will vary and generally depends on the amount of interest income and/or dividends received by the Fund on the securities it holds. The Fund may not be able to pay distri ...

Does Fund Size Erode Performance? Organizational Diseconomies

... investors are naïve in that they pay too much in fees and may be susceptible to mutual fund marketing (see, e.g., Gruber (1996), Sirri and Tufano (1998) and Zheng (1999)). Importantly, money managers are likely to want to manage large funds for a variety of agency reasons. One reason is that manager ...

... investors are naïve in that they pay too much in fees and may be susceptible to mutual fund marketing (see, e.g., Gruber (1996), Sirri and Tufano (1998) and Zheng (1999)). Importantly, money managers are likely to want to manage large funds for a variety of agency reasons. One reason is that manager ...

Cash management behavior of firms and its structural

... almost daily basis, a cash manager has to forecast the amount of funds that will be required to meet payments. He must maintain sufficient cash to handle immediate disbursements. In order to be effective, he should be aware on the various alternatives and relationships between interest rate yield cu ...

... almost daily basis, a cash manager has to forecast the amount of funds that will be required to meet payments. He must maintain sufficient cash to handle immediate disbursements. In order to be effective, he should be aware on the various alternatives and relationships between interest rate yield cu ...

1 September 2006 Page 1 of 52 The SPI Fund of Scottish Provident

... Simplified Pension Investment Funding Plans, which are group pension policies effected by the trustees of occupational pension schemes. ...

... Simplified Pension Investment Funding Plans, which are group pension policies effected by the trustees of occupational pension schemes. ...

Griffin Institutional Access Real Estate Fund (Form: N

... the principal amount invested. The Fund is a closed-end interval fund that provides liquidity to shareholders through a quarterly repurchase offer. The Repurchase Offer Amount will be no less than 5% and no more than 25% of the total number of shares outstanding on the Repurchase Request Deadline. T ...

... the principal amount invested. The Fund is a closed-end interval fund that provides liquidity to shareholders through a quarterly repurchase offer. The Repurchase Offer Amount will be no less than 5% and no more than 25% of the total number of shares outstanding on the Repurchase Request Deadline. T ...

Mutual Funds and Bubbles: The Surprising Role of Contractual

... normative implications for both, the investors and the market as a whole. Second, from a more general perspective, our findings also contribute to the debate on executive compensation. There is a wide body of literature, starting with Murphy (1985) and Jensen and Murphy (1990), about the optimal inc ...

... normative implications for both, the investors and the market as a whole. Second, from a more general perspective, our findings also contribute to the debate on executive compensation. There is a wide body of literature, starting with Murphy (1985) and Jensen and Murphy (1990), about the optimal inc ...

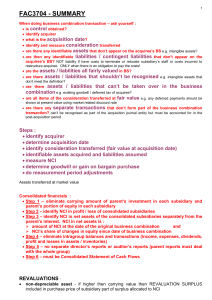

Assignment 1 is compulsory and due

... If eliminate unrealised profit of R 5 000 then subsidiary must value asset at R 40 000 and depreciation @ 20% would be R 8 000 per year So excess depreciation of R 1 000 (R 9 000 – R 8 000) must be written back every year and this is a way of saying that 1/5th of the unrealised profit is being reali ...

... If eliminate unrealised profit of R 5 000 then subsidiary must value asset at R 40 000 and depreciation @ 20% would be R 8 000 per year So excess depreciation of R 1 000 (R 9 000 – R 8 000) must be written back every year and this is a way of saying that 1/5th of the unrealised profit is being reali ...

DOC - Lasalle Hotel Properties

... dividends and proceeds will be required to seek a refund from the Internal Revenue Service to obtain the benefit of such exemption or reduction. We will not pay any additional amounts in respect of any amounts withheld. These new withholding rules are generally effective for payments made after Dece ...

... dividends and proceeds will be required to seek a refund from the Internal Revenue Service to obtain the benefit of such exemption or reduction. We will not pay any additional amounts in respect of any amounts withheld. These new withholding rules are generally effective for payments made after Dece ...

Analyszing the Cash and Carry Wholesaler`s Right of Existence in

... "Trade Centre has a wider product composition than the other wholesale groups and sells groceries, building products and household fittings, while Bingo markets household fittings only and Metro groceries only” (my translation). Through the retailer, Metro concentrates on the consumer who comprises ...

... "Trade Centre has a wider product composition than the other wholesale groups and sells groceries, building products and household fittings, while Bingo markets household fittings only and Metro groceries only” (my translation). Through the retailer, Metro concentrates on the consumer who comprises ...

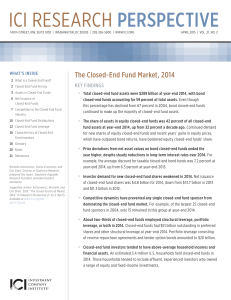

The Closed-End Fund Market, 2014

... A closed-end fund is created by issuing a fixed number of common shares to investors during an initial public offering. Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. Closed-end funds also ...

... A closed-end fund is created by issuing a fixed number of common shares to investors during an initial public offering. Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. Closed-end funds also ...

2 amended and restated private placement

... The Fund will deposit the Investors’ accepted subscription funds into the Fund’s bank account, and the Investors will, thereby, become Members of the Fund. A capital account (“Capital Account”) will be established for each Member on the books and records of the Fund. Each Member will share in distri ...

... The Fund will deposit the Investors’ accepted subscription funds into the Fund’s bank account, and the Investors will, thereby, become Members of the Fund. A capital account (“Capital Account”) will be established for each Member on the books and records of the Fund. Each Member will share in distri ...