Janus Capital Funds Plc Prospectus

... that the respective objectives of the Funds will be achieved and that the value of the Shares of any Fund, and the income earned on such Shares, may fall as well as rise. An investment in the Funds should not constitute a substantial proportion of an investment portfolio and may not be appropriate f ...

... that the respective objectives of the Funds will be achieved and that the value of the Shares of any Fund, and the income earned on such Shares, may fall as well as rise. An investment in the Funds should not constitute a substantial proportion of an investment portfolio and may not be appropriate f ...

Powers

... another, larger partnership. Enron needed to find a new partner, or else it would have to consolidate JEDI into its financial statements, which it did not want to do. Enron assisted Kopper (whom Fastow identified for the role) in 6 -forming Chewco to purchase CalPERS' interest. Kopper was the manage ...

... another, larger partnership. Enron needed to find a new partner, or else it would have to consolidate JEDI into its financial statements, which it did not want to do. Enron assisted Kopper (whom Fastow identified for the role) in 6 -forming Chewco to purchase CalPERS' interest. Kopper was the manage ...

BASE PROSPECTUS Dated 9 September 2016 NOMURA BANK

... specified entity or entities (Credit Linked Securities), Index Linked Securities or Equity Linked Securities which are short price payout N&C Securities (Short Price Payout N&C Securities) and excluded index securities linked to a series of preference shares (Preference Share Linked N&C Securities) ...

... specified entity or entities (Credit Linked Securities), Index Linked Securities or Equity Linked Securities which are short price payout N&C Securities (Short Price Payout N&C Securities) and excluded index securities linked to a series of preference shares (Preference Share Linked N&C Securities) ...

everett spinco, inc.

... This Registration Statement on Form 10 (the “Form 10”) incorporates by reference information contained in (a) the proxy statement/prospectus-information statement of Computer Sciences Corporation filed herewith as Exhibit 99.1, referred to herein as the proxy statement/prospectus-information stateme ...

... This Registration Statement on Form 10 (the “Form 10”) incorporates by reference information contained in (a) the proxy statement/prospectus-information statement of Computer Sciences Corporation filed herewith as Exhibit 99.1, referred to herein as the proxy statement/prospectus-information stateme ...

ACCOUNTING FOR GOODWILL: A CRITICAL EVALUATION

... number of acquisitions and mergers, coupled with the increasing amounts paid for goodwill, have brought the goodwill problem to the debating forum once again, perhaps now more than ever before. Davis (1992:76) cited the fact that a far larger component of companies' acquisition price comprises goodw ...

... number of acquisitions and mergers, coupled with the increasing amounts paid for goodwill, have brought the goodwill problem to the debating forum once again, perhaps now more than ever before. Davis (1992:76) cited the fact that a far larger component of companies' acquisition price comprises goodw ...

Griffin Institutional Access Real Estate Fund

... portion of the Fund’s investment portfolio that is allocated to private, institutional real estate investment funds managed by institutional investment managers. Aon Hewitt’s Global Investment Consulting Practice had $84.7 billion ($62.2 billion in the U.S.) in assets under management and $4.2 trill ...

... portion of the Fund’s investment portfolio that is allocated to private, institutional real estate investment funds managed by institutional investment managers. Aon Hewitt’s Global Investment Consulting Practice had $84.7 billion ($62.2 billion in the U.S.) in assets under management and $4.2 trill ...

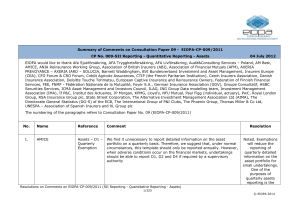

Comments Template QRT Assets final - eiopa

... provide data specifically required by insurance companies for the completion of pre-designed templates, and using identification codes for which further clarification is required. (see response on CIC Codes) ...

... provide data specifically required by insurance companies for the completion of pre-designed templates, and using identification codes for which further clarification is required. (see response on CIC Codes) ...

Credit Suisse AG Credit Suisse International

... than Exempt Securities) and will set out the specific details of the Securities. For example, the relevant Final Terms will specify the issue date, the maturity date, the underlying asset(s) to which the Securities are linked (if any), the applicable "Product Conditions" and/or the applicable "Asset ...

... than Exempt Securities) and will set out the specific details of the Securities. For example, the relevant Final Terms will specify the issue date, the maturity date, the underlying asset(s) to which the Securities are linked (if any), the applicable "Product Conditions" and/or the applicable "Asset ...

- - - - Prospectus Open Joint-Stock Company«Pharmsynthez

... During the placing of securities, the prior right to acquire securities according to the provision 40 and 41 in the federal law on joint-stock companies shall not be granted due to the results of voting at the annual general meeting of shareholders ...

... During the placing of securities, the prior right to acquire securities according to the provision 40 and 41 in the federal law on joint-stock companies shall not be granted due to the results of voting at the annual general meeting of shareholders ...

important notice this offering is available only to investors

... Confirmation of your representation: In order to be eligible to view the attached offering memorandum or make an investment decision with respect to the securities being offered, prospective investors must be non-U.S. persons (as defined in Regulation S) located outside the United States and to the ...

... Confirmation of your representation: In order to be eligible to view the attached offering memorandum or make an investment decision with respect to the securities being offered, prospective investors must be non-U.S. persons (as defined in Regulation S) located outside the United States and to the ...

Proposed Rule: Money Market Fund Reform

... “money market funds”) under the Investment Company Act of 1940. The two alternatives are designed to address money market funds’ susceptibility to heavy redemptions, improve their ability to manage and mitigate potential contagion from such redemptions, and increase the transparency of their risks, ...

... “money market funds”) under the Investment Company Act of 1940. The two alternatives are designed to address money market funds’ susceptibility to heavy redemptions, improve their ability to manage and mitigate potential contagion from such redemptions, and increase the transparency of their risks, ...

Non-Principal Protected Unlisted Daily Cash Dividend

... If you are in any doubt about any of the contents of the Basket DCDC ELI offering documents, you should seek independent professional advice. The Securities and Futures Commission (SFC) has authorised our Basket DCDC ELIs under Section 104A(1) of the Securities and Futures Ordinance (Cap. 571, Laws ...

... If you are in any doubt about any of the contents of the Basket DCDC ELI offering documents, you should seek independent professional advice. The Securities and Futures Commission (SFC) has authorised our Basket DCDC ELIs under Section 104A(1) of the Securities and Futures Ordinance (Cap. 571, Laws ...

UNITED STATES SECURITIES AND EXCHANGE

... Such forward-looking statements are not guarantees of future performance and involve numerous risks and uncertainties, and actual results may differ materially from those anticipated in the forward-looking statements as a result of various factors. The risks and uncertainties involved in our busines ...

... Such forward-looking statements are not guarantees of future performance and involve numerous risks and uncertainties, and actual results may differ materially from those anticipated in the forward-looking statements as a result of various factors. The risks and uncertainties involved in our busines ...

Final decision - Review of electricity transmission and distribution

... Calculated as the yield on 10 year BBB rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.45 per cent). Calculated as the yield on 10 year A rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.28 per cent). Calculated as the yield ...

... Calculated as the yield on 10 year BBB rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.45 per cent). Calculated as the yield on 10 year A rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.28 per cent). Calculated as the yield ...

Basics of US GAAP for Life Insurers - aktuariat

... • The US GAAP financial reporting should be „true and fair“ because the main addressees are investors and analysts • True and fair implies for example that – a reserve can only be set up if there is really a corresponding claim against the insurance company •contingency reserves (provisions for unli ...

... • The US GAAP financial reporting should be „true and fair“ because the main addressees are investors and analysts • True and fair implies for example that – a reserve can only be set up if there is really a corresponding claim against the insurance company •contingency reserves (provisions for unli ...

Investment Returns from Responsible Property Investments: Energy

... investing. The goal is to reduce risk and pursue financial opportunities while helping to address the challenging public issues facing present and future generations. Because so many factors contribute to the social and environmental performance of buildings, RPI touches on literally dozens of prope ...

... investing. The goal is to reduce risk and pursue financial opportunities while helping to address the challenging public issues facing present and future generations. Because so many factors contribute to the social and environmental performance of buildings, RPI touches on literally dozens of prope ...

Annual Report 2011

... and younger people with disabilities, already covers 47 million people today. In just 20 years, it will cover 80 million. On top of that, there will be fewer workers to replace these retirees. That means less tax revenue to pay for their benefits. This fundamental imbalance is one of many factors th ...

... and younger people with disabilities, already covers 47 million people today. In just 20 years, it will cover 80 million. On top of that, there will be fewer workers to replace these retirees. That means less tax revenue to pay for their benefits. This fundamental imbalance is one of many factors th ...