Financial Mathematics and Applied Probability Seminars 2001-2002

... also captured by the recursive utility formulation. We ask: (1) how utility specifications may affect the equilibrium behaviour of security prices; and, conversely, (2) how equilibrium security prices can convey information about representative agent's preferences. For example, can we distinguish be ...

... also captured by the recursive utility formulation. We ask: (1) how utility specifications may affect the equilibrium behaviour of security prices; and, conversely, (2) how equilibrium security prices can convey information about representative agent's preferences. For example, can we distinguish be ...

FREE Sample Here - We can offer most test bank and

... I do little trading, so investment games are inconsistent with my investment philosophy and strategy. Although I do not discourage students from participating in a game, I also do nothing to encourage their use. I, however, have included two investment assignments at the end of the first chapter. Th ...

... I do little trading, so investment games are inconsistent with my investment philosophy and strategy. Although I do not discourage students from participating in a game, I also do nothing to encourage their use. I, however, have included two investment assignments at the end of the first chapter. Th ...

Great Depression II (averted)

... Banks stop lending to each other Economy freezes, stock market falls 7% ...

... Banks stop lending to each other Economy freezes, stock market falls 7% ...

The 2007/2008 financial crisis came with a strong fall in stock prices

... macroeconomic tranquility (later called the ‘Great Moderation’), which was characterised by significantly lower volatility of GDP growth. As the authors argue, the rising confidence in this calm economic environment might explain a large part of the observed boom in stock prices. And the realisation ...

... macroeconomic tranquility (later called the ‘Great Moderation’), which was characterised by significantly lower volatility of GDP growth. As the authors argue, the rising confidence in this calm economic environment might explain a large part of the observed boom in stock prices. And the realisation ...

... This paper explores the time series implications of introducing credit constraints into a production based asset pricing model. Simulations are performed choosing parameter values which generate reasonable values for aggregate fluctuations. These results show that mean reversion in simulated returns ...

Document

... • His two insights – Equities were undervalued at the end of 70s and the beginning of 80s – There is a gap between equity market and risk free asset. ...

... • His two insights – Equities were undervalued at the end of 70s and the beginning of 80s – There is a gap between equity market and risk free asset. ...

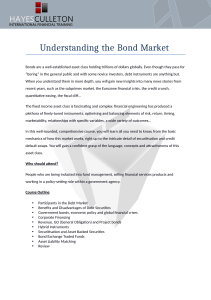

Understanding the Bond Market

... Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from r ...

... Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from r ...

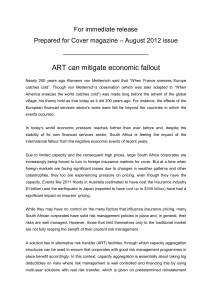

ART can mitigate economic fallout

... place benefit accordingly. In this context, capacity aggregation is essentially about taking big deductibles on risks where risk management is well controlled and financing this by using multi-year solutions with real risk transfer, which is given on predetermined reinstatement ...

... place benefit accordingly. In this context, capacity aggregation is essentially about taking big deductibles on risks where risk management is well controlled and financing this by using multi-year solutions with real risk transfer, which is given on predetermined reinstatement ...

Efficient Market Theory and the Crisis

... financial firms or by the regulators who did not see the risks that subprime mortgagebacked securities posed to the financial stability of the economy. Regulators wrongly believed that financial firms were offsetting their credit risks, while the banks and credit rating agencies were fooled by fault ...

... financial firms or by the regulators who did not see the risks that subprime mortgagebacked securities posed to the financial stability of the economy. Regulators wrongly believed that financial firms were offsetting their credit risks, while the banks and credit rating agencies were fooled by fault ...

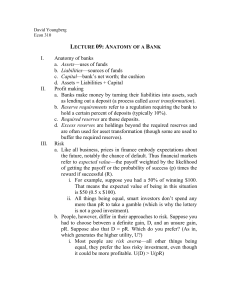

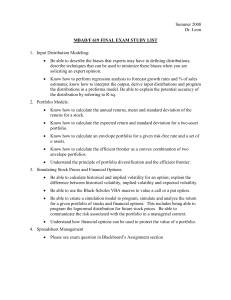

Introduction to Finance - Montclair State University

... some sectors over others. Such was the case with the conversion of the U.S. economy from producing civilian to military goods during the Second World War, and in the now abandoned use of Regulation Q to favor housing construction in the U.S. Apart from the question of an orderly functioning of a sec ...

... some sectors over others. Such was the case with the conversion of the U.S. economy from producing civilian to military goods during the Second World War, and in the now abandoned use of Regulation Q to favor housing construction in the U.S. Apart from the question of an orderly functioning of a sec ...

Views of Risk

... • Evaluate investments in terms of risk & return relative to the market as a whole • The riskier a stock, the greater profit potential • Thus RISK IS OPPORTUNITY ...

... • Evaluate investments in terms of risk & return relative to the market as a whole • The riskier a stock, the greater profit potential • Thus RISK IS OPPORTUNITY ...

Corruption in the financial markets 29012009

... Financial analysts: Should give a professional advise, but often influenced by employer. M&A corruption & blackmail + Insider info Auditors: Certify accounts but give consulting; greatly improved since 2003. Rating agencies:" rate” companies + “sell” ratings ⇒ encourage off balance, securitisa ...

... Financial analysts: Should give a professional advise, but often influenced by employer. M&A corruption & blackmail + Insider info Auditors: Certify accounts but give consulting; greatly improved since 2003. Rating agencies:" rate” companies + “sell” ratings ⇒ encourage off balance, securitisa ...

Presentation 04.2017

... - Monetary – interest rates/money supply – data dependent – fiscal stimulus – higher rates – Fed Balance Sheet - Weighted combination ...

... - Monetary – interest rates/money supply – data dependent – fiscal stimulus – higher rates – Fed Balance Sheet - Weighted combination ...

FIN 508: Financial Management

... OBJECTIVES: After completing this course the students should be able to 1. Find the present value, or future value, of various cash flows. 2. Calculate the intrinsic value of a stock or a bond. 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and re ...

... OBJECTIVES: After completing this course the students should be able to 1. Find the present value, or future value, of various cash flows. 2. Calculate the intrinsic value of a stock or a bond. 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and re ...

TopicsInAnalysis

... (Bring money and dice.) Decision-making among lotteries “EMV-ers” vs. real people Risk aversion Utility functions The Fundamental Theorem of Decision Theory (You should maximize expected utility, with respect to some probability distribution) Real probabilities vs. “probabilities” in the theorem “Ce ...

... (Bring money and dice.) Decision-making among lotteries “EMV-ers” vs. real people Risk aversion Utility functions The Fundamental Theorem of Decision Theory (You should maximize expected utility, with respect to some probability distribution) Real probabilities vs. “probabilities” in the theorem “Ce ...

Course Title - Positive Networking

... The growth percentage (Magic number) How to increase prices for your business ...

... The growth percentage (Magic number) How to increase prices for your business ...

2. Predictability of asset returns Deterministic and Random Walk

... For instance, in order to decide whether to invest in a project that costs I0, one computes the Net Present Value (NPV) of this investment as ...

... For instance, in order to decide whether to invest in a project that costs I0, one computes the Net Present Value (NPV) of this investment as ...