1 - BrainMass

... real-riskless rate, inflation premium, nominal rate inflation premium and risk premium real riskless rate, inflation premium, risk premium real riskless rate, risk premium, nominal rate ...

... real-riskless rate, inflation premium, nominal rate inflation premium and risk premium real riskless rate, inflation premium, risk premium real riskless rate, risk premium, nominal rate ...

the great risk/return inversion - who loses out?

... condition is that if a security doubles in price and the investor is half-weight, the mismatch doubles; if he is double-weighted and the price halves, the mismatch halves also. Underweight positions in large, risky securities therefore have the greatest potential to cause the manager grief. The effe ...

... condition is that if a security doubles in price and the investor is half-weight, the mismatch doubles; if he is double-weighted and the price halves, the mismatch halves also. Underweight positions in large, risky securities therefore have the greatest potential to cause the manager grief. The effe ...

Problem Set #10 Solutions 1. Using the index model, the alpha of a

... the expected returns from equally risky assets are different markets are perfectly efficient ...

... the expected returns from equally risky assets are different markets are perfectly efficient ...

Document

... True: Differential pricing can occur in several ways: it can be negotiated; it can involve secondary markets, or periodic or random discounting. Pages 274-275 ...

... True: Differential pricing can occur in several ways: it can be negotiated; it can involve secondary markets, or periodic or random discounting. Pages 274-275 ...

Investors and Markets

... and inflated prices. … Good faith had been swamped by the delusion conjured up by dazzling visions of immediate wealth. “(the Panic of 1720 was) …due to an inflation of currency and an over-expansion of credit which came from a mingling of sound ideas not fully understood with unsound ones …” Source ...

... and inflated prices. … Good faith had been swamped by the delusion conjured up by dazzling visions of immediate wealth. “(the Panic of 1720 was) …due to an inflation of currency and an over-expansion of credit which came from a mingling of sound ideas not fully understood with unsound ones …” Source ...

LESSONS FROM THE HOUSING CRISIS BOG_Karakitsos

... – Rising default risk premiums, inflation risk premiums & exchange rate risk premiums ...

... – Rising default risk premiums, inflation risk premiums & exchange rate risk premiums ...

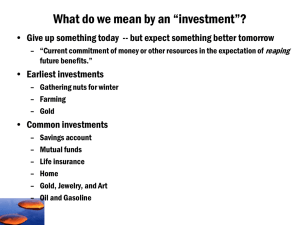

Slide 1

... Investment is the act of giving up consumption today in expectation of higher consumption in the future. ...

... Investment is the act of giving up consumption today in expectation of higher consumption in the future. ...

GreatRecession_2013-v2-posr

... Note: Implied volatility is a measure of the equity price variability implied by the market prices of call options on equity futures. Historical volatility is calculated as a rolling 100-day annualized standard deviation of equity price changes. Volatilities are expressed in percent rate of change. ...

... Note: Implied volatility is a measure of the equity price variability implied by the market prices of call options on equity futures. Historical volatility is calculated as a rolling 100-day annualized standard deviation of equity price changes. Volatilities are expressed in percent rate of change. ...

Topic 4 – Why do share prices fluctuate?

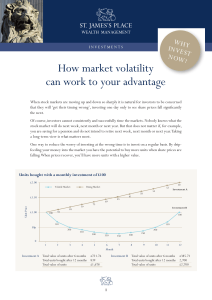

... However, trying to pick the best time to invest is very difficult because the future performance of markets is unpredictable. Therefore it is absolutely critical that investors not only diversify their investments but also diversify their market timing by purchasing their investments in instalments ...

... However, trying to pick the best time to invest is very difficult because the future performance of markets is unpredictable. Therefore it is absolutely critical that investors not only diversify their investments but also diversify their market timing by purchasing their investments in instalments ...

principles of finance

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

Part b - People

... Under this price vector, each trader would like to sell some of her endowment and purchase an optimal bundle using her income from what s/he sold; thus she solves the following program: ...

... Under this price vector, each trader would like to sell some of her endowment and purchase an optimal bundle using her income from what s/he sold; thus she solves the following program: ...

A BEHAVIORAL MODEL OF THE PERFORMANCES FOR E

... high positive returns on long term bonds and along term interest rates will fall). The crisis leads to a jump in inflation that has a greater detrimental impact on long-term bonds, and so they imply a high risk premium relative to short-term bonds. This partially explains the upward slope of the nom ...

... high positive returns on long term bonds and along term interest rates will fall). The crisis leads to a jump in inflation that has a greater detrimental impact on long-term bonds, and so they imply a high risk premium relative to short-term bonds. This partially explains the upward slope of the nom ...

9.2. International Financial Management

... b) What will be the two projects’ net present values (NPV) at the discount rate of 8 percent? c) What will be the two projects’ net present values (NPV) at the discount rate of 10 percent? ...

... b) What will be the two projects’ net present values (NPV) at the discount rate of 8 percent? c) What will be the two projects’ net present values (NPV) at the discount rate of 10 percent? ...

CRR and American Options1

... The following formula to compute the expectation value is applied at each node: ...

... The following formula to compute the expectation value is applied at each node: ...