* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Phd Economics, Siena - Finance – Final exam (16 April 2014

Beta (finance) wikipedia , lookup

Moral hazard wikipedia , lookup

Financialization wikipedia , lookup

Investment management wikipedia , lookup

Securitization wikipedia , lookup

Rate of return wikipedia , lookup

Pensions crisis wikipedia , lookup

Systemic risk wikipedia , lookup

Public finance wikipedia , lookup

Government debt wikipedia , lookup

Credit card interest wikipedia , lookup

Interest rate swap wikipedia , lookup

Internal rate of return wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Greeks (finance) wikipedia , lookup

Interest rate wikipedia , lookup

Modified Dietz method wikipedia , lookup

Credit rationing wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Business valuation wikipedia , lookup

Stock valuation wikipedia , lookup

Harry Markowitz wikipedia , lookup

Corporate finance wikipedia , lookup

Present value wikipedia , lookup

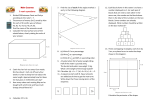

Phd Economics, Siena - Finance – Final exam (16 April 2014) 1. Compute the value of a portfolio composed by 1) a coupon bond with annual coupon of 6% and principal of 5,000 Euros; 2) a perpetuity with annual cash flow of 500 Euros. Both cash-flows are risk-free, and the risk free interest rate is 6%. How would you change the pricing of the portfolio in the case in which you introduce default risk? 2. Compute the price of a lottery paying a prize of 1,000 Euros in case of Italian default (and zero otherwise), if you know that 1) risk-free interest rate is 5%; 2) the probability of Italian default is 20%; 3) the stock TIM.IT guarantees a return of 40% in case of non-default and -60% in case of default. 3. A restaurant chain wants to open a new restaurant in Siena, and it has two options: 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with probability 60%) or 40,000 Euros per year (with probability 40%). If the risk-free rate is 5%, which opportunity will the chain take? (The answer should depend on the risk premium.....) 4. A CFO of a firm with debt-to-equity ratio equal to 9 and total value of 240mln decides to buy back 48mln of debt to be financed with new stock issuance Compute the new debt-to-equity ratio, and the change on the expected return on equity, assuming that the return on debt is 6% and the WACC of the company is 12%.